Should you pay off the mortgage early? That question is, without any doubt, the most popular question posed by my readers. And sure enough, the other day I received this note from Lauren regarding the wisdom of paying down the mortgage early:

Should you pay off the mortgage early? That question is, without any doubt, the most popular question posed by my readers. And sure enough, the other day I received this note from Lauren regarding the wisdom of paying down the mortgage early:

Len: We’ve been working to pay off our mortgage ASAP, but inflation has us wondering if we should continue doing that. Do you think it is better to divert some of our extra mortgage payments to buy precious metals?

There is always a passionate debate between those who believe paying off the mortgage early is a no-brainer, and folks like me who think it’s better to put your money elsewhere.

Ultimately, you’ll need to make your own decision, but here’s why I’m not paying off my mortgage early:

For many years, I was a huge proponent of early mortgage-retirement. So much so that, between 1997 and 2009, I made approximately $80,000 in additional mortgage principal payments to my lender. But during the spring of 2009, it became apparent to me that the Federal Reserve was no longer committed to protecting the value of the US dollar — so I began to waver on the wisdom of the early-mortgage-payoff philosophy.

Soon after, I became absolutely convinced that paying off my mortgage was no longer in my best interest, because the risk of high inflation, if not an outright US dollar collapse, had become extremely likely — and loan values are essentially inflated away in the presence of a collapsing currency.

Inflation and the Fixed-Rate Mortgage

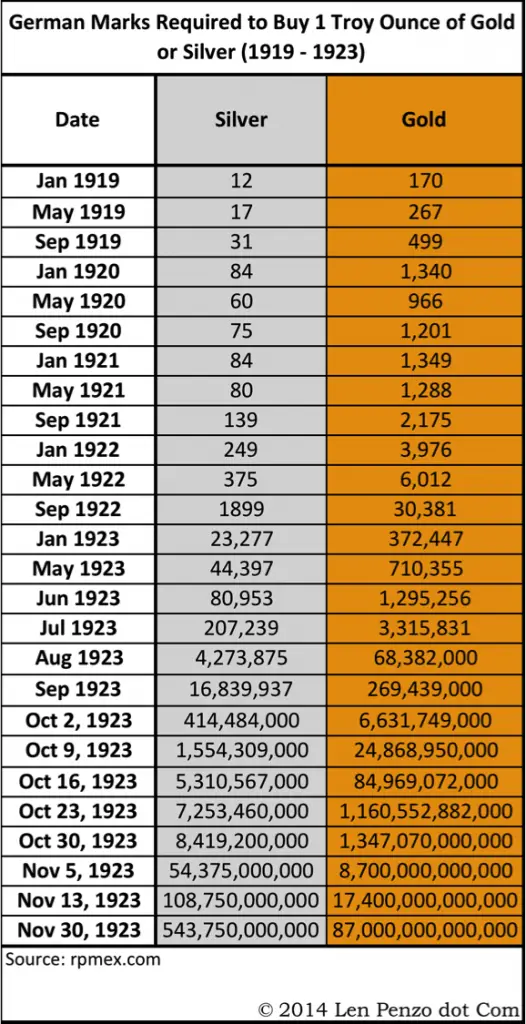

In his book, When Money Dies, Adam Fergusson chronicles life in Germany during the collapse of the mark between 1919 and 1923. The following chart shows just how quickly Germany’s currency declined relative to gold and silver as the inflation rate increased — slowly at first, but then very rapidly:

As inflation surged, rent control became widespread in in Germany. (In case you’re wondering, rent control is very common during hyperinflation events because it helps reduce the risk of civil unrest.)

As for those who had a mortgage, Fergusson writes:

Mortgage payments (became) no more than a nominal burden to (homeowners) — a consideration which dismayed the mortgage banks.

This was for good reason: Fixed-rate mortgage holders were quickly learning that hyperinflation was truly a debtor’s best friend. As Fergusson notes:

(One woman) went to stay in the country and asked her hosts bluntly what they were doing with all the money they were squeezing out of the townspeople. They replied candidly that they were paying off their mortgages.

By September 1922, inflation was completely out of control, thoroughly decimating the purchasing power of the collapsing mark. So much so that Germans with fixed-rate mortgages were paying off their home loans with a week’s wages.

Financially-savvy Germans who were able to secure loans during the hyperinflation were even more fortunate, as Fergusson explains here:

In February 1922, with a loan from a friendly banker, (a farmer) bought an estate neighboring his own property for (approximately $371,000 in 2023 dollars). He paid the debt in the autumn with the sale of less than half the crop of one of his potato fields.

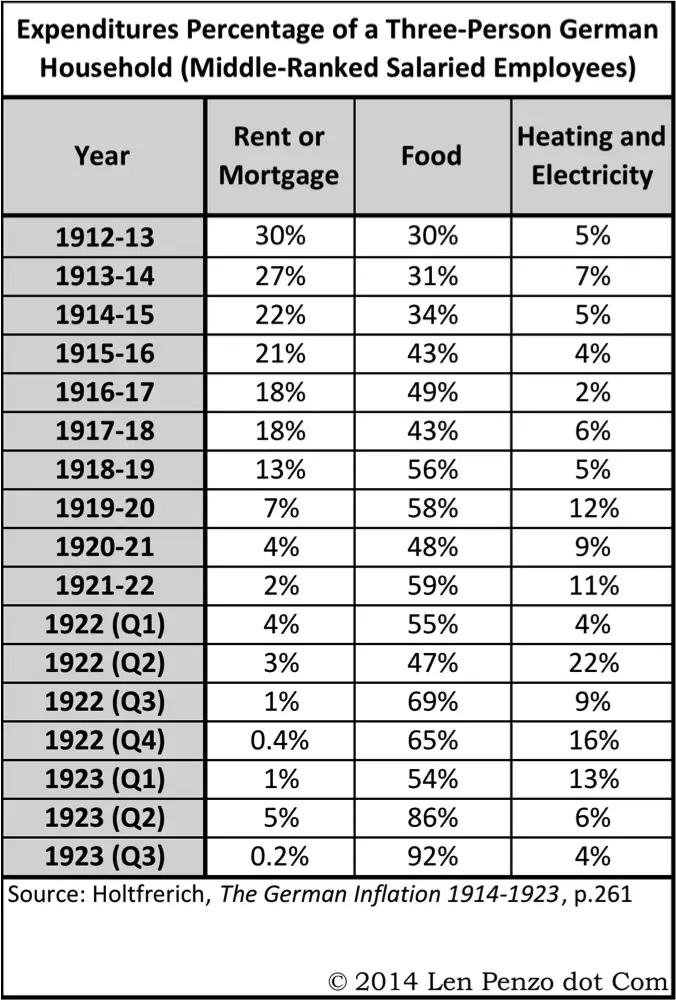

Of course, this was possible because, as the mark became less valuable over time, the proportion of currency that households allocated to shelter, food, heating and electricity shifted. Before debasement of the mark began in 1913, household expenditures for shelter and food were essentially equal. However, as inflation got worse, the amount of household income required to keep a roof over one’s head became trivial:

As you can see, by 1923 renters and fixed-rate mortgage holders were putting just 0.2% of their income toward shelter. In order to benefit from paying off your mortgage in such a scenario, wages must keep pace with the inflation. The good news is, history shows that wages do keep pace with inflation (albeit with a slight lag). That’s because they have to — otherwise, there would be no incentive to work.

What If Scenarios

I know what you’re thinking: Could the government bail out the banks by passing a law that revalues my mortgage? Perhaps.

In fact, Germany revalued mortgages shortly after that infamous Weimar hyperinflation in the 1920s; I even wrote an article explaining how a similar mortgage revaluation law would work in the US. However, I don’t think that’s likely — at least not in the United States. After all, a mortgage is a contract. And I believe that contract law will remain sacrosanct here.

And what if you’re wrong, Len? What if you’re just being a big worrywart and it turns out that the dollar doesn’t ever collapse?

Well … I’ll still have no regrets. Here’s why: Generally speaking, annual mortgage expenditures become sharply reduced over time for those with fixed-rate mortgages. Of course, the trick is in staying gainfully employed. The following chart shows how the proportion of my paycheck spent on the mortgage steadily dropped. Actually, it plummeted: from 38% in 1997 to just 3% last year. And keep in mind, that is without hyperinflation:

Eventually my mortgage payment was such a small percentage of my total income that it became an afterthought. And that gave me flexibility to allocate more income through the years for investing, and buying precious metals to protect my wealth.

Of course, that 3% figure was made possible via a series of cashless refinances. But as you can see, even if I had kept my original mortgage, the proportion of my income devoted to my home loan would still have been just 7% of my income last year.

So patience earns its reward either way.

The Bottom Line

Don’t get me wrong; there’s still a lot to be said about the advantages of paying off the mortgage early. In a normal world, with low inflation, modest interest rates, and a healthy financial system that rewards savers and punishes debtors, it’s certainly the path I would take.

Unfortunately, I don’t believe that’s the environment we live in anymore.

***

(Note: This is an updated version of an article that was originally published on 23 June 2014.)

Photo Credit: woodleywonderworks

Great read. I’ve always been a proponent of paying off other debts with higher interest rates than your mortgage or putting more money into your retirement accounts since they can usually beat the low mortgage rates of today. This is a side I hadn’t looked at. Since most conventional mortgages are 30 years long, inflation really does have a tangible effect on your payments. I appreciate this new perspective.

Being retired I prefer to extra money on being a snowbird and enjoying beautiful weather 12 months a year. Having lived from Cuba to Alaska I’ve seen all types of weather to work and live in. Its a great feeling knowing I have no pressures on bill due dates. I run my own bank and when needed borrow money from myself to be returned with interest just like up town. Rates run from 2% yr to 3% month depending on type loan. Since I left home at 17 after HS graduation and done better then many with a college education.

There is definitely something to be said for owning your home free and clear, Edward.

And if you need to borrow money, I can’t think of anybody better to borrow it from than yourself!

I think your logic is sound Len; the question then becomes will the mortgage holder see hyperinflation during the mortgage’s term? Economies are vastly different today than in 1920. Still it’s interesting to note that Germany’s hyperinflation troubles began when its government suspended convertibility of the country’s currency to gold and elected to fund its involvement in WWI through borrowing, not taxes. Sound familiar?

Yes, economies are vastly different, Kurt.

But the math is still the same. 😉

From a tangible perspective, everything you say is absolutely correct. However, for many people the intangibles have value, and must be considered when weighing in on the question. What peace of mind would it give them? What opportunities would having no mortgage payment open up? For example, you might consider taking a position in a new field that pays less at first, but could expand in opportunity later. This could be less feasible with a mortgage payment.

Each scenario is different, and so there’s not one pat answer. Sounds like you found yours and that’s great.

We paid off our mortgage last year. No regrets! We are in our mid 40s with no debt and are saving quite a bit of our pay checks. I sleep like a baby at night, knowing no one can take our home away from us. We have always been frugal, but now we don’t have to if we don’t want to.

Good for you, Maak! Congratulations!

It’s almost impossible to put a price on peace of mind.

So what to do with the extra money if not paying off mortgage early?

That’s the million dollar question. I know what I’m doing with mine — putting it into tangible products that have unambiguous value. What I am NOT doing is putting it into paper-based financial instruments (like stocks, bonds, etc.)

Hey Len,

When Germany experienced hyperinflation in the early 1920’s, did people have the extra income to pay off their mortgages? Didn’t most, if not all, of their currency go towards living expenses?

Currently, with the world central bankers completely out of control (printing money), we will eventually face the stark reality of inflation. Hopefully, not hyperinflation. I just don’t see wages keeping up with inflation. Nonetheless, the Federal Reserve will be forced to raise rates when inflation arrives, plus the central bankers will be forced to shut down the printing presses. God help us when this day comes. The stock, bond and real estate bubbles will implode, which could easly send our economy right into a depression. This is why you want to own gold and silver. Their values will skyrocket!

That is a great question, Doug.

It depends on the job people had. Believe it or not, the people whose wages were best able to keep pace with inflation were farmers and blue collar workers/tradesmen like plumbers, carpenters, masons, ditch-diggers, miners, those with skilled manufacturing jobs, and other day-laborers. Believe it or not, it was the white collar workers — government bureaucrats, those in academia, clerks, and general paper-pushers — who really suffered and had lots of trouble keeping up. People in those jobs had wages that did NOT keep up with inflation. Why? Because they had no leverage; when push comes to shove, and people can only afford to spend on needs, rather than wants, those white collar jobs weren’t the ones that make the world go round. It’s the blue collar jobs. As a result, many blue collar workers were generally able to pay off their mortgages.

History shows that wages for the important jobs will keep up in time of high inflation (with a lag, of course) because they have to — or the work will not get done. Nobody will work if they can’t make enough to pay for a roof over their head, and keep their bellies full. Those white collar workers still made enough to eat and pay the rent — but they had little or no discretionary income. (For awhile, some German government employees were receiving a large majority of their pay in the form of potatoes.)

Now take a closer look at the expenditures chart. In 1913, Germans were spending about 55% of their income on the necessities of life (rent, food, heating, electricity). At the height of hyperinflation in 1922, it was 80% or so — but that still left 20% of their disposable income for other things! And 20% of a huge number over a short period of time is usually enough to help retire a mortgage.

Fascinating. Really thought provoking. Perhaps we won’t prepay our mortgage.

Thanks Len….

Still pondering this. We ( h-64, w-55) owe 56K @3.5% . The variable is because of fear/ lack of knowledge, we have most of our retirement funds earning less than 1%, so it would appear to make better sense to pay it off, but the loss of that 56K, coupled with the fact that it saves me only 343.00 per month for the principle/interest and the entire mtg ( 639.00- i live in a high tax city) is do-able. I have been thinking when husband retires, which will hopefully be in 3-4 years, that we pay it then. But i have a hard time sorting through these variables, so if anyone has a clear way to see it ,I am all ears!

I agree with you completely. In today’s current environment, it just doesn’t make sense to pay off your mortgage early!

I don’t understand why you think the U.S. is going to collapse like Germany? If the U.S. Dollar collapses the world would take a huge hit. If that happens you are better off building a bunker and stocking up on coffee and ammo because its going to get rough. And I am talking walking dead minus the zombies. People won’t want your gold… your best chances are to trade things of practical use.

I am not saying that the U.S. can’t collapse or is “to big to fail” (like the banks)…. All i am saying is you may as well invest and pay of your mortgage sooner than 30 years and hope for a good retirement. Stop telling people not to invest their money. That is horrible advice.

Also most people wouldn’t use the surplus money to save anyway so they may as well pay of their mortgage so they actually can live off of social security.

Hi Len,

On page 251 of the book Money Master the Game, the author Tony Robbins recommends that for every mortgage check one writes, they should write a second check for roughly 1/3 of the mortgage check and indicate on the second check that it is to be applied the loan principal only. Per Mr. Robbins this will cut the loan term in roughly half. Firstly, does this work from a mathematical standpoint? Secondly, will banks be OK with this? Thirdly, if one has a 3.5% fixed rate 30 year mortgage, does this make economic sense? Thank you, John R.

Great article Len! This is my first time here and i’m actually impressed.

Thank you so much, Anika!

So Len, you said you paid about $80k in extra principal in ’97 to ’09, and your table at article’s end shows that you’ve been paying the mortgage for 25 years now. I’m thinking your mortgage MUST be paid off by now! 🙂 We did the math for a 7 yr. ARM at 2.75%, and paid the property off in that time. It was the right decision for us and one less thing to worry about.

Nope. I still have about 27 years to go. Every time I refinanced (believe it or not, six times in all!), I reset the clock on the mortgage. That being said, if I never refinance again, when the mortgage is retired in 2050 I will end up paying slightly more in nominal dollars than if I had never refinanced at all. But far less in real-dollar (inflation adjusted) terms.

My monthly mortgage payment today – and for the next 27 years – is now just $490. That’s pretty good – and even better when you realize what $490 will buy in 25 years. If inflation remains at just 7%, the answer is: less than $100 in today’s purchasing power. In the meantime, I use today’s more “valuable” dollars for other things (investing, wealth insurance, home improvements, etc.).

This is how you let inflation “pay off” your mortgage for you – or at least let it do the heavy lifting.

The final point is this: After 25 years, my principal balance is low enough now that I can easily retire the mortgage at any time with my savings. So, yes, I still carry a mortgage – and will continue to do so for another 27 years – but it’s not as if I will ever be in danger of losing the house because I am unable to pay it off in the event of a job loss or other financial catastrophe.

Wow Len I must have missed this key article when you put it out several years ago. Definitely my bad! I actually believe going over this with my gorgeous better half will finally give me the tool I need to win this ongoing argument with her that paying off a mortgage early may not be always be the best way to approach life with a 30 year fixed rate mortgage hovering over our financial heads. Unfortunately, for our argument anyway this coming May 1 she will have successfully fought off my pleas to pay minimum and invest as the best option as our 30 year fixed rate mortgage will be paid off in just 9 years. She gets her sure thing and we save massive big bucks in interest but with this I will finally get the satisfaction of saying see, Len says I am right! Thanks for helping this guy finally win one! Of course I will pay a price for that, but let’s hope the satisfaction lasts long enough to get me through it. YKWIM LOL

I wonder if the incredible bull market of the last 10 years is coloring the payoff vs. invest debate? Would we fell as strongly about not paying off after a long bear or middling market?