Dear Readers: Despite all the evidence I offer, I occasionally get an email from folks who say it’s easy for me to talk about living on $40,000 per year when I make significantly more than that. Never mind that I didn’t always earn a large salary. Forget that I’ve always spent far less than I’ve earned.

Dear Readers: Despite all the evidence I offer, I occasionally get an email from folks who say it’s easy for me to talk about living on $40,000 per year when I make significantly more than that. Never mind that I didn’t always earn a large salary. Forget that I’ve always spent far less than I’ve earned.

There are plenty of deniers out there who simply refuse to believe that a family of four — or even more — can live comfortably on $40,000 or less per year.

For that reason, awhile back I started a very popular series here on Len Penzo dot Com that only got off the ground because of readers just like you!

If you’re willing to share with my readers your secrets for making ends meet on a tight budget, then I’m looking for you! For example, I’d love it if you could share things like:

- What do you do for a living and what is your household income?

- How old are you?

- How many kids do you have?

- How much are your non-discretionary expenses: rent, groceries, utilities, gasoline, car insurance etc.?

- How many cars do you own?

- What do you do for entertainment?

- Do you save for retirement?

- Do you have life, or health insurance?

- Do you have an emergency fund and, if so, how big is it?

- How much are your property taxes, if any?

- Were you always financially responsible?

- How do you manage your finances?

- Do you have any tips you’d like to share with other Len Penzo dot Com readers?

All you have to do is send me the details and I will craft it into an article for you!

Ideally, I’m looking for folks with a household income of $40,000 or less — but that number is really just a guideline. If you’re supporting a family with six kids and have a household income of $46,000 — that will work too.

I know you guys are out there because I’ve received plenty of comments from readers who have said they live comfortably on less than $40,000 per year!

If you’re interested in potentially sharing your story with my readers — or know somebody who might be — send me an email, and I can give you more details.

My address is: Len@LenPenzo.com

Please put “$40,000” in the subject line.

It won’t make you rich, but if I publish your post, you will be compensated for your time.

This has turned out to be a terrific series — and the resulting stories are always among my most popular posts.

Thanks in advance for your help.

I hope to hear from you soon!

Len

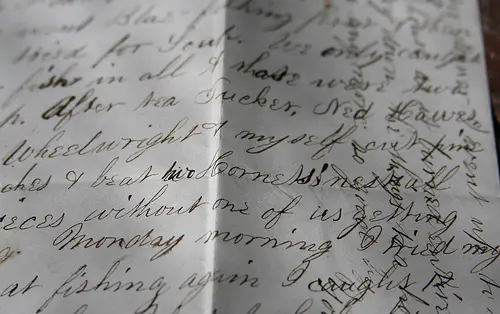

Photo Credit: Muffet

I’m currently unemployed, but my spreadsheets are predicting I will spend around $6-7000 this year. Closer to $6000 if I can cut down on some of the waste, closer to $7000 if I end up overspending more. However I live with 3 roommates, meaning we split rent and utilities, both of which are cheaper this way than they would have been were I to get a single-person apartment.

My life is by no means austure, including a rather significant quantity of video game and DVD purchases, restraunt trips, some car repairs, and other personal purchases this year.

Interested?

Er… I check your blog somewhat less than I did when I was employed, so I might well forget to check for a response. If you’d like me to submit my story, you’re welcome to send a message to my E-mail, which you should be able to view using your Super Admin Powers.

I’d be very interested!

I sent you a private email, Volfram.

It depends on your lifestyle and your state of mind. I come from a third world country. Many folks live on less than $2 a day. Some of them are the happiest and contented humans I’ve ever seen or will ever see.

Amen.

My gross was $49K last year but my net was about $35K.

I own my own home and have 2 sons in post university. I am broke most of the time and struggling with debt so I am not sure if I am a good example.

I am more like the before picture in a money makeover.

Thanks for the offer, Jane. However, unless you’re supporting a large family, I think $49k is a bit over my limit for this series.

I make less than $40K CAN a year, but I’m single with no kids. I’m happy to participate, but I’m not sure this is what you’re looking for?

Kids are NOT a prerequisite, Amanda. Nor is living in the US. 🙂

As long as your income is in the ballpark of $40,000 US or less.

Great idea for articles. But, lease keep with what you know best.

Higher income and sales taxes as well as more comprehensive public education and social welfare programs make the Canadian economy fundamentally different from that of the US, at least from a personal finance perspective.

So unless you plan to put some hefty footnotes explaining how these differences influence effective personal income and expwnses, dont bother. Given the wide variety of cost of living options within the USA, I think you will have your hands full dealing with living on $40k when it is same country and currency.

UPDATE: Thank you everyone who has submitted their stories so far.

For those who are interested in submitting a piece, here’s a sample outline to help you organize your thoughts:

– A little about you (occupation, age, where you live, kids, married, do you budget?)

– A rough top-level breakdown of your expenses (discretionary, non-discretionary)

– Savings (emergency and retirement)

– Insurance (and why or why not you carry it)

– Any tips for saving money that you’d like to share

Of course, if I choose your story, I will be working with you to help fill in any blanks and polish it prior to publishing.

I was going to do one of these per month, but the response so far has been better than I expected so far, so I’ll probably be publishing these every other week.

If you have any other questions, email me. Just remember to put “$40,000” in the subject line.

This is a great premise for a series of articles. I’m really looking forward to hearing these stories. It should be an education.

People say you live to your means, and I think thats true. If you dont have the cash, you don’t spend it

Personally, I say live *below* your means by saving at least 10% of your income automatically.

“Pay yourself first.” (The Wealthy Barber by David Chilton). This single piece of advice has had the most profound effect on my personal financial planning than any other.

Yes, feel and think better … about the shoestring (small sum of money) lifestyle! My kind of shoestring lady Barb is — living a healthy and wealthy lifestyle with a modest income. I’ve done it here in Beverly Hills, CA and if I can do it here, folks can do it anywhere my debut eBook on cost savings and inspirations entitled: ‘Life on a Shoestring … in Beverly Hills?‘. Thank you for the post it is a good reminder for all — live with less have less stress 🙂

Yes, Christine. Depending on where one lives, making ends meet on less than $40k can be done quite easily, as my readers are demonstrating. Like you say, it can even be done here in Southern California; my truly non-discretionary expenses are still less than $40k, as are a lot of financially responsible folks here in the Golden State.

Granted, I don’t live in Beverly Hills … but I don’t live on Skid Row either. 😉