With the new year upon us, I found myself in desperate need of a new desk calendar. At the time, I wasn't looking forward to venturing onto the busy streets and adding to the post-Christmas hustle and bustle, but it turns out that the Honeybee needed ...

Continue reading Are You Smarter Than a 5th Grader? Guess How Much These Calendars Cost

Black Coffee: The Blurred Line Between Fiction and Nonfiction

It's time to sit back, relax and enjoy a little joe ...

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what's been going on in the world of money and personal finance.

Here we go ...

Credits and ...

Continue reading Black Coffee: The Blurred Line Between Fiction and Nonfiction

Black Coffee: It’s Time to Batten Down the Hatches

It's time to sit back, relax and enjoy a little joe ...

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what's been going on in the world of money and personal finance.

I just got back from a long business ...

Continue reading Black Coffee: It’s Time to Batten Down the Hatches

Poll: The 5 Biggest Money Regrets of 2015 — and How to Conquer Them

I'm confident that this time last year, scrawled on your list of New Year resolutions, was a sentence relevant to at least one of these four phrases:

'save money'

'stop spending'

'get out of debt'

'stick to a budget'

According to a ...

Continue reading Poll: The 5 Biggest Money Regrets of 2015 — and How to Conquer Them

Negative Interest Rates and the Demonization of Cash

A lot of financially savvy people out there say that the world's central banks have foisted zero- and negative-interest rates (otherwise known as ZIRP and NIRP) to force people out of their savings. The truth is, there is a more pressing reason for ...

Continue reading Negative Interest Rates and the Demonization of Cash

Black Coffee: The Happy New Year Edition

It's time to sit back, relax and enjoy a little joe ...

Happy New Year, everyone!

Away we go ...

Credits and Debits

Debit: Despite being $72 billion in debt and guilty of defaulting on a portion of its bond payments last summer -- with ...

Continue reading Black Coffee: The Happy New Year Edition

Infographic: Where Your Tax Money Will Be Spent In 2016

The holiday season is now over, which means the advent of tax season is officially here. I know, but what can you do?

The average American taxpayer can expect to be taxed at about 31.5% of their wages, which comes out to a massive ...

Continue reading Infographic: Where Your Tax Money Will Be Spent In 2016

Culinary Odds & Ends: How Eating Leftovers Saves Me $1700 Annually

Last year my family spent a small fortune on groceries -- $12,764 to be exact. If you were to press me on the matter, my teenage son, Matthew, probably ate $9000 worth of them.

Anyone who thinks I'm kidding hasn't seen our kitchen after a visit ...

Continue reading Culinary Odds & Ends: How Eating Leftovers Saves Me $1700 Annually

Black Coffee: The Don’t Blink or You’ll Miss It Edition

It's time to sit back, relax and enjoy a little joe ...

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what's been going on in the world of money and personal finance.

I hope everyone had a great Christmas ...

Continue reading Black Coffee: The Don’t Blink or You’ll Miss It Edition

A Peek at My Kids’ Christmas Lists

Readers: Just for fun, I thought I would repost this article from Christmas Eve 2009

Well, according to my friend the Silicon Valley Blogger, Zhu Zhu Pets are the hot Christmas gift item for 2009. Don't tell my kids that though because those ...

Continue reading A Peek at My Kids’ Christmas Lists

Black Coffee: Excuse Me While I Blow Some Hot Air

It's time to sit back, relax and enjoy a little joe ...

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what's been going on in the world of money and personal finance.

I've got a lot of Christmas shopping ...

Continue reading Black Coffee: Excuse Me While I Blow Some Hot Air

100 Words On: The True Meaning of Christmas

In today's day and time,

It's easy to lose sight,

Of the true meaning of Christmas

And one special night.

When we go shopping,

We say 'How much will it cost?'

Then the true meaning of Christmas,

Somehow becomes lost.

Amidst the tinsel, ...

Continue reading 100 Words On: The True Meaning of Christmas

Black Coffee: The 7th Anniversary Edition

It's time to sit back, relax and enjoy a little joe ...

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what's been going on in the world of money and personal finance.

It's hard to believe, but this week my ...

Continue reading Black Coffee: The 7th Anniversary Edition

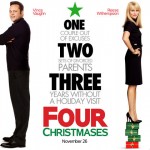

Drive-By Movie Review: Four Christmases

This is a review of the 2008 movie Four Christmases starring Reese Witherspoon, Vince Vaughn, Robert Duvall, Jon Voight, and Sissy Spacek

Plot Summary: A couple struggles to visit all four of their divorced parents on Christmas Day.

Me: Can you ...

Continue reading Drive-By Movie Review: Four Christmases

Black Coffee: Move Along, Folks. There’s Nothing to See Here.

It's time to sit back, relax and enjoy a little joe ...

Yes, I'm back. I took last Thanksgiving weekend off. I hope you all had an enjoyable and restful holiday. I know I did!

Okay, away we go ...

Credits and Debits

Credit: There's an old ...

Continue reading Black Coffee: Move Along, Folks. There’s Nothing to See Here.

Infographic: Black Friday Shopping Tips and Other Fun Facts

Anybody who has ever ventured out on Black Friday to bag an amazing deal on a clever holiday gift knows that it can try anybody's patience. It's true; enormous crowds, bumper-to-bumper traffic, and endless lines make Black Friday a living ...

Continue reading Infographic: Black Friday Shopping Tips and Other Fun Facts

Black Coffee: Wall Street and the New York State of Mind

It's time to sit back, relax and enjoy a little joe ...

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what's been going on in the world of money and personal finance.

Here we go ...

Credits and ...

Continue reading Black Coffee: Wall Street and the New York State of Mind

Buyer Beware: 12 Things You Should Never Buy On Black Friday

While millions of shoppers will be out on Black Friday taking advantage of some really spectacular deals on everything from electronics and jewelry to even wine and automobiles, there are some items that will only see minor discounts -- or no ...

Continue reading Buyer Beware: 12 Things You Should Never Buy On Black Friday

Black Coffee: More Proof There’s No Such Thing as a Free Lunch

It's time to sit back, relax and enjoy a little joe ...

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what's been going on in the world of money and personal finance.

I'm still recovering from a business ...

Continue reading Black Coffee: More Proof There’s No Such Thing as a Free Lunch

Black Coffee: No, You’re Not Going Crazy — I Am

It's time to sit back, relax and enjoy a little joe ...

And away we go ...

Credits and Debits

Credit: This week the media were celebrating the best employment figures of the year, thanks to a nonfarm payrolls report that showed 271,000 new ...

Continue reading Black Coffee: No, You’re Not Going Crazy — I Am

- « Previous Page

- 1

- …

- 131

- 132

- 133

- 134

- 135

- …

- 150

- Next Page »