At least I’m calling it a windfall. Let me explain.

You see, if I leave a twenty dollar bill in a winter jacket only to rediscover it after it has been hanging in the closet for nine months, that’s a windfall.

Now I can hear a lot of you out there already. That’s not a windfall, you schmuck, that’s just dumb luck.

Oh sure, you’ll say I didn’t gain any additional money that wasn’t officially mine to begin with anyway, but I disagree.

In reality, what I really did was rediscover a little money I had unwittingly lost the previous winter. Therefore, it’s a windfall.

That’s my story anyway and I’m sticking to it.

Why I Love Flexible Spending Accounts

Now let me tell you about my latest windfall.

Every year, I take advantage of the health flexible spending account (FSA) offered by my employer because, frankly, I’d be crazy not to. After all, FSA contributions are essentially free money. Well, at least part of them are. That’s because FSA contributions — which are used to pay for out-of-pocket medical expenses that are not covered by your health insurance plan — are tax free. That’s right tax free!

So by taking advantage of the tax-free money I contribute to my FSA I am, in essence, allowing the government to subsidize a portion of my annual unreimbursed medical expenses.

Needless to say, every year you can bet that I use my FSA to pay for all my medical copayments and deductibles on everything from prescription medicine to glasses and contact lenses.

In 2010, I elected to have a little over $105 deducted from every paycheck and placed into my FSA. For those of you keeping score at home, that’s $2750 in tax-free money.

My Summer FSA Ritual

I always have enough medical claims to use my entire FSA allowance by mid-summer. Always.

In fact, I have this ritual where every August I usually tally up the family’s qualifying medical expenses and then use the FSA reimbursement check to help soften the financial blow of our annual summer vacation. Usually.

I say “usually” because, on the eve before my employer’s annual benefits enrollment period expired last month, I was finalizing my 2011 electives when, to my utter amazement, I realized that I had yet to request any medical reimbursements in 2010 from my flexible spending account! Yep!

Just like that, 2750 simoleons that I thought I had already spent in August were suddenly available — and just in time to defray all those holiday expenses too!

As the old saying goes, I was happier than a tornado in a trailer park. Heck, even the Honeybee did her little beehive dance after I told her about our large windfall.

My only disappointment was that I badly underestimated our qualifying medical expenses for the year; we ended up having over $3500 in all.

True, everyone has to be careful to not overestimate their annual qualifying medical expenses because FSA money deducted from your paycheck is “use it or lose it,” but you may be surprised to learn that it often doesn’t take much for qualifying medical expenses to quickly add up, especially for a family of four.

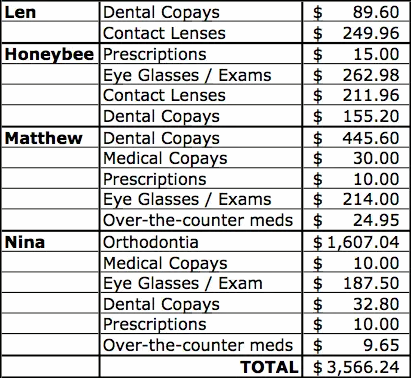

For example, just take a look at a gross summary of my qualifying expenses this past year:

Still, even though I underestimated my expenses just a bit, I’m certainly not going to quibble. After all, getting an unexpected $2750 is nothing to scoff at. No matter what you decide to call it.

I totally underestimated out health costs this year and put aside only about a quarter of what our real costs were. So frustrating!

Glad things worked out for you. Gotta put aside a lot next year because child number 3 will be getting braces…

I’m glad you were able to make good use of your FSA in 2010, Len.

I must quibble, however, with your figures. If you put $2750 in your FSA, that is money that has been sheltered from Uncle Sam at a rate of ~20-25%. So really, it’s more of a $550-690 windfall. Still nothing to sneeze at; but being the math geek, Type-A person I am, I thought it needed some clarification.

I’m certain you understand the math behind it, but I’m trying my best to make people realize that the tax savings that we get aren’t always what we think.

You actually had to spend $2750 to receive $550-690 in return. In this situation, you actually received value from that spent money, unlike a home mortgage. People spend thousands and tens-of-thousands on mortgage interest and receive back 20-25% of that money and they are thrilled. Why not have no mortgage payment and keep 75-80% of your money?

Oh well…hopefully I don’t trip and fall when I get down off of this soapbox!

Thanks for the blog, Len! Keep up the good work!

TC

Ours is set up that as soon as something clears our insurance, it is automatically transferred to our checking account. The only thing we have send in are things like receipts for contacts, glasses, etc. However, we have so high of medical stuff….we never even get that far. We put $4000 in per year, and use it all and then some.

What is nice is sometimes we get the money BEFORE the bill comes, so we have the money to pay it without having to lay anything out.

@Everyday: I know, Kris. Orthodontia is terrific for helping to maximize your FSA contributions. In 2009 I had both kids in braces and I was able to claim more than I did in 2010.

@Centavos: The good news is, FSAs definitely take the sting out having to pay for those braces.

@TC: You’re very welcome! Thanks for stopping by! You’re right, I am more than aware of how the tax implications work, but I just didn’t want to get too “tutorial” for this particular piece, if you know what I mean. Thanks for the clarification though! For what it’s worth, I did explain the tax implications with the link I included in this piece to another article I wrote on FSAs.

@Mysti: Wow! That is a very convenient set up! Still, I prefer waiting until I’ve got enough claims in hand to get all of my money in one fell swoop.

At least you didn’t completely forget about the FSA. Then you really would have missed out.

Noting that most of your medical expense were related to teeth – I really should have gone into dentistry! Darn dentists make a mint off most families. 😉

I don’t take advantage of my FSA plan, but then I also don’t have kids. My out of pocket on most medical expenses barely tally up to $500 for the year. However, I like the idea of tax-free money! Maybe I need to research this a little more.

Doesn’t matter where it came from; as long as you’re getting some unexpected money, it’s something to celebrate!

Don’t forget that over-the-counter items like cold medicine and band-aids are not eligible for the FSA in 2011; BTW, Len, you are spending way too much in glasses and contact lenses. Warehouse clubs and Wal-Mart discount the same contact lenses that the eye dr. sells and have kids glasses for $38…and they are nice…and it includes scratch-proof coating (and might even include warranty and coverage for accidental breakage)!

Hey Len – I couldn’t help but notice the money spent on dental co-payments. I was just curious if you’ve calculated whether or not dental insurance is worth it for your family.

In one of my dental public health classes, we talked a lot about insurance, and one professor even said that it wasn’t insurance at all since insurance is meant to help with catastrophic losses. He called dental insurance “a social dental pre-payment plan.”

Just curious about your thoughts on insurance for things that aren’t “catastrophic losses.”

i like to call it ‘free money’ — stuff you hadn’t expected, and could (in theory) use for whatever you want without guilt!

Don’t forget about those who are eligible for DCA (Dependent Care Acct). Same concept however, the annual contribution limit is 5k and this must be spent on daycare,elder care etc.

If you have small children in preschool you KNOW you are going to spend well over 5k annually and there’s no scrambling at the end of the year to buy OTC’s.

I usually wait until the balance accrues and spend it on family vacations and Christmas.

Our FSA amount (the withholding for next year) needs to be done by 11/5. 2 years back, our daughter got word she needed braces on 10/25. Perfect timing.

Remember for 2011, no more OTC reimbursements.

@Tom: No, I haven’t calculated if dental insurance would be worth it. My current dental plan covers some stuff, but it isn’t the greatest. The copays and deductibles are pretty high though.

@Onestep: Good point. Thanks for the tips. It looks like we both have the same idea with respect to spending our checks!

@Joe: I love it! From what I’ve read, the OTC isn’t totally kaput, Joe, as long as you get a note from your doctor authorizing the purchase(s).

@Jennifer: Those changes were implemented as part of the Obamacare bill. Another limit from the new law that is coming in 2013 limits the maximum FSA contribution to $2500, which is going to hurt a bit too.

Great discovery! “Happier than a tornado in a trailer park…” That’s GOTTA be such an old saying it’s even older than me (wow!), ’cause I’ve never heard it before.

When I was working for the state, we had a nice FSA plan, but my health insurance was excellent and so was my health, so I hardly ever had any claims. At the end of the year, I’d have to dream up ways to spend the use-it-or-lose-it money: glasses I didn’t need, medical checkups I didn’t need, contact lenses I didn’t need, and on and on. Quite a time- and money-wasting activity.

This used to be easier when the flex plan would accept just about anything. But two or three years before I was laid off, my employer changed administrators, and the new outfit wouldn’t accept anything. All of a sudden over-the-counter items I was used to covering with the Flex plan were no longer eligible, even if a doctor put in writing that you needed it. About the only things that would qualify were copays, prescription glasses, and dental procedures. This made it impossible to spend even the most conservative estimate of annual spending, so I dropped it. And frankly, was happy to see the extra money in my paycheck.

The secret is in sitting down at the end of the year — during benefit renewal season — and estimating out how much you will spend for the following year. The Honeybee and I try to determine all of our basic health expenses (like regular medical, dental, and eye checkups for the family, glasses and contact lens expenses, kids orthodontia, and planned/anticipated medical procedures). We have yet to get into a bind where we are forced to spend money at the last minute. It works for us anyway.

After reading this, I went and checked our HSA balance online, and was pleasantly surprised as well. Although as Kris says, the other shoe hasn’t yet dropped with regards to our younger one’s braces.

I would call it a windfall too as you were not expecting that money. It is like when you get a tax return. A lot of people go: yeah, it’s good, but it was already my money. I know that, but it’s nice to have it back when you didn’t think you would. I love this feeling!

Hi Len, I’m glad you remembered to use it! I never got an FSA because I couldn’t stand the thought of losing my own money, and my medical bills were low. My husband and I did sign up for the HSA which is similar, but you need a high deductible plan. It lets you roll your balance over year to year. I like the tax savings but I’m not pleased that they are making the rules stricter next year. I guess too many people were using it and the tax receipts fell.