The other day I was talking to an acquaintance who shall remain nameless. Anyway, he was lamenting that he couldn’t find enough discretionary income for an annual family vacation.

The other day I was talking to an acquaintance who shall remain nameless. Anyway, he was lamenting that he couldn’t find enough discretionary income for an annual family vacation.

I found that fascinating considering Eddie (oops!) drives a brand new BMW and lives with his family of four in a modest Southern California neighborhood.

Of course, life is all about choices.

Eddie may be upset that he can’t afford to take the wife and kids to Hawaii or Yellowstone, but that’s his opportunity cost of tootling around town in a brand new luxury car — so he gets no sympathy from me.

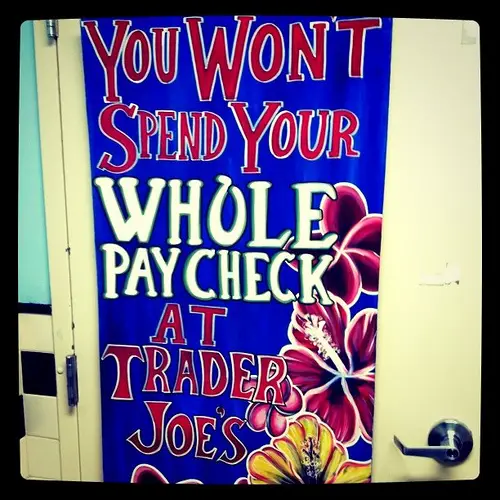

Needless to say, guys like you-know-who are always looking to stretch their income. Frankly, we all are to some degree. Here are four of the biggest ways:

Buy a used car

There are plenty of luxury car owners who struggle to pay their bills.

Experian found that the average monthly car payment last year was $576. Now, according to this handy paycheck calculator, a family of four living in California with an annual household income of $60,000 receives $4616 per month after withholding state and Federal taxes. So two car payments would consume 25% of the household’s monthly income, leaving roughly $3400 for the rent or mortgage, plus the groceries, utilities and other bills — not to mention discretionary spending, and retirement savings.

Good luck with that.

Nobody understood the financial benefits of used cars better than my dad, who brought home a very modest salary when I was growing up. He saw the folly of driving a new Mercedes to the grocery store each week only to be left with just enough cash in his wallet to buy store-label pork & beans for dinner — which is why he always did his due diligence and only bought affordable, well-maintained, used cars that he kept for many years.

Eat at home

Speaking of pork & beans … Dining out is expensive. My household spends an average of five times more money per meal when dining out compared to eating at home.

Eating breakfast at home, brown bagging your lunches whenever possible, and reducing restaurant trips can free up lots of spare income, folks. And if you want to stretch your food budget even more, don’t toss those leftovers! My family saves $1700 annually by eating them at least once per week.

Refinance your home loan

I’ve refinanced my home loan six times since 1997, dropping my monthly mortgage payment each time. The last time I refinanced I was interested in ensuring I had the lowest payments possible, so I not only refinanced to a lower interest rate, but I also extended the loan term from 15 to 30 years.

What are the results of all that refinance activity?

Well, my initial mortgage payment in 1997 was roughly $1450. Today it’s $480. That’s almost $1000 in additional monthly income.

Downsize to a smaller house

Let’s face it, a lot of people out there end up buying more house than they realistically need or can afford, putting undue strain on the pocketbook. For those times when refinancing isn’t a viable option, you can always consider downsizing to a smaller home.

True, that may seem a bit drastic. But if you’ve already cut your expenses to the bone and you still find it difficult to make ends meet, then drastic times call for drastic measures.

Besides, people downsize all the time. In fact, last night the Honeybee and I were watching an episode of House Hunters where this middle-aged couple was looking to trade their very large old house for a smaller “green” home.

“I like these two. They’re practical!” I said to the Honeybee.

“Really? In what way?” she asked.

“Well, now that their kids are off to college,” I said, “they’re selling their big old house so they can downsize into something more appropriate. It’s a win-win; they exchange their old over-sized home for a brand new smaller house — and they get to pocket the difference too!”

Soon after, I began choking on the cupcake I was eating when the narrator announced that the couple was in the market for a 3500 square-foot McMansion. With solar panels, of course.

“So much for being green,” the Honeybee snickered — although I wasn’t sure if she was laughing at me or the couple on the screen.

“Or practical,” I answered, before regaining my composure and mumbling, “I wonder if they know Eddie.”

“Who?”

“Never mind.”

And with that, I grabbed myself another cupcake.

Photo Credit: m anima

reading your blog from the Australian end of the world, it is also interesting to observe cultural difference with the use of money. To me the American obsession with eating out seems strange. We do out, but nit regularly an rarely with the whole family. And eating out for breakfast jsut doesn’t raise an interest. But where I live in Perth there seems to be an obsession with the quality and size of your house. I have one new car I bought so it would have up todate safety features for my teenage children to drive. But mum and dad, we recently purchased a 1991 Toyota Corolla with low kilometres, can’t believe how wel it runs and the lack of ratlles and creaks in the body.

Hi Chris. You Aussies are the best! It is my dream to visit your country one day — hopefully soon!

Yes, Americans love to eat out. I know a family that eats fast food or other restaurant meals for dinner roughly five times per week! What an incredible waste of money. I don’t think it is any coincidence that the entire family is, to say it nicely, definitely over their “fighting weight.”

Here in southern California, a lot of people buy into the automobile manufacturer’s marketing campaigns and believe they are what they drive. It’s an image thing. An illusory one, but an image thing just the same.

I’m not anti-luxury car, mind you; if you can afford one and that’s your thing, then I see nothing wrong with it at all. But when you have folks giving half their monthly take home pay to the bank just so they can be seen driving a flashy car, and then struggle to pay their other bills, well, I just don’t get that.

As for me, I could easily afford a luxury car but I choose to drive a more modest practical car and pocket the money for other perks. But that’s just me. 🙂

Thanks for reading and I hope you visit again!

All the best!

Hi Len,

I really enjoy reading your blog. This is some really practical advice. Unfortunately many people are sucked into the keeping up with the Jones’ mentality and end up paying the price for it. I used to buy a daily Starbucks since that’s the thing everyone did at my small yuppie office. But you learn n hopefully not make the same mistakes again!

Hi, Sabz. You know, we started a coffee club at work — for the cost of one fancy Starbucks coffee, I end up getting all the coffee I can drink for an entire month!

I enjoyed reading this. I always wondered how much it costs to own a large home versus one like mine, a 1000 sq ft condo in respect not only to monthly mortgage but insurance, utilities, and the like. Would love to see some comparison charts. I love living in a smaller place than my friends because it is less work to keep up, and there is a built in deterrent to buying too many things to clutter with.

1 and 2 I use all the time. 4 is what I think about often but don’t think I can do that.

I’m 100% the “Buy a Used Car”. If you get a car thats a year or two old your going to save a lot. For the most part, it will look and feel just like a new car and you’ll not have to suffer huge drop in value as soon as you drive it off the lot. I’ve considered refinancing my home several times in the last year but keep holding off. I can’t stand the thought of raising the amount I owe by 2-3 thousand dollars in closing costs. I’m probably being blinded somewhat by that and should re-analyze what I could potentially save.

In my case, Jose, the closing costs are small potatoes that will never be missed in the grand scheme of things — but that is a topic for another thread. 🙂

And then there’s the old standby: bring your lunch to work, don’t buy it. Amazing what a stretcher that can turn out to be…

I’ll say, William. I went to lunch today with a couple friends and dropped $7.50. That’s $7 more than the cost of a homemade PB&J!

I’ve been always curious Len! Please forgive me if this is too personal. What kind of PB do you buy? I’ve always wanted to know! Totally agree of course! Homemade PB is really good and easy too. But I can’t get the kids to eat it, and I end up using it for muffins or baked goods.

We’re a Skippy family, Dr. P.

More info coming for you on December 6th! Stop by for details!

I saw that episode of House Hunters. I only remember because I was truly appalled by the whole thing. Who “down-sizes” to 3500sf?? Yeesh.

I know, Lola. Weren’t they something? “Yeesh” is putting it nicely.

As a whole, Americans are obsessed with big houses. On average, Americans and Aussies have the largest houses (2200 sq ft+) and folks in the UK have the smallest (1000 sq ft or less). (see http://www.demographia.com/db-hsize.pdf) Not only does a large house have a larger monthly payment, but it costs more to heat and cool. I am a big proponent of downsizing. I am absolutely fascinated with this “tiny house” movement that’s been gaining populairy in recent years. (see http://www.tumbleweedhouses.com) They’re like the modern-day version of a vardo. Granted a family of four couldn’t consider living in such a small space, but I think my husband and I could be quite happy in 300 sq feet (or less if the space was used very efficiently).

We also rarely eat out. It is much too expensive, but an easy out if both halves of the couple have full-time jobs. I think eating out or getting take-away two or three times a week becomes the norm when both people work full time.

I’ve had one new car in my life. I got it at a year-end clearance sale to get the old models off the lot to make way for the next year’s models. It was a new car, but I think of it more as a left-over.

I wanted to read this article and discover a great way to stretch my income, Len; but it looks like I have it covered, at least on these points. 🙂

Sorry I couldn’t have been more help, Allyn. 🙂

As for the small houses, I’m with you. It’s an interesting phenomenon — and the homes really know how to maximize their space — but I don’t think they are very practical unless you live alone. A couple may be able to pull it off, but I suspect they would be at each others’ throats after awhile!

I’ve actually been planning to write a post on the topic of those small houses for awhile now, but I keep pushing it back.

A lot of couples probably couldn’t handle the small space, but my husband and I would be fine. We lived for a couple of years on a houseboat. It was pretty cramped quarters but we have very compatible personalities, so we managed without any problems. The ‘big’ tiny houses are pushing 300 square feet, which I think would be good for us.

I’m also fascinated with the idea of converting cargo containers into living spaces. (see http://www.littlediggs.com/littlediggs/convertible_spaces/)

My parents both grew up poor in Newfoundland. They had large families (9+ kids) living in 3 bedroom houses under 1500 sq. ft.

Amazingly(insert sarcasm), they all survived and grew into fully functional adults. My mothers only complaint was that she shared that bed with 3 sisters, one of whom pee’d the bed until she was 14. It was a mattress stuffed with straw so the smell was horrendous.

I in turn grew up in Canadian military housing with 1(gasp)bathroom. When we built our house, we only built one bathroom. 15 years later we still have only one washroom . Another one would be nice, but absolutely NOT a need.

Just found your blog and am interested to read back through.

I also know many luxury car owners who claim not to be able to afford some of the basic things in life.

When I explain about cars being depreciating assets and priorities for spending your money I am normally met with blank looks.

All the four options as advice are well taken.

However, there are other venues as well that can save you big.

Contribute more in your 401(k). Many companies match a certain percentage as well. That’s absolutely free money that many folks miss. It’s like getting a bonus every year.

If not 401(k), contribute to your IRA the maximum amount the law allows you.

These tax-free savings will go a long way till / and in your retirement.

Go to IRS website and read about it.

To grow money, one of the best ways is to invest it. Dollar-cost averaging is a proven and successful method.

Revisit and adjust your portfolio at least once a year.

If you don’t have the time and can’t do it yourself, find a good – I mean a good – financial adviser to guide you through the maze of investing.

We are really working on eating at home as much as we can! 🙂

Michelle-

Eating gluten-free is definitely a challenge. I’ve found it much cheaper purchasing a nice grain mill and milling my own GF grains. We steer clear of packaged and processed foods as they typically have other nasties added when the gluten isn’t there.

Hm, gonna need some other ideas here Len. 😀

1,300 sq ft on the house with no plans to move in the next decade or two. We had the good fortune to refi into a 15 year loan at 3.5%. The payment was actually lower than our 30 year loan. No heating costs in the winter as we installed a wood stove & we get wood for free (except for the cutting/splitting/stacking part).

We eat out once every week or two – we’re limited because our son is on a gluten free diet for autism. Breakfast is a good meal out for us because it tends to be cheaper and bacon & eggs are gluten free and delicious.

Only bill I see that is way out of whack for us is our grocery bill – about $150/week for four. But with the gluten free for my son, and having to work around a low fat diet for my husband’s Crohn’s disease, that’s the best I can do.

“Breakfast is a good meal out for us because it tends to be cheaper and bacon & eggs are gluten free and delicious.”

Grrrreeat tip, Becky!

That’s ridiculous. I guess they must be rich to downsize to a 3,500 sq ft home. Driving an economy car instead of luxury car will free up a bunch of money in the long run. Luxury cars are expensive to maintain.

I agree with this Joe, in my opinion, a second hand car is just as good. I have drove a 2004 car for the past 3 years, and it does me the best, plus saves me 20k odd.

I pin (Pinterest)articles I am interested in, as do a LOT of people. If you have a graphic attached to your articles, it would make them easier to pin. I have to pin an ad graphic now, and that doesn’t reflect your great articles. Just my 2 cents.

There’s loads of ways to cut costs. The average car has 4.5 owners in the UK. Cars are lasting longer now so getting a good used car is a way of saving. However there is a downside here. Gas guzzlers new and old are taxed heavily per year, in addition to tax on petrol in Europe, the like of which would make Americans scream! So older cars can be very expensive to run. We have just sold our very low mileage Mercedes A-class that we bought new and yes, lost some money. But we are replacing it with a car which will do twice the mileage and will cost nothing per year to tax. So you have to do the sums.

I agree with all comments abover as Americans we’re obsessed with everything big, big food big houses, big cars….I don’t understand the eating out. My wife makes so much better food for half the cost of a meal in any resturant. I’d rather save that money for a nice family vacation, memories are priceless. Loved your post.

Jon, I think a lot of people “want it all”, so they spend their money as if they can have it all. The problem of course is that we can’t have it all, so but most people spend all of their money before making the conscience decision on what they want to spend their money on based on what they value the most.

Nice job, Jon, that you are aware of this and make that conscious decision; instead of having the decision be made for you (by running out of money!)

I think it all comes down to how strong we are inside to resist the constant marketing we are exposed to because this is how our desires increases.

We used to eat out a lot, and our excuse was that we still had to eat, and we’d only be saving a couple of dollars eating at home. Now that we’ve buckled down and started eating at home almost exclusively, we’ve been saving a LOT of money. It’s kind of exhilarating. We have been eating very well, and have a lot of extra money at the end of the month.

Nice post! Unfortunately, many people have a bad relationship with money in the respect that they live by the ideal that “they work hard for their money, so they are going to enjoy it.” But we all have limited money (to one degree or another) and with limited money comes having to make choices.

However, most people don’t make those choices until they are forced to, because they have nothing left. Eddie may place a really high value on family vacations, but by the time he gets to thinking about it, the money is already gone.

Decide what you value the most and work yourself down from there with how you allocate your money.

We cut down on eating out, reorganized insurance policies,

remortgaged, BUT THE BIGGEST THING we did was to find other sources of income, there was a time I was delivering newspapers and we still have a small lawn care service, BUT we learned to get things in order and you can too.

One can “stretch” one’s income by making some of what you want yourself and buying a reduced remainder.

working up some firewood for household heating was mentioned by Beckybeq, above. Meal preparation from “raw materials” at home was mentioned by several folks. And, one doesn’t have to buy all the raw materials, even.

Like BLT’s? You can have them cheaper (and tasting better!)

Grow the L and Ts and buy only the B.

But the more general strategy would be to avoid needing money at all, to some extent. Preppers do it, but not comfortably, IMO.

Len has featured some of the strategies, Here:

https://lenpenzo.com/blog/40000-2

We buy new cars/trucks, because even though I do my own work on them, I don’t want a vehicle with somebody’s problem, or unknown history of maintenance. That said, we get a LONG time out of our vehicles, and pay cash for them when buying.

Wife’s last car, 1998 Honda Accord. Got 13 years out of it, buying a 2011 Subaru Outback, (now 6yrs) and plan to keep it another 10 years.

My current pickup is a 2003 Chevy, (now 14yrs) bought new, which replaced 1986 Ford, also bought new. I don’t know when, if ever, I’ll buy another.

Several things you can do to extend car life….regular maintenance, and keep in a garage when home….that last one adds many years to the paint, interior life and so on. I have the same policy with my farm equipment….most all of it lives in a barn/shed when not in use.

We rarely eat out….not because we can’t afford to, but because:

1. The quality of the food is well below that we raise.

2. The service is generally lousy. I like to go get another glass of iced tea when I want it, not when I can manage to snag the eye of my ‘server’.

3. The noise level is often that of a grade school cafeteria….who needs that ?

4. It’s ridiculous to spend $20-30 apiece for the above, when we can enjoy a home grown steak in the quiet of our own place, for a fraction of that price.

Other ways we’ve set ourselves up for the level of retirement income we have:

1. We built our farm to be fairly self sufficient. Spring water (better quality that town water) is free.

Septic means no sewer bill.

Raise most of our own food (beef cows, pork, chicken, veggies). We can, root cellar and freeze extensively (6 freezers !) Home butcher our beef, pork, and meat chickens.

Chickens pay for themselves from egg sales, which also put us in agriculture classification for lower property tax (which was pretty reasonable to begin with)

Power company pays us about $1,000 yr for excess power we feed back to the grid (solar), in addition to no bill.

Heat is wood and really I enjoy cutting/splitting. Have 16 cords cut, split, in dry now, which is next 3 winters easy. (Can you believe people actually PAY to go to a gym ?) Super efficient mini-split heat pumps (2) are backup heat, and provide the occasional cooling we need in mountains of East Tennessee. Whole house fan does most of the work bringing in cool night air.

Internet pays us $100/mo to use the tower I built at the top of our mountain + provides us with a 40mb, no data limit service at no charge.

Home phone and flip phone cell run us $42/mo combined (Verizon on both), and DISH runs $56/mo

As a result of our lifestyle, we easily set aside 25-30% of our retirement income per month.

Great tips, Andy! Thanks for sharing these!

Really interesting, your lifestyle, andy. It’s of particular interest that’s it’s fashioned in the Appalachian mountains, as is mine:

https://lenpenzo.com/blog/id22017-how-i-live-on-less-than-40000-annually-ralph-from-west-virginia.html

Let’s hope our location doesn’t become fashionable enough to attract too many more of the folks escaping where they were, only to try and install some of the worst collective practices of their erstwhile origins.

Hi Len,

I can relate to your friend Eddie to an extent. I’m not proud of purchasing a luxury car this past year, although used.

On the flip side this has made me more conscious with my budget, and has led me on a never ending spiral to learn more about growing/maintaining my wealth.

I agree that we could find ourselves in tough situations because of bad financial decisions. In the end we need to prioritize our needs/wants so that we can leverage our money to help us achieve our goals.

Such good practical advice Len. Thanks for sharing this.