My son, Matthew, is quickly approaching his 16th birthday and so I’ve been giving him a few driving tutorials.

My son, Matthew, is quickly approaching his 16th birthday and so I’ve been giving him a few driving tutorials.

I haven’t let him get behind the wheel just yet — that’s on next month’s agenda — but it’s gotten to the point now where every time Matthew and I are in the car together, I take a few moments to pass along a tip or two regarding the rules of the road, or the fine art of driving a stick shift.

My 1997 Honda Civic is a stick shift, as was the first car I ever owned — an old 1971 Datsun 510 that I got from my cousin, Kevin.

Personally, I think everybody should learn how to operate a car with a manual transmission before they get their driver’s license. I really do.

Why should folks be excused from knowing how to drive a stick just because 95% of all cars sold today in the US have automatic transmissions?

After all, one day you may take a European vacation and discover the only rental cars on the lot have manual transmissions. Or maybe a time will come in the not-so-distant future when you’ll need to drive someone to the hospital in a life-or-death emergency and the only car available will be one with a stick shift.

Hey, you never know.

Besides, unless you’re stuck on the hilly streets of San Francisco during rush hour, driving a stick shift is a lot of fun — so much so that I’m sure the auto industry would be selling a lot more cars with manual trannies if the general populace ever caught on.

The thing is, stick shifts are simply too unconventional for most folks — so they never bother to learn about them. And that’s a shame, really.

The same thing is true when it comes to budgeting our household finances. Many folks who are serious about keeping their finances under control rely on budgets that focus on their short-term living expenses. And that makes a lot of sense for those who are struggling to make ends meet and find themselves living from paycheck to paycheck.

Now, unlike short-term budgets, long-term budgets are unconventional. It’s the reason why most people’s eyes glaze over when you ask them if they have a strategic household plan.

A strategic household plan isn’t as much of a budget per se than it is a financial road map that helps the household CEO run his household like a business and anticipate big-ticket purchases that will require future savings.

Thankfully, the process for building a strategic long-term plan is essentially no different than conventional budgeting:

1. Identify your future big-ticket expenses. Big-ticket items aren’t limited to just houses, automobiles, and vacations. They also include things like college expenses, outstanding credit card debt, home renovations, weddings, elder care, and even rainy day and emergency funds.

2. Poll your family members for their long-term needs. Trust me, folks. This is a good idea if only because you probably won’t be able to think of everything.

3. Project when you’ll need to pay for everything. Remember, unlike a conventional short-term budget, the strategic plan timeline is spread out over a period of many years. Projecting your annual savings requirements as accurately as you can will give you a good feel for whether your long-term goals are realistic. If not, refine your strategic plan as necessary. For very expensive items, you may need to spread your savings plan out over multiple years.

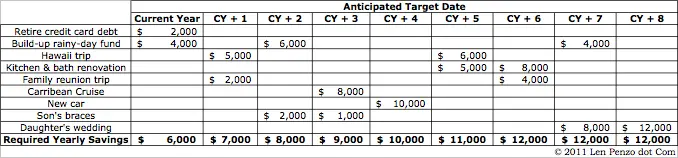

When you’re all done, your strategic plan might look like this:

In the old days people typically created their strategic plan with a pencil and paper. Nowadays, I prefer to use spreadsheet software.

Oh, and by the way … If you’re one of those folks who still hasn’t figured out how to use a spreadsheet, you might want to learn. After all, there could come a day when the world finally runs out of trees and they have to stop making pencils and paper.

Hey, you never know.

Photo Credit: Sean MacEntee

Question: If you need 10K for a new car 5yrs out, should not your required yearly savings be $2k (in addition to whatever is needed for interim years and goals)starting in the CY? In that way you will have $10k when the time comes?

Well, Art, that’s a good question! (You’re definitely thinking strategically.)

The answer depends on whether the owner of that example plan believes he can save $10,000 in that particular year. If not, then, yes … the $10k should be spread out over multiple years.

I learned how to use a stick shift – my first car was a 65 convertible mustang, but my husband never did. 5 years into our marriage, we rented a large u-haul truck to move ourselves. They gave him the keys and surprise, it wasn’t automatic. He didn’t know how to drive it, so I did. It’s like riding a bike, once you learn a stick shift, you never forget. So you just never know. Recommend learning parallel parking too. I let my daughter do circles in an empty parking lot to get the feel of driving before we went on the open road.

Yes, I plan on taking my son to the biggest parking lot I can find, Sandy. We won’t be driving in circles though — I’ll get car sick.

Of course, before I can think about that, Matthew is going to have to master Lesson 1: Learning how to engage the clutch and get the car moving without stalling it! (That’ll be more fun than a barrel of monkeys!) 🙂

I learned on a Chevrolet Luv truck – but I took my driving test on an automatic. I’m with you on this – my Saab is a stick, I figure that makes is 100x less likely to be stolen, since a ton of people wouldn’t know how to drive it away.

I’m embarrassed to say that in the San Francisco situation you describe, I often cheat and use the e-brake. Internet shame?

My folks actually had me take my driver’s test in an old Chevy pick-up truck with one of those big overhead camper shells on it. The DMV instructor was impressed that I was able to parallel park that baby without a hitch (no pun intended).

I never thought about sticks being less likely to be stolen because fewer thieves can drive them, but I guess you’re right! lol

As for using the e-brake in SF … your secret is safe with me, PK. 😉

Thieves foiled by stick shift!

http://news.yahoo.com/blogs/sideshow/carjackers-foiled-mysteries-stick-shift-215110818.html

Oh brother. LOL!

Nice catch, AJ!

When we moved into our house in 2007, I created a spreadsheet tab that actually had a 10-15 year list of things I would like to do over the time frame. I keep track of it regulary. I find that we haven’t done as many of the things that I originally listed, some because we haven’t needed to and others because we can’t afford to (it was created as a list independent of finances). It’s interesting to track and update it. Sometimes I simply push out years, sometimes I remove the task, and other times we add new things. It’s a good gut check to make sure we’re not falling behind on keeping things up around the house.

I update mine every January. It seems like I’m always tweeking it and making changes, but that’s to be expected. Strategic planning, by its very nature, is always subject to change as we get more information!

I wish that getting a driver’s license required passing the driver’s test on a car with a manual transmission. I think that many people would fail it, which would result on less bad drivers on the road.

I like your thinking, Squeezer. Of course, I don’t think the lack of a driver’s license will ever stop somebody from motoring around if they’re really determined to drive.

I kind of talked about this today on my blog. We have been so focused on paying off my girlfriend’s student loans that we forgot about the big picture. We now have a plan for the next few years though.

Yes, that was a nice post, Lance.

Here’s the link for those of you who want to check it out:

http://www.moneylifeandmore.com/how-we-lost-sight-of-the-big-picture-3043/

My Civic’s transmission is a bit more demanding. I really like to push it too.

Awhile back I actually stalled it in the drive-thru line at Jack In the Box after getting my order. Sheesh. Needless to say, that was very embarrassing.

I don’t know what came over me. I guess I was so excited to get my Jumbo Jack and chocolate shake that I temporarily forget how to drive. 😉

I did this with my home’s roof and siding when I bought my house. I prices out the costs and started saving from the first month.

I’ve never thought about using it with a car, since I usually don’t spend more than a few thousand on a used one.

Excellent longer-term cash flow planning tips. I tried to teach my then girlfriend, now wife how to drive a stick. Suffice it to say we’ve never owned a manual transmission vehicle since we’ve been married. Our son attended school in MS for a semester. I got a call once at 3 am asking how to drive a stick as he was the only sober one of the group. It was a “three on tree” truck to boot. I think I told him to use the clutch and wing it. Evidently he made it OK (this was in the fall of ’11).

My sister had an old Ford (I think it was a Fairlane) that had “three on the tree.” Those don’t seem to be quite as fun to drive though!

Wayne – Early in our marriage my husband tried to teach me stick and we realized our relationship was more important than a few bucks. We broke down for lessons. I got the most patient and encouraging teacher, (he also taught guys how to drive 18 wheelers). Best investment we ever made.

The scene is from the security cam in the mega mall parking lot in Vallejo, Ca.

It is late and the car is alone.

Out come the three bad guys who break into the car and they pile in and close the doors.

The car sits. And sits. And sits.

Finally the doors open and the bad guys leave the car behind.

It turns out that none of them knew how to drive a stick!!!

For myself, I have never owned an automatic. With an automatic the vehicle transports you to your destination. With a stick, you drive the car.

My daughter is coming up on 15 and , yep, driving is at the top of the list.

My wife will teach her first in the soccer van with the automatic. And the dad gets to take her out with his car and the stick.

Over time, she has seen that it is just more fun to drive a stick than an automatic and wants a stick for her first car. Tee Hee. She’s a Driver!!!

Allow me to pass along a great tip I learned a while back regarding the side view mirrors.

Adjust the mirrors so that they pick up where the rear view mirror leaves off. This causes you to adjust the mirrors farther out than what you have been doing, and it takes a little to get used to, but done right, you eliminate any blind spot on the side. A quick glance and you know exactly what is happening on the side of your car without having to bob your head around while you check.

My mother is 74 and says a stick is ‘more fun,’ though she now drives an automatic Honda CRZ [honda’s hybrid sport car — in bright red]. Me too honestly — and I drive a manual Toyota Rav4 [2004] in San Francisco. Our Honda Civic sedan [1998] had the softest, easiest stick shift I’ve ever driven — so maybe yours needs a little adjustment?

The only long-term planning I’m doing is for my daughter’s college fund [though I plan on trying to talk her into just taking the classes she wants, traveling, and not bothering with a degree since she wants to be a writer], and we hope to go on a Europe trip in three years. We drive our cars for 15+ years, so I’m not worried about those any time soon — and with common 1%-2% financing on cars, it seems foolish to pay cash. Seems like you could do better with that money elsewhere.

Funny, I just had a similar conversation regarding the fact that no-one really learns to drive on a stick shift this past Sunday; I bought my first car, a used manual VW Rabbit in 1981; I had felt that mastering the clutch–I would be able to drive any car home in any situation. I always had a Plan A and a Plan B. Most kids today fail to plan…at all 🙁

Great minds think alike! I too have an 18 year old Matthew; He is a freshman (Journalism major) with a plan. He is working on a resume trying to secure a summer internship. I am Blessed! “We reap what we sew”