Despite earning just $2790 per month, Amanda is usually able to save a significant portion of her paycheck.

My name is Amanda, and I’m an example of someone who didn’t worry about financial responsibility and saving until relatively late in life — but I’m so glad that I finally did!

My current income averages $2790 per month. Even so, over the past few years, I’ve been able to save more than 50% of my total income.

It wasn’t always that way.

Reality Checks

I was a stay-at-home mom for many years. And I always purposely avoided learning about money: I didn’t know anything about investing or saving. I had always been poor, so I knew lots of frugal hacks, but I spent most of the extra money I earned on my son and daughter.

After a messy and financially-devastating divorce, I became a single working mother who earned around $14,000 per year, at best. During that time, I managed to keep a roof over our head, maintain a seriously-used car, and help my son a little while he was in college — but nothing more.

I used to joke that my son was my retirement plan. It didn’t occur to me that this was morally problematic; I guess because I didn’t see any alternative.

Only after I turned 57, did I start worrying about the future. I decided to go to graduate school, and then work as a teacher until I was really old — but that was a big miscalculation.

I ended up with a full-ride scholarship at the University of Michigan that included paid fellowships and teaching assistant jobs. I found additional ways to make extra money too: editing, serving as a paid witness at mock court trials, research work and so on.

Despite the extra income, I didn’t save for the first couple of years.

Then two things happened: First, I began to notice that, although I had great grades, the job market was abysmal. I also realized that my age was working against me — and significantly so. I also developed health problems; specifically multiple sclerosis, so I wasn’t sure if I could continue to work multiple jobs indefinitely. Eventually, I became unable to drive. Second, I began reading every personal finance blog and book that I could find. That’s when I set up an IRA and found ways to contribute the maximum each year.

Savings

As I moved closer to graduation, the job market realities became clearer and so for the last two years I ramped up my savings. In all, I’ve been able to save and invest nearly $60,000!

I also invest my time — I spend at least 30 minutes every day studying money, frugality and retirement issues.

I’ve been looking hard for a job, with no luck. The academic market is fairly saturated — even for younger people — and most other jobs require driving. As a result, I’ve reluctantly concluded that I’m probably involuntarily retired. Unfortunately, my Social Security payment will be very small, due to my time off the market, and low subsequent wages. This scares me, but what scares me even more is that if I hadn’t gotten a grip when I did, I’d have no savings at all!

I’m planning on moving from Ann Arbor to a low-cost area. I’m also working on a much more seriously frugal retirement budget!

Expenses

Spending is addictive; I work hard to ignore that little internal voice telling me my life is stressful, the future is scary, and I “deserve” to “treat myself.”

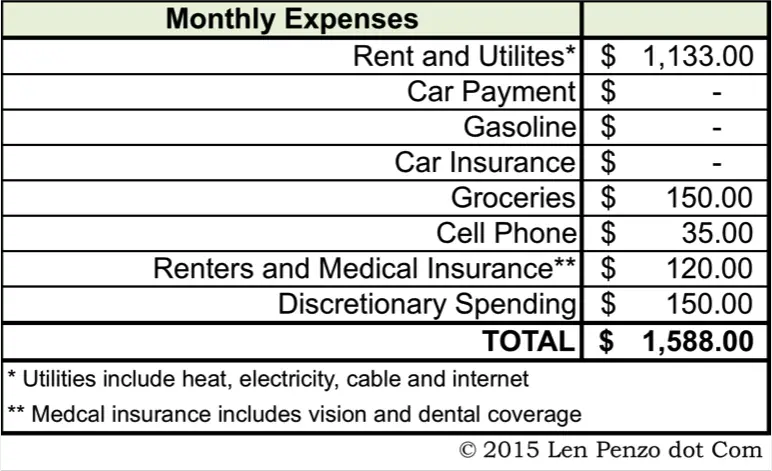

I keep my total monthly expenses to $1588. Not having a car goes a long way toward keeping my expenses down.

To get around, I use the free University bus system and the public bus system, which is free for students and seniors — so I qualify on both counts.

To get around, I use the free University bus system and the public bus system, which is free for students and seniors — so I qualify on both counts.

For several years I would walk two miles to the supermarket, shop and then push a cart back. My MS has since gotten worse, so now I walk to the market but take a cab back. When I go to the airport or train station for visits to my son or for research, I take a cab too, although the research visits are paid from dedicated grants.

My apartment rent is $1133 and includes all utilities, plus the Internet, which is great.

To supplement my regular medical insurance, I take advantage of the student health clinic, which is free with my grad insurance plan.

I limit my discretionary purchases to $150 per month. I like to travel to visit my son and his family every few months, and I sometimes buy gifts for my granddaughter. I also buy one really good pair of walking shoes every year.

Other than that, I try not to spend money. I don’t do “recreational shopping!”

Closing Tips and Thoughts

It’s easy to hold a pity party if you start saving for retirement really late and have a lower income. I did for a bit — and still occasionally fight the urge — but I eventually realized that I just had to work harder.

Here’s how I handle things now:

- I question every expenditure that I’m planning, don’t make impulse purchases, and try to eliminate as many expenditures as possible. My mantra is the old Yankee saying “Use it up, wear it out, make it do, do without.”

- I use the “48 hour” rule for everything, even my grocery list — usually I can find something to substitute or scratch off if I wait.

- I check my balances daily; this keeps me focused and ensures that my money is working as hard as it can.

- I take advantage of my improving financial situation: For example, as soon as I earned an excellent credit score, I got a rewards credit card, which I use for everything. (And I pay off the balance every month.)

- When I save money via special offers, I immediately put that money into an account where it will do some work!

- I take as much additional part-time work as I can manage, even if it doesn’t pay much — because something is better than nothing.

Remember, there’s almost always something you can do to save — even if you’re in a tough spot.

Finally, it’s important to realize that frugality can affect your friendships — some people view thrift as “boring” or pointless. A friend once told me: “It’s not like you’re going to be able to save as much as you should have for retirement, so why bother?”

I initially felt bad about this — then I decided I couldn’t afford that friendship.

***

If you’re a household CEO who is successfully making ends meet on roughly $40,000 per year or less, I’d love to hear from you. Contact me at Len@LenPenzo.com and be sure to put “$40,000” in the subject line. If I publish your story, you’ll get a $25 gift card or 1 troy-ounce of pure silver!

Photo Credit: calamity_sal

Wow great job on your savings! I’ll try to apply your “48 hour” rule..hope it helps me!

The 48 hour rule has saved me from so many ill-advised expenditures! Often, I look back at the stuff that I wanted to buy and can’t figure out what the heck made me want it in the first place!

Great job!!!!

I’m curious to know, of that $60,000 you saved up recently, how much of that was due to saving and how much was due to investment gains?

Thanks so much Amanda! Keep up the good work. Very inspiring!!!!

I have made about 1500 on investments so far. I started investing much later than I started saving because I didn’t know anything about it, and spent lots of time studying before I jumped in, I lost time because I had a belief that I was not someone who would understand this sort of thing. Failing to challenge this belief for too long cost me money!

Do you have all of your savings in one account? Or do you have multiple accounts for emergency funds, retirement, etc,?

I have multiple accounts for a couple of reasons. First, I have a couple of short-term low-interest savings accounts that I opened with the minimum to get promotional money- I only do this after I make sure it is going to be worth it, and I keep them open as long as the offer requires. Second, I have several Cap One 360 accounts for special purposes: an “an extra money” account where I keep track of saved and found money; an account that has two years worth of money that- together with social security- would be enough to pay my bottom line survival expenses; and an emergency account with six months of money that- without social security- would pay my very bottom line expenses. I have the rest of the money in index funds and in dividend-producing stocks.

Amanda, depending on how long you were married (and assuming your ex paid into Social Security via FICA taxes), you might be eligible for social security benefits based on your ex husband’s account. It sounds like you’ve become good at research, so here’s a link to get you started (and the best of luck to you!) http://www.benefits.gov/benefits/benefit-details/4388

Thanks! I appreciate the information!

Congrats Amanda! That is really something to be proud of. I am planning to take some time each day to read anything about money specifically on investing and saving. Thanks for the idea.

It also has the advantage of being a free form of entertainment that uses either (free) library books or internet that can be used for other things as well!

Thanks for the encouragement! I’ve done a lot of research on how to save, (and implement many crazy ways to do it), but have been intimidated by the investment part. Your study method makes a ton of sense.

In the glare of hindsight, I really regret the fact that I didn’t learn to invest earlier, but it is really never too late!

If ur ex is eligible for retirement income via ss, pensions and/or any accounts with $$ so are u by state and federal laws. I wish u much success!

Amanda, your story is so inspiring. I hope that you were married for 10 years so that you would be entitled to 1/2 of your husband’s social security or all of yours (they will give you whichever is the larger). I wonder too if you are eligible for 1/2 of his 401k or pension plan if he (or his company) contributed to either one during the marriage.?? I’d love for you to email me personally. Please use my email above if you would like to correspond.

Just a note to let you know how inspiring your post is. Like you I never thought and planned for retirement before, but after reading your article will make a consciousness effort to do so.

Your drive and courage are truly amazing, and very inspiring. Thank you for sharing your life’s lessons!