My name is Barb and I live in Alberta, Canada. I've been working in retail sales management for ten years. My income is just over $40,000 per year, although the climb to get there was very gradual.

I have a teenage daughter who lives with me. ...

Continue reading How I Live on Less Than $40,000 Annually: Barb from Alberta

How I Live on Less than $40,000 Annually: Mary from New Mexico

My name is Mary. I'm 58-years-old and I live in New Mexico. I've been working since I was 16 years old.

I have a bachelor's degree, as well as a master's degree. I was fortunate to attend college in the 1970s and 80s without accumulating any ...

Continue reading How I Live on Less than $40,000 Annually: Mary from New Mexico

How I Live on Less than $40,000 Annually: Caine from Colorado

A little about me. On the internet, I usually go by "Caine Volfram." No, that's not my real name. I also go by "Clockwork Gremlin."

I am largely unremarkable. Single white male, just turned 28, Irish descent (among others), living in rural ...

Continue reading How I Live on Less than $40,000 Annually: Caine from Colorado

Are You Smarter Than a 5th Grader? Guess Which Item Costs More.

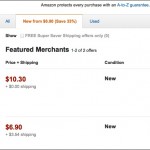

Last night I was doing a little shopping on Amazon and I came across an item that was being offered for sale by two different vendors. Here was the price summary that appeared on my screen:

So, which item is the better bargain?

On first ...

Continue reading Are You Smarter Than a 5th Grader? Guess Which Item Costs More.

How I Live on Less than $40,000 Annually: Jen from Virginia

Readers: Welcome to the first installment of my new series featuring Len Penzo dot Com readers who make ends meet on roughly $40,000 per year -- or less. Originally, I was hoping to run one or two articles per month, but the initial response has been ...

Continue reading How I Live on Less than $40,000 Annually: Jen from Virginia

The Trouble with Buying Movie Tickets Over the Internet

We all come across things in life that are wildly popular, even though it makes little sense to us.

Take "Duck Dynasty" -- going into its fourth season, it's one of the hottest shows on cable television.

I recently watched a couple of episodes ...

Continue reading The Trouble with Buying Movie Tickets Over the Internet

Cheap Cooking: Fantastic Frugal Meal Ideas from Past and Present

I was on an extremely tight budget when I was in college, so I had cheap cooking down to a science.

Back then, dinner was number four on my list of priorities; right after tuition, beer, and rent -- in that order.

Many people on limited incomes ...

Continue reading Cheap Cooking: Fantastic Frugal Meal Ideas from Past and Present

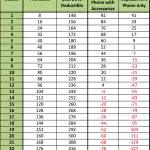

Is Cell Phone Insurance Really Worth It?

Last month our previous cell phone contract finally expired. That made the Honeybee happy because it meant we could finally move to a new carrier with better coverage.

However, nobody was more excited than the kid with the fastest thumbs in the ...

Continue reading Is Cell Phone Insurance Really Worth It?

Yet Another Reason Why I Hate Buying Tickets from Ticketmaster

Most of you know I've had a hate/hate relationship with Ticketmaster for a long time now.

After all, this is the company that wrote the book on ridiculous consumer fees that, many people argue, only serve to exploit their hapless customers; it's a ...

Continue reading Yet Another Reason Why I Hate Buying Tickets from Ticketmaster

A Fun Interview with Stacking Benjamins’ Host, Joe Saul-Sehy

I recently met with Joe Saul-Sehy to talk about his new money podcast, Stacking Benjamins, which debuts this week. We had just finished recording his final Two Guys and Your Money show, and I figured it would be clever to conduct the interview via ...

Continue reading A Fun Interview with Stacking Benjamins’ Host, Joe Saul-Sehy

More Reasons Why I Decided to Buy a New Car Instead of a Used One

As I mentioned in my previous post, I finally relented and bought myself a new car.

I can understand why some of you may be scratching your head at my decision to buy new instead of used. Especially when the playbook of good personal finance ...

Continue reading More Reasons Why I Decided to Buy a New Car Instead of a Used One

I Finally Broke Down and Bought a New Car

OK, I did it.

After commuting to and from work in my 1997 Honda Civic for the past 13 years, and with my son on the verge of getting his driver's license, I finally relented and bought myself a new car.

That's right. I'm now the proud owner of ...

Continue reading I Finally Broke Down and Bought a New Car

How to Get the Best Travel Deal from Price Comparison Websites

Price comparison websites are a great resource for budget-conscious travelers, with many people skipping travel agents altogether and doing the flight booking themselves. Due to the huge growth in this type of website, there are now more price ...

Continue reading How to Get the Best Travel Deal from Price Comparison Websites

A Small Victory in My Quest to Raise Financially Literate Kids

Teaching kids about personal finance is not an easy job. Even so, as a parent I believe it is my responsibility to ensure that my kids have a thorough understanding of good personal finance practices before they leave the nest.

Ultimately it will ...

Continue reading A Small Victory in My Quest to Raise Financially Literate Kids

Why Bag Ladies are Financially Savvier Than Many Celebrities

Grammy Award winner Dionne Warwick, who found fame in the 1960s singing "Do You Know the Way to San Jose?" filed for bankruptcy yesterday.

Younger folks may recognize Warwick from the 1990s, when she was the celebrity spokesperson for the Psychic ...

Continue reading Why Bag Ladies are Financially Savvier Than Many Celebrities

How I Stupidly Got Ripped Off by Not Getting Multiple Estimates

Whether we realize it or not, we manage financial risk whenever we take the time to get multiple price estimates from competing contractors. Those who do often get rewarded for their efforts.

As for those who don't, well ... they often end up ...

Continue reading How I Stupidly Got Ripped Off by Not Getting Multiple Estimates

Economic Collapse 101: What It Will Look Like, and How It May Start

It takes courage to face the bogeyman.

I bet many of the good folks in Great Falls, Montana, were more than a little worried earlier this month after a local television station there sent out an ominous message warning viewers that the dead were ...

Continue reading Economic Collapse 101: What It Will Look Like, and How It May Start

9 ‘Oops’ Moments That I Ultimately Paid For (One Way or Another)

Last week I needed to venture into my attic to check on some rat traps, so I grabbed my flashlight to help me navigate my way through the rafters. As luck would have it, the flashlight wasn't working; the last person who used it forgot to turn the ...

Continue reading 9 ‘Oops’ Moments That I Ultimately Paid For (One Way or Another)

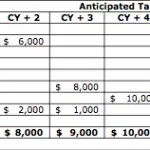

The Unconventional Wisdom of Household Strategic Planning

My son, Matthew, is quickly approaching his 16th birthday and so I've been giving him a few driving tutorials.

I haven't let him get behind the wheel just yet -- that's on next month's agenda -- but it's gotten to the point now where every time ...

Continue reading The Unconventional Wisdom of Household Strategic Planning

The Best Credit Cards of 2013

This is a guest post by Logan Abbott. Logan is the editor of MyRatePlan.com, a leading comparison site for credit cards, mobile phones, phone service, insurance, and more.

The New Year is upon us, and that means you probably made some New Year's ...

Continue reading The Best Credit Cards of 2013

- « Previous Page

- 1

- …

- 139

- 140

- 141

- 142

- 143

- …

- 150

- Next Page »