Before I started my blog, I spent my free time as a dedicated volunteer for Little League baseball. And although I rose through the ranks over the years to eventually become a league president, looking back, my fondest Little League memories still come from the time I spent managing my son’s baseball team.

Before I started my blog, I spent my free time as a dedicated volunteer for Little League baseball. And although I rose through the ranks over the years to eventually become a league president, looking back, my fondest Little League memories still come from the time I spent managing my son’s baseball team.

My first “practice” was a pitiful failure. I was woefully disorganized and, as a result, the 5-year-olds got bored almost immediately. Before long, that practice session looked like something straight from Lord of the Flies; I had lost complete control, surrounded by a band of marauding boys who defiantly spent the rest of the hour kicking up the infield dirt and pulling the wings off moths in the outfield.

Needless to say, I made sure the rest of my practices were always well-organized.

The Importance of Organizing Your Personal Finances

Organization is a means to an end. The truth is, organized people save more time and money than those who aren’t. When you’re organized, you become more efficient and that makes life much easier.

With respect to your personal finances, organization is what enables people to manage seemingly complex and/or enormous jobs such as tracking their income and outgo down to the last penny with relatively little effort.

The good news is, organization isn’t hard. In fact, all it takes is a little commitment and discipline. And I found that one of the best ways to get organized is to run your household like a business.

My Household Business Organizational Structure

In the grand scheme of things, a household is a business with real assets and liabilities. There are revenues, represented by our household income, and there are non-discretionary obligations such as the mortgage and utility bills. There are also discretionary costs in the form of entertainment, vacations, and other non-critical expenses that require careful analysis and smart decisions.

And just as any smart business works to efficiently manage and maximize its revenues, I too want to ensure that our household spending decisions always give us the most bang for my paycheck.

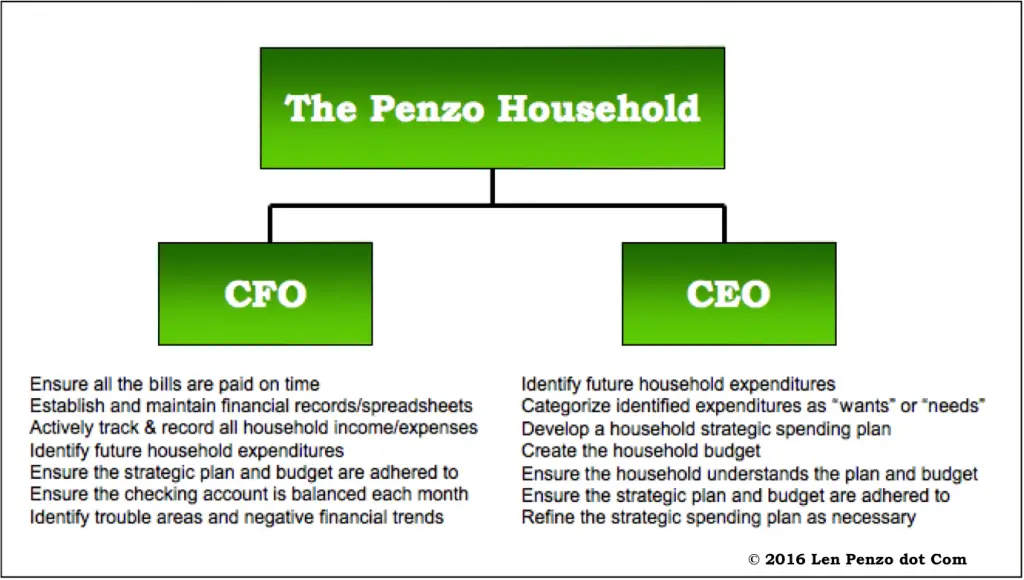

From the day we were married, the family finances have been jointly managed by the Honeybee and me. Each of us has separate responsibilities, as shown in the handy dandy household organization chart below.

As you can see, it’s quite simple; I act as the CEO, while she is the CFO. I know. But just play along.

I’ll now go into a little more detail for both our jobs.

My Duties as the Household CEO

As the CEO, I’m responsible for long-term and strategic financial planning decisions, including stuff like how much life, auto and home owner’s insurance to carry, retirement and investment contributions, emergency fund allocations, and future big-ticket discretionary spending. That requires me to evaluate all household expenses, both past and future, and then determine whether those expenses are discretionary or non-discretionary.

In short, my job consists of seven primary tasks:

- Identifying future household expenditures

- Categorizing those expenditures as either non-discretionary or discretionary (“needs” or “wants”)

- Developing a household strategic spending plan

- Establishing the household budget

- Ensuring my family understands the strategic spending plan and budget

- Adhering to the strategic spending plan and budget

- Refining the strategic spending plan as necessary

My Wife’s Duties as the Household CFO

As the CFO, the Honeybee acts as the family’s financial manager. Essentially, in addition to handling day-to-day financial operations, she keeps her fingers on the family financial pulse, always aware of past and impending non-discretionary expenses, as well as any near-term discretionary spending considerations.

In a nutshell, here are her seven primary responsibilities:

- Establishing and maintaining our financial records and spreadsheets

- Paying the bills on time

- Actively tracking household expenses and income

- Identifying present and future household expenditures to support strategic planning

- Faithfully adhering to the strategic spending plan and budget

- Balancing the checking account each month

- Identifying negative financial trends and potential trouble areas

Summing It All Up

Running our household like a business plays a crucial role in ensuring that our family income is utilized as efficiently as possible over the years. In fact, it’s been more successful than I ever imagined.

Will the way we run our household work for everybody? That’s doubtful.

Has running a household like a business worked perfectly for us? Of course not.

But it has instilled a strong sense of organization and financial discipline into our lives. And for anyone who aspires to take control of their personal finances and achieve financial freedom, that is absolutely essential.

Photo Credit: ell brown

We have similar roles in our house; hubby’s the CEO & I’m the CFO. We’re a team!

I really enjoy the tandem approach. I think it is especially beneficial when there is only one household breadwinner in the home — as it is with us. I think it is important for the stay-at-home spouse to have a handle on the finances, so they are not caught flat-footed in case of an unexpected death, or even a divorce. (No need to read anything into that, folks. I’m happily married. LOL)

there is a saying that goes like this,

“if businesses were run more like a family and families were run more like business everyone would be better off.”

i have often countered this by saying;

” if more families were run more like a business then everyone would realize just how much that businesses are already run like a family.”

I like that, Griper!

You are way too organized Len. But, it’s better to be organized and hit the target, than to be disorganized and flounder around.

I’m the CFO in our family and I have a much simpler method for running the finances. I squirrel away a bunch of money on payday, then I act like we are broke when everyone comes asking me for money. We will be married for 21 years next month and it still works.

LOL! Hey, Bret, if it ain’t broke… 🙂

Yep, I know a lot of folks who do that. I like the split duties because it not only spreads out the work load, but it also keeps both partners involved and invested in the family finances.

It seems like your wife has more work. You have all the big picture things and she has all the day to day things. Sounds like your maintaining all the CEO characteristics.

Oh, she definitely does have more work than I do, Matt! But she is also a stay-at-home mom, so she has more time than I do too. 😉

I think in the grand scheme of things, she actually gets more perks than I do. (And I’m sure I’ll be sleeping on the couch after the Honeybee reads this. LOL)

I think we are also split down those CFO/CEO lines in a sense. And, we come to an agreement on the large expenses.

Yes, the Honeybee and I always come to an agreement on the larger expenses too. We rarely disagree, thankfully.

That’s a great way to give people roles and make sure that things get done. I like the important sounding names as well.

And if you like the names, you should see our business cards! 😉

Can you explain in more detail what “developing a household strategic spending plan” means? Is this a statement full of #’s: expenditures/balances/leftover? Or is this a general approach type statement?

Hi Debbie. The household strategic plan is the long-term vision for your spending made up of big-ticket purchases you plan to make over the next, say, 5 to 10 years or so.

One of the first articles I ever wrote for this blog discusses long-term strategic planning. You can read about it here:

https://lenpenzo.com/blog/id467-creating-a-household-strategic-plan.html

We don’t have similar structure in our household but it seems that all humans are born with no structure ingrained in their genes. We must learn to be organized not only in our personal finances but in all other activities as well. Folks who follow some kind of organized structure in their lives have lived and are living successful lives.

Very funny these roles. I am definitely the CTO!

Good plan Len. My wife do similar, and we have an annual Summit Meeting, which you might liken to a shareholders’ meeting. Really helps to keep us on track and in accord.

I have been running my finances like a business for years. I started to realize that I also run the rest of my life a little like a business. I delegate the things my wife is good at to her and I assume the duties I am good at as well. Together we discuss our dreams and plans just like a good partnership.

I love the way you have broken it all down. This is similar to how my husband and I manage our finances. I think the critical thing to household finances for couples is that both partners are involved and know what is going on so they can be on the same page. It definitely keeps the financial arguments to a minimum…

Len, after reading your post I realized that I am both CEO and CFO. No fair! I think I have to ask my husband to assume some responsibilities. Rather than dumping it all on him at one time, where do you think I should start? Asking him to take on one or two smaller tasks?

Wow. As you well know, handling both chores is a lot of work, Suzanne!

It’s a tough call … I think the CFO task requires more time — but if you have been handling both duties, I suspect you might want to hold on to the CEO role.

Thank you for this. Very enlightening, I also went thru all the comments. Really am needing some inspiration to get our family finances in order and this really helped.

In the Enwealthen household, I’m CEO and CFO but the Mrs is COO, making sure everything happens that needs to happen.

We still discuss our finances together quarterly, unless something urgent comes up.

It keeps us all on track. But like all things family, it’s hard work.

Looking forward to our sons becoming independent business units!

Ha ha … looking forward to my kids being independent business units too, Jack! Good comments.

Stay at home? Wow, that still exists? We can’t afford that unfortunately.

very informative post..thanks

What a nice and friendly way to divide the task!

At home we do things a bit different (I mean, we have not appointed any CEO or CFO) but they work for us.

This is a really interesting take. I love how you actually have a chart.

I often look at my household in military terms. I should write an article about that!

Thanks, Eric!

I never really thought about running my household as a business, but I agree it would help. The only issue I see is having a spouse who doesn’t want to run her family this way. In the end, you can always tweak this system until it fits for both partners.

Thank you for this, Len! Great post!

Found your website through Stacking Benjamins! I really enjoyed reading this article! We are 2 years married and we do run our household as a business as well. I love how you broke down the CEO/CFO roles. My husband has a good idea of how we budget but I think he needs to be more involved!!!

Hi, Crystal. Thank you for the kind words. I’m glad you stopped by and enjoyed the article!

And, yes … by all means, get your hubby more involved in your financial management. It should be a team effort!

I think it’s adorable that your wife let’s you think you have a say in the decision making.

I do too! 😉

Even my grocery budget is run like a business. I’ve run out of snacks. What else do people do for fun?

It also helps to have a shared vision. This means communication is key and that really that means listening to each other. For example, to own or not own a home could be a given as well as something being affordable really means not going into debt unless the money is already in the bank to cover the expenditure. If one partner is on a different page, well good luck with that. Conflict looms. I base this on my elderly neighbours. She is 88 and he is 95. She agreed to move here for just 10 years, and that was 65 years ago. Her entire life was spent living another person’s dream. Their bickering is a habit and hard to listen to.

My mother had a saying> a woman can throw more out the back door than the man can bring in the front door it can be reverse!