Awhile back I described ten common characteristics of debt-free people.

Awhile back I described ten common characteristics of debt-free people.

In that article, I specifically asked my readers to consider this question:

“Why is it that there are families out there with household incomes under $40,000 comfortably making ends meet and saving for retirement with no debt on the books — or at worst, a single mortgage payment — while others who make millions per year like Sinbad, Ed McMahon, Mike Tyson, and Stephen Baldwin have trouble keeping their financial heads above water?”

While that list was met with general acceptance, I did manage to start up a minor debate between the readers as to whether or not it was really possible for the majority of folks here in the good ol’ United States of America to make ends meet on $40,000 per year. Keep in mind that I originally published the article in 2010 — so, after adjusting for inflation, that number is equivalent to $45,000 in 2017 dollars.

Even so, how can I make such a claim?

Well, I live in Southern California; it’s one of the most expensive places to live in the United States. In fact, according to the Council for Community and Economic Research, Los Angeles currently has the seventh-highest cost of living in the US, behind only New York City, San Francisco, Washington D.C., Boston, Seattle and San Diego.

Even so, there are still millions of people living here right now that are making ends meet on $45,000 or less.

I know if I had to, I could make it here too on that amount of money — and if I can live on an annual income of $45,000 here in Southern California, I’m certain I could make it most everywhere else in America, where the cost of living is significantly cheaper.

How do I know for sure? Well, if you’re a regular Len Penzo dot Com reader, you know that I’ve been meticulously tracking every penny I’ve earned since 1997.

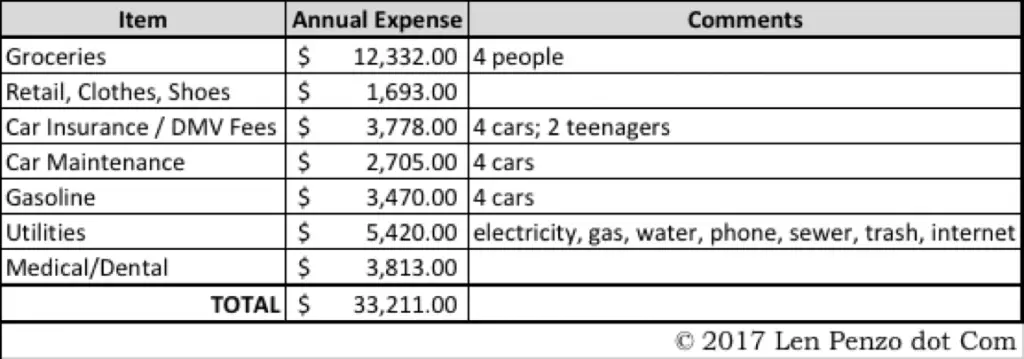

Although I have a much more detailed breakdown, here is a top-level summary of just my key household expenses in 2016:

Remember, most of these expenses should be considered conservative. Why? Because if I was making only $45,000 per year I would certainly work much harder to cut some of those costs down — starting with kicking my two teenagers off the auto insurance policy, which would reduce that bill by more than half.

You can also bet I’d be much more vigilant about limiting our gasoline and utility bills. Likewise for the retail purchases. However, the biggest area where I could really cut corners is the grocery bill; although we do plan our dinner menus to save money, we rarely take advantage of coupons. We currently eat lots of steak and other expensive cuts of beef too, so I’m quite certain that I can easily cut our grocery bill by at least 25%.

But, Len, what about the mortgage?

Well, my mortgage payment is a bit less than $640. And although I bought my home almost 20 years ago, there are still places in Southern California where you can find a place to live for $1000 per month.

With that in mind, if you add everything up, those basic expenses come to about $45,000 annually.

Yes, I realize I still haven’t accounted for federal, state and social security taxes. But I’m certain I could offset whatever taxes would be deducted from my paycheck with the savings I’d get by reducing my other bills.

Would my family be living like kings and queens? No.

But we would be living in a respectable and comfortable home in Southern California, with four insured cars in the garage, and presentable clothes on our backs. We’d also go to bed each night with full bellies. Unfortunately, the downside is that there would be little money left over to put away toward my retirement, or an emergency fund in case my water heater broke.

I admit, it’s not ideal. Clearly, it is a no-frills lifestyle; but it’s certainly not poverty either.

So if you and your family are blessed with good health, but you find yourself still having trouble making ends meet on approximately $40,000 per year — and are truly serious about living within your means — I strongly suggest you reassess your situation and see where you can cut back on your expenses. After all, as these testimonials show, there are plenty of folks in America who have been able to live comfortably on less than $40,000 annually.

Otherwise, you’ve really got nobody to blame but yourself.

One Last Thing …

I completely understand that households earning less than $40,000 have to work extra hard to ensure they have enough savings in retirement — which is why it’s still important to invest in the stock market, no matter how little the amount.

Investing in stocks is a great way to increase your annual household income. With stock market research, you’ll learn the art and science of buying and selling to attain successful outcomes.

Here are some benefits of investing in stocks:

- Long Term Gains. Remember that over a long time period, the stock market increases in value, even though individual stock prices fall and rise daily.

- Dividend Income. Many stocks offer income through dividends that can be used to pay other investments as you grow your investment portfolio, including a retirement fund.

- Investment Diversification. While it’s good to have money in the bank, diversifying into investments like bonds and stocks can provide you with additional returns.

- Ownership. When you buy a share of stock, you become a business owner of the company.

With all that in mind, it’s important to remember that investing in stocks should be done as early as possible so you can maximize the benefits of investing and reduce the downside risks that come with those occasional — not to mention inevitable — bear markets.

***

If you’re a household CEO who is successfully making ends meet on roughly $40,000 per year or less ($45,000 maximum, please) I’d love to hear from you. Contact me at Len@LenPenzo.com and be sure to put $40,000 in the subject line. If I publish your story, you’ll get a $25 gift card or an American Silver Eagle!

Photo Credit: Hitchster

First thing to do, if you do make that much, should be to move some place cheaper. I want to move to cheaper location – I would take about 25% pay cut, but that would be more than offset in lower taxes and bills. Alas, my wife’s career right now makes that impossible.

Someday I will leave Boston…

Meeeh, I disagree. Established family/social/business networks are worth the premium.

Would rather be poor but surrounded by culture/family/good weather than living in a McMansion in a town where the cultural center is Wal-Mart.

I have lived in both such places. The latter was soul-sucking and required a car to get everywhere, the former has made my day-to-day life joyful by comparison.

I think kids might switch the equation, but if you’re single and your living in the middle of nowhere in the prime of your life, you’re a fool

how do you figure you can save anything for retirement. if you add in a mortgage — albeit that small one that you have — that already puts you in the low 30s. And I think $640 is on the low side — really low side – for a supposed high cost area.

If you pay Fed/State tax on the that 40k you’re already down to 32k — not including Social Security tax. That basically leaves you w nothing to save. You might have to cut your grocery bill by half in order to save $4k or 10% of $40,000. not to mention SS tax.

“by low 30s” I am talking about your expenses $25k+7k mortgage

My husband is 45, I am 51 and we’ve been married for 24 years. A first glance we might seem poor, hell, even financially pathetic to some if they judge us on income alone. But they would be wrong. I worked for over 20 years but retired at forty because I loved what I did yet hated having a job. That leaves me time to actively manage our finances and save lots of money by doing things like cooking for us, myself. We have learned to make do on what was once our lower income and we’ve never been happier.

We make less than the 40K you mention. In 2014, we put between 9 and 11% right off the top, adjusting upward as he earns raises, into a Roth 401(k) at my husband’s work. He received a $2/H raise two weeks ago and I changed the election to 13%. We will never miss it. He also receives a 3% match.

I pay an extra $250.00 in principle on our mortgage every month.

We have no credit card “debt”, though I do use Discover every month to get the cash back. I pay it off in full, maintain a terrific credit rating (836) and in the last 24 months they have paid us over $250 to use their card. That is more than the interest we’ve made on the money we keep in our emergency MMA fund ($40K.)

And, for the last two years, I have put $2,000 into a Roth IRA for me so that we would both qualify for the 50% Savers (tax) Credit – $2,000 combined. (Where else can you get an IMMEDIATE 50% return on your investment ?!? ) That lowered our 2014 Fed tax bill to $44, which includes the tax on the nearly $8K we put into the 401(k)! Bless those Roth’s that grow tax-free.

We take the money we saved on taxes because of the credit ($2,000) and invest it until it is time to take it and add it to my IRA again, to qualify for the next credit. We will be down to a 20% credit this tax year. Still, though, win-win-win.

Of course, we are in Wisconsin, so the cost of living is much more reasonable than on either/any coast. $1.19 for two pounds of carrots. A loaf of whole grain bread goes for $1.89. A gallon of gas is $2.65. Et cetera. We are generally content with simple pleasures and can pay cash for the occasional extravagance, which for us can mean hot dogs with everything and root beer floats.

Most important, we want for nothing and are able to make regular modest cash donations to charities whose good works we admire.

I also find the time to post lengthy (very) parenthetical comments.

More than 40 percent of our 40000 in Canada is taken for taxes. Then add in rent or mortgage and you can’t do it. Let alone While working in Toronto.

That’s what I was thinking, a mortgage that low is almost and heard of, and after that and taxes, what’s left?

How about making less than $11,000? What can you do with that?

Well said? I agree completely.

I can’t see how you would note this as a very expensive place to live when your ANNUAL insurance for 4 cars is 3k. My insurance for 6 months is 1200 and I don’t have a bad driving record or any accidents … And you can find places to live that cost under 1k. I’m from NYC where a 2 bedroom apartment in a neighborhood with a bad school system is 1600 dollars on the cheap end.

Insurance rates vary *wildly* not only across the country, but across carriers.

I *strongly* recommend shopping around every ~11 months (just before renewal time, if you’re on an annual policy) to see what you may be able to do to save on premiums.

That said, every time I’ve shopped around in the last 3 years, I’ve come back to my current carrier (Liberty Mutual). We carry a top-end policy from them with full collision on both 2014 vehicles (one still on a lien) we have, and have our home-owners’ through them, and an umbrella (because I travel a lot for work). We live in semi-rural Kentucky (higher rates, oddly enough, than when we lived in a major city in KY), and our monthly car insurance payment is ~$180.

I live on $25,000, no problem.

Although, I would use some extra money for traveling and a Tesla car.

I absolutely agree with you 100%, but I’m also afraid that I couldn’t. 🙂 One thing about it though, we pay a significant amount of money in taxes, and we also aren’t eligible for any of the services or discounts that many people at this income level do. We have often wondered if we would be better off to make less money, which is a sad thing to ponder in a capitalistic society.

I think – check that – I *know* you could make it on $40,000 per year if you had to.

We should never ever have to wonder in this country if it might be better if we should make *less* money. Once that thought process starts to pervade our society, we become beholden to the politicians – not the other way around!

You forgot daycare. I have two small kids and no family close by. I pay close to 22K in daycare for them. I’m lucky I’m taking them to a daycare where I work (admittedly in the boonies), because I’d be paying about $150 a WEEK more if I had to take them to a daycare where I live. I don’t want to wish their childhood away, but I’ll breathe much easier financially once they go to school.

I like how you shut him up with a perfectly valid point. 🙂

People (especially single parents such as myself) who have to pay for childcare and their child’s medical/dental/vision insurance (because my work offers it, my child isn’t eligible for the free program through my state, and I can’t insure her without also insuring myself as they don’t let you do that) can’t afford to live on $40,000/year in most cities, let alone large ones with high rents to live in neighborhoods where you can get to work by 8am (so you don’t get fired) and won’t get shot at.

I make very close to $40k/year. I claim what I have to claim on my taxes so I won’t owe at the end of the year and might get $50 back. Add to that, my health insurance through my company for myself and my child is expensive!!! (around $7,000+ per year pre-tax, it has to be the most expensive plan with copays and the tiniest deductible or I’m paying to have insurance I can’t afford to use because I’d have to pay $4-5k out-of-pocket and after taxes before it kicks in, which I don’t have the ability to do on my very tight budget).

Thanks to my city being suddenly insanely popular and tech companies moving their employees here in droves to save money, my rent has nearly doubled just in the last couple of years.

Bottom line: after finally leveling up with several pay raises at two different jobs, my checks are as small as when I was making $29k per year, and my expenses are *at least* 1.5 times what they were then. Think about that; I was struggling then, now struggling would be a step up from where I’m at. Getting by in the city I’m now stuck in is impossible on that much money. It wasn’t always so unaffordable.

I get sick of seeing so many glib financial advisors on the internet who have been able to put themselves in a position to not truly have to take their own advice. It must be nice.

Jade, I didn’t respond because I was trying to be nice by not stating the obvious. If you have to pay $22,000 for child care and can’t afford the child care, then whose to blame for that? The childcare company? Or the person who had the kids without having the means to afford them in the first place?

As for taking my own advice: I follow it every day — be personally responsible. That’s all I’m advocating; why do you have a problem with that? That doesn’t mean bad luck can’t befall me that will eventually put me in dire financial straits — but if it happens, it won’t be for lack of trying.

With all due respect to you, Len, I completely agree with Jade. I am neither taking sides nor attacking you, but I honestly wish there were less of these “If you can’t…” “It’s your own fault” articles, if one can call it that.

You probably have a respectful background in finances–I’m not arguing against that at all. But what you and many other people are failing to take into account is the state of the economy on the average John and Jane Doe. I am a young professional who knows the value of work hard, and has been since she was 14 years old, but I now find myself still paying off student loans and tuition and medical expenses from 7 years ago! I live in NYC on a very strict budget that does not give me any freedom to have any sort of life other than to work like a dog and then to apply for other jobs in hopes that there is one that pays better–it’s absolutely soul-crushing, to say the least. And let’s not discount the fact that I’m unmarried without children or pets to care for!

Again, I’m not speaking for anyone here, but life sure seems cushy if you live in a palace or a mansion or even a nice NYC apartment, but some of us are trying to pull it together with what little we have. It depends on one’s job, the mercy of one’s employers, and whether one is fortunate to have financial support from others–but many people don’t. I’m one of those people who busts her back to make ends meet, and I very much get upset when “financial advice” implies it’s ‘my own fault’ that I’m suffering and that I can change my life around by simply ‘cutting back’. Of course that’s all true, but it’s not possible to cut back even more on my salary–I don’t own a tv, and the only way to reduce my grocery bill is to starve myself for a week.

Life isn’t black and white. That’s what I wanted you to be aware of. And I want EVERYONE to know that if you can’t live on $40k, it’s NOT your fault and that we should all continue to try–maybe it means we change jobs or negotiate for a raise or look into government assistance or something.

Well, I’m attacking you. Most people have kids assuming they’re financially ready. But life happens, and gets more expensive. Dogs are expensive, should poor people not have any companions? Women need less money than men, like the woman above justifying her laziness with cooking at home and handling finances while her poor husband is killing himself daily to support them both. He should take your advice and cut her loose. She’s a financial burden. He could be living like a king.

The short of this is retirement is not guaranteed. Your saving for a future that may not come to pass. One stock market crash away from you wasting your 30s collecting cans and blogging. Your blog cost money. Get rid of it because you’re clearly not qualified to give rational advice.

According to you, no one should have a pet (digs cost a LOT), a college education (which is an investment in which to have more earning potential), a girl/boyfriend, or a life really, unless you can afford it without any risk or debt. Meaning, poor people deserve to die alone.

Come see me when you retire and let me know how the last 5 or so years you’ll have left of finally being able to live without a job is treating you. Of course, once the normal medical bills start rolling in because you’re elderly, I’m sure there won’t be much to enjoy.

Okay, Mary Sue. I can take the heat … believe me. Can you?

Yes, “life happens” — but there are ways to manage it.

You tried giving a couple of reductio ad absurdum (RAA) examples to make your point — but they’re badly flawed. For an RAA argument to work, your implicating assertions really have to be truly absurd — but yours aren’t! For example, it’s not absurd to suggest that if you can’t afford a dog, you shouldn’t own one. After all, that’s how responsible people act. Likewise, it’s not absurd to suggest that if your free-loading wife is truly breaking the bank and won’t change her ways, then divorce is a legitimate solution. (You are the one who made the ridiculous assertion that all women are a financial burden to men; that didn’t come from me.)

Instead, you ironically ended up portraying acts of personal and financial responsibility as absurdities. As a result, both of your reductios failed — miserably. Do you really think it is absurd to not own a dog if you can’t afford one (even if it is forever)?

I can’t afford a home in Beverly Hills, and I never will — does the fact that I’ll never be able to buy a mansion with a 90210 zip code because I can’t afford one sound like an absurd proposition to you too? Of course not … however, what IS absurd is buying something — no matter if it is a dog or a mansion — when you know you can’t afford it. At least it used to be. In today’s entitled society, I’m not so sure anymore.

As for my retirement, you can come see me anytime. I’ll even open up my books to you. Hopefully, you’ll see that it really is possible to live responsibly and make ends meet to the bitter end — even in instances where “life happens.”

Thank you for your comments.

I think it is weird to make the sweeping statement of “families should be able to make it under $40K per year” and then admit that you probably aren’t going to get under $40K if you have daycare aged children…

I’d say that is a pretty big segment of the people who are looking to you for financial advise… I mean, I’m sure everyone could thrive under $20K per year… if they don’t have to pay their mortgage… It’s true, but not really helpful.

Bingo! DayCare…. Widowed Dad here, everyone forgets to mention daycare! I have no debt, mortgage paid, my daycare takes half my monthly pay!

Among other reasons, the cost of daycare is a huge financial factor in why my wife is a stay-at-home mom: the cost of daycare for our crew would be nominally equivalent to her take-home pay as a teacher.

I live just outside Cleveland and when you have young children school districts is something to consider. With our 3 year old just starting preschool that is 1k a month for the cheapest school by us where your kid won’t come home with bruises scabies and bed bugs and it’s not even 5 days a week for the whole day so you have to add in daycare baby sitters.

Next, your really lucky if your insurance premiums add up that cheaply and don’t give me the BS of finding a better job with better premiums where you make more money,I lost my magic wand when I was six years old. Then your family is blessed to be healthy enough that they don’t need meds and copays and all the stuff that goes along with that. Personally I have hospital acquired systemic MRSA that a doctor or PA gave me during a routine hernia operation which it is impossible to get compensated for. We recently had to move quickly from a $850 duplex we were renting because all of us but especially my son had lead poisoning. We live in a town thats considered affordable and $850 is on the lower end of average here for a two bedroom rental. I’m glad you have your 20 year old mortgage of $640 a month, does that include property tax and home insurance? How big of a down payment did you out down? Did you factor that in to your cost of living? I doubt it, probably weren’t thinking while you were patting yourself on the back. Also do you have bank notes on all four of your cars? It seems like you left a lot of large purchases out that other people have to make payments on.

We don’t qualify for any assistance, it probably would be a lot easier if we made a little less many and qualified for these things. It’s maddening paying thousands of dollars a year for an infectious disease given to me by one of the greatest hospitals in the world or that we took a hit suddenly having to move because our home was poisoning us, or that it would probably make life easier if one of us stayed home instead of working to offset the cost of daycare and preschool. But maybe it’s not always everyone’s own damn fault as you so elegantly have stated maybe you’ve had more help and better luck. Maybe there are thousands of tiny little unique factors that you simply haven’t taken the time to think or care about let alone try to understand. We get by, we have good years and bad years but the last thing I want when I’m struggling is to read an article by some guy (who I admittedly know little about, what you’ve had to overcome or endure or what kind of life you come from and what kind of help you’ve had) to tell me that I shouldn’t be struggling and if I am it’s because I’m wreckless or impulsive. We do t drink or do drugs, we rarely eat out, we shop at Aldi’s and most of our clothes are second hand. We also teach our child to help others less fortunate. We probably want the same things for our children; security, good health and a childhood filled with rich experiences not expensive things. Maybe your article isn’t inconsiderate but lacks the information and understanding or maybe you’re just self centered and and lacking empathy. See, I don’t know much about you as you don’t know much about me but we’re both putting ourselves out there. Are there wreckless people out there who only have themselves to blame about their financial problems? Absolutely. But there are countless others you smugky lump together with those people you havebt shown the slightest effort in understanding. You seem to ignorantly assume everyone is created and remain equal and that couldn’t be any further from the truth. I really hope your luck holds because I’m not sure you would be able to shoulder the weight of the struggle a million people are suffering that you write off as financial immaturity. Good luck mate.

I cant do it. I have a mentally retrded nonverbal autistic son and I have ms addisons and lupus. my medical runs 800 a month that eats up my paycheck and then some plus a sitter for my son so I can work. my mortgage for my trailer that is making me sick is 750 a month lot rent included. we don’t qualify for rent restricted once we leave the trailer but we cant afford 900 + amonth pay the car payment 355$ buy food I have to have boost or ensure besides regular groceries. we live in macon county Tennessee. it cost my husband 75.00 a week in gas to commute to mt Juliet to go to work which is 90 miles round trip. got any ideas for me.

Lisa Joyce

I understand your sons medical condition and the costs associated with him but you can make it on less by cutting your expenses. I cannot comment on many of the other posts, not knowing the cost of living where they are, but I am very familiar with Tennessee. I know you can find housing, i.e. a trailer for less than $750 a month almost half. And that car payment is ridiculous. You can save a few car payments and find all kinds of cash cars for $2000-$3000. I bought a very basic 7 year old base model American car in Nashville for $2950 with 33k miles on it. I also know there are many trailer parks that rent for around $400 a month. I bought a house in a low income neighborhood for $30k, which I admit isnt ideal, but the house had good bones. The neighborhood wasnt bad just all the houses were built in the late 60s early 70s and people want newer/brand new houses nowadays. My mortgage wan $326 a month of a 15 year mortgage.

I wrote a reply right above yours. Thank you for like me sharing what real life is like for millions of people not priveleged or lucky enough to live like the author. We are not created equally and those of us who understand that and build our character by shouldering the weight of these experiences are at least lucky enough to be empathetic and count our blessings because as hard as our lives are we know there are millions of others, perhaps billions who have it even worse. My heart goes out to you and your family.

You sir are an idiot.

Try being a single parent, with no assistance, making only 40/year minus taxes. Not possible unless you can find a 2 bedroom for less than 600/mo (not possible where I live), don’t have a car payment (which would mean you’re either rich already, or have a super cheap beater car that isn’t reliable. which also means your insurance is high.), plus you figure in student loan payment (even on income based of 40.00/mo), utilities, gas, groceries, diapers, etc. It is not possible. My car insurance is 1632/year for ONE car, and that is cheap where I live. Add in the cost of child care…forget it!!!

Please, Ashley … I understand you’re frustrated, but there really is no need for name calling.

These people have little trouble living on $40,000 annually. If they can, you can too. Rather than shooting the messenger, read their stories — you might learn something.

Choosing where to live makes a big difference; Like moving to Panama or other country where you can live very comfortably with under 1k a month. But that is not practical for many,

unless you are retired.

Limiting credit usage also makes a difference. But we must not forget that because of the high cost of education, many families have to live with low salaries for lack of a career. Some statistics show that close to twenty five percent of the US population exists with twenty five thousand dollars a year. About thirty percent earn 50k> a year. These stats are as of 2012. Obviously salaries have not increased that much to offset the cost of living. On the other hand, some cannot make it with even higher wages due to the “cost of living high”. As more people are being displaced by automation and farming jobs overseas, the working people find themselves competing for the same low paying jobs. The ones that really benefit are the big corporations because all they have to do is increase the price of their goods, without increasing salaries. We live in a world that is really messed up. If you have your house paid for, consider yourself blessed. Some of us lost our homes due the greed of those who created a bubble and then bursted it. Yes, it may be possible to live “comfortably” on 40k. But the economic reality shows it as an exception rather than the rule. I don’t read of thousands of families succeeding at it.

I haven’t been following you long but I suspect you’re not including a freelancer’s scenario. Freelancers pay both halves of Social Security, plus federal, state and local taxes. So a $40,000 income would knock off about $8040 in our locale. Netting $31,960. It’s low enough income to avoid federal taxes once you do all the deductions and exemptions. As one though, you’d also have to cover individual health insurance and retirement, totally out of pocket.

In our case we’re hiring the kids out, if only to cover their food costs. Both are older boys in athletics, if you know what I mean. Maybe they’ll marry young…(Just kidding. Sort of.)

Olivia, this cracks me up. My son is an athlete in college and he eats half the food in our house. The good news is that he got a job at the grocery store, so he has his own insurcance and brings home food. It’s awesome.

Great point. You’re right, I didn’t consider freelancers. A serious health issue will most certainly upset the apple cart, which is why I included the caveat about being in good health. There are options such as getting a catastrophic health insurance policy.

Even so, my example did include over $3000 in health care expenses. 🙂

$3000 a year is very very cheap for healthcare for a family of 4 unless you have a substantial employer subsidy for healthcare – I pay $2400 a year for health insurance for a single healthy 24-year old. You can certainly go a bit cheaper if you are single and healthy, but the coverage starts getting patchy, and if you can’t get decent coverage through your employer and have children or are in a higher risk category… most bets are off on what you’ll be paying for health care.

Not to say that families couldn’t live a basic lifestyle on $30000 or $40000 a year without a nice health plan provided, but it starts looking a lot riskier and it does start to involve more difficult choices than giving up a fourth bedroom, granite countertops or a new car.

Absolutely, Tim. If I had to do it over again as a single guy in my 20s – assuming I did not have employer coverage – I would roll the dice and go with a catastrophic plan. I would get a catastrophic plan (I am fairly certain they can be had for $100/month, if you are a healthy young adult). I would then allocate another $100 per month into a savings account for non-catastrophic medical “pop-ups.” That’s just me.

It can definitly be done. My husband and I take care of our family of five on less than 40,000. Of course I am blessed my husband can fix anything and I bake everything. No frills. But we are always full and don’t have a dish on our house like we are waiting for aliens to reply 🙂 oh. no offense. It is all about choices. our mortage will pay off next year and then we can relax and live a little. I am 37. husband 42. we are self employed so we know all about the taxes! In our area we have apparently high local and state taxes too. We still live on less than 40,000 in 2010 it was 35,000

You go girl! I would love to know if you live in CA and how you are doing it. Do you have a blog?

In the early ’90s, I was floating a family of three on $21,000 per year, in very expensive San Clemente, CA. That was about the equivalent of $40,000 in today’s dollars. During that time, I saved up a down-payment for a house and started college funds for my kids.

Having done it, I can say that it’s definitely possible, but not desirable. I wish I had of concentrated on college and earned a higher wage when I was young. It’s much more pleasant for my family to live in our house, have multiple cars and be able to afford entertainment. Barely scraping by is no way to live.

Len, I bet you could cut your food bill by 50% if you really wanted to – even without coupons! I’m not sure how food prices in PA compare to Los Angeles, but we spend about half as much per person on food as you do. The key for us is avoiding convenience foods and limiting meat intake (though we still eat a good bit).

I also have to agree with you, because if you can live in LA on $40k/year you can live just about anywhere on that. But people are too stubborn to realize that many of their “needs” are just wants. If you’re going to live on less, you’ve got to learn the real difference between what you need and want.

Well, Paul, I have a teenage son, so he might throw a monkey wrench into any plans I had to cut my food bill by 50 percent! But you’re right. We don’t eat a lot of convenience foods – I cook most of my meals from scratch using lots of recipes – but we do eat a lot of meat though. We could definitely cut back significantly in that area if we had to.

Hmmm, rations for the teenager?

Just kidding! 🙂 I know it can be more difficult with teenage boys. I was one once, you know. I remember rummaging through the cabinets and fridge looking for food all the time.

But meat really is a killer on a food budget, especially the expensive cuts. But with a little know-how and some help from Alton Brown, you can turn some cheap cuts into really good eats. We do that often to get our meat fix.

We also rotate a few key dishes (cheap ones) into our menu every couple of weeks. I’m talking beans and rice type of things here. But they’re easy to vary by adding different chopped veggies and with the right seasoning they’ll taste great.

Have you made Alton Brown’s mac and cheese yet? It is really good! (Not as good as my stove top recipe – hey, people, don’t knock it ’til you tried it! – but very good!)

We’ve made the baked one several times. And yes, it’s delicious! He has a stove top recipe, too. But I haven’t tried it.

Mac and Cheese? Oh God. Not healthy. Stick to way more vegetables and fruit and a little clean fat and NO BREAD, cheese or gluten. You can save so much by not buying bread and gluten filled crap. I know this is about saving money. But I dropped 70 pounds in 15 months due to changing my diet. I earned $22K in 2017 and I lived with my mom before she passed. Now I’m single in So. CA and my rent is $750 a month and my place is 490 sq feet and my unemployment is only $850 a month. For 6 months. No kids. My main three expenses are Rent $750. car insurance $240 and my gasoline is about $300 – $400 a month. I do drive about 300- 320 a week as I go to a gym and I pay yearly for that. I don’t like anyone having my debit care for a gym. I pay yearly for MS Office. I pay $8 for Netflix (a want). I rarely eat out as it is not clean eating. I rarely by meat. I do buy fish. I buy way more veggies and fruit. I’ve gotten rid of so much after my mom passed downsizing from a 1600 home to only 490 sq feet. And now I want to move to San Diego County from Riverside County? Rent is more which means I may need to rent a room Renting a room in San Diego County is at least $1,500 a month. I’m blessed to have my own place at $750 a month rent. And my unemployment will END around June or July. I just drove to Escondido (50 miles south) for a job interview with Staffmark today. I told them I want to relocate down there near Vista or Fallbrook. Close to ocean for me. I’m 60 miles away from Oceanside. I want to live near OCean. And that will COST ME yet it is my choice where i want to live. For now I’m happy where I’m at. I WANT to live with a partner. I don’t need to look for a girlfriend (I’m a lesbian). I am happy living alone (as I don’t really want to rent a room and share the kitchen. How weird is that? Living with my mom was okay ….she was my mom. But another person a stranger and cooking in their kitchen? I’d cut costs down if I rented a room for say $1K a month yet….I don’t know if I’d feel comfortable with that set up.) I’d LOVE to earn $40 K a year. I would love it. I never earned over $21K a year. Never. So bring it on.

Thanks for the comment, Sandra. Good luck on your endeavors!

One thing: unless you suffer from celiac disease, the gluten bogeyman is a myth.

https://www.everydayhealth.com/diet-nutrition/diet/gluten-myths-facts-know/

Sorry but 40,000 isn’t realistic living in some areas. I agree with the original poster however he has the luxury of living in a safe area. I live in Chicago. There isn’t a single apartment that cost 500-600. In fact most apartments in Chicago are 900+. Can I find cheaper places? Yes but they are also in the most dangerous areas too. So I can live within my means trying to avoid gangbangers and drug dealers on a regular basis or I can live in a safe area barely making it lol. Also I don’t know what california

S taxes are, but I can assure you chicago has one of the highest taxes in te nation. Our tax is 10%.

So again can one live off 40,000? Oh definitely if you live in the a state like Georgia, North Carolina, South Dakota. But where I’m from buddy it doesn’t work.

Forgot to add where I’m from middle class is virtually non existent. You either live in a nice safe area(which is expensive) or a dangerous area (which is affordable).

Also I was thinking if 40,000 was the amount given with taxes and all that jazz taken out then yes one should be able to live anywhere on there own. I know my salary is about 38k and when you take out Illinois and chicagos stupid taxes I’m at about 25k or so.

40000 less taxes and other deductions = 2400 per month

Rent $1200. other bills $250. 3 adults. How do I save for retirement on this

I lived in Chicago for seven years on $15,000 per year. East Rogers Park, Albany Park, and West Rogers Park are safe and affordable. I usually had roommates, but the year I had a studio in East Rogers Park, it was $500/month. Biked everywhere, bought my groceries at the small produce stores like Devon Market and Andy’s Fruit Ranch.

I bet you can even live in the suburbs outside of Chicago for $40,000. 😉

My sister lives outside Chicago, in NW Indiana, and it’s extremely affordable.

I think we’re essentially in agreement, Paul — although I’ll argue most people can easily get by in 99% of the country’s land area for $40,000.

I agree and disagree simultaneously.

People live way beyond their means these days. You have a very frugal way of living that I agree with.

However, I have some crippling issues that cause my budget to overflow a bit:

Gas: My commute is LONG, not by choice, but because I work in a rural area. My 35mpg car still results in 8400$ in gas annually! Also, my car maintenance is a solid 840 a year (I do my own everything as far as cars go), not including tires (I have ones I expect will last a while).

Car insurance is 180$ for a single male at 24. That’s another $2160 a year.

Car payment is 360$ (fortunately I have an interest free loan). Another 4320$ annually.

Student loans bite me for 480$/month. 5760$ annually.

So an extra 20640$ a year just due to cars and debt. Ouch.

These are all things that ‘somewhat’ in my control. I have a good job that will allow me to advance. However, it IS costly to commmute, and there are no carpool options. I did choose to go to college, which left me with debt – but that is hardly a ‘poor’ choice if you ask me.

Hey Nuku. I related to your post though I am now much older, I wanted to bring up a point- that of making the commitment of using tomorrow’s money today- loans. Loans kill budgets. I went to college, all 12 years without a loan. It was hard but possible. I ended up with five degrees including a doctorate. Going to college, for some, is a smart choice but the cost must be weighed in future money. Luckily you got the “better” job but many do not. Debt does burn!

I had to reply because I’ve heard that tired old saw about “decent” neighborhoods in Chicago going for 900 plus. I live in one of the most (having had the greatest increase in real estate prices and homes going for 700 grand plus) neighborhoods in chicago. Yet, my friends living in one-bedrooms? None of us pays 900. I’ve never paid more than 800 and that was for two bedrooms.

The issue again, is just like the point of this blog. You have to be willing to think differently. Here, if you want a good rent, NEVER answer craigslist, or go to an apartment finder, or really answer an ad of any kind. Walk around the neighborhood you like and call the manager listed on the side of buildings you are interested in. It is strange, I guess, but the way it is done here. I currently pay 550 for a smallish one bedroom, but very nice building with on site management and great tenants. One of my friends just got here from L.A. and with only looking at two apartments, found an enormous one bedroom with den and dining room for 850. My last apartment was 750 with two decks, walk in closets and parking included. And all have included utilities. If paying 900 for one bedroom, well… must be a more hipsterish neighborhood, cause I don’t even see them on Craigslist going that high for a one bedroom.

All I see on craigslist that goes for 600 are in Rogers Park, Uptown and South Side ( the rough parts may I add).

Sorry forgot to add. Thanks for the advice.

With no mortgage, and no car expenses it would be a breeze to live on 40k for one or two people wanywhere in America except Manhattan! Even Sf is doable at that salary!

Minimum wage on he otherhand, no way.

I believe dual income at minimum wage will hit close to 40k. And 40k should put a family in the range of gov help with housing.

I know my wife and I are doing quite well on 55k a year (one income) while putting around 20k into our school loans.

Minimum wage = $7.25 nationally. Most minimum wage jobs I’ve heard of don’t give a paid lunch or paid vacation, so people end up working less than 40 hours a week, 52 weeks a year. (Usually only 35ish).

For the sake of argument though, I used those maximum numbers.

$7.25hr x 40 hrs a week x 52 weeks = $15,080 per year.

That’s only $30,000 a year with two incomes. Not counting state and city taxes, Medicare tax, SSI, etc. which no one gets back, unpaid sick time, holiday closures, etc.

The waiting list for help with housing in Philadelphia for example is almost 10 years and priority goes to people with no incomes way before this hypothetical couple. They also don’t qualify for any food stamp support with a monthly income of $2,320 (the cutoff is $2,069 for their household size, using PA again as an example).

The budgeting advice in this article is great, and I’m glad you (Robert) and your wife are doing well, but you make almost double the income of a two worker minimum wage family. Please don’t go around spreading inaccurate information.

Wow, I just realized that the author used his budget from 2009, when the minimum wage was still $5.15. That means the couple would have only made $10,712 a year without missing a day of work, or $21,424 combined!

Government help with housing…lol.. Live in SoCal on 40k… lol.. ID10T error.

SF Valley… Near JOBS..

Single Person. REAL NUMBERS AHOLES>>>>>

Rent room in house ROOMATES. 700.00 mo

Util split 4 ways

elect = 250

gas = 50

Water =80

Trash = 35

Cable = 225 (every movie channel) Your renting a room this is voted on by roommates not your choice to cut it. And never being able to afford to go to a movie you need it).

RENT TOTAL = 860

MIn Car ins = 50 not full coverage min.. coverage

PHONE = 100

TOTAL = $1010 per month Fixed Bills.

ADP pay check for 40k 2 week check 1182.19 after TAX ADP 2015 table. REAL NUMBER…

1280.71 24 checks per year. 2x per month

On P.s. $40k a year is $ 19.23 per hour…. 2x the min wage.

OK back to reality..

Total take home per mo. at 19.23 per hr. After Tax $2561.42

Less fixed Exp. $1010. = $1561.42 mo

Food= ? Yea could eat beans everyday. (Health?) How much a day for food… Could you eat on 10 dollars a day? 3 meals ? Healthy? NFWay… I eat crap and it costs me 150 a week one person and yea I eat some meat too. $600 food mo. ONE PERSON

Gas =? Depends on where work is.. 350 miles a week is a tank of gas. 50 miles a day x7. You have to go to the food store too… Ill be cheep here and say $40.00 week gas $160 a month. (One reason you have cable)

$801.42. after eating crap and getting to from work.

Health ins.= ? Well for me. I’m older and would only get a partial discount making the big 40k. Mandatory Health Ins Making over 48k = $902.00 a MONTH!!!! I am 59..

Making $40k = $500.00 400 dollar low income discount.

After everything leaving the WORKER with 401.42 a month.

OR making 8k more a year 48k income… Got a raise ?? DOOM!

After everything making 8k more…. leaving the worker with Negative – $98.50

O yea and this is single person… Make it a female with one child.. Try again….. You can find a job for 19 dollars an hour!!!!

Double the rent to1400 either studio or 2 rooms… same price unless living in south central with a child is considered good parenting.

Redo this at the wanted 15 dollar rate not 19 = FAIL awful life….and add a child

Wow, Keith. Where do I begin?

Your numbers may be real, but all they prove is that you are living beyond your means when you don’t have to. In fact, it shows that you’re living somewhere with a cost of living that is far beyond your means. (Never mind that you aren’t trying hard enough if you can’t eat healthy for $300 per month. Also, if you drive 50 miles per day, you need to find a job closer to home — or a home closer to your job. Also, if you have roommates who insist on you doling out $56 per month for cable, then find new roommates! — Don’t say you can’t … because you’re making my point. As for taxes … Your pay check example shows total tax withholding of $9300. Based upon the marginal tax rates for 2015, someone making $40,000 would owe $5855 in federal taxes — but that’s BEFORE deductions and tax credits are even applied, which would lower that figure appreciably. And state taxes would be even less. So bottom line is there is a lot of income that is ultimately returned to you by the tax man that you didn’t account for.)

But even so, if it’s as bad as you say it is, the solution is simple: move. Yes, move. Out of SoCal. To some place with a lower cost of living — like another state in flyover country, or the SE United States.

Don’t feel like moving? Then look in the mirror. ID10T error, indeed.

The truth is, people can and do live comfortably and happily on $40,000 annually. Here are almost 20 detailed testimonials from fellow Americans who do it every day.

Best of luck to you in the future.

I agree with Keith. The author of this article was probably born with a big silver spoon in his mouth and has no sense of reality. He can easily say “I could live on pennies per day”, but the thing is, he obviously makes much more than $40k or inherited it. I suggest that this author go back in time to when he was young and get dealt a bad hand rather than his silver spoon. He should get hooked on heroin at age 13 due to this bad hand he was dealt, bad environments, and bad influences; then try to get clean in his mid 20’s, get a job earning $28-$38k a year, while needing to pay rent, utilities, food, extraordinary out of pocket medical expenses, insurance, gas, vehicle repairs, etc. while also trying to meet the needs of two children. Then in attempts to afford this low class lifestyle and to try to give your kids a better chance at life than I had, get a second or third job (like I did) just to have the state of maryland screw you by telling you that you earn too much money now thereby forcing you to remove your children from their decent state subsidized insurance and put them on your company insurance which then costs over $1600 a month. Now he’s working 70-80 hours a week and is in worse financial standing than he was before getting the second and third jobs. Oh and taxes… It’s so transparent that the author has a silver spoon when he said something to the effect of “I would just offset some of my living expenses to afford my taxes”. People who live in reality cannot simply “offset the living expenses”. Let me show the author a little bit of reality:

$40k a year – $6000 taxes (not including sales or state tax) = $34k – $14000 rent = $20k – $10000 child expenses (low ball number) = $10k – $19200 family health insurance = – ($9200) – $3000 gas = (-$12200) and I’ll stop right there, there’s no need to continue. Lifes not easy, but it’s really not easy when dealt a bad hand despite working your ass off in attempts to improve yours and your childrens lives.

And the author will ignorantly say “oh well it’s your fault for starting heroin at age 13, mistakes happen you’ll have to live with it, and because I like to imagine that I can live on pennies a day, even though I’ve never had to pinch a penny in my life and I was dealt a good, if not great hand in life, then you can too and you’re just complaining because you don’t have as much money as I have.” And to that I would reply, “yes I am complaining, but I’m also working 10X harder than you work and earn much less while navigating every avenue I discover in attempts to make more money with more multiple jobs, going to college WITHOUT the help of FAFSA because I “earn too much money” despite the fact that my and my children’s necessary living expenses far exceed my income. You know what… I could write a book about everything I’ve done to give my kids a better chance in life just to hit a wall. I would honestly live a better lifestyle and my kids would have a better chance in life and a healthier life if I just quit my job and collected wellfare and state health insurance; but I won’t do that because I am determined and a hard worker. I also scored a 160 on the Mensa IQ test and refuse to let my intelligence go to waste. But then again, my IQ won’t amount to a small pile of beans (the same beans I use to feed my family) because the more I work and the more I earn the less money I actually have because I can receive no form of assistance for healthcare or school or food, etc. maybe it would be a smarter, more intelligent idea to quit my jobs and become a dependent of the state. Oh, but I can’t do that because then I’ll have to wait so many months before the state sends financial help and by then my kids and I would be living in a cardboard box.

I honestly cannot believe the nerve of this author. Oh and by the way, when you said that there’s lots of families who live a comfortable life on $40k or less, I would like to know where you found that information… Or did you just make it up in order to support your impractical idea that you could support your family on $40k?

Mike: I wasn’t born with a silver spoon in my mouth. I grew up in a lower middle-class family — for awhile my dad had to hold down three jobs to keep a roof over our head and food on the table. As for me, I sacrificed and worked my ass off to get where I am today. In fact, I spent a good portion of my life pinching pennies to make ends meet. So, please, don’t belittle my accomplishments just because you can’t handle the message.

That being said, if it makes you feel better, you can continue to rationalize away the reasons leading up to your current financial situation. I get it: you don’t think it’s your fault. I’m here to say that our lives are all about choices — more specifically, literally the thousands of choices we make from the time we’re born. And the results of those choices play a huge role in where we eventually end up financially — like it or not. For example, children are expensive — but they’re also a choice; you and I both know they don’t magically fall in our laps. There are conscious, deliberate acts that have to occur before an innocent child is brought into this world. The decision to use heroin is a choice too — no matter how you try to rationalize that it isn’t a personal decision. Deciding to put down roots in Maryland, one of the most tax-oppressive states in the nation is a personal choice too. I think you get my point.

As for living on $40,000 annually, there are plenty of people who have shared how they do it on my blog. You can read their stories here.

Now, does luck play a role in our lives? It can and does for many people, but there is a saying that I firmly believe in: “People who work hard make their own good luck.” And there are plenty of folks in this world who start with nothing and end up financially free — if not outright wealthy — to prove it. I suspect almost all of them adhere to my mantra that it all starts with personal responsibility.

Think about it.

Best of luck to you.

Apologies.

I didn’t say some things aren’t my fault, but every road leads to a dead end. And I’ve tried to leave MD many times. Every time I somehow manage to save up money something happens which sucks it away. For example repairing my vehicle. And as for young children or young teens making rational choices, i’m sure you’re aware that the prefrontal cortex does not finished developing until approximately age 25. And as a kid who probably would’ve been diagnosed with autism back then, if i was born in today’s world, I definitely did not have the cognitive abilities to foresee the future. And in my opinion most 12 or 13-year-olds can’t make rational choices either, especially in a drastically unsupportive environments. So when speaking about the past yes I am firm that that was not my fault. Fortunately, through amino acid therapy I am in full cognitive control of myself and would definitely not be diagnosed autistic now. I refuse to play the victim, however I am very aware of counterproductive systems and tax policies in place which essentially victimize anyone trying to create a better life for themselves or their family. Especially since no one can just up and leave their state and expect to find a job which pays decently close to what they used to get paid right off the bat. And even if they could, it would be a selfish move to steal my children away from the rest of their family without even knowing that I could find a place or employment.

Yes I was a little angry after reading your post; primarily because you’re clearly not aware of how hard I or some other people actually work yet continue to become in worse and worse financial shape due to Obamacare and other government systems which steps on people trying to improve their families lives. Being born many decades ago was a very clear advantage in America. You actually had hope of going somewhere in life. In today’s world the government keeps you down. I’m not antigovernment, i’m just a realist. And as a realist, I can comfortably say that your approach to living on $40,000 a year would definitely work if it wasn’t 2015. If it was 1980, 1990 or even 2000 I think your approach would work. But in today’s world you either have to be super rich, upper middle class, or super poor to live a decent life style as long as you’re responsible with whatever money you have. if you are in the Low middle class region, you’re screwed. I’m not a betting man but if I was I would bet that you grew up during an American age that did not step on people trying to advance their life. So your perspective is misconstrued because you’ve never actually had to deal with today’s realities while only earning $40k while raising a family. Or have you?

Now you’ll say I’m still rationalizing my own irresponsible financial decisions, but you have no idea how hard I work or how determined I am. I do make smart financial decisions. But smart financial decisions won’t accrue any wealth when obamacare and my health insurance costs $1600 a month when I only bring home $3200 BEFORE taxes. You completely negated the fact that the basic necessities for my families survival in today’s world costs more than double my income. So if you can explain to me how you would be able to make money and build a better life when JUST the necessities cost more than you earn, and how you would be able to move to another state when you can’t even save up enough for a deposit, or how you would be able to afford mandatory health coverage of over $19000 a year, etc. then I will concede that you must be correct. But you can’t answer these questions because the current American paradigm prevents most low middle class families or individuals from even having a chance at success unless they win the lotto. Would you agree?

Try finding a mate after 30 on minimum wage.

Great posts. We are all over the place on age and life situation. I have so share AGAIN that I just retired after teaching 31 years and am trying to live, as a single, on $40K. The #2 expense I face after food/housing is deducted from my pension (it replaced my salary) is healthcare at $8000/yr. I looked into other options and found one about $1000 less but not deductible- some benefit I get on taxes, so about the same per se. I end up, after taxes with $31K a year. I don’t owe on anything but it is tight living even for one. Living on a budget never really ends does it?

Thanks I’m single 32 year old. I moved out my apt an lived in a van I turn into a rv. Pay off half my debt then saw a house in California city rural area I could get a usda loan ($0 down) save for closing an assessment. I make $42000 work 2 jobs. Best thing about living in van I learn I don’t need a lot crap and I can live off a solar panel an 500 watt solar power bank (keep charge in day) which also runs my freezer. As woman only wear same darn 6 clothes mostly scrub tops I wear my jean 2 times. Also my cat loves being in van which was a shock. But now to home yea not in big city but like rural area my goal is have home that I can pay off or keep payments super low an debt I’m not try to impress anyone. I have one friend and she doesn’t give a crap about material crap either lol (plus more money for beer )

We have grown so accustomed to thinking that we need more of everything, but you clearly show that this is not true. I don’t think that the challenge is to make more money to solve your money problems. The challenge is to live with the money you make. There are plenty of high income people ($100,000+ p.a.) who are struggling financially.

It wouldn’t make it impossible to survive, but it would make it pretty difficult to save. If I made $40,000 and spent the way I did this past year, I would not have been able to save much for future goals. Take wife and kids into account and it becomes nearly impossible.

Amen!! I am a new reader of the blog, and so far I am in love! I’m reading this post as I eat my homemade sausage, kale and carrot soup (which is delicious by the way), and I am part of one of those families earning less than $40K/yr and living comfortably.

It takes some ingenuity (hence referencing my lunch above), but it can definitely be done. I’ve noticed on other PFBs that many write “make more than you spend”, but I agree with Money Obedience, our focus shouldn’t be on MAKING more (b/c that usually just enables you to spend more), but it should be on spending LESS than you earn.

Made the same soup a few weeks ago. It is delicious!

What about travel? I have family all over the world. I’d hate to cut them out of my life because I can’t afford a plane ticket…

So let them come visit you for a change. What, are their reasons for not travelling somehow more valid than yours?

I completely agree about the challenging nature of the grocery budget. We used to spend $500-$700 per month as a family of two. We now spend anywhere between $200 and $250 as a family of three, and we’re far from “starving” ourselves. It’s just a little pre-planning and a lot of buy-one-get-ones. 🙂

Love this post. I wrote a post last week about a family of four living off 111,000, and many people were aghast because they didn’t think it was possible in California or New York. I love that you showed empirical proof that it could be done.

As an addendum to my previous comment, it wasn’t so much on my site that people were aghast about the 111,000. It was over at Funny About Money when they wrote a post based on my post about 111,000. They were much more in defense of needing more based on where you live.

Great point, I always wondered if it would be possible to live in a big city on less than $50,000. I think what big city folk consider are needs is different than someone that lives in a satellite city like myself…

Absolutely-It’s amazing to compare wants and needs. Our needs are really very affordable in many cases. This one’s going in my round up!!!!!!

Poverty is in the eye of the beholder. 🙂

@Bret: I agree that it is not desirable. Thanks for backing me up and showing us its possible by sharing your own experience.

@Sam: …and after reading this article, I hope any teenagers out there will realize that for people earning a minimum wage it will be virtually impossible to support a family.

@MoneyO: “The challenge is to live with the money you make.” Absolutely! To do that we need to have a good handle on wants versus needs.

@Daniel: To be honest, even though I could make it on a salary of $40,000 per year, I wouldn’t “settle.” I’d get a second part-time job to give me a little more breathing room.

@Jamie: I love new readers! Welcome aboard! The soup sounds delicious, by the way. I am a HUGE soup fan!

@Jenna: But wouldn’t a second part-time job take care of that? 🙂

@Wojo: Just wait until you have teenagers, my friend! LOL Our family could save so much money if the Honeybee and I spent 15 more minutes every other week, going through the coupons and looking for special one-day only food sales.

@Everyday: I’m probably going to tick off a few people, but it won’t be the first time here. Most folks who say living on $40k can’t be done (or $110k for that matter), either haven’t really tried – or have trouble differentiating wants from needs. (Duck. Here come the rotten tomatoes… LOL)

@Money: You may be right.

@Barb: Thanks, Barb!

@WorkingPoor: Yes, but if we are being honest with ourselves, most people in the US confuse real poverty with simply having a lack of discretionary spending.

Couldn’t find a better place to post my thoughts. In response to one poster’s comment you wrote ” If you have to pay $22,000 for child care and cant afford the child care, then whose to blame for that?”.

Len, I enjoy your sight, don’t agree with everything, but I think this comment was/is an attack. You have no idea of the circumstances or the reasons why she is a single parent. Just an aside, about 14 years ago I got engaged, we both worked, lived in MD and were planning a lifetime together. I was 32. 9 months before our wedding he had a massive heart attack and died. my biggest fear was that I would find out I was pregnant. Had that been the case, I would have instantly become a single parent and been challenged in the same way the women was that you chided. I only ask that you take a minute and maybe consider that there are often circumstances that are out of our control. A little compassion or silence would go a long way.

We’re living on $24k right now in the San Francisco Bay Area and it is a very, very tight budget, even factoring in that we are receiving public assistance while our business is building back up after the economic downturn. I think that we would be quite comfortable making $40k a year; we could, at that point, get off of public assistance and be self sufficient, a goal we’re striving toward.

The poster above who posted whether a family of four could live on $111k? I guess that family has a much more expensive lifestyle than us, but also, they’re not making the most of their resources if they’re not sure they could make it on that. We’re making it on less than a quarter of that and everyone in my family is alive, healthy, and usually pretty happy.

Wow! Making it on $24k in SF is really an achievement. Congratulations! I hope your business gets up to speed real soon.

Gross mismanagement of funds is the only way I can justify not being able to survive on $111k per year – regardless of where somebody lived. (Duck! Here comes another rotten tomato!)

Never fear Len. At our house we don’t toss rotten tomatoes at people, they go into the compost pile. (Which is why we have a six footer merrily growing in our raspberry patch.)

Where in Socal can you find a 3 bed 2 bath for $895 a month, Len? I’m thinking you live in the South Bay, given your engineer credentials… The only area I can see being that cheap is Compton or some really rough areas of Lomita.

If not, care to share where you found this rental listing?

California city, Bakersfield , Lancaster

Just bought a house $124000 w/ 3 bedrooms & one bath in ca city

Provocative post and so true. We cut back severely in 2009 and it was fun making it work. It’s a good idea to do a reset once in awhile and see how little you really need to spend to live comfortably. We don’t have cable — get by on netflix. I know cable is a tough frill for people to give up but we don’t miss it.

@Len Penzo / What about retirement savings?

@Olivia: Good for you!

@Chubbuni: I sent you the link showing the home, via email.

@Susan: The cable would be one of the first things to go at my house, Susan. Netflix is a terrific low-cost substitute.

@Jenna: That would come out of what was left over! As I mentioned, it isn’t huge, but there would be enough available to contribute some small amount. 🙂

$40,000 is about £25,000 in the UK — which is the national average wage! As long as you don’t need to try and buy a house, you could easily live on that here, and our standard of living is much higher.

I know it, because I did for years taking into account I earned much more but saved it all (and more!) And that was in London, the sometimes top 3 most expensive city in the world (though currently much cheaper due to currency effects).

Len also has the benefit he can turn to catwalk modelling if he needs to make ends meet, remember.

Er, sorry, I mean “Our *cost* of living is much higher”.

Although what price do you put on life without disgusting Hershey’s chocolate? 😉

Great post! We’re making it just fine on less than $40K a year and we eat a lot of meat here. But we NEVER buy meat unless it’s on sale. The most we ever pay per pound is $4 and that’s only on for a special occasion like ribeye steak for say, the fourth of July or a birthday or New Year’s, and those cuts are nearly always on sale on those days.

Oh wait a minute. I should wake up before trying to think or post. We actually gross over $40K year. Sorry, my bad.

You’re cracking me up!

Hey, Nancy! Why are you making multiple posts under different names? You are also posting as “Thalia” and “Jennifer”. Inquiring minds want to know!

I definitely agree with this! If you can make it on $40k in SoCal, you can make it anywhere on $40k. In our area – East Tennessee – $40k would put you in a very comfortable lifestyle. I don’t have children, but I spend $600 each month on necessities – gas, groceries, rent, utilities, Internet, and cable. I’m also able to set aside $100 for “entertainment” – i.e. going to the movies or out for dinner.

People who complain about not being able to make it on $40k after cutting expenses need to really consider changing locations. Who cares if you live in SoCal when you can’t afford to enjoy it?

We’re a midwestern family of 5, living on less than $40K per year. We pay cash for everything, have virtually no debt, but our budget is increasingly tight with 3 growing children. Luckily, we have health insurance, 401K’s, and no car payment (paid cash for our one and only vehicle). My yearly food budget has gone down to less than $4500 per year, including eating out, which we rarely do. We live in a modest 1300 sq ft 3 bedroom home, very large yard, and 3 dogs. It can be done.

Great Post Len!

First we live in the SF Valley. Where did you find that $900 house, for a 575sf 1bed we are paying $1200. I would love to know.

Second, we are one of those folks that can’t live on $40,000, no we don’t have cable or netflix, we cook at home every single day and our grocery bill is less than 300 a month. BUT I am including our retirement savings as a need and giving as a need. We need a LOT more than $40000 if I include those 2 in the equation.

But for basic necessities/survival I totally agree, we can manage with less than $40000.

@Monevator: Yes, Investor, catwalk modeling is still in the cards for me, isn’t it? LOL With $168 cheese sandwiches it’s no wonder London is the third most expensive city in the world! I guess cheese sarnies are even more expensive in at least two other cities in the world. 😉

@Out of Debt Again: Pass the peace pipe, Mrs. A! LOL

@Red: I have a relative (by marriage) in Mississippi, and the cost of living there is even lower than Tennessee. I could retire tomorrow (at 46 years old) if I moved there!

@Momma: Good for you! Keep it up! 🙂

@Suba: It does go to show, if people who are making more than $40k per year really wanted to, they could build their retirement savings up very quickly!

The issue with this blanket statement is that everyone has varying financial situations. Some people have massive medical bills, student loans, car payments, etc. And, these debts are not a choice.

Now, once most bills have been paid off, I can see a family of 4 living on such an income. But, don’t forget, Len, that most Southern Californians don’t have to really heat their homes often. My winter gas bill is anywhere from $135-$200 per month.

I also want to know whether or not your children played sports, joined band, took dance lessons, or any other school-based activity? How about daycare and after-school care for those who have no other option. Len, just remember that not everyone shares the same circumstance. I found the cheapest house I could find on the market (foreclosure)without having to go in and make major repairs. Sure, I could have moved to a $50,000 house in the worst of neighborhoods and have subjected both myself and my children to violent crime and unsuccessful outcomes, but let’s get real. The only other choice I had was a $114,000 foreclosure and a mortgage of $878. I purchased this last year (not 13 years ago). Even my insurance company was impressed with this deal.

I am a single (separated) mom with an ex that contributes at random. Please Len, if you have the time, could you show us an itemized list of how you do it. Please at least factor in child care, student loans, heating, and a car payment so that I can see how I can stretch $40,000 a year for a family of 4.

I see that you are out of the woods for a lot of these debts, so you feel secure. But, most of us have to have these debts at some point until we can pay them off.

Hi Jazzjune, thanks for the dissenting opinion.

As I noted in my article, I specifically excluded bad luck due to massive medical bills.

Let me first say that my position is that student loans and car payments ARE a choice.

For example, people can avoid car loans by saving their money to buy very modestly priced used cars. As for college, in California at least, people can go to community colleges and get all of their general ed classes out of the way for a fraction of the cost of big universities. In the meantime, they can work and save up for a reasonably priced college. I got an electrical engineering degree exactly that way with no student loans.

Even so, lets say I just graduated from college with student loans and a job in So. Cal. that paid me a $40000 salary. I could still make it on that salary – easily! I would find a small apartment or rent a room in a home with other people for $500 per month. For example, my office mate is currently renting three rooms in his house in Long Beach to three tenants for exactly that price.

What I wouldn’t be doing is buying a house. And if I got married, I’d probably delay having kids until I could afford to buy a home.

“Please Len, if you have the time, could you show us an itemized list of how you do it.”

But I showed you an itemized list of how I do it – including heating – with a family of four, no less! I also said it would be no frills – just the necessities, of course. (You must not live in Southern California. It gets cold here too in the winter! “Cold” is all relative, of course, but, for example, our winter gas bills were $137 and $112 last December and January.)

“Please at least factor in child care, student loans, heating, and a car payment so that I can see how I can stretch $40,000 a year for a family of 4.”

Respectfully, the decision to have children is a choice. Therefore, child care is a a de facto choice.

As I mentioned, my utilities WERE included.

The car payment is a red herring. I’ve already explained why it is a choice.

Student loans are also avoidable – and even if they aren’t people just graduating with them can still live on $40,000 per year very easily – assuming they make the right choices.

“I see that you are out of the woods for a lot of these debts, so you feel secure. But, most of us have to have these debts at some point until we can pay them off.”

Exactly! I agree with you that people who have made a series of incorrect decisions in life – for example, trying to get too much way too soon – may have a difficult time living on $40,000 per year.

But that’s on them.

The most important message here for people just starting out, is that it CAN be done – as long as they make smart choices.

You might duck a few more rotten tomatoes with your response to Jazzjune because a lot of people reading your column and comments ARE those people who made the “mistakes” of going to school(even community college requires student loans these days)with student loans, buying a car to get to work (many not-so-rural areas have lousy transit systems) and end up with children before they are financially solvent. All she wanted was some guidance to get out of this path that she “chose”. That’s why we read these columns- for help.

Well said, @Ani. I thought the reason to read these posts/articles was to get some guidance not to be berated for not having all of your proverbial ducks in a row. I can understand that he’s not in a position to have made those “mistakes” but the same can’t be said for everyone.

With comments like “well that’s on them…” what is the point in reading these types of articles?

Exactly! I really don’t see how, “don’t have done that” shows how something is currently possible. People can’t change the past and are looking for information about how it is possible to live on that income in their current situations. Most people under 35 have student loans, many have kids and/or medical expenses and many need cars to commute and keep their jobs.

I was a lot more impressed with this article before his argument broke down in a different family situation and he decided the best route was to continue to blame people for not going back in time and making the “choices” that they did- to get sick, go to school, or have kids. It’s a very narrow-minded view to say “my life is like this, therefore everyone’s lives should be like this.” The truth is, most people’s lives are not, and instead of using this as an opportunity to show people how to be more conservative with spending, the author chose to dismiss the average circumstance with blame.

My husband and I have lived, and saved, on $40,000 and are now making $60,000, but ironically, not saving much more. We moved to a state with an astronomically high sales tax, which has eaten up a good chunk of what seems to be a huge difference, but the real deal-breaker for us has been health insurance. Keep in mind that people working at low-wage jobs don’t necessarily have access to good health benefits. My husband is able to get insurance through his workplace, but it’s even more expensive than paying for private insurance, which we do. To keep costs down, we’ve both opted for high deductible plans, which means that we pay for virtually all of our health, dental, and vision care out of pocket. The premiums alone, for the two of us, are about $350, much more than our monthly grocery bill, and that excludes all dental and vision care. We’ve always been quite frugal, and it took us awhile to figure out where all the “extra” money we though we’d have was going, but that’s what we finally determined. We don’t want to scrimp on health care just to save money, so we’ve made the choice to continue getting two dental cleanings a year, going to the doctor if one of us is having strange symptoms, etc., but all that really adds up. Rent alone, but that way, eats up about a third of our take-home pay. I’m not saying it’s impossible to make it on $40,000 a year, or even $60,000 in our case since we are still saving money, but having lived on $40,000 before, I can’t imagine trying to cover the extra expenses of living in this state (WA) on that small a salary, and we were already living in a trailer on $40,000. I guess I was just bothered by your casual assumption that you could squeeze thousands of extra dollars a year out of a budget by simply reducing grocery and utility bills, etc. I’ve been juggling the household budget six ways to Sunday since my marriage, and I can promise you that it’s not quite as easy as it looks. Anyway, that’s just my kind of rambling two cents. I just wouldn’t be quite so blase about how easy it is to get by on a small income.