"This is going to hurt me a lot more than it is going to hurt you."

That was an admonition Mom or Dad occasionally gave me and my sister when we were growing up -- and I know we weren't the only kids to hear those words either.

Of course, as a ...

Continue reading Why I’m Making My Daughter Pay for Her Dental Braces

A Fond Look Back at My 10 Most Popular Posts of 2013

All in all it was a successful year here at Len Penzo dot Com. In terms of traffic, the blog had almost one million visits and nearly two million page views in 2013.

I know. I don't understand why either -- but I'll take it!

Anyway, thank you ...

Continue reading A Fond Look Back at My 10 Most Popular Posts of 2013

If I Got to Pick the Gifts in “The 12 Days of Christmas”

I don't mean to sound like a scrooge, but when it comes to Christmas carols, "The 12 Days of Christmas" has got to be the most annoying one of them all, even when Burl Ives sings it -- and nobody sings Christmas carols like Burl Ives.

Okay, you ...

Continue reading If I Got to Pick the Gifts in “The 12 Days of Christmas”

Len Penzo dot Com Is Five Years Old Today!

I wrote my first blog post five years ago today.

Now I've got to be honest with you, folks: I only started Len Penzo dot Com as a way to try and keep myself from getting bored. It's true!

Hopefully, I haven't bored too many of you since ...

Continue reading Len Penzo dot Com Is Five Years Old Today!

Why Doing Lines on Black Friday Isn’t All It’s Cracked Up to Be

Despite the conventional wisdom, Black Friday is not the busiest shopping day of the year. Most procrastinators know that honor belongs to the Saturday before Christmas.

Black Friday has changed over the past decade or two, and the Internet has a ...

Continue reading Why Doing Lines on Black Friday Isn’t All It’s Cracked Up to Be

Financial Market Outlook: USA Versus UK

Both the United States and the United Kingdom's stock markets have had their share of ups and downs in the last few years, partly due to a shaky global world economy and the real estate bubble burst. While it's impossible to predict exactly how the ...

Continue reading Financial Market Outlook: USA Versus UK

Are You Smarter Than a 5th Grader? Which Emotion Is More Powerful?

Those who are concerned with managing financial risk understand that, when it comes to investing, it's especially important to have a diversified portfolio -- at least in theory. It's also important to have an exit strategy in place whenever you take ...

Continue reading Are You Smarter Than a 5th Grader? Which Emotion Is More Powerful?

How I Live on Less Than $40,000 Annually: Calin from Romania

My name is Calin and I am a professional blogger living in Romania. Next year I'll be celebrating my 30th birthday with my beautiful wife and our newborn son. Yes, we still party, even though we live on less that $15,000 per year. (And no, I didn't ...

Continue reading How I Live on Less Than $40,000 Annually: Calin from Romania

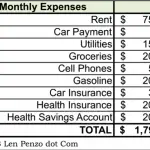

How I Live on Less Than $40,000 Annually: Fawn from Illinois

My name is Fawn. I'm a 54-year-old nurse who is a single parent to four children -- a son who is grown and married, a daughter who is away at college, and two teenage boys who are still eating at home.

I've always been responsible with money, but ...

Continue reading How I Live on Less Than $40,000 Annually: Fawn from Illinois

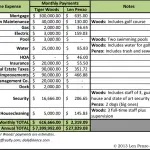

How I Live on Less Than $40,000 Annually: Ralph from West Virginia

My name is Ralph and I'm a retired US Patent Examiner. I have five kids, all of them in their fifties. Since retiring, I've developed a prize Angus cattle herd. I've also bought and sold real estate that I've held title to, sold timber from time to ...

Continue reading How I Live on Less Than $40,000 Annually: Ralph from West Virginia

How Cheaper Gasoline Ultimately Costs You More

You know, there used to be a guy named Ripley who made a fortune explaining why things aren't always what they seem. For example, a banana tree is not a really a tree at all, but a massive herb that can grow as tall as a four story building.

If ...

Continue reading How Cheaper Gasoline Ultimately Costs You More

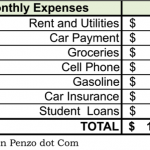

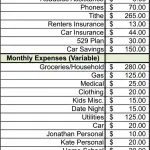

How I Live on Less Than $40,000 Annually: Lynsey from Minnesota

My name is Lynsey and I'm 25-years-old with no children. I'm from Minnesota and have a bachelor's degree in Marketing and Business Management. I am currently employed in the marketing field.

I've always been pretty responsible with my money, ...

Continue reading How I Live on Less Than $40,000 Annually: Lynsey from Minnesota

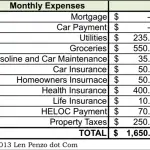

Comparing Tiger Woods’ Home Carrying Costs to Mine

When it comes to holes-in-one, I always tell anyone who will listen that Tiger Woods has got nothing on me.

Did you know I recorded my first ace not long after reaching my 18th birthday, fully two months before Tiger got his first one? I ...

Continue reading Comparing Tiger Woods’ Home Carrying Costs to Mine

How I Live on Less Than $40,000 Annually: Kacy from Iowa

My name is Kacy and I'm currently employed full time as a leasing agent and resident manager for a community college property in Central Iowa.

I've always been financially responsible. My dad is very good with finances and he taught me to always ...

Continue reading How I Live on Less Than $40,000 Annually: Kacy from Iowa

How I Live on Less Than $40,000 Annually: Jeff from Washington

My name is Jeff and I've been reading Len's blog off and on for a couple of years now. I'm 55 years old.

After getting my high school diploma I spent six years in the military, and then followed up my service with a series of various jobs.

My ...

Continue reading How I Live on Less Than $40,000 Annually: Jeff from Washington

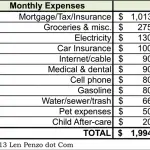

How I Live on Less Than $40,000 Annually: Jonathan from Ohio

My name is Jonathan. I'm 27 and I've been married to my wife, Kate, for almost four years. We have three girls, ages 3, 1, and a newborn.

After graduating from college, Kate worked for two years at a job that paid $35,000 annually. Then, after our ...

Continue reading How I Live on Less Than $40,000 Annually: Jonathan from Ohio

How I Live on Less Than $40,000 Annually: Tracie from North Carolina

My name is Tracie and I'm 30-years-old. I'm an associate chemist in coastal North Carolina. I have an eight-year-old son and I'm engaged to his dad.

I wasn't always financially responsible -- I was saddled with $10,000 in consumer debt. Twice.

Then ...

Continue reading How I Live on Less Than $40,000 Annually: Tracie from North Carolina

How I Live on Less Than $40,000 Annually: Ruth from Kansas

My name is Ruth and I'm a stay-at-home mom for our four kids. When our first child was born, I vowed to stay home as long as we could afford it. It's been 16 years and three more kids since then, and I'm still here.

I was always very frugal, ...

Continue reading How I Live on Less Than $40,000 Annually: Ruth from Kansas

How I Live on Less Than $40,000 Annually: Barb from Alberta

My name is Barb and I live in Alberta, Canada. I've been working in retail sales management for ten years. My income is just over $40,000 per year, although the climb to get there was very gradual.

I have a teenage daughter who lives with me. ...

Continue reading How I Live on Less Than $40,000 Annually: Barb from Alberta

How I Live on Less than $40,000 Annually: Mary from New Mexico

My name is Mary. I'm 58-years-old and I live in New Mexico. I've been working since I was 16 years old.

I have a bachelor's degree, as well as a master's degree. I was fortunate to attend college in the 1970s and 80s without accumulating any ...

Continue reading How I Live on Less than $40,000 Annually: Mary from New Mexico

- « Previous Page

- 1

- …

- 138

- 139

- 140

- 141

- 142

- …

- 150

- Next Page »