When it comes to holes-in-one, I always tell anyone who will listen that Tiger Woods has got nothing on me.

Did you know I recorded my first ace not long after reaching my 18th birthday, fully two months before Tiger got his first one? I did.

Of course, Tiger was just 6 when he got his. I also have yet to score another hole-in-one, while Tiger has gone on to bag 17 more of them over his illustrious career; but who’s counting?

I only bring this up because last month I saw a report that said Tiger had to hire contractors to do some massive renovation work in order to keep his Jupiter Island, Florida mansion from sinking.

Yes, sinking. As in, well … sinking.

Anyway, as you might expect, Tiger’s palatial estate is quite impressive, with waterfront property spread over 12 acres. According to People magazine:

“The estate has a four-hole golf course with sand traps, 100 ft.-long swimming pool, diving pool, spa, 100 ft. field and track area, tennis and basketball courts, a pair of boat docks, and a reflecting pond. Inside the facility is a 5,700 sq.-ft. fitness center.”

Superb.

I wonder if Tiger would be as impressed with my modest little 2048 square-foot 3-bed 2.5-bath home. Then again, who am I kidding? I know exactly what he’d say after getting the 30-second tour of my place: “Meh.”

I’ve been told that Tiger reportedly took out a $54 million mortgage to pay for his fancy digs. Uh huh. In fact, his monthly loan payment is supposedly in the neighborhood of $300,000.

And you thought your mortgage was expensive.

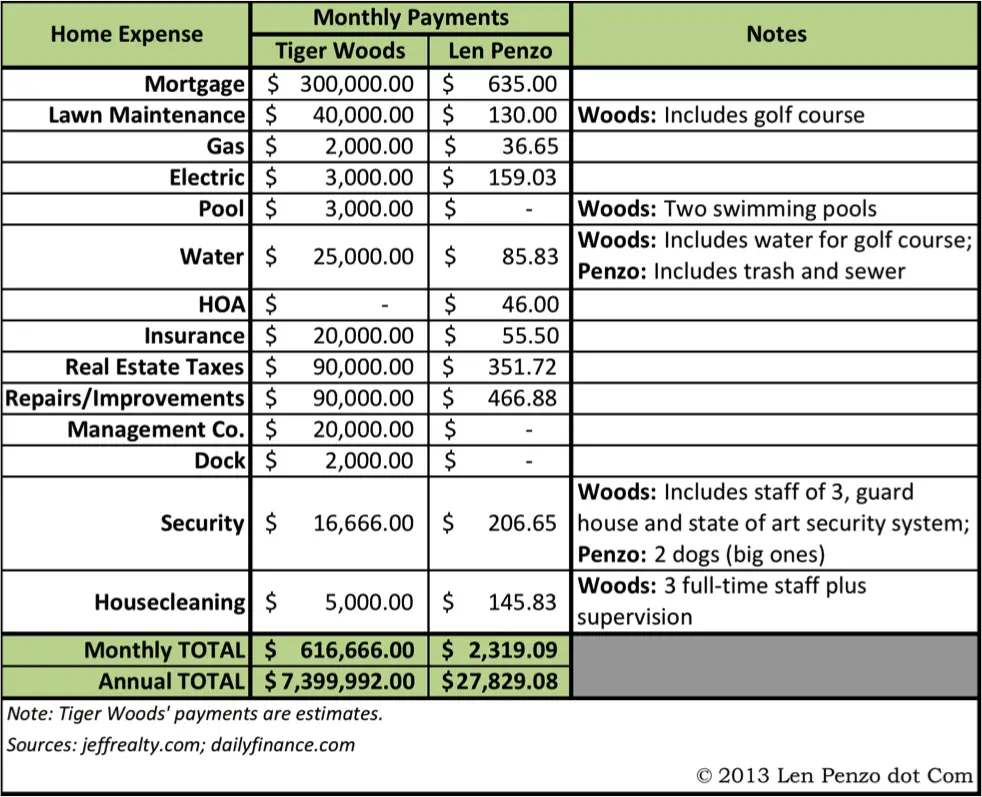

But wait, there’s more. If you include Tiger’s carrying costs — which represent the real cost of home ownership — he’s probably shelling out well north of $600,000 per month on his house. I know.

Obviously, my house expenses don’t come anywhere near that; but just for fun, I thought I’d put together this quick-and-dirty cost comparison between me and Tiger Woods, using data from my household expenses spreadsheet, and information I gathered from around the web:

I know what a lot of you folks out there are thinking right now: How come Tiger doesn’t have any homeowner association fees? Beats me. I can only assume he bought the entire association out. I would if I had his money.

Regardless, there’s a lesson to be learned here: The cost of owning a home goes far beyond the mortgage, taxes and home insurance — so plan accordingly and don’t forget to consider all of the other carrying costs before you buy.

Generally speaking, the bigger the home, the higher the carrying costs for everything from the utilities to maintenance. For many people, those additional home expenses act as a frustrating yoke on their discretionary spending options. That’s certainly one reason why I’ve refused to “move-up” for many years now, despite the fact that I can afford a much bigger place than the modest home I live in now.

Hey, can you blame me?

After all, if I’m ever going to match Tiger’s hole-in-one record, I’m going to need all the extra cash I can find.

Photo Credit: Friar’s Balsam

Don’t forget that Tiger is also paying everything for his ex-wife’s house. I don’t think she has an entire golf course in her back yard but I also don’t think she is living in a modest bungalow.

I think she got a home in her native Sweden and an American place as well.

Len, great article! I did some quick math and your carrying costs are 3.7 times your mortgage. Any idea if that is an average number for most homeowners? 🙂 (I rent so I have nothing to compare your number to.)

Thank you, CN.

To answer your question: I would guess there is no rule of thumb if only because there are so many variables and everybody’s personal situation is different.

One example: If I still had the original loan that I had back in 1997, my monthly mortgage payment would be over $1400 per month, so the multiple would be a lot less than 3.7.

You’d think for $54 million, you’d get a house that was built on a solid foundation.

It’s almost impossible to get my head around those numbers. If they are are correct, Tiger’s gas bill is more than my mortgage! It’s really like living in a whole ‘nother world.

But do you think Tiger is happier than you Len?

Good question. I suspect that the only days that Tiger could possibly be happier than me are the days when I happen to find myself in the Honeybee’s dog house.

(And on those dark days, I’ll wager even the prisoners at Gitmo are happier.)

What I really want to know is whether any female has ever chased you around with a golf club?

LOL!

No comment.

Hey, but I bet the average amount of time Tiger spends commuting to a swimming pool and golf course is cut substantially. So, you know, he’s saving on gas. 🙂

Everyone’s a comedian today! 😉

I wondered how you got a house for that low of a payment in southern California then I remember hearing you refinanced on a Stacking Benjamins episode. Then reading through the comments it all made sense. I’m sure you’re paying it off as slow as possible if you locked in a rate in the last couple years.

Actually, the refi I completed in January 2013 was my fourth refi since 1997 — only the most recent one was a cash-back refi (and even it was for a very small amount), and that allowed me to shrink my payments substantially.

It also helped that I made about $80k in extra principal payments between 97 and 2009.

Ah, I would jump with joy for three days in a row if I would make in a year as much as he pays monthly!

What’s crazy is that 7.5 million is only about 1.5% of his 500 million net worth. There are plenty of “normal” people out there (myself included) that have a much higher percentage of their net worth being poured into their house.

Fun article.

How many days do you think he spends at home? Maybe 100 days?

Ouch. I’m impressed with your low mortgage payment. I moved to California in 1997. If only I’d bought then instead of waiting 7 years. Ouch.

Well, at least I have no plans to “trade up” from my 1947 1150 sf “starter home”.

I wonder if Tiger Woods is able to deduct some of these expenses against his earnings on his taxes? For example, as a professional golfer, would he be able to deduct portions of his lawn maintenance, security, repairs/improvements, management costs, and any other costs associated with his golf course and other facilities that he may consider essential to his athletic career (like a home gym and the two swimming pools, maybe)?

If yes, his monthly costs may be lower. (Although they’ll still be high compared to the average person.)

I have a feeling he can deduct some of those expenses as part of his taxes. As a freelancer, that’s what I’d do, or at least find loopholes to be able to do it, because if he NEEDS all that lawn to be able to practice his swing and putting, it should go under “job-related expenses”.

On tour a number of years ago, I saw the outside of his house and man it sure was nice looking. His two docks are made of marble, no splinters allowed.

While I think it is crazy to have homes like that (I might think differently if I had the money, but I do not think so) we have to realize that that Tiger can easily pay for this and his other homes. The man is worth some serious bucks.

Fun post,

David

No kidding. Have you seen his yacht?