That’s one of the most important pieces of advice I’ve ever received, if only because it applies to so many things in life — and it’s especially true with our personal finances.

The household CEO is not only responsible for putting together a short-term budget that handles monthly expenses, but also identifying the household’s longer-term needs, obligations, and desires. In fact, before any short-term budget worth its salt can be created, one needs to develop a roadmap for anticipated big-ticket purchases like houses, cars, and vacations that will require large outlays of cash in the future.

This roadmap is better known as a household strategic plan; it’s essentially a crystal ball that is used as the basis for the decisions that help the household CEO determine the household budget.

Here’s how to develop your strategic plan in three easy steps:

Look to the future. Identify your long-term desires, then estimate when you’ll need them and how much they’ll cost. Keep in mind that long-term desires do not only include big-ticket purchases like houses, automobiles, and vacations. They also include financial goals like paying off your credit cards and other debts as soon as possible, building rainy day and college funds, feathering your retirement nest egg, home renovations, weddings, and even elder care for your parents.

Poll other members of the household for their long term desires. This is very important for keeping peace in the family. Believe it or not, teenagers and even younger children have desires that can be integrated into your strategic plan. That doesn’t mean you have to shoehorn all of their wants and needs into the plan, but they certainly deserve consideration.

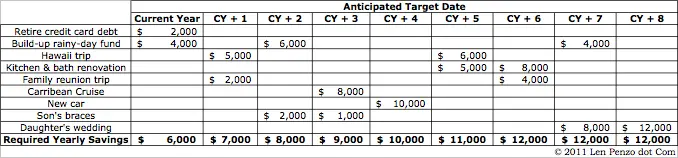

Build your strategic plan. Here is a very simple example of a household strategic plan for the Smith family:

I built this plan using an Excel spreadsheet, but you can also do it with pencil and paper.

You’ll want to build your plan in the form of a timeline that illustrates the need dates and estimated expenses required to meet the household’s long term desires. At the bottom of the plan, project your estimated required annual savings requirements to get a feel for whether the collective long-term goals of the household are realistic. If not, you may need to refine your plan by moving some of the need dates back a little to ensure your strategic plan is still viable.

In some cases, such as when you have plans for very expensive items, you will need to spread your savings plan out over multiple years. In the example I provided, both the bathroom renovation scheduled for CY+6 and the wedding scheduled in CY+8 requires the household to save over a period of two years.

One other thing to notice in my simple example plan is that the annual household savings rate increases relatively gradually to account for an anticipated increase in income over time.

In some cases, you may not be able to meet every household want and desire. If that’s the case, you may be forced to temper family expectations and make an unpopular decision or two — so don’t be afraid to say “no!”

Some Final Thoughts

When you’re done refining your timeline, you’ll have an initial household strategic plan! Keep in mind that your strategic plan should be constantly reviewed and updated as your household circumstances change. For example, on the positive side you may get a new job at a substantially higher salary resulting in higher anticipated long-term cash flow. On the negative side, perhaps your daughter decides that she wants to attend Harvard instead of a local state college after she graduates from high school; obviously, that would result in a significantly higher demand on your available future discretionary funds.

Once your household strategic plan is completed, you can then use it to help build your household budget — but that’s a topic for another day.

Photo Credit: kvanhorn

I do the same thing with excel!!!

Only I don’t just focus on finances — I track several different areas of my life, goals I want to achieve, etc.

I even assign point values (with the more important stuff getting higher points) to make sure I’m focusing on what I need to be focusing on.

I know, it’s a bit overbaord, but it works for me.

Thanks for sharing. I found this to be a very helpful and insightful article.