Now I know how it feels to be paid like my favorite gynecologist, the world famous Dr. Dean, from the Millionaire Nurse Blog. At least on a weekly basis.

Now I know how it feels to be paid like my favorite gynecologist, the world famous Dr. Dean, from the Millionaire Nurse Blog. At least on a weekly basis.

The reason I say that is because a couple days ago, after a long hard day at the office, I was immediately greeted by the Honeybee as I opened the door. And I instantly knew something was amiss because, usually, the only one to greet me ā or even acknowledge my presence ā when I come home from work is my dog, Major.

That is, unless Iām bringing home dinner. Then the whole family suddenly gets sentimental ā at least until they pull the bags out of my hands. But I digress.

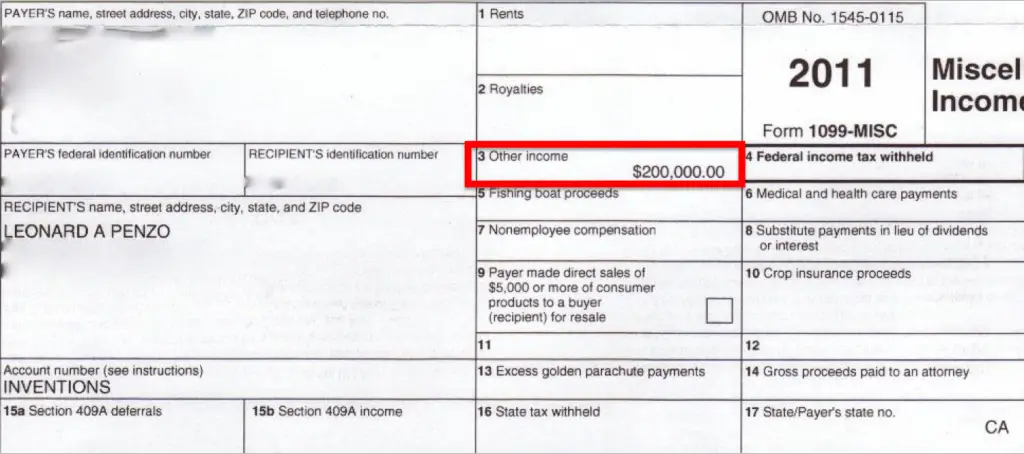

Anyway, this time the Honeybee was waving in her hand a 1099-MISC from my employer that reported some bonus income they paid me last year for a patent I was recently awarded.

āHave you been holding out on me, Len?ā she asked, although I still had absolutely no idea what she was talking about.

āWhat are you talking about, Honeybee?ā

āTake a look at this!ā And with that, she handed me the 1099-MISC form. Hereās what I saw:

Yep; thatās $200,000 in the āother incomeā box.

Naturally, the Honeybee wanted answers and she wanted them fast. And to tell you the truth, so did I.

Of course, she wanted to know when my employer was going to pay us the other $198,000 that the 1099 form said I was entitled to.

As for me, I just wanted to know how I was going to explain to the IRS that this was all one big mistake.

Luckily, the fine print on 1099-MISC form explained what to do in case of an error.

āIf this form is incorrect or has been issued in error, contact the payer. If you cannot get this form corrected, attach an explanation to your tax return and report your income correctly.ā

Thatās it. Simple! So I contacted my employer; it turns out the company was already aware of the error and a new 1099-MISC is now in the mail.

By the way, in case youāre wondering, the procedure is slightly different for an incorrect Form 1099-R. According to the IRS, in that case you should still try and contact your employer and have them correct it. However, if you fail to receive the corrected form by February 14th, you should call the IRS at 800-829-1040. For more info, click here.

See; sometimes the IRS can be reasonable.

Well, at least they can if youāre not the one who made the mistake.

Photo Credit: H. Michael Karshis

hahahaha!!!! good thing you werenāt holding out on the honeybee!

I never hold anything from the Honeybee, tracee.

Uh huh. Sure you donāt know where it came fromā¦.haha. I guess this makes you for certain a part of the one percent and I must envy you for eternity.

*sarcasm off*

Wait ā so does that mean you donāt envy me even a little bit? š

Thatās awesome the wife got up for you once opening your mail!

Guess money does by love! š

The IRS are up to their old tricks so people can pay more taxes! Go government go!

What are you doing, Sam? The government already has enough encouragement.

Most of the time my dog doesnāt feel like greeting me when I come back from work. He is one lazy pug! My husband usually yells āHello!ā from another room. And if football is on, I might not be greeted at all! š So, donāt complain! š

I am glad your employer figured it out. You donāt want to confuse the IRS.

The day my dog doesnāt come to greet me at the door, I would be devastated, Aloysa. Just devastated.

Thatās why I cry a lot.

Honeybee accused you of holding out!!! mmm, what have you done in the past so as not be given the benefit of the doubt, Len? š

Iām still trying to figure that one out, Griper. There are no secrets between the Honeybee and me. Heck, there are very few secrets between my readers and me.

Yo, Len, thanks for picking on me. You couldnāt have found a more deserving targetā¦

It is nice to get 6 figure 1099āsā¦.Maybe you can try it next year.

When will the next payment for your patent be delivered? Next year? Maybe the residuals will go up.

āIt is nice to get 6 figure 1099ā²sā¦ā

I wouldnāt know, Dr. Dean. At least a 6-figure 1099-MISC that actually counted. š

Itās too bad the error couldnāt have REALLY been in your favor with a $200k check in the mail š

Being the honest, upstanding guy that I am, I would actually feel worse in the end because I wouldnāt accept the money. š

I saw this recently. āEvery home needs a dog to adore you, and a cat to ignore you.ā

Since we have cats, you can guess the kind of greeting I receive at the doorā¦ unless, like you, I come bearing food. That seems to perk up everyoneās interest.

About that 1099-MISC. If that cool $200K was real, you would not just be in trouble with the Honeybee, but the IRS if a corresponding tax withholding had NOT been made in the same quarter it was received. So no $200k check in the mail ā more like $134k assuming a marginal 33% rate was applied, never mind exemptions phasing out.

Yeah, cats get a pass though because theyāre, well, cats. š

Would I really be penalized if that were real? I was under the impression that back-up withholding rules depended on particular circumstances. Did you say that because of the size of the check?

Oops, I believe you are right. If you actually received a $200k bounty with no withholdings, AND the taxes withheld in 2010 was more than 90% of what you actually owed in 2010, THEN you are exempt from the usual penalty for underpaying taxes. You would just have to write a whopping $130k or so check to the IRS. Whew!

The above is from memory, and no Iām not a tax expert.

The penalty thinking from earlier has more to do with being self-employed and/or receiving pay as a contractor.

Darn, I did it again! There really needs to be an edit feature.

You would have to write a check of approximately $70k to the IRS (no penalty), leaving you with approximately $130k left. There, thatās better.

This is why, given a choice of winning a car valued at, say, $35,000, or getting $35,000 cash, Iād rather go for the cash.

They assured me the solution was no problem at all and they were all over it like BBQ sauce on baby back ribs.

A month ago, I received a letter from IRS stating that in 2009, I sold securities and I had to pay extra tax. They had looked at just the sale price and not the cost basis.

I am still working on it, asked IRS for more time. Actually I had capital loss so I think I wonāt have to pay the extra tax of $6,532. Like I said I am still working on it.

Len,

This ā at least ā brought short lived happiness at home. š

I love you blog. Keep up the great work.

Shilpan

Thank you, Shilpan. Iām glad I could make your day. š

I thought I was the only one that this happens to. Not the 200000 mistake but the family only greeting you when you have food in your hands. LOLā¦waving her hands..what have you been handing..if I could have seen the look on your face.

Whew! Iām glad to know Iām not alone too, Thomas! š

Good grief, am I the only one who greets my man with a genuine smile and a hug when he gets home (even though he smells like bait juice when he walks in the doorā heās a commercial fisherman) because I am *so* glad to see him and I missed him all day? Yes, I really do. Iām not being sarcastic.

His 1099 was wrong this year, but not by much and certainly not off by six figures. In fact, it was short and I still called his buyer to have it corrected.

One thing that I think your readers missed in the telling is that you said Honeybee met you at the door waving your 1099. That means she opened your mail and the envelope was probably marked that it was a 1099. No one in their right mind would ever try to hide finances from a spouse who opens your mail, so yeah, it either had to be a mistake or youāre not in your right mind. (which may still be a possibility.)

LOL! No, Iām not in my right mind. And the Honeybee knows exactly how much I ā I mean āweā ā make.

If youāve been married more than 10 years, then yes, I suspect you may very well be the only one who still gets up to greet your man when he gets home. š

I still do it after seven years (eight come July)ā¦

Regarding the tax foul-up, just be glad yours wasnāt an IRA rollover that was mistakenly reported as a taxable distribution. That one took hours of phone calls and letters to clear up.

Ooo, that sounds like it was a real nightmare! I guess I shouldnāt complain too much.

Seven years. Does that still count, or shall I get back to you on it in 2015?

Wait a sec ā¦ you invented and patented something?

Yes, Paula. I have two patents, actually. š