My name is Tara, I’m 39, single, and I currently live in Ellicott City, Maryland.

My name is Tara, I’m 39, single, and I currently live in Ellicott City, Maryland.

I used to work as a Linux Systems Administrator making a six-figure income.

Then I lost my job.

I remained unemployed for 18 months, but now I work in marketing with a salary of just $35,000 per year.

Coping with the Loss of a High-Paying Job

When I got laid off, I withdrew $5000 from my 401k — but that only put $3000 in my pocket after paying the taxes (blah!). I also immediately signed up for unemployment benefits, which pretty much covered my basic living expenses. When my unemployment extension ran out I began tapping into my savings.

That’s when it got really hard.

Nobody was hiring — and the expensive large loft overlooking Baltimore that I was living in was rapidly eating up my savings, so I moved into smaller suburban digs with a roommate. Losing the loft was especially tough on me; living in a warehouse was a dream of mine and I had spent lots of money renovating it before I was laid off.

The view of Baltimore from a renovated warehouse loft where Tara used to live before she was laid off.

Eventually, I was down to my last $1000 when a friend asked me to do some temporary consultant work for $50 per hour! Thank God for being techy!

So how did I cope? It’s funny; early one morning, not long after I lost my job, I was looking out my window overlooking the city, watching Baltimoreans scurrying around to get to their jobs and what not. That’s when I had an epiphany: Yes, it’s great to make money, but it’s all temporary — and for what?! Things that we don’t really need — most of the time. All that really mattered was that Jesus died for me and my life was in His hands and that I didn’t need to worry about my future, or present situation.

While I was unemployed, I tried to live like nothing bad happened. Rather than lamenting what I had lost, I focused on online marketing because I knew it was possible to make a decent passive income there! So I spent every day hustling online: learning, trying techniques, applying for jobs and working my butt off more than when I had a “job.” And then I spent my evenings with friends to avoid becoming a recluse.

Of course, I had a couple of breakdowns along the way, wallowing in tears and anxiety, but they didn’t last long and I was able to regain my hope and focus quickly.

Thankfully, I’ve always been financially responsible; it’s one reason why I never ran out of money while I was unemployed.

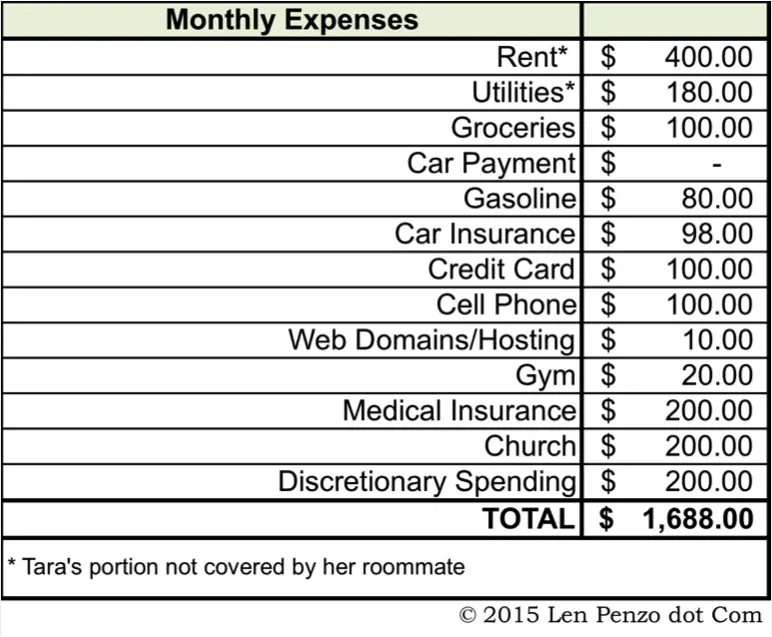

Expenses

I now share a condo with my roommate. My new bedroom is smaller than my old loft bathroom, so almost everything I have is now squished in this tiny room — but at least the rent is affordable!

It also helps that I don’t have a car payment. I drive a 2009 Toyota Corolla, which I bought brand new.

It also helps that I don’t have a car payment. I drive a 2009 Toyota Corolla, which I bought brand new.

I used to stick to a strict budget. However, after I started making a lot of cash, I stopped thinking about the budget and looking at prices. Unfortunately, now that I don’t make a lot of money again, I’m still trying to adjust. At the moment, I have no budget in place. I just try to make sure that I pay all my bills as soon as I get paid.

I don’t like to shop, which helps keep my discretionary expenses down.

In my free time I hustle, spend time with friends, and meet new people. I also enjoy helping people with their business’s online presence.

Savings

I’m not saving for anything special at the moment, but I’m dreaming. I have an emergency fund that’s got about $2000 in it.

As for my retirement savings, I have $10,000 left in the 401k from my previous employer and I currently contribute 1% of my pay into my new 401k retirement plan.

Closing Tips and Thoughts

I try to keep focused on the things that matter and what I have. I’m not concerned with the latest fashions or trends. I don’t normally buy clothes. If I do, I keep it to single digit price tags. I refuse to spend double digits for clothes. I eat very simply when I’m home, usually rice and eggs with a glass of water. Sometimes I’ll buy more, but rice and eggs usually keeps me happy. I eat better when I go out with friends; that’s when I splurge a little.

Other than that, I just don’t spend a lot outside of going out with friends.

Looking back, going from a six-figure salary to $35,000 was quite an adjustment. But over time, learning to live on the lower income taught me that the old saying “money doesn’t buy happiness” is so true!

And after everything I’ve gone through lately, I like myself a lot better now too.

***

If you’re a household CEO who is successfully making ends meet on roughly $40,000 per year or less, I’d love to hear from you. Contact me at Len@LenPenzo.com and be sure to put “$40,000” in the subject line. If I publish your story, you’ll get a $25 gift card or 1 troy-ounce of pure silver!

Photo Credits: Tara

I think it’s great that you’ve placed your experience in a positive light as a journey to becoming more financially responsible. It’s these habits of frugality that, if you continue to practice them when your income eventually improves, will really boost your wealth going forward.

hope so!

I think we all get humbled financially sometimes and it’s the strong ones who come out fighting harder than before they were humbled who win, I think you are stronger today, thank you for sharing.

Thanks for reading…It was definitely a humbling experience, but a good experience. It does add a little spice to life~

Thank you for your inspiring story, Tara. Last year my hubby lost his job that paid 6 figures. So far no luck in finding a replacement job, but he’s looking. In the meantime, we’ve hunkered down financially as best we can while we live off of our savings.

Sorry to hear… Hope you guys will be ok until a job comes along.

That’s quite a view of Baltimore you had. I’d hate to lose that too. I’m glad you’re back on your feet though. It’s clear that you have a lot of drive. I have no doubt you’ll be making a lot more money soon enough.

I really loved that place…it was like living in a castle! But, it was really nice to be able to pay my rent and all until the end of my lease, and as sad as it was to leave…having more money in my pocket to survive bc of having less rent was a little more exciting than living in a warehouse! It’s also nice to have a roommate again.

I see you have a $100 expense each month for a credit card. Is that from bills you ran up long ago and are still paying off? Thanks for sharing your story!

Hi Pepper,

So, that was from an emergency when my old new car blew up, literally right after the warranty expired. So, I used my credit card to put a down payment on a new car. Only about 1k left to go! It’ll be over before I know it 🙂 Last debt I have to pay off for now!

Thanks for your encouragement everyone 🙂

Great insight! Could you tell us more about your diet? I think I spend too much of my income on food every month, admittedly I eat out a lot.

Hi Paul,

Yes, eating out can add up to a salary, if you do it too much and get whatever you want! I hate those $100 weekends!

I have an obsession with eggs and could, and do eat them for breakfast, lunch and dinner, when I’m able. Yum…

I discovered that mixing a little rice into the egg increases the amount of egg experience I can have, so I mix them together. Fancy times, I have seaweed (roasted and seasoned laver?) to roll it up with and, very special times, thinkly sliced meat, like steak ums. I really enjoy eating simply. And yes, some of it has to do with laziness. If I cook huge gourmet type dished, it’s because I’m cooking for other people. I love cooking for others. I don’t use a microwave if I don’t have to – I’m pretty much in great opposition to it. You really can cook a meal in the same time, if not less, than using a microwave, and it’s healthier. My roommate gave it away when I moved in! When I crave a flavored drink, I’ll treat myself to almond milk, or infuse Shisondra berries (5 flavor berry) into some hot water. Very rarely, I’ll have a Ginger Ale.

Hope that helps~

You’re making me hungry, Tara.

(I didn’t even know Steak Umm’s were still around!)

Ha!

Thanks for your story. We used to live in Ellicott City, I know how expensive it is. I just wanted to say that I was inspired by your decision to tithe on your small income. That is a big deal. I know God will bless you for your faithfulness. All my best to you.

Thanks! I actually didn’t remember that that image was going to be posted, but it’s cool 🙂 Figures are slightly different (i miscalculated some stuff), but it’s about 90% accurate.

Glad for Christ’s faithfulness!

Take care~

Getting laid off is never easy. I know because its happened to me twice — but I made it through the storm both time. As the saying goes, this too shall pass. I was making about $50k the last time I got laid off and that was tough. I can only imagine how much harder it is to lose a job that pays $100k or more! Thank you so much for sharing your story, Tara.

You’re welcome! Glad you’re in a better place as well!

Take care~

I have learned a lot from the story of this young lady. I like how positive she had been during this journey. I wish I could have that determination and consistency she possesses to live less than that amount of budget.

Contentment is a huge asset and as Paul says, something we have to learn. Thanks for the encouragement.

I know you say you love eggs and could eat them three meals a day. My concern for you is that while they are certainly a great food, I am hoping you aren’t actually consuming them to the extent you are implying. Too much of anything isn’t healthy and I hope you are not eating this way in order to stay within your stated $100 a month for food. That seems to be too low, unless you are also eating out a fair amount or your friends are inviting you over for meals. How are you getting your vegetables and fruit? Being frugal at the cost of your overall health is not doing yourself any favors.

I have every expectation you will soon be making far more again and, in the meantime, to earn more you obviously have the ability to do freelance work on the side. Good luck.