Everybody needs an emergency fund. However, believe it or not, a USA Today survey found that 70% of Americans have less than $1000 in savings. And while I can at least partially understand why those living on very tight budgets may have trouble accumulating a large amount of savings, I fail to see how anyone making more than six figures annually can fail to set aside an emergency financial cushion for the future. In fact, 73% of people who admitted not having even $1000 in savings earned more than $100,000 annually.

Everybody needs an emergency fund. However, believe it or not, a USA Today survey found that 70% of Americans have less than $1000 in savings. And while I can at least partially understand why those living on very tight budgets may have trouble accumulating a large amount of savings, I fail to see how anyone making more than six figures annually can fail to set aside an emergency financial cushion for the future. In fact, 73% of people who admitted not having even $1000 in savings earned more than $100,000 annually.

Unbelievable, isn’t it?

Why You Need an Emergency Fund

The Honeybee and I are on the other side of the spectrum, as we actually keep three everyday household savings accounts — not including my retirement savings — that we rely on to manage our day-to-day finances: a “mad money” account, a “rainy day” fund, and an “emergency savings” account.

What’s the difference between our rainy day fund and the emergency savings account? Well … we keep the rainy day fund for short-term, relatively low-impact financial storms of less than $2000. Our emergency savings account is for longer-term crises such as a job loss, medical issues and other unanticipated events capable of putting a huge dent in your finances — as such, it’s much bigger than our rainy day fund.

At the beginning of October our emergency fund had a little more than $16,000 in it. Then, a week later we were hit with one of those rare events that made us glad we had the fortitude and discipline to gradually sock away enough cash over time to maintain a robust emergency fund: our 20 year-old air conditioning unit died.

Biting the Bullet

Of course, rather than wait for the furnace to kick the bucket too, I decided to do the right thing, bite the bullet, and replace the entire HVAC system.

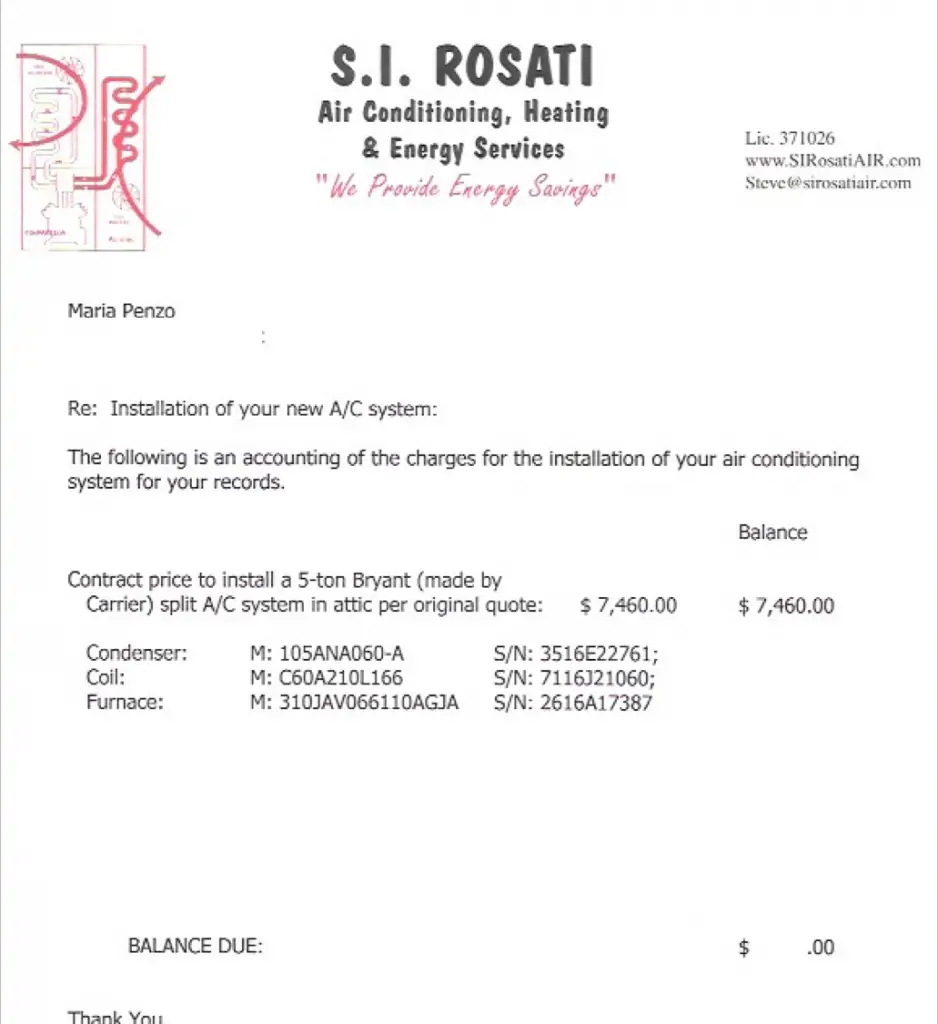

Needless to say, HVAC replacements aren’t cheap — which is why yours truly almost died when he saw the bill. How much was it? Well … take a look for yourself:

That’s not a typo, folks. It’s $7460.

I’m just thankful we had the cash in our emergency fund to cover that little unexpected expense – without the need for a credit card or emergency loan. Especially so close to the holidays.

It’s also a great example of why keeping an adequate savings cushion on hand can provide your household with a rock solid financial hedge against the unexpected. And, in the process, help you stay in better control of your life too.

***

(This article was originally published on 29 November 2016.)

Photo Credit: StockMonkeys.com

Yikes! Now that’s a nasty maintenance bill! One more thing to think about when deciding whether to buy or rent.

Yeah, Susan … we knew we were living on borrowed time with our AC unit — so it wasn’t a total surprise. Frankly, it lasted several years longer than it was supposed to.

With all due respect, Len, cuz I really do love you, bushwah!

Yes, absolutely, each of us needs to be prepared for a financial emergency. But we don’t have to have separate bank accounts to be prepared. If I were hit with this bill, I’d put it on a credit card (yea, points!) then take money from my brokerage account in time to pay the credit card bill in full. My point is that the money doesn’t have to be instantaneously available.

Also, a good topic for a post would be the nature of financial ’emergencies’. A twice-yearly insurance payment is not an emergency. Nor is a repair bill on an older car, a tax bill, or a bill for a routine medical visit. These are all predictable — if, we hope, infrequent — expenses that we can plan for.

I hear ya, Dorothy! And I appreciate your comment.

Truth be told, I did put it on the credit card for the points — of course, for those who can pay the bill in full at the end of the month, putting a charge like that on a credit card to collect the rewards is a no-brainer. Not so much, though, if you don’t.

The point I am trying to make is that, when it comes to large unforeseen expenditures, it is important to have the cash saved up and ready to deploy before you need it — whether the savings is in a “high interest” (LOL) savings account or a brokerage account is a secondary detail!

Let’s everybody send an email to Steve at S. I. Rosati and ask him to give Len a discount in exchange for this publicity!

Oooh … I like the way you think, Amanda!

Your post comes at a perfect time – relative to our situation. Our current HVAC system is 18 years old this January and has needed repairs 2 out of the 3 last years. We bit the bullet the Tuesday before Thanksgiving and had it replaced.

We ended up at $5.5K (closer to 5K after IRS $300 credit and local utility $250 credit). It was nice to just put it on the credit card (for cash back), and then we will pay it off next month and not think about it going out when the weather is 115 degrees out!

I hear ya, Eric. I never regret big expenses like the HVAC because they’re worth every penny.

Thank you for sharing such an interesting blog with us.

Dear Friends, I’m cheering for Dorothy, Len and anyone else who suggested paying by credit card in order to get points, or in my case, United airlines miles. I’d do the same AFTER calling Mr. Rosati and asking him if he would give a discount if I paid by check instead of credit card. Many businesses will give a discount for getting paid cash / check instead of credit card if you ASK because they lose a percentage of your credit card payment to the credit company. If there is no discount for cash / credit card, then I’m going to whip out the plastic, pay off the credit card within a week, and pocket those miles!

I really like the idea of a short term emergency fund and a medium term emergency fund. You can also increase your risk a little in the medium term fund if necessary (like a bond fund instead of money market) just for the growth.

Yep. In one year, I paid medical bills for a brother flattened in a car accident November , insured but needed help before claim settlement . In May, A lightning strike took out a stand of trees, the berm of dirt and roots had to be regarded out (of course this was a 15 feet from the house). Not covered by insurance. The guy doing the grading enthusiastically removed too much roots near a retaining wall, so that had to be repaired. June. We brought back bedbugs from a hotel (daughters wedding all cash) and treating the whole house correctly ran up about $2k in expenses. July. Freaked out we replaced carpet with hard flooring. August. Water began pouring in the corner of the house, literally the week we put the furniture back in place, Sept. insurance company decreed that the issue was improper flashing, it wasn’t, and refused to pay the claim. It was caused by a gutter spike used to secure a downspout that was pounded through the brick and sheathing. The exterior wall was full of mold , so it was removed completely along with internal structure and an adjacent door to rid the unseen rot. Gutters and custom scuppers in that section too (whole thing was 3 years old). All covered by yours truly. We’re flat broke, savings wise, but not indebted.

Wow … that’s quite a run of bad luck, Mary. On the bright side, I suspect things can only get better from here.

Len,

Great article! Can you tell me…what is your “mad money” account?

Thanks, Steven.

It’s the fund we use for planned — and unplanned — discretionary expenses. Think stuff like: vacations, a new barbecue, or last-minute tickets to “the big game” (like the time I spent $2462.35 on two tickets to see Game 4 of the Stanley Cup Finals when my LA Kings were playing).

Len, there are ways to avoid dependence on “things” which can surprise you with a demand for large emergency expenditures.

Situation is important – in our case, we live on a breezy ridge in Appalachia and don’t need air conditioning and we heat with firewood.

The “things” required are simple, inexpensive and free from dependence on public utilities or servicing enterprises: woodstove in the winter and open windows in the summer.

Nonetheless, a spartan lifestyle isn’t necessary.

https://lenpenzo.com/blog/id22017-how-i-live-on-less-than-40000-annually-ralph-from-west-virginia.html

Good job, Len….on the prep finances and acting on the HVAC before it was a dire emergency. The bill was very reasonable, or should I say it costs what it costs. I’ve been in and out of the building trades for 50 years as have my brother and son. All materials and services are expensive, plus we are still at the top of the pandemic price spikes that have yet to subside. As for renters not paying for repairs, as a landlord I can only say it is always built into the amount charged; taxes, contingencies, etc etc. It’s just math and the market.

Once prep finances are in place, then the top ups requires no more than regular living expenses. It is just a way of organising the inevitable.

Having said that, Like RD…the man who pointed me to your blog some years ago….I also live on a breezy river just 5 clicks from the sea. In Farenheit (which doesn’t make sense to me) it should be in the 90s here today which seldom happens, but it will for sure. By late afternoon the wind will crank up to 30 kts and it will then cool down.

Good luck with the heat wave. We live 1500 miles west of you…up the coast as we say, and just on the fringe of the real heat. No fires here this year although the woods are now on early shift and should shut down in a week or so. Last year we had a two quad driving tourists lighting arson fires in the bush, 7 of them to be exact. We were on evacuation alert with the tankers dropping just 3 km away for three straight days. Rotary was dipping into the river just around the corner from us. Can’t really prep for arson.