Teaching kids about personal finance is not an easy job. Even so, as a parent I believe it is my responsibility to ensure that my kids have a thorough understanding of good personal finance practices before they leave the nest.

Ultimately it will ...

Continue reading A Small Victory in My Quest to Raise Financially Literate Kids

The Unconventional Wisdom of Household Strategic Planning

My son, Matthew, is quickly approaching his 16th birthday and so I've been giving him a few driving tutorials.

I haven't let him get behind the wheel just yet -- that's on next month's agenda -- but it's gotten to the point now where every time ...

Continue reading The Unconventional Wisdom of Household Strategic Planning

Save Money: In-School or Going Back

Whether you're starting college for the first time, or going for a different degree years later, you should look for ways that you can save money during college. College is a great expense and many people incur thousands of dollars of debt in student ...

Continue reading Save Money: In-School or Going Back

Essential Tips for Lowering Your Grocery Bill (Part 2)

Food isn't cheap.

Want proof? Then chew on this: I spent almost $12,000 in groceries last year for my four-person family, including two teenagers.

And what's really scary is that I work very hard to keep my food bill as low as possible every ...

Continue reading Essential Tips for Lowering Your Grocery Bill (Part 2)

I Just Made the Biggest Impulse Purchase of My Life (but It’s OK)

Yesterday I did something I rarely ever do: I threw all caution to the wind and, as a result, I made the biggest spur-of-the-moment purchase of my entire life.

Believe it or not, I spent $2462.35 on a pair of tickets to see a hockey game.

Yep; ...

Continue reading I Just Made the Biggest Impulse Purchase of My Life (but It’s OK)

What Goes Around Comes Around: Rising Interest Rates Are Inevitable

Last summer my 12-year-old daughter, Nina, was extolling the fashion virtues of her hot pink Converse Chuck Taylor All-Star high-top sneakers, better known to many as simply, "Chucks."

What I found amusing was while Nina really thought she was on ...

Continue reading What Goes Around Comes Around: Rising Interest Rates Are Inevitable

The Apocalypse Can Wait: My State of the Household Report for 2012

As the old saying goes, knowledge is power.

When it comes to tracking personal finances, one of the most important pieces of information in you can have in your knowledge database is a detailed summary that highlights where your household income ...

Continue reading The Apocalypse Can Wait: My State of the Household Report for 2012

A Simple Trick to Get iTunes Songs at a Significant Discount

I've written before about my insatiable addiction to iTunes; it's one of the biggest money leaks I have to deal with on a monthly basis.

Believe it or not, some months I'll spend upwards of $100 on iTunes songs for my iPod, although I'm trying my ...

Continue reading A Simple Trick to Get iTunes Songs at a Significant Discount

How Being Absentminded Resulted In A $2750 Year-End Windfall

At least I'm calling it a windfall. Let me explain.

You see, if I leave a twenty dollar bill in a winter jacket only to rediscover it after it has been hanging in the closet for nine months, that's a windfall.

Now I can hear a lot of you out ...

Continue reading How Being Absentminded Resulted In A $2750 Year-End Windfall

Why Marriage Makes It So Hard to Control Remodeling Costs. (Well, Kinda Sorta.)

As I've previously mentioned, the Penzo household is in the middle of a long-awaited home renovation project with a reliable contractor.

Originally, it was supposed to be a fairly modest kitchen renovation that involved replacing our porcelain ...

Continue reading Why Marriage Makes It So Hard to Control Remodeling Costs. (Well, Kinda Sorta.)

Evaluating The Costs of a Longer Commute: When It’s Better to Just Suck It Up

As many of you know, I live in Southern California; cars are king here. Most of us who live in Los Angeles can't even spell "public transportation."

That's why it was big news when I found out my employer was moving 21 miles down the road, ...

Continue reading Evaluating The Costs of a Longer Commute: When It’s Better to Just Suck It Up

My Store-Brand vs. Name-Brand Blind Taste-Test Experiment #2

Are name-brand groceries really worth the extra cost when alternative cheaper store-brand groceries are available? More specifically, when it comes to edible products, does the quality and taste of name-brand products always justify the price premium ...

Continue reading My Store-Brand vs. Name-Brand Blind Taste-Test Experiment #2

Flexible Spending Accounts Provide Free Money. Why Pass It Up?

The relentless rise of health care costs can really put a strain on your household budget. � Even with an insurance plan, health care expenses can add up when you consider most people still have to pay deductibles, copayments and other items not cover ...

Continue reading Flexible Spending Accounts Provide Free Money. Why Pass It Up?

Evaluating the Cost of Extreme Frugality

Earlier this month one of my favorite personal finance bloggers, Bret Frohlich, wrote a terrific piece where he declared war on frugality and explained why frugality doesn't always pay.

In fact, Bret's post got me thinking about those who choose ...

Continue reading Evaluating the Cost of Extreme Frugality

Kids and Money: Our Decision to Let Our Impulsive Spender Fail

I've written in this space before about just how difficult it is to teach kids financial literacy. For every kid, that seems to have a natural ability to grasp the value of a dollar and a real determination to save as much as they can, there is ...

Continue reading Kids and Money: Our Decision to Let Our Impulsive Spender Fail

Inflation: Your Four Best Defenses For Preserving Your Wealth

I kicked off this series on inflation with a warning about why all of us should fear inflation and why the US government needs it to take root in our economy. But I'm not the only one who thinks so.

Forbes posted an excellent article on the coming ...

Continue reading Inflation: Your Four Best Defenses For Preserving Your Wealth

What It Really Feels Like To Be A Millionaire

Yesterday my family and I got in the car and drove to Arizona for the day to see my beloved Los Angeles Dodgers play a Cactus League game against the Chicago White Sox at their new spring training complex known as Camelback Ranch.

The Dodgers lost ...

Continue reading What It Really Feels Like To Be A Millionaire

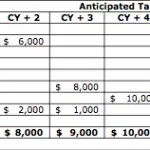

Budgeting to Meet the Household Strategic Plan

A household budget should be based upon a well-thought strategic plan for the future. I've already discussed how to establish your household strategic plan so you can begin to build a household budget that meets your long-term strategic plan. ...

Continue reading Budgeting to Meet the Household Strategic Plan

- « Previous Page

- 1

- …

- 5

- 6

- 7