This past weekend a good friend of mine told me that, after faithfully keeping a strict budget for more than a decade, he finally stopped — and now he was feeling guilty about it.

This past weekend a good friend of mine told me that, after faithfully keeping a strict budget for more than a decade, he finally stopped — and now he was feeling guilty about it.

I know what he means. Although I’ve written before about the importance of following a budget, the truth is I ditched one of our household budgets quite awhile ago too.

Okay … I can hear you now: What do you mean one of your budgets?

Well, the truth is, for many years our household had two budgets:

- a short-term spending budget for basic living monthly expenses

- a longer-term savings budget for bigger-ticket items.

The former is what most people think of when they’re talking about budgets; a monthly spending plan for things like the rent, utilities, groceries, entertainment, and other monthly non-discretionary and discretionary expenses.

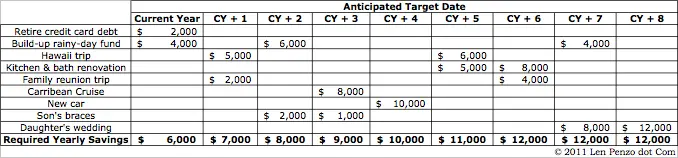

The latter, however, is not so much a budget per se — rather, it’s more like a financial road map, or a long-term spending plan. I look at it as a financial crystal ball that anticipates significant upcoming purchases like houses, cars, and family vacations. It also includes other things that folks typically need to set aside extra funds for including:

- paying off large credit card and other debts

- building up a rainy day fund and/or a retirement nest egg

- putting the kids through college

- home renovations

- the kids’ weddings

- elder care for parents

In other words, a long-term savings budget covers future expenditures that will require larger future outlays.

One of the very first topics I ever covered for this blog explained how to build your own strategic savings plan. Although I won’t rehash that for this piece, here is a very simple example of one from the article:

Now despite the fact that the Honeybee and I finally stopped following a rigid monthly household spending budget several years ago, we’ll always maintain, update, and follow our strategic financial road map. Why? Because the need for us to constantly plan and replan future expenditures is never ending.

By the way, in case you’re wondering, we no longer have a monthly short term spending budget because several years ago we finally reached the enviable position where our income became high enough that we now have plenty of wiggle room to handle modest budgetary overruns resulting from the occasional desire to splurge — or any other unexpected expenditures, whether they’re discretionary or not.

That’s not to say that the Honeybee and I have thrown fiscal responsibility out the window. After all, it’s not as if we have stopped tracking how we spend and save every penny we earn. In fact, we’re just as vigilant as we’ve ever been about maintaining financial discipline. It’s just that we’re now reaping the many rewards that we’ve sown during the past two decades by: 1) faithfully living well below our means; and 2) keeping our income steadily growing.

Having the financial freedom to finally get by without following a strict spending budget is certainly one perk I happily enjoy now — and unlike my good buddy, I don’t feel guilty about it either.

Neither should you.

Photo Credit: Wei Hsin Li

I think you nailed it – if you have specific shorter term goals with expiration dates like credit card debt or underfunded emergency funds, you need to budget. There is no way around it… if you haven’t been able to retire the debt or fund the savings account without budgeting, budgeting’s the next logical thing to try.

If your goals are more esoteric or further away (like retirement), you might be able to get away with the “no-budget budget”. Even though retirement expenses cover thousands of things, you are saving for all of them just by saying “20% of income, spend the rest”.

It all starts with “faithfully living well below our means”. Nice article!

Ive never had a budget (I can hear the gasps already), but I’ve always had longer term financial goals, and to me these have always seemed more of a focus than deciding how much to spend on a particular category in each month.

Thinking about what you’ve said, maybe I’ve always had an income that’s slightly higher than my needs, so I’ve always had wiggle room (that’s not because I earn a lot, it’s because I’m boring and careful with money!) and I’ve not had to worry about splurging on something one month. All I’ve needed to know is that if I do it repeatedly then I’ll never reach my financial goals.

As an aside, my Mother is a budgeting expert. Every penny that comes in and out of her life is catalogued and fitted into her 12 month plan. It fascinates me the way she knows exactly how much she will spend on something any given month. I can’t see her ever giving up her spreadsheets!

Doesn’t it feel good to not have to follow a budget but do it anyway? Due to our spending habits, my wife and I have lived this way for about 3 years. It truly is amazing! but it takes discipline. We like zero based budgets so the “extra” money isn’t so bad. we just spend a little more and invest a lot more to make up the difference

Yes, Dom — it does. 🙂

I don’t live on a budget per se, but I am aggressively saving 35% of my gross income for retirement, and whatever is left is what I live on. Whenever I see an unnecessary expense I cut it out, and there are some things I just will not spend money on because I feel they are too costly for the perceived benefit. Otherwise I have plenty of food, can afford my pets and bills, and if I feel like going out to dinner or some place with friends, well I do it. And I still have extra unused money accumulating in my checking account that I periodically apply to extra mortgage principal payments. It does however help to have an income that allows this freedom. When I was in college I lived more hand to mouth due to my paltry income at the time.

Len,

This article totally rocks! I loved it. Came across with plenty of ideas. Thanks as usual for your great work.

Thank you, Norma. I’m glad you found the article useful!

I’ve never had a problem with out of control spending so I’ve always been served well with the type of long term strategic savings plan that you use. In my case I decided how much I wanted to save for retirement and what I call capital spending projects. Examples of capital speding projects are: childrens’ education, car purchases, major home expenses like a future roof. After those savings came off the top of our income the balance was for everything else. This has been working for me for 40 years. Now I’m working on a plan for retirement income that will work the same way.

Perfect! Keep up the good work, dEBI!

Gosh..I long for the day that I would be in that position too. You’re an inspiration!

I consider the long term savings as essential as the short term. Actually, the two solely depend on the person how much money s/he set aside. I am now saving for a house, which is a part of the long term savings. I have a target that within three years I can get a house of our own. Also, the savings includes education plans, paying my car loan, and a lot more.

At times I feel exhausted to keep a budget, Sometimes I delay it for a while as well but I always catch up at some point. I make it an activity and restrict myself from stuff I enjoy doing to get it done.

I agree that long term saving is as important as short term savings. As a 20 something, I don’t always see my peers planning long term. I know I can’t do EVERYTHING right now, but I try to keep myself educated on different financial strategies and possibilities for my portfolio. I recently have been research annuities. To be honest, its been hard to cut through the vague promises and controversy. But I recently came upon a website (www.stantheannuityman.com) that has gotten me sooo motivated. I had to share. You should check it out. Stan is refreshingly blunt, while still being optimistic and clear. I plan to enlist his help in the near future.

We never had any kind of spending plan. It was obvious that we were content living on a fraction of our income and that additional spending didn’t make us any happier. In a case like that it is no problem cash flowing home renovations, cars, college, weddings, etc. Or it would not have been a problem if those had happened, but since I got free company cars, our kids eloped and all three got college for free we saved that much more for the future. We did track our spending for the last three years I worked just to confirm we were ready to retire slightly early, but that’s the only planning we did.

You are absolutely right. There should be both short term and long term. Short term help you understand how much and where you need to spend money and long term saving gives you a bigger goal or a number, to reach to. We need both to become financially sound and when you do your budget, you tend to spend less.

Len, you are so right about planning for future expenses. You won’t get a big surprise that raises your blood pressure.

I have pretty much kept a long term budget for decades. I plan in advance for vacations/hurricane evacuation expenses. I know exactly when the different insurance, auto, and medical expenses are due.

So far, I haven’t big time stumbled. I hope and pray that I never do.