Most financially responsible people experience a bit of euphoria — along with a genuinely-satisfying sense of accomplishment — whenever they save money. However, when it comes to spending, those good feelings aren’t always a sure thing. So, can money buy happiness?

Most financially responsible people experience a bit of euphoria — along with a genuinely-satisfying sense of accomplishment — whenever they save money. However, when it comes to spending, those good feelings aren’t always a sure thing. So, can money buy happiness?

Having a higher income can give us more leisure time, access to homes in safer neighborhoods, better health care and nutrition, and fulfilling work. Money can also provide the peace of mind that allows people to avoid many of the day-to-day hassles that cause stress.

However, the positive effects of money – such as buying a new car or home – are often offset by the negative effects. For example: working longer hours, or remaining in a high-pressure or stressful job in order to maintain that higher income. Maybe that’s why a recent study found that about 20% of participants saw increasing happiness with rising income. But only up to a certain threshold. After that, no amount of additional money increased happiness. This group tends to experience negative feelings – such as heartbreak and bereavement – that earning more money simply can’t alleviate.

The Wall Street Journal reports that buying more things doesn’t always make us happy because we adapt to it:

‘Human beings are remarkably good at getting used to changes in their lives, especially positive changes,’ says Sonja Lyubomirsky, psychology professor at the University of California, Riverside. ‘If you have a rise in income, it gives you a boost, but then your aspirations rise too. Maybe you buy a bigger home in a new neighborhood, and so your neighbors are richer, and you start wanting even more. You’ve stepped on the hedonic treadmill. Trying to prevent that or slow it down is really a challenge.’

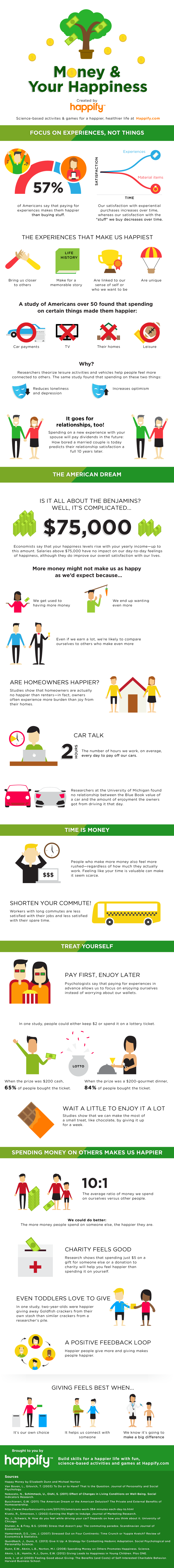

The good news is there are more than a few ways financially responsible people can maximize their shopping experiences. Happify, a website and app dedicated to helping people build skills for happiness through science-based activities and games, broke down the science-based strategies for getting the most joy out of what you spend.

It’s easy for financially responsible folks to condition themselves into feeling guilty whenever they spend their money. And that’s a shame. After all, the money we earn is ultimately meant to be spent. As with everything in life, it’s all about moderation.

All things being equal, can money buy happiness? Maybe so.

The trick, of course, is in finding a balance that avoids neglecting the material things and experiences we enjoy simply for the sake of saving.

Photo Credit: Daveness_98; Infographic: Happify

It’s true that giving to charity feels good. It gives us a sense of purpose and that is being of use to others selflessly.

Well said, Adam.

So true. My wife and I focus on living well below our means, and we do our best not to blow our money on material possessions. When it comes to experiences, however, we are much more liberal with our spending. Vacations are a perfect example – we usually don’t think twice on spending a few thousand dollars for an amazing experience. In 2014 we went to Turks & Caicos which was unforgettable. A peer of mine at work recently said “hey, Grace Bay Beach is ranked as one of the best beaches in the world” and I was able to say “yep. and I’ve been there!”. I can’t say the same thing about a new car or a new laptop. I love this concept, and I think if more people focused on spending their money on experiences instead of material items, we’d be in a better place. Spending can become an addiction, which can lead to “keeping up with the Joneses” – all the while, frugal people are enjoying sunny days on amazing beaches. Something to think about.

Great comments, Chris. I agree; I get mush more satisfaction from experiences. And unlike most material things, those experience are almost guaranteed to last a lifetime.

From France.

Yes. I agree.

Experiences belong to you all your lifetime and can’t be stolen, whereas you can lose your trendy laptop or having your beautiful car stolen.

Great article, Len, and I agree with everything except the part about making the most of a treat like chocolate by waiting a week for it. Pretty sure I’d DIE if I waited a week for chocolate! 😉

Agree with comments. We’re not rich but thanks to living below our means we don’t have too many worries. Last year we gave a substantial amount of money to the Ukraine Red Cross when cities first started to be bombed. Then, I built new kitchen cabinets for my neighbours and had them pay for my labour by making another in same donation and they had to decide the amount by conscience. Win win. As for buying stuff, forgetaboutit. I just had to clean out a Sea Can when our friend and tenant finally moved into assisted living. He called it his ‘Gold Room’, and cherished everything in it. It didn’t take long to figure out it was mostly junk. He could not help himself about buying stuff. And after I cleaned up the house full of his ‘stuff’, which was one hell of a lot of work, I sold the Sea Can. My Father In Law passed and had a house full of art and art supplies. We managed to give the art supplies away and some of his books and now 2.5 years later have no idea what to do about the hundred or so paintings. Someone might like the frames and matting……

My joke was going to leave a box of books in every unlocked pickup canopy I could find. We’ve now got his books in every ‘free library’ we could find. But the art books? My wife can’t part with them. Yet.

For any seniors out there think of your kids one last time and start to get rid of your stuff as your world starts to shrink. Especially your cherished books. No one wants books these days. No one. Or pianos. They smash family pianos up and send them to landfills; thousands every day across North America. I told my older brother we don’t want his boat, furniture, or tools, etc. I have started to disperse some of my own tools to local high school shop programs and they are glad about the donations.

Stuff. There is more storage units out there than rentals. Crazy.

Money is like manure. It doesn’t do any good unless you spread it around. Mr. Dave taught me that.

(actually, it’s a line from Hello Dolly). He played Dolly.

I enjoy giving, traveling, good books, and music. I am content with what I own. I just wish my back wasn’t hurt. I could go back to Scotland on vacation.

I completely agree with the experiences bit. As we’ve aged, we’ve also learned a bit more about what (repeated) experiences we really enjoy and which ones won’t matter. For example, part of our vacation this summer will be in Copenhagen. We’ve decided to spend less on a hotel so that we can spend more on some well regarded restaurants. We’ve only dined at that level of restaurant a handful of times, and have very fond memories of all of them. However, memories of hotels don’t matter. (Location matters though).

Charitable giving is great. I’m always anxious about it up in until I commit, but then it feels great.

One comment on owning/renting. I don’t really derive any more joy from owning my primary residence than when I rented. In fact, repairs are a huge source of stress. On the other hand, we derive huge joy from our second home because it’s made it much easier to engage in our principal recreational activities and provides a great excuse to spend extra time with friends.

One of the best thoughts I have heard about money and happiness was something like, “Money may not buy happiness, but I can’t think of many situations where having money will give you fewer options for comfort and happiness.” That stuck with me over the years and I share it when I can!