The trouble with holding long-term savings in cash is that the purchasing power of the U.S. dollar decreases every year because the federal government continually spends more than it earns.

The trouble with holding long-term savings in cash is that the purchasing power of the U.S. dollar decreases every year because the federal government continually spends more than it earns.

Unfortunately, the erosion of the dollar’s purchasing power is slow enough that most people fail to recognize how devastating this can be over long periods of time. For this reason, the safest and most effective way of protecting your long-term savings‘ purchasing power over time is by holding physical gold and silver.

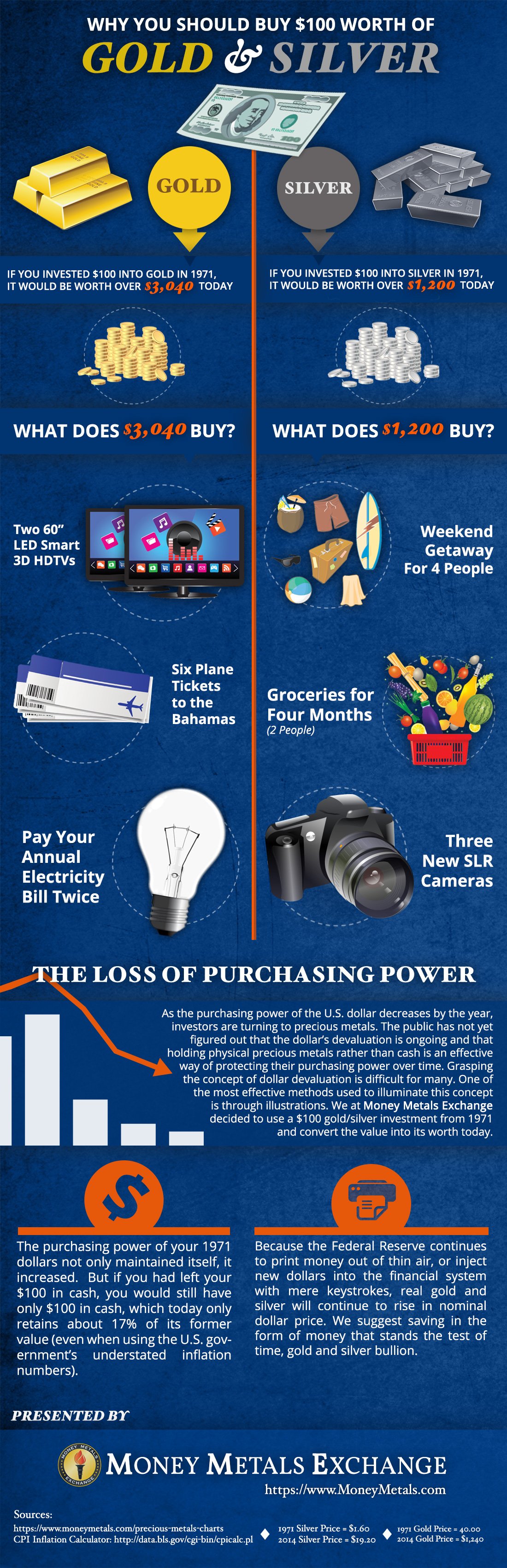

To illustrate this point, consider a precious metals investment worth $100 in 1971 to its purchasing power today.

Specifically, if you bought $100 worth of gold and $100 worth of silver in 1971 and then stuffed them in a coffee can, along with a solitary $100 Federal Reserve Note, this infographic shows the purchasing power of all three options — assuming you decided to spend them today:

Photo Credit: public.resource.org; Infographic: Money Metals Exchange

you really have to stop pimping metal how has gold done the last 3 years.

The only thing I’m “pimping” is a message — and a very important one, Joe. You have demonstrated your disdain for that message before. As long as you continue to look at gold in terms of dollars, rather than as a store of value, you will continue to miss the point of that message.

By the way, based upon your comment, you sound like a guy who loves to buy high and sell low. The “smart money” does the opposite.

I am a buy and hold investor I do not store food or metal I am an optimist owe nothing to anybody and am comfortable with my investments. I’m now retired after 45 years in sales .

Investing is the smartest thing to do with your savings over time because it grows your net worth. $100.00 invested in 1971 in Johnson & Johnson would be worth about $16,000 today. That’s just one company but that fact cannot be argued.

What the author is foretelling is an abrupt end of currency and economy (and therefore governments) of which the world has not seen the like of since the fall of Rome. People like to compare it to revolutions of countries (which are usually quite minor on a global history scale) or even the Great Depression (during which there was still currency, stock markets and trading) but that is inaccurate. Personally, I think there would be so much death and destruction were that to happen that pieces of yellow metal would be the last thing on my mind. But that’s just me. Let’s check in to this blog again in about 10 to 20 years and find who is correct.

I only found this because I was curious to see how much the price of gold versus a dollar will fall when the Fed increases interest rates.

I agree with almost everything you said, Bill.

Almost.

Investing IS the smartest thing to do with your savings — in a healthy economy with a healthy currency and plenty of room for growth. But we’re tapped out. Additional debt is no longer able to keep the economy growing — all it’s doing now is killing the dollar. All of the stock market gains since 2009 are due to the Fed injections of more than $9T. Without that, the Dow and S&P would be a fraction of what they are today. The markets are rigged today. There are no free markets. It’s all an illusion.

Peak debt is here (the math proves it) and the international monetary system is on its last legs. Our leaders can either institute a new one in a controlled fashion, or let the system crash on its own. The former will be less disruptive than the latter, and both will result in a sharply reduced standard of living for middle class Americans — but I firmly believe it will not be the end of the world. Although, in the latter scenario, we may see martial law for awhile in some of the biggest cities until a new system is put in place, and people slowly come to accept the new paradigm.

The US government cannot afford to let interest rates rise much. Even 5% interest (which is less than the historical average) on $20T in debt would result in the government paying $1T annually just to service the debt. So the Fed will have to print trillions MORE than it’s already doing. Talk about monopoly money! Besides, the stock markets would implode long before interest rates ever got that high — and that would send rates back down from where they came.

Nope. The Fed is trapped and they know it. There is no way out of this mess; the dollar is toast. Until then, they’ll keep pretending everything is going to be fine — but, eventually, the Fed will lose control and then everybody will realize that you really can’t have a free lunch.

As for who is correct: I suspect we’ll all know within the next five years at the latest. (Frankly, I don’t think we’ll be waiting that long.)

Fair enough. I never advocate gold as an investment — rather, it’s insurance against the failure of fiat currency.

Buy and hold worked well before we leveraged up and the general public (not mention world governments) reached peak debt. Those days are gone and won’t return until we wipe the slate clean and start over with a new currency.

Good info though hindsight is 20/20. Big money will always win.

I’m not sure what you mean.

What is the comparison to a S & P 500 Index Fund for that time period?

You’re talking investment, Rick. I’m talking insurance. But I’ll answer your question anyway:

Over the same time period, the annualized return return of the S&P was approximately 10.4%, assuming you reinvested the dividends. That comes to $7,041.

That being said, if the currency fails tomorrow or two years from now, the return on the S&P will be 0 — meanwhile, that gold and silver will still buy the same amount of stuff they buy today, if not more.

If you had a $250,000 available to invest, how much of it would be in gold and silver. What would you do with the rest? If it matters, I’m retired.