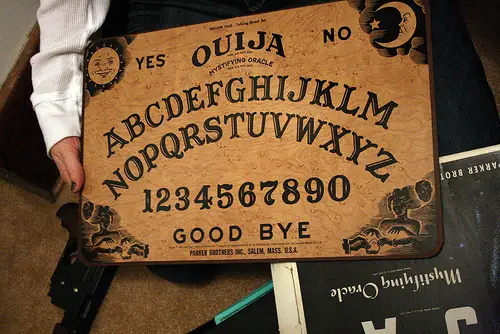

When I was a kid I used to have a Ouija board.

When I was a kid I used to have a Ouija board.

Thankfully, my nerdy friends and I were never possessed by evil spirits while conjuring up our dead relatives to see how they were doing (they’re fine, thanks); or getting answers to burning questions like whether or not certain members of the junior high school cheer leading squad had the hots for us (they didn’t — at least not for me).

Even so, I know a lot of people who insist that Ouija boards are evil and should be avoided at all costs.

There are also folks who refuse to carry credit cards because they feel they’re just as sinister as Ouija boards. Fair enough.

I understand credit cards aren’t for everybody, but I think they’re a good thing; I’ve been using credit cards for many years without a single regret.

Of course, like many things in life, credit cards are a double-edged sword. So the decision on whether to embrace or eschew them comes down to understanding why you should and shouldn’t use them.

Why You SHOULD Use Credit Cards…

Credit cards provide us with the privilege of responsible short-term borrowing. Yes, they can be abused, but when used wisely and responsibly, credit cards provide valuable benefits including:

- Convenience. With plastic, there’s no need to carry wads of cash with you everywhere you go.

- Peace of mind. Unlike credit cards, if you lose your wallet, the cash in it is gone forever. Worse, those seen with large sums of cash are more vulnerable to being robbed. I hate being robbed. In fact, it’s happened to me twice.

- Expense tracking. Credit card companies send monthly statements of all your purchases that make it very easy to track your expenses.

- Consumer protection. How many times have you bought something on the Internet and never received it? Or didn’t get what was advertised and the merchant refused to give you your money back? A simple call to your credit card issuer is usually all that’s required to fix the problem.

- Insurance benefits. Often, credit card companies offer product insurance if an item is stolen, and many offer free rental car insurance.

- Extended warranties. Some credit card companies will offer extended warranties on certain items.

- Credit history. When they’re used responsibly, credit cards help establish your credit history and build your FICO score — that’s especially valuable if you need longer-term credit extended to you. High FICO scores also get the most favorable interest rates which can mean savings of tens or hundreds of thousands of dollars over the life of a loan.

- Rewards. Whether it’s cash, airline miles, free gasoline or other incentives, there are plenty of credit cards to choose from that offer rewards; I’ve received thousands of dollars in cash and other perks over the years by simply using my credit card to make purchases.

Why You SHOULDN’T Use Credit Cards…

- You’re financially undisciplined. If you’re unable to control your spending then a credit card is definitely NOT for you.

- You’re unwilling to pay off your credit cards in full each month. Two of the most important benefits I mentioned as reasons for using credit cards, establishment of credit history and credit card rewards, are neutralized — or worse — when you start to carry balances from month to month.

- You feel credit card companies are morally bankrupt. Some folks believe credit card companies take advantage of consumers. If that’s you, then it makes little sense to keep one in your wallet.

- You’re personally irresponsible. If you’re unwilling to accept the terms you agree to when you sign on the dotted line — whether you read the contract or not — then you’ll be much better off sticking with cash.

Yes, credit cards can get careless people into a lot of financial trouble, but that’s no reason for responsible people to eschew them, any more than it makes sense to avoid using knives because they’re potentially dangerous.

So there you have it. Hopefully, I’ve explained the pros and cons well enough to help you make an informed decision.

And, after all that, if you still find yourself unsure about whether or not credit cards are right for you, well … you can always try consulting a Ouija board.

Photo Credit: jmawork

Our society has too many folks who are financially ignorant and tend to pass that ignorance down the family tree. One manifestation of that ignorance is overspending that is enabled by the availability of easy credit. Credit cards are the primary tool of easy credit and are a means by which FICO and the credit industry financially enslave the ignorant. Of course, I also understand that if we didn’t have credit cards, most personal finance bloggers wouldn’t have much left to say or sell.

Debit cards rule!

Debit cards don’t rule if one is stolen and you don’t realize it, or the information is stolen. YOUR BANK ACCOUNT WILL BE WIPED OUT IN MINUTES AND YOU HAVE NO RECOURSE! The money is gone forever. Someone steals my credit card and runs up $50,000. in a day, and I’m not liable because when I learn that there are charges I didn’t make, the credit card company lets me off the hook. Debit cards are CASH, all the cash which is in your bank account.

I want to thank you for making the point in your post that by signing the credit card application the user agrees to be bound by the terms of the credit card company’s contract. I think that is a point of financial education that is frequently glossed over. Many people have never read or understood the terms of that agreement that clearly gives the benefits of that relationship to the lender. The acceptance of that credit includes the risk that the credit card company has the right (which you agreed to) to changes the terms in their favor at any time. The use of credit cards can still be beneficial to those who use them with that knowledge. For the most part the way we issue credit cards in this country is like giving everyone a car when they turn 16 without giving them any driving instruction.

the problem with credit cards is people abuse them, buy things they can’t afford. And they don’t pay the balance off each month.

A couple of notes, other than ‘great article’. Working in retail, I’ve found that a lot of debit cards can also serve as credit cards. Also, if you think the big banks are crooked, get a card through your local bank. I think it was Clark Howard who pointed out that if your debit card it stolen and used that money is already out of your account and you have to fight to get it back. If they get your credit card, you are fighting to NOT lose the money. Which is a stronger position? Again, great article.

Bravo

I’ve been meaning too write something about this, but I guess you beat me to the punch! I’ll still write about it but from a different angle.

Mr CC

I agree, Len. If credit cards are used responsibly, they’re really convenient, provide consumer protection and in many cases, excellent cash rewards. My significant other Martin and I have two American Express cards connected to my Costco Executive Business membership which gives us 4% cash back on gasoline, 3% for restaurants, 2% for travel and 1% for everything else. It’s fun taking our annual rebate check in February to Costco, loading up the cart and paying $0.00.

Good stuff Len. I’m glad you didn’t embed in your post a link to a 0% credit card offer as so many other sites may do following a post like this! 🙂

Harnessed properly a credit card is a powerful tool. Some people just shouldn’t play with guns right?

FS

I got my first card at 19 to establish a credit history. It happened to be a rewards card because I’m a diligent shopper and wanted to get the best credit card that would be granted to me. I now have a second card that is not a rewards card. I happen to use the first one more because it makes sense to use my rewards card more often, but again, my purpose in obtaining a credit card in the first place was to establish a credit history.

I get a lot of flack for suggesting that other college students should do as I did and get a credit card and use it responsibly. But frankly, there are too many things that affect you when you graduate to ignore establishing a credit history while in school. Employment, getting an apartment, getting a car loan, and insurance can all be affected by your credit history – and those are all things I and my friends have had to deal with since our recent graduation.

It’s fine to decide that a credit card is not for you, and to look into other ways to establish a credit history. But it’s too important to ignore.

Great post Len. Credits cards don’t cause financial irresponsibility any more than flies cause garbage. We can certainly understand how some may have OD’d on credit and have had to take a rather radical stance as a form of detox. We value the rewards and credit cards make it easier to rent cars. We drive clunkers (by choice) for our local communtes and rent new cars when we take vacations. What we save on car insurance, by driving clunkers, more than pays for our vacation car rentals 2 to 3 times a year. What we’ve saved over the years by avoiding costly depreciation on new cars has catapulted our savings tremendously. Intelligent use of credit can be a money saver.

I am definitely pro credit card. Using my credit card is how I get points for use in buying Christmas gifts. Once in a blue moon, I’ll carry a balance, since I freelance and have irregular income, but the interest I get hit with in an entire year is usually not more than $10, and the Rewards I get in the same year will be $75-$100. I definitely come out on top.

Hi there…I am very much anti-credit card. We rang our credit cards up and put ourselves in a whole (and wondered later how we did it!). We definitely lived well past our means. Yes you can use them responsibly, many people do.

However, I am now Mr. Debit Card! I only buy things I have the cash for etc. I believe credit cards contribute to the sense of “I want/need something now, can’t wait, must get it”. At least they did for me!

We found the best budgeting software called YNAB (You Need a Budget) and that has helped us tremendously to live within our means and has opened up our communication as couple. It’s an electronic envelope system that allows you to make sure you set aside money for things and plan out what you want to spend. Especially for emergencies. I used to just use the credit card to pay for a car repair for example, now I have money set aside to pay it free and clear.

I have been following Dave Ramsey’s plan and it has made an incredible difference for us. To me, it’s a mindset. If I pay for something using credit, I am now in debt to that person/company. I don’t like that at all! Even if we have the money set aside and plan to pay it within 25 days, I still have to pay them.

To me, it’s so easy with credit cards to dig yourself a hole. It’s possible not to, but highly likely you will at some point. The credit card companies (despite rewards they offer) are not in the business of losing money! By using a debit card/cash, I can make sure I won’t do that again!

Thanks for the well written and balanced article!

Duncan: I am on BS6 and have been for years as a diligent follower of the DR plan. I have not had a CC since 12/25/07, and I do not miss it one bit! I had paid it off, in full, every single month for 12 years. All I had, in the end, was a house full of junk I should have not bought in the first place.

I am one of those that feel credit card companies are morally bankrupt. I don’t even want to play with snakes!

WTG!

Wow, this is the first article I’ve seen that talks about the pluses of credit cards. I am pro credit cards, even though I have had a lot of credit card debt in the past and still do carry some. I ran up debt when I was unemployed for an extended period and had exhausted all other savings (not because I was being spend-happy – we’re talking food, home, gas, and medical costs here).

I’m still working to pay all that off, but I regularly use my Amex reward card for charging most purchases. I have a lot of my utility bills charged to it and use it for everyday purchases. The great thing with the Amex is that you can’t carry a balance on it, so it forces you to pay it off every month. They do have some “pay over time” programs, but you have to opt in to them and I simply don’t.

Last year, I was able to get 4 round-trip coast-to-coast flights for free (one in first class!) with my reward points. I also managed to triple-dip during some extended travel by first getting a discount on my hotel by using the card, then racking up reward points on the card, and finally getting frequent-stay points in the hotel program. The frequent stay points allowed me to have about 3 weeks worth of hotel stays for free. I even got tax benefits via per-diem employee business expense deductions.

Credit cards are a tool and for some jobs, they are the best tool. A chain saw can hurt you, but you wouldn’t use a butter knife to cut down a tree. Tools are only as good as those who use tthem.

Sure, it would be great if I didn’t have a lot of debt with the horrible interest rate increases they’ve been dropping on us of late, but that’s not the fault of the cards. It doesn’t mean I’m happy with the credit card companies for raising rates to ridiculous levels at a time when the federal interest rates are at all-time lows, but it’s not illegal. It’s just up to me to pay it all off quickly.

Having all that credit available when I needed it was a godsend, even if I’m paying for it after the fact. Without it, I would have lost my house, my car (and any means of getting to work), health insurance, etc…) so I think I’ll keep credit cards in my financial toolbox.

Like Len said, credit cars are a double edged sword. There’s so many benefits to using them, I especially like the cash back and reward cards (unless they have a fee). On the other hand if you are undisciplined with them they can be a disaster. I was undisciplined with my cards for many years and I’m paying for it now, using money that should be invested to pay down the debt.

It is my experience that the financially undisciplined are the most likely to get a credit card and use it to the max. I wonder why that is?

I know sooooooooo many people that are both personally and financially irresponsible and put the blame for their mney problems squarely on the evil credit card companies. It really is sad listen to the whining and crying…

I love credit cards for the purpose of expense tracking. If you put everything on a card, it is accounted for. Cash it too often lost in the shuffle. Rewards are a huge bonus to credit cards, but I’ve met people who have a credit card for the rewards, yet pay far more in interest on their cards than they collect in the reward. It makes no sense.

Awesome piece. I have been both the irresponsible and the empowered. Credit cards weren’t the cause for either of these choices. I’m so glad to have come out of debt with lessons to avoid repeating the debt cycle (as well as with which to teach my kids.) It saddens to me to see people as much in bondage to the idea of credit cards as they are to the use of them. I’m happy to now be using them responsibly, to build my business, and to get awesome rewards!

The thing is that I prefer to pay cash for stuff and at the same time, it’s not that I’m not financially disciplined, it’s more of actually making the effort of paying the bill every month. So it’s more of a lazy thing as to why I don’t want one.

Folks who are born citizens do not seem to appreciate the value of money. Credit is still relatively cheap in America. Many folks have no idea how to control themselves in spending especially when it’s money that belongs to someone else like using credit card.

Many folks here get credit without thinking they have to return it especially the ones who can afford it with cash but use plastic and forget about returning it to its proper owner.

Many folks when they charge it to their plastic think it’s their money they are using whereas in fact they are renting it for a while.

Thanks for sharing your thoughts on this, Len. They’re much appreciated!

Regards,

Marilyn

The credit card Industry has 2to 3 secrets that they don`t want the consumer to know,(1) they don`t need you to pay your bill on time and they want you to be late.(2) They don`t want you to know your billing cycle so they can screw you by tacking on last`s month balance on to the new billing cycle. Once people figure this stuff out then they have a better chance at beating the CC industry. Again it requires discipline and paying your card off … AKA never carry a balance. The credit card industry calls people like us who never carry a balance “dead beats.” Call me what they wish. I still win against these financial knights of the round tables.

This was very helpful, Len. Thank you.

Hi Len, I’m so delighted I found your blog page. I really found you by accident, while I was browsing on Google for something else. Regardless I’m here now and would just like to say cheers!

My sister is becoming an adult and was mentioning to me that she was looking to get a credit card but didn’t want to get swamped in debt.