It takes courage to face the bogeyman.

It takes courage to face the bogeyman.

I bet many of the good folks in Great Falls, Montana, were more than a little worried earlier this month after a local television station there sent out an ominous message warning viewers that the dead were “rising from their graves and attacking the living.”

Hold on, hold on. Before you grab your shotgun and hunker down in the basement, consider this: It turns out Montana wasn’t ground zero for the dreaded Zombie Apocalypse.

Nope. It was just a hoax — thank God — perpetrated by some clever joker who managed to hack the station’s emergency alert system.

I know. But “The Night of the Living Dead” will have to wait.

Our Prosperity Is An Illusion

That being said, I do believe America is in for some tough times ahead. I still believe America is the greatest country on earth, but we’ve had it too good for too long and, as a result, our nation has become sadly complacent with its finances. So much so that I believe we’ve crossed the Rubicon.

Our government is now so massive, and its obligations — both present and future — are so large that, barring a remarkable and sudden change of attitude by our politicians, a systemic economic collapse is inevitable.

In 2013, the US National Debt was more than $16 trillion; by the end of 2015, it was more than $18 trillion. Unfortunately, the US currently owes, depending on who you believe, somewhere between $60 and $200 trillion more in unfunded liabilities for things like Social Security, Medicare and public employee pensions.

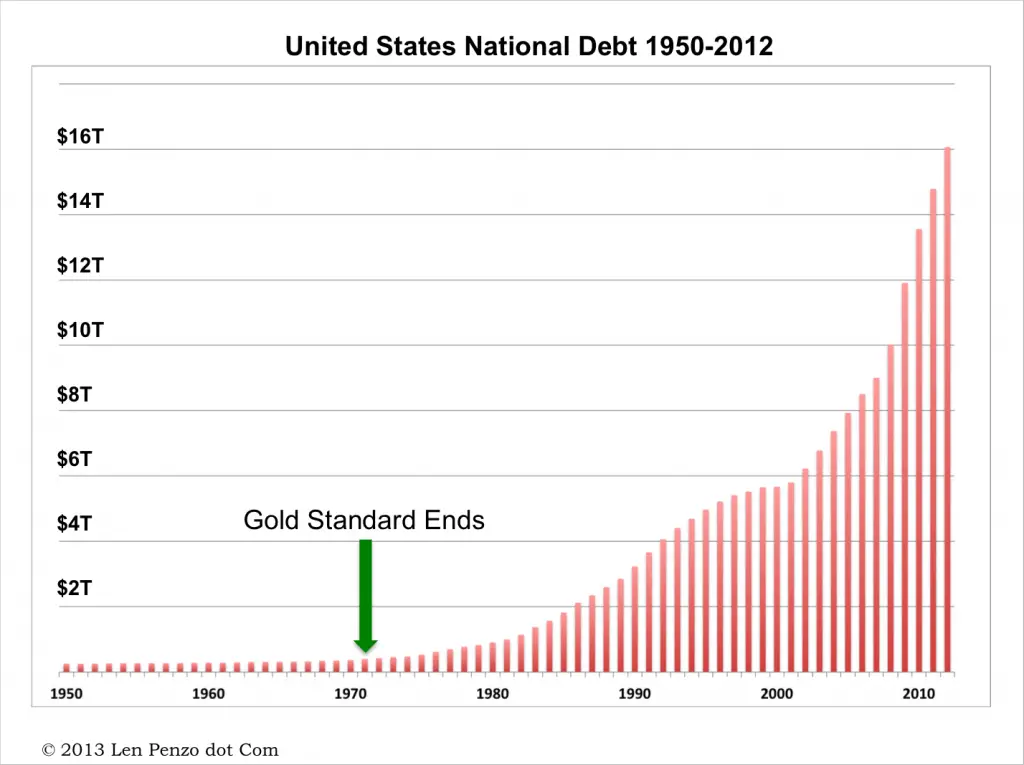

America has been able to run up these huge debts because it broke away from the gold standard in 1971. The gold standard imposed at least a modicum of fiscal responsibility and faith in the US dollar because the world’s central banks were allowed to exchange their greenbacks for the gold sitting in Fort Knox.

But once the gold standard was abandoned, our politicians were freed from the constraints that had previously forced them to be fiscally accountable. Pandora’s box was opened.

Since then, lawmakers have been borrowing an unlimited quantity of freshly-printed money to fund their spending sprees — courtesy of the Federal Reserve Bank — thereby eliminating the need to worry about tax hikes.

As you can see by the chart below, government spending — and the inherent money printing that is ultimately required to finance it — is now completely out of control; the National Debt is expected to reach $22 trillion before the end of this decade.

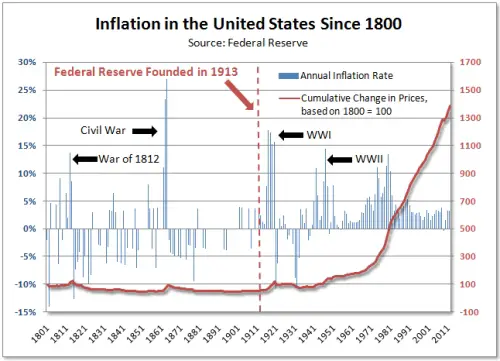

Of course, there’s no such thing as a free lunch. Every new dollar that is printed by the Fed increases the money supply, which in turn reduces the value of the dollars already existence — including the ones in your wallet and retirement account.

As you can see from the chart below, soon after the United States abandoned the gold standard in 1971 — and our politicians began to greatly expand the size and scope of the government — cumulative price increases embarked upon an exponential trajectory. Those price increases are the result of the declining purchasing power of the US dollar. In fact, the buck’s purchasing power has been decimated since 1971; so much so that today you would need $559 to buy something that cost $100 back then.

Clearly, abandoning the gold standard was a fiscally reckless decision, akin to giving a teenager a credit card without a credit limit. To illustrate, let’s first look at the current impacts of America’s spending addiction:

- 2015 Federal revenue: $3,250,000,000,000

- 2015 Federal budget: $3,690,000,000,000

- 2015 New debt (deficit): $440,000,000,000

- National debt: $18,700,000,000,000

- Interest paid on National Debt in 2015: $402,000,000,000

Next, let’s drop a whole bunch of zeros from those figures to make the federal government’s ledger look at least little more like a typical household’s finances:

- 2015 Household income: $32,500

- 2015 Household expenditures: $36,900

- 2015 Credit card debt: $4,400

- Outstanding balance on the credit card: $187,000

- Annual interest on credit card debt: $4,020

The figures reveal a dire situation. A financially responsible individual who found himself in a similar situation would drastically cut his spending while looking for ways to increase revenue.

Our politicians insist that’s exactly what they’re doing but they’re really just going through the motions, financing the nation’s obligations in the same way any financially irresponsible individual would — by taking on even more debt through the selling of US Treasury bonds.

It’s a practice that’s essentially no different than using a VISA card to pay the MasterCard bill.

The Illusion Is Unraveling

The problem is, using one credit card to pay another credit card bill only works for so long. As long as a debt addict can continue to find lenders who are willing to extend additional credit, the game can continue. But once the pool of lenders dries up, the game is over.

No, I can’t say exactly when this will happen. But it’s coming, folks — and when it does, middle-class America’s way of life will undergo a catastrophic change that will dramatically drop their standard of living forever more.

Until recently, the United States’ profligate spending wasn’t much of an issue. For years, plenty of investors — both foreign and domestic — have willingly parked a portion of their money into the perceived safety of America’s bonds. But over the long march of time, the dollar’s standing has seriously deteriorated and, as a result, foreign nations are becoming increasingly reluctant to buy US Treasury bonds because, thanks to the Fed’s near-zero interest rate policy, the risks are no longer worth the reward.

Normally, depressed demand for bonds results in higher interest rates, but so far the Fed has managed to keep bond demand artificially inflated via their quantitative easing campaigns. And the Fed is keeping US Treasury bond rates as low as possible now because interest payments on the National Debt already consume roughly 10% of annual revenue. If US Treasury bond rates increased to merely 5%, America would be forking over one-third of its annual revenue just to satisfy the interest on its $16.5 trillion National Debt; it would also be increasing its annual deficit by more than $800 billion.

The Beginning of “the End”

Although they won’t admit it, the Fed backed itself into a corner with its reckless easy-money policy. They know that once the money-printing party stops, interest rates will have to rise — and then the bond market will almost certainly crash. If that happens, things are going to get very interesting. For example:

- As bond rates rise, mortgage interest rates will naturally follow them upwards. And since higher mortgage rates ultimately result in higher house payments for a given size loan, it follows that home prices will have to drop in order to keep them affordable — and the decline could be devastating.

- The cost of borrowing will also go up for everyone else including small businesses, corporations, and state and local governments.

- The stock market should fall as higher interest rates hurt economic growth and hurt stocks’ value.

Once interest rates start rising, a vicious cycle can ensue as higher interest rates beget larger deficits, which in turn lead to still higher interest rates. As the debt piles up, and the faith in the US dollar continues to diminish, the US will eventually reach its day of reckoning. The US will then be faced with two very unpleasant choices for solving the crisis: print away the debt or default.

Default would lead to the loss of the US dollar’s standing as the world’s reserve currency which would, among other things, cause the price of imports to skyrocket. Consumers’ purchasing power would plummet, and the government would be forced to severely cut back on its spending since it would no longer be able to finance its deficits. However, this is politically untenable.

So the more-likely alternative is that the Fed will simply print away the debt. That would result in hyperinflation as the last vestiges of the dollar’s utility as a reliable store-of-wealth all but disappeared.

What Will Economic Collapse Look Like?

While I don’t expect a Zombie Apocalypse resulting from either scenario, temporary supply disruptions caused by market uncertainties will be inevitable — and that will lead to empty supermarket shelves, fuel shortages and, possibly, utility failures that will almost certainly result in civil unrest and increased crime in more densely populated areas.

The good news is a new (hopefully gold-backed) currency will be issued and society will slowly recover. Eventually. I’m hoping it will take no more than six months before the supply chain recovers enough to eliminate most shortages.

Thankfully, tangible assets won’t go up in smoke after the economy resets; your home, automobile, and other possessions will be unaffected.

More good news: Any long-term debt you hold in old US dollars will essentially be wiped out because you should be able to retire it with worthless currency. It’s why I no longer bother trying to pay down my mortgage early.

Even so, things will never be the same for most people.

Although it’s anybody’s guess, I believe Americans will be lucky if their post-collapse standard-of-living will be equivalent to half of what it is now; worst case, one-third. That ain’t so bad if you earn $1 million per year but, if my assumption is correct, and you earn $60,000 annually, then your post-collapse standard-of-living will be between $20,000 and $30,000 today.

The ensuing economic collapse won’t be the end of the world, but it’s going to be a wild ride. Next, I’ll share some tips on how to survive an economic collapse, and get out relatively unharmed.

Photo Credit: Koshy Koshy

“Under my plan, import prices will necessarily skyrocket.”

Oh they will … the big question is when. China has been quietly building its gold reserves for the past 5 years or so. I guarantee you prices will skyrocket if the Chinese announce a gold-backed currency and as a result the US dollar loses reserve status, or the petrodollar paradigm (where all oil is currently only traded in US dollars) is abandoned.

If its only about risk and not about the morality and benefits to America of their supposed sacrifice then we should all thank taxi drivers and skate boarders for their service due to the risks associated with their professions. The US Military is just a very expensive social program that benefits both businesses and military families, but because they wear flags and sing anthems good people are tricked into believing its all done for their benefit.

You’re still conflating two separate issues, bob. I can’t help you if you can’t recognize that.

I’m curious about your animosity towards the military. National defense is one of the few Constitutionally authorized powers of the federal government. That being said, have we overstepped our bounds over the past few decades? Absolutely. Even so, spending has historically been around 5% of the GDP — a level at which it maintains to this day.

The vast majority of the spending by our federal government — the spending that is REALLY bankrupting us — is on things NOT authorized by the Constitution: social entitlements and countless numbers of ridiculous government bureaucracies answerable to nobody, like the EPA.

As for the budget: 19% goes to defense; 22% to social security; 21% to medicare and medicaid; and 12% to other safety net programs.

http://www.cbpp.org/cms/?fa=view&id=1258

I have news for you — without our large military, we wouldn’t be able to maintain the petrodollar. Without the petrodollar, we couldn’t have Obamacare and all of those other expensive social benefits from the federal government that the people keep voting themselves — the same ones that are now consuming 55% of the current budget.

Instead of the men and women of our military, who have nothing to do with the mess we’re in, why not focus your derision at an electorate that keeps voting for federal politicians who promise them endless “free” bread and circuses?

Although the scenario this story paint’s, sounds great, many, many factors simply were glazed over.

90,000,000 Not in the Work Force

50,000,000 Food Stamp Recipients

45,000,000 Americans Addicted to Drugs

6,000,000 Unemployment Recipients

5,000,000 Welfare Recipients

I am leaving out 10,000,000’s of Millions Gang Members, Mafia’s Corrupt people etc…etc…

From the beginning of the financial collapse 200,000,000 Americans will be Totally devastated by Day-5

And it’ll get worse with each passing week

FEMA was a No-Go in New Orleans during Katrina

FEMA was virtually useless in Hurricane Sandy

DHS has a “Recovery Plan” that involves 2,000,000,000 (2 Billion) Bullets and 3,000 MRAP Wheeled Tanks

When the USD Collapses, the Global Economy will Collapse simultaneously.

All of these things will create huge “Voids”. Void’s that will be filled by the greater force. This force is often “Not Civilian friendly”

I have been the “Army of Occupation” several times. I have seen first hand the atrocities, that most people will not………survive.

By the end of this coming Total Collapse, I expect upwards of 150,000,000 American will “Not Survive”.

Another 100,000,000 American will be Permanently Disabled, Terminally ill, Too old to be effective in a recovery, etc…

***** PREPARE — NOW! *****

Here is some of my 1st hand experience:

Army – Tours:

1990-1991 – IRAQ – Desert Storm

1992-1993 – South Korea – DMZ

1994-1995 – U.N. Mission in Haiti

1996-1998 – IFOR/SFOR

First off, thank you for your service to our country, Frank.

Although I am fully aware of the other pitiful stats you mention, I remain optimistic that things won’t get that bad — at least not for too long. I do believe we will have relative chaos for a few weeks early on, but not forever. That would imply a total and permanent breakdown of society — and I just don’t buy it.

If you are right, then God help us.

Only in America is ignorance and stupidity no longer considered a vice. Point being, while talking about the coming collapse of America you thank someone for volunteering to fight in multiple overseas conflicts that played a large role in bankrupting this country. Now lets thank the bankers and politicians for their service.

Really, bob? Really?

You’re conflating Frank’s selfless and noble decision to put his life on the line and serve his country with despicable decisions being made by the politicians and bankers to bankrupt our nation (from the safety of their ivory towers, no less). Unbelievable.

Apparently, you don’t see that.

Talk about ignorance and stupidity.

I am a awake american with a young daughter who just is trying to prepare for the shit thats coming our way! Should i pay my mortgage or just forget it and put that money on buying a pull behind camper and roll where i need to go? If you could give me some advice this patriot would appreciate it since i live in liberal hell whole in maryland but on eastern shore which is more farm country.

Do both

Believe it or not, the USA will fail the last in the world. So, I think, nothing to be worried about

I appreciate your clear headed presentation about the effects of QE. Your example of a family budget mirroring the federal budget was particularly helpful. Price increases are something we cash only grocery shoppers notice all the time. According to BLS the average worker makes $45,230. We don’t make any where near $60,000 a year either, so I anticipate a very “wild ride”. I’m planning on adding to our raised beds this spring. Looking forward to your suggestions.

If you believe the government’s numbers, Olivia, inflation is tame … tame they tell you! 😉

But the main gauge of inflation is constantly manipulated to hide inflation; in fact it actually excludes the things we depend on most to get by in our daily lives: food and energy! Why? Because they want to keep people in the dark with respect to the blatant theft they are foisting on everybody through inflation.

Len, It seems that many people I know agree with you (and my wife and I) that there is an economic crash coming soon. But when I have tried to see what they a doing to plan for it, they all seem to shrug and ask what can you do? We have done a lot of thinking on this and have try to look ahead at what we are going to need to get through it. But it just seems to come up short and we still feel we are have more to do and quickly. So we look forward to your next posts. And I hope there is some good solid suggestions. I would almost like to start a blog on what people should be doing now to soften the impact of the certain economic collapse to come. Do you know of any blogs that are doing that? It seems like it is really needed. I bet a lot of people will offer suggestions to you. Thanks for your site. We love it. Nothing better than a clear thinking engineer.

Rick, there are lots of great blogs out there that shine a light on the trouble with our financial system and how to protect yourself.

Three of my favorites are:

The Schiff Report – (YouTube.) There is a wealth of free information here from Peter. Schiff called the crash of 2008, and knows what he is talking about. He always gives lots of great advice, usually in easy to understand language.

ZeroHedge — (Blog.) It’s one of my favorite financial sites. You occasionally have to separate a little noise from the main message, but that’s easy to do. It does a great job pointing out and explaining the folly of our financial system and the systemic problems that plague it. Sometimes it gets fairly technical, but stick with it, and you’ll learn. The comments are usually a riot too. (I often learn as much from many of ZH’s regular commenters as I do from the articles.)

The Peter Schiff Radio Show — (Podcast.) There is a fee for Peter’s premium content, but you can listen for free on weekdays between 10 and noon.

Of course, then there’s my blog. I am going to start covering this topic at least once or twice a month. There is a lot of info to mine, and I have things I want to share with you on this subject because I feel I owe it to my readers –especially since I have a personal finance blog. I would be remiss to NOT discuss it. (Even if it makes me look like a nut in some people’s eyes.) 🙂

Len

I just stumbled upon your website last week and have read probably 75 articles. I have enjoyed all of them. Now I find out you are a Peter Schiff fan and I like you even more! You have gained another reader for sure!

Awesome, Kyle! Thanks for reading. I love Peter Schiff too — er, like a brother. Lord knows for years now he has been trying to warn anyone who will listen that our massive government and the cost of supporting it is completely unsustainable, but our politicians refuse to listen.

Get out of debt, stock up on barter goods(non-perishables, gold coins and jewelry, a lot of people including myself are fans of bullets, possibly some Bitcoin), make the acquaintance of or become someone who already has a long-term plan for self-sufficiency, with the eye on offering them some labor in exchange for housing and food.

There’s no need to panic. Just prepare your Plan B, and then when it becomes necessary, enact it.

I’m still not convinced about Bitcoin, Volfram. But my mind isn’t made up yet. I just need to think about it a, um, bit more (dang, no pun intended). I like all of your other suggestions!

There are a ton of sites dedicated to “prepping” for what is to come. One of my favorites that helped me greatly when I started prepping is “preparing your family”

http://preparingyourfamily.com/

He has articles on every topic from food storage, to bee keeping, to gun stockpiling, to building a cabin in the woods. A lot of common sense info. His food storage advice is invaluable to someone who is just starting to realize the shelves will be empty sometime in our future.

I’m breathing better now that you’ve assured me there will be no zombie apocalypse. The cycle you discuss, I think, is well underway. We’re on the escalator down now and most people are pretty oblivious.

Most folks are oblivious. Then there are those who are in denial — or think I am a nut. I’ve talked to several folks who don’t want to hear it; no matter how simply I try to explain things, they can’t conceive of a dollar collapse ever happening here in the United States. They just think we can continue to run up these debts and grow government for ever and ever with zero consequences.

There is not one single currency in the history of mankind that has lasted forever.

Yep. And that’s because certain leaders and politicians eventually get in charge who realize they can stay in power by simply making promises that require robbing the Treasury. But a currency backed by a sacrosanct gold standard would go a long way toward preventing those urges from ever being acted upon, Mindimoo.

I found it interesting to read Debt: The first 5000 years, a good book on the history of debt, loans, and currency. One interesting point made in the book is that when the US went off of the gold standard in the 70s, we held large gold reserves, along with other well off nations. Poorer ones, on the other hand, held US bills, assuming they were as good as gold. The shift effectively inflated the value of our gold reserves, and deflated the value of poorer countries Dollar reserves.

Exactly, Peter. The real coup, however, was the US convincing Saudi Arabia and then OPEC to agree to the petrodollar paradigm that requires all oil to be traded in only one currency: US dollars. That agreement greatly expanded the world’s demand for US dollars, and as a result — that is what has insulated us from the problems that all other nations encounter when running up massive debt.

The sad thing is so few will actually see it. Argentina didn’t think it could happen either. If you haven’t read it already, I suggest a perusal through http://www.amazon.com/Modern-Survival-Manual-Surviving-Economic/dp/9870563457

In the meantime, every time I read another article that confirms my thinking, I invest in a hard asset – 50 lbs of rice, a case of peanut butter, a greenhouse.

Oh yes! Becky, thanks for reminding me … 😉

Ferfal has a great blog on surviving economic collapse. He is from Argentina and lived through theirs. The blog is called Surviving in Argentina.

I’d make one change to your treatise: Instead of blaming politicians, I’d blame the people responsible (US electorate) for putting the same people from the same parties with the same ideas (none) in the same jobs election after election.

@KURT — I agree. Our politicians are a reflection of us, the people who vote and the companies that we support. And we’re so responsive to distracting hot-button issues that most people don’t cast votes related to the whole picture.

Great post Len.

To take a quote from Ferris Bueller’s Day Off, “I weep for the future.”

Looking forward to more reading on what options we have for softening the crash that’s surely heading our direction.

I do too. If economic collapse is truly inevitable, I actually hope it will happen sooner rather than later and, especially, before my kids get out of school. That way I can shelter them somewhat from the storm and they can avoid the massive savings and nest egg losses that most unprepared Americans will surely be experiencing.

Assuming there really is no way out from this, the sooner we reset, the sooner we can work on rebuilding and getting our economy back on track. But the piper has to first be paid, and it is going to hurt. A lot.

Stay tuned, Michael.

Thank you for such interesting and informative articles. It’s much appreciated! I would like to get your opinion on something: since I was a kid (I’m 50ish) now, my father bought me savings bonds. They’re now worth about 70k (or more). I haven’t cashed them because of the “save, save, save” philosophy ingrained in me from having Depression-era parents. Of course these bonds will be worthless in an economic collapse. What is a good investment for a large amount of cash. I already own 2 rental houses and another house on acreage, so paying off a mortgage is a non-issue. Thanks!

Hi, Georgia. I don’t give investment advice … however, if you read some of my recent posts you may be able to glean the type of investments you might want to consider.

In general, useful, tangible assets are one way to protect yourself from economic collapse.

Peter Schiff offers lots of advice on what you should do to protect yourself. Check out his websites I linked to in one of the earlier comments. He recommends things like investing in gold, silver, and investments overseas.

I don’t believe the Gold Standard is practical any more, since the global GDPs vastly exceed the world’s gold reserves. Sure, you could argue that inflation would have been held in check or that gold would be worth $10,000 per ounce if America was still on the gold standard. But, the reality is the world’s economies have grown too large to be limited by the amount of gold and other shiny metals that exist. We need a new global monetary standard that:

1) Limits governments from printing money at will

2) Discourages currency manipulation for exports

3) Doesn’t limit growth and expansion of economies

4) Works in the digital age of the future

Disclosure: I’m not an economist. The depth of my experience comes from an economics class in community college. However, I am smart enough to realize most of our government economists are simply professional misleaders.

Actually, Bret, the world’s collective GDP is irrelevant. What is stopping a nation from tying the printing of its currency to some proportion of gold on hand in the treasury vault — which would be audited annually?

A new global monetary standard would be disastrous because, to be be effective, monetary policies must agree with a population’s values. The Euro is a perfect example of why one-world currency would never work: the work ethic and values of the Northern European states are at odds with those of the South.

But I will argue that gold and silver meet all four of your criteria. 🙂

The only way a one-world currency will work is if there is a one-world government.

Len,

I’m definitely not for a global currency. I’m just for a global monetary standard. In other words, the central banks watch for currency manipulations and over-printing and adjust the exchange rates accordingly. There is no way I would want to share the same currency with countries that don’t want to work. That would be disasterous.

Since our U.S. dollar is the current global standard, we need to be much more careful with our finances, so we don’t get bounced, like the pound.

Len Please explain the following statement..

“More good news: Any long-term debt you hold in old US dollars will essentially be wiped out because you should be able to retire it with worthless currency. It�s why I no longer bother trying to pay down my mortgage early.”

I am paying my mortgage off early (my only debt). Please explain why I could take that money and do better with gold/silver/emergency supplies now or in the immediate future in light of this statement.

I am in a fixed rate loan. Would not the selfish bankers just convert the debt on my house to a new standard?

I do not understand this.

Spedie

You should always do what you are most comfortable with, Spedie. As far as i am concerned, paying off the mortgage early is never a losing bet. I used to feel that way; I paid $100,000 in extra principal payments between 1997 and 2009. You can even check the archives for one of my old posts extolling the virtues of paying off the mortgage early! Then I reevaluated our government’s commitment to protecting our currency, saw that they had no interest in doing so, and reconsidered my position. That being said …

In a high- or hyper-inflationary environment, the key will be staying employed. If they want to keep their employees, most employers will have no choice but to hand out big raises two or three times per year — of course, for the most part you may only be able to keep pace with cost of living as food and energy prices climb, but over time that fixed rate mortgage is quickly going to take up a smaller and smaller percentage of your income. So as long as you can manage to set aside some of that rising income to pay off your fixed-rate mortgage sooner, you’ll be able to pay off your loan fairly quickly and the banks will be the big losers.

Can the bankers change the terms of the mortgage contract? I don’t see how they could, unless there was a clause in the contract that called for a conversion in the event of a dollar collapse.

The fact that the lender failed to charge enough interest to account for hyperinflation is the risk they took when they handed out your fixed-rate loan! 😉

This is why it is wise to buy physical gold and silver now. Sell a small amount after hyperinflation hits and pay off the mortgage. Or wait until PM’s are in a bubble during an inflation crisis then sell the PM’s for physical real estate. This is Mike Maloney’s plan. Real estate prices should drop during an inflationary crisis.

Spedie-

Think about it like this…

In 1950, $10,000 was a lot of money.

In 2012, $10,000 is not a lot of money.

It’s much easier to pay off $10,000 now versus if you paid it off in 1950’s dollars.

If there’s one thing that inflation benefits, it’s people (or governments) with a lot of debt.

This was not the best thing to read before I go to bed. Scary stuff.

In the interest in presenting things on the same scale… could you do the first graph from 1950 to 1980 on a much smaller scale to see whether or not it really doesn’t move like it looks like?

Here are the figures from 1950-80, Lance — direct from my spreadsheet. As you can see, the debt was very stable until 1967. Then the Vietnam War and LBJ’s War on Poverty began to strain the US’s ability to stick to the gold standard. By 1971, US spending forced Nixon to abandon the gold standard.

Debt $B Year

0.257 1950

0.255 1951

0.259 1952

0.266 1953

0.271 1954

0.274 1955

0.272 1956

0.270 1957

0.276 1958

0.284 1959

0.286 1960

0.288 1961

0.298 1962

0.305 1963

0.311 1964

0.317 1965

0.319 1966

0.326 1967

0.347 1968

0.353 1969

0.370 1970

0.398 1971

0.427 1972

0.458 1973

0.475 1974

0.533 1975

0.620 1976

0.699 1977

0.771 1978

0.826 1979

0.907 1980

Thanks Len! Now only if my traffic would grow like the debt does!

In our household, we have quite a hard time to heat our New England home. Oil prices are being inflated month after month. I don’t see any end to it this winter season.

Prices at the gas station have increased as well. The national average is reaching the $4 mark.

Unfortunately, Caesar, unless we get politicians in office who believe in a much smaller federal government — not a bigger one that is responsible for taking care of us from cradle to grave — I see little hope.

Keep in mind, we don’t have to eliminate the debt. We just need to keep it at a manageable level. Economic growth is a great elixir for that — but we need the right policies in place to encourage an expanding economy. So far, that ain’t happening.

I suppose we all look like nuts. There are those that are socking all their cash into strong, reliable dividend payers, those that are paying off their mortgages, those that are hoarding cash, those that are building up a physical gold supply, those that are arming themselves with seeds and guns�. (oh, and those that are still buying lattes and Gucci, but they don�t read Len because they need time to get their nails done).

Minus the seeds and guns�I�ve been doing it all. It�s been difficult to navigate, given the naysayers that are celebrating in the current stock market highs. They are the real nuts! I like tangible things that I own outright best. Yes, paying off the mortgage is dumb knowing that it will cost a pittance soon enough. But, it�s the security of owning it and not caring that the value will most likely crash again before hyperinflation can save it. I have pretty good job security but I am trying to attain iron fortified �brick house� with metal bars security if I can help it, with or without my current employment. I�ve been paid very well for a long time and thankfully had the wherewithal to be able to save most of it. My cash and hard asset hoard will cover a good amount of time (factoring in estimated hellish inflation). My 2 properties will do me well after the storm. What I do know is that when all is said and done, it can only get better. Our government will finally have to abide by the principals our forefathers intended and set forth.

Len, I have seen exactly what you are describing and your picture is fairly accurate. This is pretty much what happened in Central and Eastern Europe in the early 90s. My Dad had saved money for an apartment for me – within a year this was enough for three ice-creams (and from a street vendor at that). About a year ago, I wrote an article on TMP where I said that it is time people stop fixating on their debt but to start worrying about their saving – while you are right that debt gets wiped out the same happens to savings.

I have also been think about surviving this kind of catastrophic event; honestly, given that we should expect a reversion to barter economy at least fro some time, I have absolutely no idea whether and how someone like me will survive – the time when poets and story tellers stood on street corners and got coins for their gift is long gone. Better be off to brush up on some more practical skills.

Yeah, it will all get wiped out. Savings and debt. Unfortunately, in the end it is the debtors who will end up being rewarded and the responsible people who have scrimped, saved, and sacrificed and lived within our means in order to build up our savings who end up the biggest losers.

When and if economic collapse finally happens, there will be a lot of justifiably angry people out there looking for “those responsible” after they realize they’ve been robbed of their life’s savings.

The good news is, those who prepare, can still come out fairly well. More on this later…

An interesting fact.

After the collapse in the Soviet Union many people were able to py off there mortgages just as you describe.

However, most people were so poor and so in need by the end of the collapse that they took out new loans on the houses in order to get by.

The trick is to store up enough now to be self suficient as possible, food, household items etc . . . as well as gold and silver. When the dust settles it might be possible to be better off then you were in the beginning. But it takes a lot of prepping.

Well said, Josh. I agree completely.

I just wanted to say thank you for posting this.

You explain it much better than I ever could. I just hope enough people read this and start to prepare themselves and their families.

Your very welcome, Kevin. 🙂

Awesome article. I agree with most of what you said, and I wish more financial blogs talked about this. It is obvious the US cannot dig their way out of this hole.

The only thing is I don’t think we can count on a currency collapse to erase or pay off our debt. The powers that be are way too smart to allow that happen. I doubt they will allow millions of debtors to pay off their debt with de-valuated currency.

In Mexico when their currency was devalued they simply made everyone turn in their peso’s right away, and re-issued new currency that was worth 10% of the old. You could not pay off your debt with the old currency, only with the new. I could see the US doing this.

Hopefully things don’t get that bad, but it never hurts to prepare. Very well written article. Thanks so much.

Thanks, Melinda. With all due respect, let me just say that the US is not Mexico. I’m certain that if the US government is allowed to pay off its debts via hyperinflation and currency collapse, then the citizens will be allowed to as well. I am confident the rule of law will ultimately prevail — one way or another. Unless there is a “currency collapse” clause in the mortgage terms, the lenders will not be allowed to change the terms of a binding contract. 🙂

Ultimately, you have to make your own decisions, Joe. It all depends on whether you are looking to preserve your wealth or chase returns. Of course, precious metals will protect the purchasing power of the wealth you have already earned. I do not look at silver and gold as an investment; as far as I am concerned you DON’T buy precious metals to earn returns. If you’re looking for returns, that is a bit more complicated but there are plenty of options, some of them more creative — if not less conventional — than others. A lot of financial gurus who I respect recommend looking at overseas investments.

Well that was a little terrifying.

Now I desperately want to see what the UK version is like

Great post. I think this will happen sometime in the future. It’s already happening all across western europe with the almost economic collapse of EU. The fact is the Fed is too powerful. Giving a group of individuals the power to print money is too dangerous for anybody. That immense power can corrupt anybody and we are going to start to see consequences in our society. But, I hope you are wrong. The question is how do we prepare?

I agree with many of your points, as someone who believes in paying cash and in austerity, I believe something has to give and the federal debt can’t go on forever.

But in order for this scenario to play out I think the US creditors have to stop lending to us. The only way we have been able to get away with this huge debt is because of our creditors who can’t find other places to place their money, it seems.

If for example China and Japan (our biggest creditors) keep giving us money, our government will continue to spend it. Will they stop the flow? and if they do stop lending, who will buy their goods?

I do believe we need to fix out debt dependency though.

Sylvia, compared to what it used to buy, China is now buying far fewer treasuries from the US. Japan has recently upped its buys, but overall, more and more Treasuries are being bought up by the Fed to pick up the slack left by waning foreign interest.

You’re right. To support your point even further, China’s impending real estate bubble will eventually burst making it more likely that the Chinese government will redeem our bonds, not buy more.

Just saw the 60 minutes piece on China’s huge real estate troubles.

Hi Len

Thanks so much for answering my question. This is well thought out and detailed. I’m really looking forward to part 2.

I too like listening to Mr. Schiff. If you can’t subscribe to his show, he has an app which has selections of his best moments. I do believe he needs to change the way he argues his points with other economists. I feel he would be taken more seriously if he showed more humility when he debates with others. Sometimes it looks like he is trying but slips into almost schoolyard like arguments which dilutes the points he is trying to make . It is the difference between him being good and exceptionally good. Patience Peter !

Maybe you could also explain who gets/benefits from the interest payments on the national debt in part 2? I googled it found one interesting explanation but still not 100% sure. The government pays itself interest? Also other holders of their treasuries?

Thanks again!

Where are the tips for making the economic collapse bearable? You mentioned you would have them this week…

Thanks. Love your blog…

Hi Mary Ann, I know. I’m running a bit behind schedule. Sorry for the delay. They’ll be posted on Monday, March 11.

Alright, I’m 14 years old and I cannot convince my parents about how bad the economy is. I’m wondering if it will happen before I become an adult, or if i will have time to prepare?

Hayden, first off, I am very impressed that you are reading this kind of article. And not just because I wrote this. 😉

I have teenage kids myself. A 13-year-old daughter and a 15-year-old son. For their sake and yours, and the sake of all young people, it would be best if a collapse happens sooner rather than later. That will minimize the losses to any wealth they — and you — will have accumulated prior to any collapse.

I’m in my 40s. Older people like me are the ones who will be much worse off because we stand to lose more wealth — and, even worse, we’ll have less time to recover from our losses. Think about it, somebody who is, say, 65 or 70 will have virtually zero chance to regain all the wealth they accumulated over many years if the economy collapses — but a 25 year-old will have at least 40 years!

All you can do is read as much as you can, and try to nudge your folks into at least reading the warnings of others. Best of luck to you, Hayden. Keep reading and learning as much as you can. Knowledge is power.

Thanks Len. I’ve been trying my best academically and am hoping to the good Lord that I will at least be nearly done with high school by the time it happens, I know this is a longshot, but I can hope. If I am lucky enough I plan to become a physician, but again all I can do is hope. I live in the heart of Oklahoma and my family owns plenty of land and cattle, so I’m just gonna freshen up on my survival skills and religion and hope for the best.

Hayden, nobody can say with any certainty when an economic collapse will happen. If we’re lucky, our government will stop spending money it doesn’t have and we’ll be able to turn things around so it never happens. I don’t think so, but you never know!

If you live on a ranch or farm with cattle, you and your family will almost certainly be able to weather any storm because you are already self-sufficient. You’ve got a ready supply of beef and milk to exploit, and barter for whatever your family is going to need. Try not to worry too much. You and your family are going to be just fine. For the most part, it’s the city folk who are dependent on the supermarket and other stores for everything that are the ones who have to worry.

One last thing-sorry for the inconvenience, but my family and me have all been refreshed on our firearm skills. Do you think in a small area (rural-ish town)I will have to worry about violence as much? We are getting a Doberman soon, and I think that will at least “discourage” robbery 😛

Don’t worry, bud. If there is an economic collapse, I don’t think you’ll notice anything different where you live. I suspect almost all of the crime problems are going to occur in and near the bigger cities, due to people who don’t know how to live on their own that failed to prepare. Most people in rural areas know how to take care of themselves.

Hello Len, first of all I love your article, it really explains a lot. I have a question though, I live in northern Texas and work for the Chesapeake Energy Corporation. My question is, since my job is a non goverment owned job, and we are a major gas producer, is it any more or less likely that I will lose my job?

Thank you, Jared. I’m glad you found the article helpful.

Energy is critical to any functioning economy — and for society, as a whole.

If you are in the energy sector, I suspect the risk of sudden unemployment will be significantly lower than other areas.

What do you think of the people who say it will last years or cause an end of the world effect?

I don’t believe it, Margret. Not for a single minute.

I expect a relatively short period where we are going to have a real bumpy ride with shortages induced by a frozen financial system. But the crisis will be solved with the introduction of a new currency. Since I am confident the powers that be realize the financial system is eventually going to go bad, I wouldn’t be surprised if they don’t already have some sort of implementation plan already in place.

As soon as a new currency is authorized by Congress and fully implemented, confidence in the financial system will be restored, and then life will get back to “normal” relatively quickly — although many people will have the shock of their lives when they realize their living standard is much lower than it used to be.

I’m planning for six months of empty supermarket shelves and shortages of other goods, but I believe (and pray) that the supply chains will recover quicker than that.

So one of the main problems with currency is it seems like this always happens. I am not entirely sure what you mean by their standard of living will decrease, does that mean they will get payed way less? and wouldn’t a new currency also means goods prices would balance out with the new currency? care to specify please?

When I say people’s standard of living will decrease, Matthew, I mean they will no longer be able to afford as much as they used to. There are lots of reasons for that, and so I’ll write another post to explain all the dirty details.

For now, suffice to say that the prices for almost everything Americans currently buy are artificially suppressed for two reasons:

1. We are the world’s reserve currency

2. we are the beneficiaries of the petrodollar paradigm

Without going into detail here, those two items give the US tremendous trading advantages that allow us to buy things much cheaper than other countries.

When the dollar collapses, those privileges are going to disappear and the subsidized prices we have been paying for everything (especially imports and oil) will come to an end.

Gasoline prices will almost certainly double, and import prices will skyrocket.

You are correct when you say prices should eventually balance out with the adjusted prices of the new currency — at least that’s true for a typical country. However, that wouldn’t apply to the US unless reserve currency status was restored (unlikely) AND we convinced the rest of the world to return to the petrodollar paradigm (not a chance).

Therefore, those price subsidies for imports and gasoline that we currently enjoy and, as a result, raise our current standard of living, will never return. That will force more things to be made here in America — which is a good thing, and that will quickly get us back on the road to recovery. But still, things will never return to the privileged trading position the US has enjoyed since the end of World War II.

I love your blog len, but respectfully disagree with things will return back to norm. I beleive we will continue under a fascist setup type of Government after thing collapse here in America. I beleive this will set a precedent for a New World Order where dramatic change will happen, forget the constituton or the rule of law. The elite of this world has planned since America’s inception to transform this country in what they had intentionally planned for it to be. My 2 cents.

I hope you’re wrong, Mark. I hope you’re wrong. That being said, I can see how once a collapse sets in, the public will be weak and more than willing to sacrifice its liberty in return for “security.”

It’s how the Patriot Act, the TSA, and the Department of Homeland Security were born — it’s also how people like Hitler came to power.

“He who sacrifices freedom for security deserves neither. People willing to trade their freedom for temporary security deserve neither and will lose both.” — Ben Franklin

What did you think of David Stockman’s NYT Op-Ed over the weekend? Sound pretty similar to your views…

I think Stockman did a good job, Rick. I disagree with his comments on Milton Friedman. He called out a lot guilty parties — and rightfully so — although he went far too easy on the current administration for their role in this. Then again, considering he wrote this for the NY Times, it probably wouldn’t have seen the light of day if he did.

Of course, once collapse comes, it won’t matter who is to blame. Our energies will need to be focused on getting the economy back on its feet and returning to a society as the Founding Fathers intended and laid out in the Constitution; one that relies on personal responsibility, self-reliance and a very limited federal government that is prohibited from acting as a societal sugar daddy.

Here is the link to Stockman’s NY Times op-ed piece for anyone who is interested:

http://www.nytimes.com/2013/03/31/opinion/sunday/sundown-in-america.html

My biggest worry is the income, cash flow, and surviving (not losing my home, business, etc…). I am self employed. Products come from China. I am already seeing a downturn.

Sales will decline more and more and advertising is becoming less and less effective [already]. This means, eventually you need to put in more advertising dollars proportionally to what you need to sell. This will put you out of business eventually, unless I can find some competitive edge, or find a way to divert / convert the business into a US originating product with a tougher edge.

Forget to mention, our business is very cash-poor, goods are on credit.

For selfish reasons, can you believe it, I wish the collapse will be an overnight collapse or at least not longer than over 1 or 2 months. An over-night collapse will at least assure that we won’t lose our home while a stretched out collapse over years and years sounds painful and could give collectors the chance to put you through the legal processes. Everything happening too sudden, all at ones and to literally everybody, will simply clog up the pipe and create a bottle neck in the foreclosure process. In the meantime you can ride on the hyper inflation through trading for food and other goods and then cash in pm’s with a new currency, and pay off the debt before the banks can process the foreclosures…

It’s horrible having to think that way. There is a huge advantage being able to pay off your house. “Peace of mind”. If business were that good I wouldn’t worry. But you just don’t know how much more worse it can get. It’s survival right now, next year it may not.

So, thanks for the article. There is a lot to think about. Unfortunately the exact outcome is unpredictable. You can’t compare Argentina, Mexico, or not even the Great Depression, and Weimar Republic history to what’s coming our way. The great depression is a walk in the park compared…

best wishes.

Len, could you reply or prepare an article on the differences between Household Debt and the Budget of the United States ?

I will with hold any comments until I understand your position on the differences as I have read what you believe are the similarities.

Thank you,

Jonathan Fraser

( + Two sons who are taking personal finance and economics this Summer )

There will be no recovery for the United States. We are owned by China and other countries. They will occupy the United States and the American people will be sold into slavery to recoup some of their loses. If you think it can’t happen read up on your history.

The Chinese will never occupy the US. They can try, but the citizenry is armed — and that would pose a bit of a problem for any invaders who had intention of sticking around.

Then again, if you are speaking in terms of financial slavery, you may be correct. At least for those who put their trust in the US dollar.

I am not sure that economic reset or worse will take place or not as I didn’t researched myself and reluctant to draw conclusions from articles.

I certainly understand that middle class will expand in USA with more forced compliance to authorities. USA is military hub of world so considering economic positions only will be not logical. Let say your lenders are reluctant you can always use force to see the things goes your way.

As as value of possession is concerned, you are assuming that no one will not be able to take it away from you.

i found this to be an interesting read..

but do you really think they will forgive the debt for everyone ?? i just don’t see that

Yeah I’m hoping so! I don’t have much debt anymore though, I’m VERY anti central banks now. I even rent now! No more mortgage. Problem is I used most of my cash to pay off the debt when my company collapsed. Honestly knowing what I know now, I would have gone bankrupt and let it die at the doorstep of the banks, and I’ve never even considered that before now. I own more Bitcoin than USD now!

I’ve been through my economic adjustment already! I’m building my online business back-up and as long as we can keep the grid and Internet up my family will be fine.

A company (I know one of the principals well) is soon launching the first Direct Sales Bitcoin business! We are all very excited, as it couldn’t come at a more opportune time. It’s perfect for anyone to participate in the leading worldwide digital currency market without investing a large amount of capital. We get paid Bitcoin (we can convert into local currency if we choose) simply sharing the benefits of Bitcoin, the educational training and risk management strategies, along with an integrated advertising and marketing platform.

I’m not sure why I went into so much detail! Anyway, my question that I can’t seem to find an answer for is if we really head off the deep end. I’m currently in an apartment. I wonder for i.e. if the banks close etc. (yes that bad) if we’ll all be forced out of the apartment or if I can count on this as a safe haven. It’s corp. owned so it’s not a local family or group of families that might want to move in relatives. Just curious. I’ve been educating myself a ton, and something hit a cord with your content. Keep up the good work!

I appreciate the charts and comparison lists. The US financial problem is really not hard to understand, it’s just spun and ignored.

It also seems so clear that silver and gold on hand are the only ways to preserve buying power for economic catastrophe. But this idea also has many detractors. I’m not encouraging people to invest in it, but rather to buy and hold it as insurance!

Thanks for your article.

Wes T.

Indiana

I read lots of comments about how not to worry about your mortgage or debts. I believe you may find the govt in charge will implement a debtor’s prison and if you have debt you cannot pay you will be rounded up and shipped off to a re-education camp or whatever euphemism they come up with (bring your gas mask with you).

Im sorry too say that I don’t think this will happen. The smart people who run the country will not let this go default. I respect your opinion. But the USA will keep moving forward.

Same things are happening over and over again, ruling party may change but policy will almost be the same.

Debt rises but still the US economy is the strongest having the USD as a reserve currency in multiple bank systems all over the world.