Millennials have been slow to enter the home buying world; many carry huge debts from their college education. Others are still recovering from the Great Recession. Their hesitancy has confused the markets for new and previously-owned homes.

The ...

Continue reading When Is the Right Time to Buy a House, and What Purchasing Options Do You Have?

What Is So Great About Living in Vancouver?

Are you ready to settle down? Perhaps you're looking at where you want to purchase a home and Vancouver, Canada is at the top of your list. If so, you're on the right track! Vancouver is a beautiful city in British Columbia and a great place to live. ...

Continue reading What Is So Great About Living in Vancouver?

Online Mortgage Deals: They’re Not Your Parents’ Home Loan

It's a pretty safe bet that when your parents were buying their first house, the only way to get a mortgage was to go directly to a bank -- or search around town for one of only a few mortgage brokers willing to help.

Thankfully, times have ...

Continue reading Online Mortgage Deals: They’re Not Your Parents’ Home Loan

Why Many People Are Choosing to Buy a Villa for Their Next Home

Villas are the ultimate homes to live in. Modern villas are made from high quality building materials and user-friendly appliances, which makes the living experience even sweeter. These homes are designed for maximum comfort and habitability via the ...

Continue reading Why Many People Are Choosing to Buy a Villa for Their Next Home

How Spending Money Can Help Your House Fetch a Higher Sale Price

Putting a house up for sale is a lot more complicated than putting a 'For Sale' sign outside your house and phoning up a few real estate agents to manage the property. For one, there's the task of finding another place to stay while the house is ...

Continue reading How Spending Money Can Help Your House Fetch a Higher Sale Price

What Services Does a Mortgage Licensing Company Offer?

Looking to become a loan officer? Want to work at a financial institution, or expand the services offered by your current company? Many people do not accomplish this all on their own; they may use the services provided by a mortgage licensing ...

Continue reading What Services Does a Mortgage Licensing Company Offer?

4 Home Financing Options for People with Poor Credit

We've all heard the countless horror stories from our friends with poor credit. A poor credit score can absolutely ruin your finances and any future plans you may have had; this includes your ability to buy a new home or car, and can even affect your ...

Continue reading 4 Home Financing Options for People with Poor Credit

When Is the Best Age to Buy Your First Home?

While there really isn't a "best age" to buy your first home, according to a study by Bankrate.com, everyone except the oldest Americans said the best time to buy your first home is at the age of 28. As a point of reference, the median age for ...

Continue reading When Is the Best Age to Buy Your First Home?

5 Things Every Student Must Know Before Renting Their First Apartment

The excitement of leaving home and going to college is a feeling that most students experience when they're making that big change in their lives. Many students rejoice over the fact that they'll be away from home where there are no house ...

Continue reading 5 Things Every Student Must Know Before Renting Their First Apartment

Grandfather Says: Here’s a Clever Way to Change Neighborhoods

Grandfather says he moved his house once.

When the road in front of it was widened, he moved it out of the way, up to the top of a hill on his place. That was before the family moved where we have been for 40 years now.

Grandfather learned a ...

Continue reading Grandfather Says: Here’s a Clever Way to Change Neighborhoods

Here Are a Few Basic Factors to Consider When Shopping for a Home Loan

Today, almost everyone understands that the last recession had its roots in domestic mortgage borrowing. Many home loans were effectively toxic and were almost completely dependent upon the increase in real estate values providing lenders with their ...

Continue reading Here Are a Few Basic Factors to Consider When Shopping for a Home Loan

5 Basic Tips for First-Time Homebuyers

Buying a house for the first time can be a thrilling and nerve-wracking experience. Although the learning curve is steep, doing a bit of financial homework will make the task a lot easier. With that in mind, here are a few tips that will help make ...

Continue reading 5 Basic Tips for First-Time Homebuyers

3 Essential Tips for Finding the Best Home Loan

Going through the mortgage process can be an intimidating, overwhelming experience, even for people who have done it before.

For newcomers, it can be especially difficult. It's easy to understand why: you're facing the prospect of entering into an ...

Continue reading 3 Essential Tips for Finding the Best Home Loan

A Quick Overview of 4 Potential Loan Options for Homebuyers

When we think of financing for a home, we often assume that there are very few options. Sure, we know about first-time home buyer's options. We might also know that we can find loans with varying term periods. But there are other options out there ...

Continue reading A Quick Overview of 4 Potential Loan Options for Homebuyers

How to Know If It’s Better to Renovate Your Current Home or Move

Home buying is an emotional decision, seldom dominated by the most rational part of the mind. That's not to say that there is nothing practical about buying a home. But practicality is only one part of the equation. There's always a mix of practical ...

Continue reading How to Know If It’s Better to Renovate Your Current Home or Move

Basic Tips for Buying Your First Home on a Budget

Buying your first home can be both exciting and terrifying at the same time. The old standard of saving a 20% down payment seems like an insurmountable task at times -- but there are alternatives available that can make owning your home a dream come ...

Continue reading Basic Tips for Buying Your First Home on a Budget

Real Estate Agents: Why They’re Not Worth It

I've sold one house in my lifetime -- way back in 1997 -- and I did that without a real estate agent. Yep ... For sale by owner (or FSBO).

It wasn't supposed to be that way.I actually started out with a realtor because I thought it would be crazy ...

Continue reading Real Estate Agents: Why They’re Not Worth It

Is It Better to Be Prequalified or Preapproved for a Mortgage?

Readers: This is article 23 of 25 from my no-nonsense "Mortgage Basics" quick-reference series.

The difference between being prequalified or preapproved for a home loan can be a critical factor in determining whether or not you'll get the home of ...

Continue reading Is It Better to Be Prequalified or Preapproved for a Mortgage?

Mailbag: Are US Savings Bonds Worth Buying Anymore?

So in light of the Federal deficit, devaluation of the dollar, lack of jobs, etc., what's your view of U.S. Savings Bonds these days? I have some, and can't find anyone talking about whether they're still a good investment. Yes, they earn relatively ...

Continue reading Mailbag: Are US Savings Bonds Worth Buying Anymore?

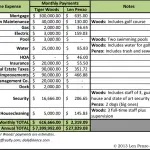

Comparing Tiger Woods’ Home Carrying Costs to Mine

When it comes to holes-in-one, I always tell anyone who will listen that Tiger Woods has got nothing on me.

Did you know I recorded my first ace not long after reaching my 18th birthday, fully two months before Tiger got his first one? I ...

Continue reading Comparing Tiger Woods’ Home Carrying Costs to Mine

- « Previous Page

- 1

- …

- 6

- 7

- 8

- 9

- Next Page »