In 2004 my gross annual income crossed the magical $100,000 benchmark for the first time.

In 2004 my gross annual income crossed the magical $100,000 benchmark for the first time.

Reaching that milestone became a personal goal after graduating with an electrical engineering degree in 1988 and taking my first job at a salary of $31,000. At the time, I figured that once I was earning $100,000 per year, I’d be set for life, and able to buy whatever I wanted, whenever I wanted it.

The funny thing is, once I finally had that coveted six-figure salary, it wasn’t all I had hoped it would be. While I did have more spending power than those who weren’t earning $100,000 per year, I didn’t feel rich. I certainly wasn’t making enough money to stop worrying about how I was spending it.

Even today, with my income significantly higher than it was when I first crossed the $100,000 mark over eight years ago, I still don’t feel rich. Financially free, yes. But rich, no — especially after my paycheck deductions to cover taxes, the mortgage, the money I faithfully set aside for retirement, and my emergency funds.

True, I’m thankful to live in a nice, albeit very modest home, in a pleasant Southern California neighborhood, but the Honeybee still drives her 2001 Honda Odyssey. Yes, in 2013 I finally broke down and bought a new car — but until then, I had driven our trusty 1997 Civic for 17 years. We also still shop at places like Costco and Target, cook most of our meals at home, and eat leftovers to save money.

Moving The Goal Posts of Success

The reality is, at one time, earning $100,000 annually used to be a sign of real wealth. The pinnacle of success. Not any more.

Clearly, I’m not the only one who feels that way either.

A recent poll by Gallup found that Americans essentially set the threshold for being “rich” at an income of $150,000 annually. Forty-seven percent of Americans — myself included — think the actual number is somewhere north of that.

Don’t get me wrong, earning $100,000 annually is nothing to sneeze at, and anyone earning six-figures is obviously better off than those who don’t. But it’s not all it’s cracked up to be.

That’s because the dreaded one-two punch of time and inflation has moved the goal posts. So much so that the importance of the old $100,000 measuring stick has been completely obliterated.

In fact, in order to have the equivalent purchasing power that came with a $100,000 salary back in 1988, one would have to have an annual income of approximately $202,000 today.

One example of how rising costs have made the $100,000 benchmark obsolete is the price of housing. According to the US Census Bureau, the median price of a home in 1988 was $112,500; by 2016 it was $223,200 — almost double.

The $100,000 Club Is No Longer Exclusive

Of course, inflation has also increased salaries, and more people are earning $100,000 than ever before. But that only serves to further diminish the six-figure income mystique.

For instance, US Census data shows that in 1992, approximately 5% of all households were earning at least $100,000 annually. However, by 2010, that figure had quadrupled to 20%; that figure is almost certainly higher today.

The proof is in the pudding; jobs paying $100,000 or more per year are nowhere near as rare as they used to be 30 years ago. Today, they’re quite common.

A quick search over at Salary.com revealed more than 1000 job titles with median salaries of $100,000 or more — and you definitely don’t have to be a brain surgeon (median salary: $561,190) or a rocket scientist ($126,768) either.

Today, you’ll find corporate secretaries ($190,937) in the Hundred Grand Club hobnobbing with senior attorneys ($157,444), and regional chefs ($121,119) mixing it up with dentists ($144,744).

The Bottom Line

True, there are some places where an annual income of $100,000 will go a long way — but there are other places where it won’t.

No matter where you live, the bottom line is this: earning one-hundred grand a year certainly no longer has the cachet it once did. Sorry, folks.

I think it’s finally time for a new benchmark. Two-hundred thousand, anyone?

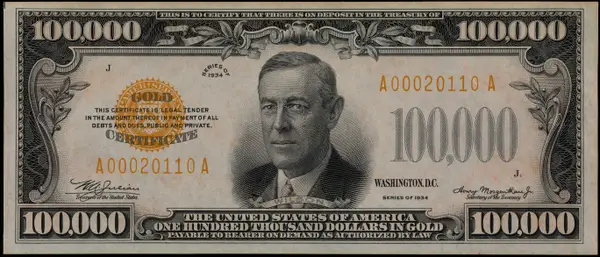

Photo Credit: US Treasury

So true that inflation has worked to erode the value of the dollar or 100,000 of them. The same holds true for retirement savings. With the Federal Reserve pumping out the notes, better get used to it.

Hard to argue that, considering that since 1988 the purchasing power of a dollar has been virtually cut in half. And my guess is the devaluation over the next 25 years will be at a much quicker clip!

Wow Len! You sound just like me. Once we hit six figures I wanted more. However, I felt I was being greedy given the fact that my beginnings was humble. The more you make the more you want. After taxes, retirement and insurance you’re back to making 5 figures. So I will say $200K a year is a good target to strive for.

If I stuck to my original goal, and taking inflation into account, I need to reach an income of $182k. Even that number wouldn’t make me feel rich though, Marie.

I’ve never made $250,000 a year, but my guess is you would need at least that much to feel rich. Of course you still wouldn’t be any happier than you are now.

I think $250k is getting warmer. If I was a single — it would definitely suffice. With a wife, two school-age kids and a dog, still not there yet.

great article and very true. the dollar just doesn’t stretch as far these days.

I’ll say! Since the Federal Reserve took over in 1913, the purchasing power of a buck has dropped 97 percent. I know.

I earn over $100k and I feel the same way you do. I think the benchmark today is $250k. Like you said though, it’s constantly moving. In 10 years it will be probably be $400k or more.

I hope not — but you’re probably right, Wilson.

Once you get past the worry of feeding your family and paying bills, the only difference would be making so much you don’t worry at all about what you spend.

I, like you, have not reached that stage.

Private jets and all that goes with them…. I can dream, but I don’t worry.

That’s a good way to put it, Dr. Dean. My biggest worry is actually loss of my job. Since I work in a very cyclical (and at the moment, unstable) industry, I end up having to bank a good portion of my salary every year to build cash reserves as protection against a potential layoff. If I didn’t have a family to worry about, I probably wouldn’t set aside so much, and enjoy a little more of it.

Sometimes I feel like the proverbial ant on steroids!

Wow, now I feel even poorer than when I woke up this morning. Sure, $100k isn’t what it used to be. Now, see I live in Pennsylvania and have much lower taxes and a much much lower cost of living than So. Cal. I wonder if anyone has devised a conversion rate of California earned dollars to Pennsylvania earned dollars yet? Gasp.

They do have cost-of-living calculators, Bill, that do exactly that. Here’s one:

http://cgi.money.cnn.com/tools/costofliving/costofliving.html

Len,

I think for me the benchmark is anything over 175K. I really liked your notes about inflation. SO many people focus on the numbers and completely forget about “buying” power. Sadly I think this trend is only gong to continue, especially once people start spending their excess capital and true inflation starts to take place.

Congrats on crossing the threshold and thanks for “putting yourself out there” I’m sure you debated sharing this type of personal info. I think it only adds to your credibility.

all the best.

AG

Thank you, AG. I’ve always tried to be as open as possible, so I really didn’t debate it too much. This time I think I struck a decent balance, being open, but without giving away exact details (which I think most people realize is for obvious reasons).

Well said Len! My own post discusses 5 different income levels with $500,0000 as the level that is deemed rich.

22 year old undergrads now make $100k out of school!

What a way to start after graduating, huh?! Good for them!

My starting salary in 1988 was the equivalent of $56k today.

I would have needed to secure a starting salary of $55k in 1988 to have the purchasing power of $100,000 today.

Several years ago, I had a job where I was making $75K and wow, did I feel rich! I don’t have children, though, which helped matters a lot. Since I only had to support myself and am paying a mortgage on a condo I bought in 1999, I was able to sock most of it away. That came in useful when I was subsequently laid off. Now I’m working for much less money.

Good for you, Pamela! I know a couple people who also have wild swings in their annual income. It requires a lot of discipline from them to save up a good chunk of cash for rainy days during the good times.

I just hope you didn’t burn through too much of what you were able to sock away.

Sometimes I feel lucky that I picked a marketable degree in computer science and have made a decent living for myself. But still, I think the salary cap for a software developer is somewhere a little north of 100k in my area so it will still take me some time to reach that point.

Remember, your salary may have a cap, but that doesn’t mean you can’t increase your income by doing things on the side!

Well, as Yogi Berra said, “the future ain’t what it used to be”. I have a feeling we’ll settle on the often bandied ‘$200,000 for a single and $250,000 for a couple is a millionaire’ rhetoric which is in vogue, and not index it to inflation. Slowly, more and more people will find themselves in the ‘millionaire’ category, not knowing that they bought into the hype that’s now engulfing them.

On that note, ‘millionaire’ isn’t all it’s cracked up to be anymore now, is it?

Berra also famously observed that “a nickel ain’t worth a dime anymore.” 😉

As true that it maybe that $100,000 in not what is used to be. I believe that it still a great attainable goal since the median family income in this country (regardless of what state you live in) is well below that. A majority of households would love to reach that benchmark some time in their lives.

Absolutely, Erik. I believe the median household income in America today is approximately $50,000, so making $100,000 is still a very worthy goal everyone should be shooting for.

It’s doesn’t work anymore though, when it comes to the old idea of $100,000 being used as a benchmark for real wealth. At least that’s my story — and I’m sticking to it! 🙂

I don’t think anyone ever gets that “feeling” that they are rich. when you think deeply about it the whole idea of rich/poor is determined by what others think it should be defined as. even the poverty line is not by our own definition by by the definition government gives it. I know a lot of people who would be defined as poor by that standard but they do not “feel” that they are poor.

to me the whole concept is nothing but fodder for the promotion of class division and for political purpose.

So true. Even that Gallup poll I referenced essentially found that folks generally would only consider themselves rich once they reached an income level around double what they were currently earning — even if they were already making over six-figures.

So the $100K today deflates to about $55K in 1988. You’re ahead of inflation, and improved your situation, especially with the cost of money less than 1/2 what it was. I recall 30 year fixed was 9% in Apr 1987.

You are right, $100K is not what it was when Andrew Tobias wrote his “Getting by on $100000 a Year.”

I’d definitely believe the 9 percent figure, Joe. Funny how that seems almost unbelievable now.

And Andrew Tobias is one of my favorite money writers.

Absolutely, KC. There are plenty of folks making over $100k who are much worse off than others making a fraction of that.

You and I both know you can be financially free at virtually any income level. It eventually all comes down to how much you spend, as opposed to how much you make.

I remember that when I was a kid, another benchmark was the concept of the millionaire. People who actually had a million dollars was still pretty uncommon and that was something to aspire to!

Great point, Debbie. The term “millionaire” barely turns heads anymore.

When I was making $15/hour I dreamed of being rich and making $25/hour. When I passed that and still didn’t feel quite rich, I started to dream of being rich and make $100/hour. The scary part is that if I ever make that much, I fear that I still won’t feel rich. I made all the mistakes I could: my salary went up, my expenses went up, my life style changed. I think there are people who can be happy and feeling rich making 40K a year. And there are those who won’t ever feel rich no matter how much they make. It is all relative.

Try living in NYC then 100k is like 80% rent 25% food. Bottom line BROKE.

That is SAD.

I work on straight commission. My wife makes decent money, but went through a 6-month period of unemployment from late 2008 through mid-2009 – at the same exact time my income fell like a rock

My experience is that as long as you live well beneath your means, there’s surprisingly little difference between $110K a year and $250K a year family income. Who’da thunk it.

Once you start making real money; income taxes bite hard. Every time our income dropped, the lower tax burden made the drop much more tolerable.

I’m thinking got-it-made territory for a middle age working family in flyover country is at least $350K, but ONLY if you REALLY control your expenses.

Amen on the tax impacts, TMS. One of the biggest hits are the tax credits that get gradually phased out — especially as your income rises above $100k.

Good points, Len. This totally applies to retirement savings as well. The amount that one can retire on has changed over the years, but I’m not sure that many people realize just how much. While wages increase, so do costs. Inflation is something we all know about, but often lose sight of.

This post makes me sad only because I’m so close to hitting that six figure mark – and I really want to be there. Unfortunately, you’re right, it’s not that much. In fact, it wouldn’t really help me THAT much in my finances but it would be something. I think the number is more of a benchmark than anything else – once I hit it, I’ll be just trying to go for $150,000. Kind of sad but it’s a never ending cycle.

@Young Professional Finances — Cheer up! I don’t think that’s sad at all. I think you’re doing the right thing. It’s great to set incremental goals.

If you run a 9-minute mile, you wouldn’t set a goal to run the 6-minute mile … you’d set a goal to run the 8 min, 30 second mile. And once you got that, you’d set a goal for the 8-minute mile. And so on.

What Paula said, YPF. 😉

(No sense trying to improve on perfection.)

I think it largely depends on how many dependents you have. Are we talking about a $100K household income for a family of four? That doesn’t sound “rich” to me. But if we’re talking about $100K for a single person with no dependents, then — wow!

No doubt the number of dependents you have makes a big difference, Paula! If it was just me or even me and the Honeybee, we’d be golden right now. Dare I say I would probably even consider myself rich. Probably.

Well Len I make 1/2 of 100k and I feel I’m far wealthier than many of my co-workers and friends who make much more. We focused on being debt free and building a recession proof lifestyle. I have a ranch in Texas mortgage free which we bought many years ago. Drilled a water well, put in a septic system, I burn my own trash, planted a huge garden and fruit trees. My property taxes this year came to $108 (because of ag-exemption) yet the ranch is appraised for $500,000. Our house was paid for in cash (sold our house in the city & used the money for the 2nd house). The only thing I lack which I’m working on is adding solar power. I have no mortgage, no car payments (always bought used in cash), no water bill, no sewer bill, no trash pickup bill, low food bill, our electric bill usually comes in about $70 a month. My wife is a stay at home mom. We could probably live good on $400- $500 a month easy. While many of my friends focused on buying McMansions, new cars every few years and a high consumer lifestyle we went the opposite way and now are enjoying the pay off. My friends constantly worry about their debt and fear being laid off. Both spouses work just to make ends meet. An income goal (100k, 250k, whatever) may seem to be the answer to being financially wealthy I disagree. That’s only 1/2 of the equation. While your income was going up you should of focused on making your expenses go down. Most people don’t work on that part.

That is absolutely beautiful, Money_Illusion. You’ve done a great job illustrating what it is like to be financially free. The best part is — and I say it here all the time — financial freedom is achievable at virtually any income level.

Conversely, a million-dollar salary doesn’t automatically immunize anyone from becoming a slave to their creditors.

People have written me who have five kids and a household income of $25,000 but still manage to make ends meet (and have little or no debt) because, as you’ve pointed out, they’ve learned how to keep their expenses low.

Thanks for the great comment!

Money Illusion – you are a BadAss! Your story really fires me up!

I mirror your statement “while your income was going up you should have focused on making your expenses go down.” I use a football analogy on this one (being a fellow Texan how else would I make the comparison?)…Income Generation is like playing Offense (scoring points) in football. Just as important if not more is PLAYING DEFENSE (Debt Abolishment AND Expense Minimization).

Wow, I feel so far behind. My job pays $13.40 an hour (about $27k a year). Good thing we have 2 incomes, but I really would like to make more money:(

I make over 6 figures right out of grad school, but with student loans these days it doesn’t go as far as you’d think. My student loans are basically a second mortgage (in fact they are more than my actual mortgage). It is all relative to many things though. I had the opportunity to take a job in upstate New York working for the same pay/company I am working for now in a different city in the midwest. And at the same salary, the buying power in the midwest is so much greater. I talk with friends on the coasts and them without children and no mortgage (at a similar income) vs me, my wife, and daughter, and a mortgage seem to be doing better than they are. Some of that might be financial responsibility too. At over $100k, I would say we are comfortable, not rich. But by making double the median salary of my city, we can afford to have a stay-at-home mom/wife and not be hurting when bill time comes. Having a wonderful wife and daughter makes me rich, not the money.

two comments. both the same meanings.

@Seth said it best:

>>Having a wonderful wife and daughter makes me rich, not the money.

and:

Same boat here, more money did not make me feel rich, just more ability to save if I choose to do so. and I did. but in thinking about this, I think if I doubled my salary I would not feel “rich”, if I quadrupled my salary I would not feel “rich”. Because…

Rich is a state of mind, not a location. Like those unfortunates who win the lottery and a year later they are broke, having money doesn’t make one a different person, it is in living a rich life does one become rich. Sure money helps to keep the wolf from the door and buys use some protection from the elements, crime, etc., but its all in how one lives, not where one is on the pay scale.

Well said, Guy.

I think your perception has changed more than inflation itself. When you dreamed of the 100k mark you thought you would be living large but you never took into consideration having to support a family. If you weren’t supporting a family you probably could be living that luxurious life style you dreamed about (or at least be pretty close to it). Plus, when everyone around you is poor (like in college) that extra couple thousand dollars in your pocket makes you feel rich. When everyone around you is richer (because you live in a nice neighborhood were the average salary is 100k) you see that half the people around you are richer and that makes you feel poorer by comparison.

Also, I don’t think inflation is the only cause for the change of 100k being attained by more people (although it is definitely a part). There is a wage gap occurring and the middle class is being gutted. Before if you were an unskilled laborer (blue collar, secretary, unskilled service, etc) you were able to make a decent middle class living. But now you either make a skilled salary (Financial services, Computer Science, Engineering, Medicine, Lawyer) or you make minimum wage working unskilled.

Facebook, Google, Apple have average salaries for their engineers of over 100k. And they are making profits of billions with just a handful of programmers. No need to hire thousands of people with middle wages when you can hire a handful of high wage people that can make even more money. I think there will be a handful of people with high educations, high skilled jobs making and inventing new products and then a bunch of unskilled jobs paying really low wages.

Wow… This article depressed me! I live in Southern California and make $46K base salary. I am happily able to pay my rent, take care of my bills, contribute to my 401k, and save some more on the side, as well as splurge on a nice vacation about once a year. I have no roommates, no spouse, and no kids (I have one dog who acts like a kid though!)

My income has decreased $9K/year since 2008, and while I work for a great company now that has terrific benefits (100% employer-paid insurance, ESOP, profit sharing, and 401k matching to 4%), the salaries are a bit low IMHO. I am SO thankful to have a job I enjoy at a place I like, though, and I want to stick around here. So I did a re-work of my budget at the beginning of this year.

Here are the cuts I made:

1. Changed cell phone company/plan ($10/month savings)

2. Got rid of DirecTV and added Netflix streaming ($60/month net savings)

3. Switched my landline phone to digital ($15/month savings – unfortunately, I do have to have both a traditional phone and a cell at this point)

4. I was giving Uncle Sam too much money, so I changed my withholdings ($50/month savings)

I also began cooking more, bringing my lunch to work daily, found a place online where I can buy my dog’s special food for a few dollars less per case, grocery shopping from a list (and knowing how much I will spend before I enter the store), and buying everything with my rewards credit card, which is paid in full 2x each month. I have one credit card with a balance (0% interest), and that will be paid in full by the end of October. I budgeted based on my base salary, and any overtime money I make will go straight into my savings account. This will all be re-evaluated at year-end.

I find these changes so empowering! The only thing that really scares me is my vehicle – I worry about a vehicle catastrophe sucking up all my hard-earned savings. Of course, if I was making $100K… 😉

Len, your situation would be much worse if not for Prop 13 and purchasing your home 13+ years ago.

As someone who clears 100K for the past few years, I completely agree. California state taxes, inflation, gas prices (taxes), we are all paying the ‘sunshine tax’ for living out here. Lol.

WOW, I feel so sorry for you. If I were in charge, I’d make a law that made everyone that makes less than you (90% of the population), give you all of their money.

Really? You sound like you’d make a great president for Cuba, Venezuela or North Korea.

I think the only way now and days for the average person to make six figures is to own there own home business and treat it like a real business. It might take time to earn six figures but when you do you will be your own boss and get take advantage of the tax advantages that business owners have which you lose when you are just an employee.

It is in reality a great and helpful piece of information.

I’m happy that you just shared this helpful information with us. Please keep us informed like this. Thank you for sharing.

I was making about $60K in 2006 and now in 2013 my salary has almost doubled, but I feel as poor as ever. Why? With rising salary came rising expectations and rising ability to spend on things I didn’t need or couldn’t afford to in the past. To name a few: I’m putting MUCH MORE into my retirement savings than I did in 2006. I’m paying for life insurance and just started a long term care insurance policy. The LTC policy alone costs me about $350 a month. I’m paying my mortgage off early with extra principle payments. And I still drive beat up used vehicles and will never be able to afford a new car until I reach retirement age. The result of all these extra expenditures is my take-home pay is now slightly less than it was in 2006.

Stevie, you sound like you’re extremely responsible with your finances. If you feel as poor as ever, back off a bit on your retirement savings — or slow down on the early mortgage payments. Not a lot, but enough to afford you a little something for yourself today. (Maybe a modest vacation getaway, a new hobby, or an extra evening out with the wife and/or kids once or twice per month.)

There is no reason why somebody making as much as you should feel poor.

By the way, I’m going to feature your comment in a new post on this topic next week.

Nice article, Len. This is a good wake-up call for a lot of people. I appreciate that reaching an arbitrary income figure won’t change your life – especially one that isn’t as high as it used to be. Life, and happiness, isn’t just about chasing a random dollar amount.

Thanks, Jay.

100k is nothing. My wife makes that working part-time 3 days a week. I’m 24 and made $413,000 last year and probably $450,000 this year. Me and my wife are already multi-millionaires. 😂😂😂😂