My name is Jonathan. I’m 27 and I’ve been married to my wife, Kate, for almost four years. We have three girls, ages 3, 1, and a newborn.

After graduating from college, Kate worked for two years at a job that paid $35,000 annually. Then, after our first child was born, she became a stay-at-home mom.

We try to live a simple life because we think God is calling us to have a big family and we want to have the joys of kids and grandkids. We’re breaking Len’s number one rule about not having children too early, but we’re prepared to make the necessary sacrifices.

Income and Expenses

For the past three years, I’ve had a full-time job working for a large bank doing entry-level tasks. My current salary is $32,430 annually, but I’ve been able to work overtime and Kate has tutored, which brings us to around $40,000 per year. I’m also a representative for Lighthouse Catholic Media which specializes in providing awesome inspirational talks.

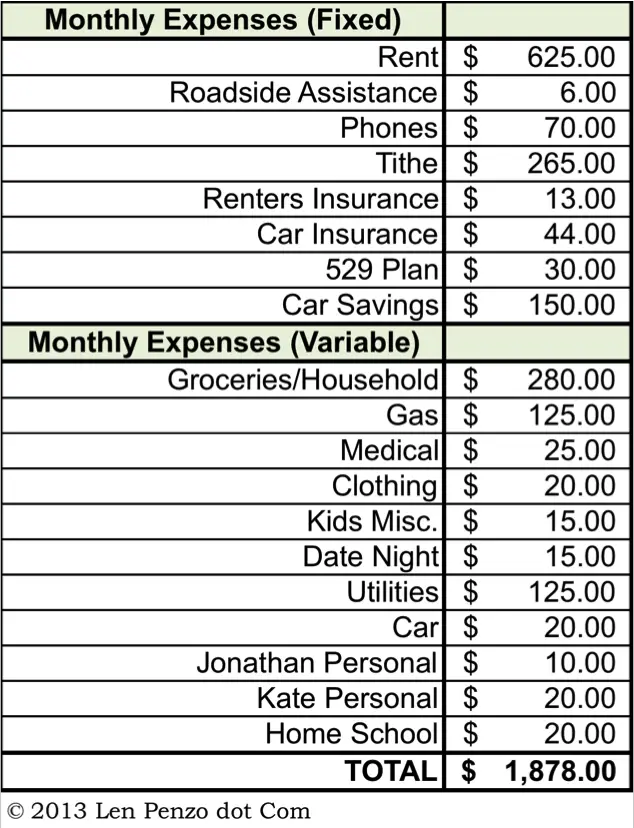

After employer deductions for taxes, health and life insurance, and our 401k retirement savings plan, there’s about $1900 available every month. We usually overshoot the budget, but it’s no big deal because we don’t budget my whole income.

After employer deductions for taxes, health and life insurance, and our 401k retirement savings plan, there’s about $1900 available every month. We usually overshoot the budget, but it’s no big deal because we don’t budget my whole income.

Non-discretionary expenses like rent, food, utilities, car insurance, and gas to get to work is roughly $1000 per month. The remaining $900 is reserved for everything else. More often than not, most of that buffer ends up going into our savings; we’re saving about 35% of our take home income every month, and giving away 10% of our gross income to charity.

So far, we have approximately $10,000 saved in retirement 401k plans. I currently deduct 5% from my paycheck to take full advantage of the company’s matching contribution. We also have $5000 in our emergency fund.

Last November, we finished paying off $40,000 in student loans.

Living the Simple Life

We basically just try to follow Dave Ramsey and live simply.

We’re renting a townhome for now but we’ve been saving up for a house down payment. We currently have $16,000 saved up.

We own two cars, a 2002 Honda Odyssey and a 2002 Ford Explorer. They’re both paid for.

We sold a lot of our stuff when we got married. We’ve also been given many gifts and are very grateful for the incredible generosity of our family and friends.

Closing Tips and Thoughts

If I could offer a few tips to share with you, I’d say these are some of the most important ones:

1) Study and learn as much as you can before making decisions.

2) Set short, medium and long term goals and stick to your plan when it gets hard.

3) Really dig in and understand the difference between needs and wants.

4) Shop as little as possible, and stay away from commercials and “wants.” Get rid of cable.

5) Sweat the big stuff — things like cars and housing.

6) Always have a side hustle! Sell the old stuff that you never use or find other ways to make extra money.

Finally, do your best to be generous, humble and thankful. Rather than trying to compare yourself to your neighbors, look at how you’re doing when compared to the whole world. Compare your life to the poorest of the poor, and remember your blessings.

***

If you’re a household CEO who is successfully making ends meet on roughly $40,000 per year or less, I’d love to hear from you. Contact me at Len@LenPenzo.com and be sure to put “$40,000” in the subject line. If I publish your story, you’ll get a $25 gift card!

Photo Credit: Jonathan

Very well done with such a large family. I hope no one criticises your decision to tithe. I do not belong to a church but I respect those who choose this way of life.

How long will you have to wait until you are able to buy your first home?

Great job controlling your expenses. At this point, you probably should concentrate on making more money. That will give you room to save and invest more.

Good luck!

Wow! The amount of money you are saving right now is amazing! I think Joe is on the money though. If you plan on having a bigger family, you are going to have to up your income. Believe me, as your kids get older their expenses are going to increase. Best wishes to you and Kate!

I notice you list $15 for “date night”. I think that is great, but $15 doesn’t go very far. Is that usually spent on a matinee or something like that?

Yeah, Jonathan. I’d like to know your secret for that too. The Honeybee and I spend that much on our date nights before we get to the appetizer. 😉

This is very inspirational, thank you for sharing. The security and freedom a simple lifestyle provides is priceless.

Hi Jonathan.

Thanks for the pointers!

Simple life doesn’t mean boring one.

I recently released myself from financial troubles also.

Saving all money possible while enjoying life on countryside.

I cannot ask for more.

Cutting to one car (I am using bicycle now) and saving on petrol/insurance was great way to straighten things up also.

Good luck!

I echo Sharon’s comments. Everything gets more expensive…grocery bills, car insurance, dental & medical bills, clothing, etc once you have teenagers. Just plan for it. Because it WILL happen. Your monthly expenses are closer to what I pay each WEEK for those categories…and I consider myself frugal. Wouldn’t trade my 2 kids for the world, but they are expensive. I am grateful everytime I fill up my car with gas and realize we have enough money to provide for our family’s needs. But there is no way we could do it on less than $40,000 at this stage in our lives. Maybe soon…once the kids are on their own.

I use to live for $35K years ago. Dark times those were..

Jonathan. I would love it if you could share some of your short, medium and long term goals. Or an example of each maybe? I say that because I could see your house being either a short, medium or long term goal. I think you are doing a great job managing your finances. I wish I could save as much as you.

THIS IS AWESOME! Great job!!! I am hoping that you (or any other readers) can offer advice about how to keep your grocery /household bill so low. We are a family of 2 and it’s way more than yours!!! Would love to hear some meal ideas/tips from Johnathan and Kate!!! God Bless!

This is a wonderful job of budgeting, and I applaud the choices you are making. Keep it up!

I am so stunned that you thithe so much of your pay. I really admire you for doing this. I am speechless, I make over 70 grand a year and I tithe once a year. I do give to my mom and dad every pay I do t know if that counts but bless your heart. You deserve the best for that

You could never live like this (low expenses), even in a rural area in New York State!

Jonathan, I believe your positive attitude is encouraging God (or the universe or whoever) to open up pathways of blessing for you and your lovely family. Not to get religious or anything — but I have seen for myself how a crappy attitude toward money seems to shut off wealth, like you were turning off a spigot. Bright blessings to you, and keep up the good work.

Hummm, something seems a bit off on the monthly expense breakdown. Says monthly total expenses adds up to $1203, but I show that amount just for the fixed expenses. The variable expenses adds another $675 per month, for a monthly total of $1878, which is almost the entire monthly take-home pay. Your narrative says you save 35% of your take-home pay each month. At $1900 per month, that would be a savings of $665 – which doesn’t seem possible with the expenses listed. Also, if you tithe 10% of your gross income ($40,000), that’s $333 per month, not $265. I agree these expenses already look very low, hopefully they can make this work down the road as the kids get older!

Good catch on my graphic, Mark. Looks like I have a wrong formula in the “TOTAL” cell that I need to fix. It should read $1878.

That is the cause of the confusion. My apologies.

As for the other numbers, the confusion lies in the fact that the 529 Plan, Car Savings and Tithe are included in the breakdown. Remove those ($445) and Jonathan’s true expenses are $1433.

Also, he is not counting his overtime and wife’s side hustle money as part of his “pay.” That is reasonable for budgeting purposes, as it is variable income.

All,

Thanks for the support and questions. I will do my best to answer.

@ Jane Savers – We hope to buy a modest house by Summer 2014.

@Cindy – We usually rent a movie from the Library, go to the park or get dessert out, not dinner except for very special times and always split the meal.

@ John B- Yeah we had one car for 3 years and it really helped.

@ Renee B – Thrift stores, yard sales and hand me downs.

@ 3-Pointer – Short Term – Make $50/month side income this year. Medium Term – Vacation Next Summer Long Term- 20% downpayment for a house.

@ Kristi – We shop at Costco and Aldi, eat meat once or twice a week only; eat eggs, toast w/pb or oatmeal for breakfast, eat the same dinner two or three times. I pack my lunch with leftovers for work. We use a pressure cook or crockpot and make big batches and freeze for later. Eat “Power Foods” that get us a lot of bang for our buck.

@ Mary Ann – Every situation is different, but i would expect to make more if the cost of living was much higher, but I think an equivalent percentage wise could be achieved.

@ Mark – Len’s comment pretty much covers it. Sorry for any confusion and I am sure the numbers aren’t 100% accurate. Like we don’t save 35% per month without some side income that is for sure, a little side help goes a long way. We will not be saving as much now that my wife has decided to stop tutoring.

We also tithe on side income, but do not budget that as it is side income.

“Thrift stores, hand me downs, yards sales”..we already do that. My daughter gets all my cousin’s nice hand me downs, so we only buy her personal clothing. My son gets a small budget to manage for his clothing, and anything over that he gets to pay for with money that he works for. I got to thinking what we lived on when our kids were your kids’ ages….it was about $30,000. So I know HOW to do it, I just know it’s not possible at this stage in my kids’ lives, cause I’ve tried when my husband lost his job about a year ago. How long does your wife plan to home school your kids? That will definitely help if it’s through their high school years.

“Live Simply that others may simply live” – Mother Teresa

Nice job, Jonathan. Seems like your simple life is making it work for you.

The one suggestion I would have for you is your 529 Plan. Budgeting $30/month, or $10 per child, is not enough. Unless you increase this, you will have $6480 at the end of 18 years for THREE children. Considering current in state tuition and cost of living at a 4 year university, you are looking at about $16K-$22K/year for one child. In 18 years, it is likely to double. Multiple this times four years and three children and you will see what I mean.

I won’t sit in judgment of tithing because everyone needs a purpose in life. However, of all your expenses, the tithe is really the only truly voluntary expense. If it were me, I would look at increasing the 529 to at least $200/month, somehow, whether it is through another job to keep the tithing at the same level, or to reduce the tithe to a more reasonable amount based on your income. While you may look at the tithe as an obligation (and I respect this), I believe you have as important, or maybe a more important, obligation to your children to help them provide for a college education so they don’t end up too in debt.

I doubt he plans to pay for his children’s college. Many parents in that income bracket do not. His children are also being home schooled. If I had to hazard a guess, there is not a private, religious school in their area and they prefer not to send their children to public schools. The children can get jobs at 15/16 (some jobs sooner) and work their own way through school with little or no debt. Everyone in my family did just that at all private colleges.

I would like to know what you do for a living to have only $25.00 per month listed for medical expenses.

I pay $132.00 – 26 times per year out of my paycheck, plus my medical deductable is $3,000.00 per year before they start paying 80% and my max out of pocket is 7 grand per year.

Dee Dee: His numbers seem reasonable to me. When you’re young — as Jonathan and his family is — medical expenses are typically extremely low, if not non-existent. (Note, I said “typically.” I realize stuff happens.)

Thank you for responding. Does this mean they just budget $25.00 per month for medical, but have no health insurance? I am just curious because I don’t know of anyone who gets free health insurance from their employer for an entire family any longer. I am certain there are exceptions to this, but in my area putting your family on your plan is not free or cheap.

Hopefully, Jonathan will tell us — but if I had to guess, I suspect the $25 per month is a budgeted amount and not the monthly price he pays for family health insurance. If it is, he’s got a great deal!

I work for a very large Fortune 30 company and my family health insurance rate is nowhere near that total — even before the rates started going through the roof after Obamacare was passed.

Low-income families are often eligible for Medicaid (at least the kids if not the whole family).

I think a home alarm system is getting a bum rap here.

I’m retired military, and I have no affiliation with any company. My wife and I live in an area that has multi-unit housing units all around, and it’s not the safest area in town based on the daily crime report I get by email.

Our home alarm system is cheap. It is connected by cellular to the central monitoring system, not a landline that can be cut or disconnected. It has never, not once in 12 years, gone off inadvertently, and it also covers smoke or fire incidents.

And the best part is, because of the alarm systems capability for all three; burglar, smoke, & fire, my insurance company pays for it because of the discount given for these features in protecting us and our home. It doesn’t really cost me a dime.

And we use it all the time…it’s so easy to turn on at night when we go to bed, and on during the day when we go out.

So, do we have the big company like ADT?…heck no. I was able to go with a smaller company here that subscribes to a central station at a substantial discount for all monitoring. No ADT signs in front of my townhouse, but then again, we don’t allow signs in our town home community. Which is all the better, since a thief/burglar has no idea which home has the alarm systems installed.

And My Wife Would Never Be Without It Now since I frequently travel without her.

Nice job! I don’t see anything about life insurance. With 3 little ones, you need some on both of you.

I’d like to know more about your security system. I pay way too much and my house is still being broke into.