One of my favorite fables attributed to Aesop is The Ant and the Grasshopper. You know the story; the grasshopper spends all summer long partying it up like a rock star while the ant prepares for the coming winter by building a shelter and storing food.

One of my favorite fables attributed to Aesop is The Ant and the Grasshopper. You know the story; the grasshopper spends all summer long partying it up like a rock star while the ant prepares for the coming winter by building a shelter and storing food.

Of course, winter eventually arrives and the industrious ant finds himself well-fed and toasty-warm while the improvident grasshopper simply ends up as, well, toast.

The fable offers a terrific lesson for kids and adults on the importance of saving and hard work.

Why I’m Constantly Saving for Winter

Now, as an engineer, I occasionally have to endure business cycles where my employer has to layoff employees. It’s the nature of the industry and one that I have always taken very seriously, especially since I am the sole breadwinner for my family. Never mind that the threat of layoffs are even greater now that we’re in the midst of a very significant economic slowdown.

If I were laid off tomorrow, I would be entitled to five months of severance pay, after which I’d be eligible for unemployment benefits of roughly $2000 per month before taxes — which poses a tremendous problem because our household expenses are currently, on average, more than $9000 per month.

Don’t Panic — This Is Only a Drill

With that in mind, several years ago I decided to undergo a little layoff drill to try and ascertain exactly how much we’d have to cut back to make ends meet on unemployment benefits alone.

Luckily, the Honeybee and I have been using a spreadsheet to meticulously track our monthly expenses for 20 years, so we’ve also had an excellent handle on exactly where all our income is going.

Anyway, I asked her to propose what cuts she would make to our household budget in the event that I was laid off. Meanwhile, I independently made my proposed cuts.

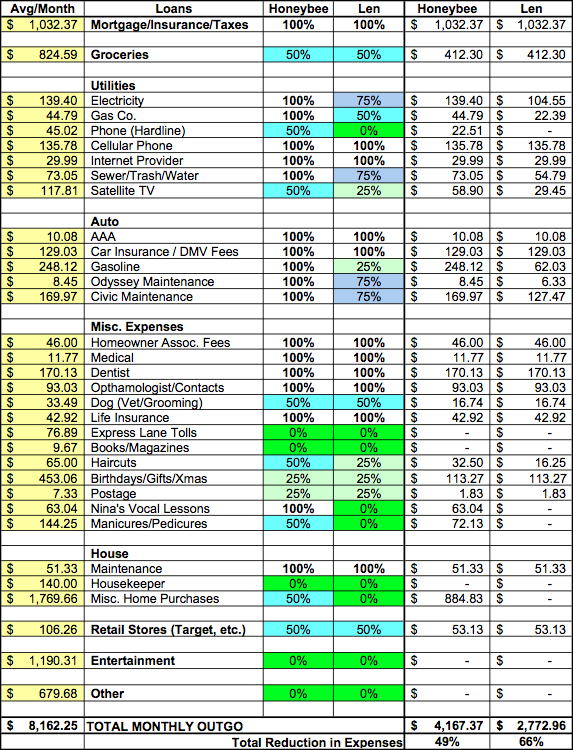

The results are shown in the spreadsheet below. Now some of our expenses have changed since we originally did this — at the time, our average monthly expenses were $8100, which is slightly less than they are today in 2020 — but that doesn’t change the message.

As you can see, we disagree somewhat on the scope and magnitude of the cost cutting; she knocked down our budget by almost half, while I was a bit more draconian, slicing our spending plan by two-thirds.

Although we disagreed with our first pass on the size of the cuts, neither of us were able or willing to pare the budget to a degree that would allow us to live on unemployment benefits alone.

Back to the Ant and the Grasshopper

On the surface, it might seem like our family will be in a very tough predicament if I end up losing my job.

Fortunately, I’ve never forgotten about the ant and the grasshopper. As such, even though I am very well-paid, I’ve always tried to live well below my means and save up for that dreaded day when I may finally lose my job — as such, we try to always keep a cash cushion of at least $25,000 on hand.

For the sake of argument, let’s assume we agree to split the difference on our proposed budget cuts so that our monthly expenses top out at, say, $3500 per month. Add another $1250 per month to extend my health benefits through COBRA, and that brings our total monthly expenses to $4750. So in order to pay all the bills we would need to draw down our savings by $2750 per month, assuming unemployment benefits of $2000 per month. At that burn rate, we’d have at least a six-month cushion beyond the five months of severance pay I’d receive. That’s comforting to know.

The Moral of the Story

Don’t be a grasshopper and fool yourself into believing unemployment benefits will be sufficient to sustain you if you lose your job; for most households they won’t.

I can’t imagine the upheaval that our family would face if I was laid off and we didn’t have a healthy amount of cash saved up to get us through a financial “winter.”

Having a large savings cushion gives us the ability to postpone — if not outright avoid — the extremely tough decisions we’d have to make when living on unemployment benefits alone. And going through a layoff drill like this not only helps hone a plan of attack prior to facing a severe financial challenge like a layoff — it also shows how well you’re prepared should such a disaster strike right now.

Photo Credit: mickeymox

As usual, thought provoking. In our situation my sweetie is also the sole bread winner, but our housing is part of the package. So if he lost his job we’d be scrambling for living quarters. Not a pleasant thought. Which would involve moving expenses and all those nice little upfront deposits on utilities, rent, and such, too.

Yes, we would be in a lot of %#!_+ if DH were to lose his job. He’s a public employee and has already had all overtime cut (due to county budget woes) which amounts to anywhere from $750 to $900/mo. before taxes. Also would be hard-pressed to find the funds for private health insurance.

I took a part-time job to help bridge the gap but it pays so little and the commute is 30 min. ea. way that it seems to not make much difference overall.

I recently drove my satellite bill down from $110 to $17 by cutting it and making a one-time purchase of a Roku device & a antenna converter box. Roku streams internet to my TV in HD, With a $7.99/mo fee to Hulu Plus � and $8.99/mo to Netflix, I can see virtually (no pun intended) everything and am saving $93 a month. Don�t get me wrong, I loved satellite with DVR� but not $1320 a year kind of love. Simple changes add up to amazing savings.

Looks like Honeybee cut out your haircuts when you become unemployed… 🙂

I was actually just thinking about this very thing the other day. My husband was sole provider for years, but I work part time now as a computer programmer (entirely from home, no commute for me!).

Even with my part time employment and unemployment, we would be in trouble.

Cobra is ridiculously expensive. When my husband changed jobs willingly a couple years ago, Cobra was going to cost 1200/month. Since his employer didn’t provide benefits for the first 2 months, I just bought a short term catastrophic policy through Assurant for 386 bucks (total for both months) and hoped for the best. It all worked out fine, but I feel bad for those with chronic conditions that can’t make such choices.

Great post.

I was laid off twice in the last couple of years – as the sole breadwinner (single parent). The first was 12/2008 and the second was 1/2010 – a mere 13 months apart.

I live a month ahead on my bills (what I get paid in January goes to ALL of February bills, for example). That gave me time to react.

I also have my monthly budget divided – the first part comprises absolute necessities. The second part is optional stuff like investing, etc. When I got laid off, the second part went to zero on the budget. I was also able to cut things like commuting costs, as I wasn’t driving very much any more. I used about a tank of gas a month in my Corolla after both layoffs.

My state gives about $1200 per month in unemployment benefits, which I applied for and received. This is the maximum in my state and I received the maximum.

I had several “hold” accounts from my optional category of my budget, which served as an additional cushion before I had to start using my emergency funds.

At the time of both my layoffs, I had 6 months of necessities in my budget in savings – about $28K. I was and still am, debt free, except the house.

I was not able to afford COBRA – and went without health insurance during both layoffs. I didn’t die from it. I went to the doctor once – but negotiated the cost of the visit, to be paid in cash, upfront, prior to the visit. It worked well.

I was ruthless with my expenses. My current income is about $106K per year. When I am in “emergency mode”, my monthly expenses are $3900 per month….of which $2207 per month is just my STUPID house payment!

I advise everyone to go through the exercise Len suggests. I prepared, just in case. I was born a Grasshopper. When it came time to exercise what I had planned it was painful, but it was manageable.

In my case, I didn’t have to use one cent of my emergency funds, in both layoffs, but it sure was scary.

I meant ANT!!

I am the sole breadwinner and I was unemployed for six months during the dotcom crash. Having money put away and low bills is a blessing. There is nothing worse than stressing over money and it’s so easy to avoid.

$750 for COBRA…consider yourself lucky Len! My wife stopped working to take care of our baby and our COBRA bill is staggering (maybe because she had a really good plan). In fact, I think finding independent insurance for her and the baby would actually be cheaper, so I probably need to shop around.

Ok, ok, stop nagging, I’ll start shopping around now :). I’ve been putting it off for too long anyway.

It’s always good to prepare for the worst. Dealing with problems is always easier if you’ve figured out a plan of action beforehand.

I don’t care for the grasshopper/ant story. Why does the grasshopper get the bad rap? Plus, the ant did end up feeding him at the end of the story, so who’s really screwed? 🙂

Len, I just want to say that I admire how open you are when it comes to sharing your finances. That takes a lot of guts especially because (I assume) you are using your real name. It really helps give me a good reference point for where my household finances are. Thanks again.

Len,

Great exercise…one everyone should do. I am impressed that you and Honeybee are so close to being on the same page, especially considering that you didn’t give her a benchmark to shoot for. In my case, I am fortunate enough to be drawing a lifetime pension which is more than adequate for our monthly expenses of $3600. Our concern? Hyperinflation. How do I run a scenario check for that?

It’s great that you’re hoping for the best and preparing for the worst. And terribly brave of you to list your Expenses for us like that. But, Good Grief, you SPEND A LOT OF MONEY!! You spend the equivalent of my house payment on Entertainment, and then again on Misc Household Expenses. And there’s still $679 un-named, just “Other”. CAN I COME LIVE WITH YOU ;c)

Sure, come on over. LOL Just remember, those numbers are a monthly average. The entertainment section includes things that really skew the totals — like our family summer vacations (which last year included a two-week stay in Washington D.C. and the East Coast) and several concerts. Misc Home Expenses was another area that had a big monthly total — that was skewed by remodels to our kitchen and our two bathrooms. The “Other” category includes donations to charity and other catch-all stuff not covered in the other categories.

I knew I’d be a total HARPY if I’d gone so far to mention a ‘Charity category’. (And I sure wanted to stay welcome in your Blog ’cause we all need you.)

Should have know you were ONE OF THE GOOD GUYS.

first time here and just wanted to stop by to say hello all!

Welcome to the zoo, Shelley!

Just curious, but what do you count under “misc. home purchases”?

Hi, Kate. Anything that is used to make the house a home. This year it included all the costs of our kitchen and bathroom renovations, indoor and patio furniture, landscaping, pots and pans, wall clocks, etc.

I’m curious how you could expect to cut some of these expenses as deeply as you project. Some of the categories you propose partial reduction on seem to be fixed monthly plans – how do you just reduce those? We have no way to cut our water/trash/sewer bill, for example. We have a basic satellite plan, so it would either have to go completely or remain at 100%. And to slash utilities (at least by the amounts you’re projecting) when you’ll be staying at home more & cooking in more – is that realistic?

It think if I’d done this exercise & saw items that could be slashed to 0 or 25%, that I’d be revising my regular budget to reduce spending in those areas to some degree immediately – if I could live on 50% of the current budget for the short term, I could probably cut back at least 20% without suffering.

Good questions, valleycat1. Well, the water bill can be cut by reducing the amount of water we use. By taking shorter showers, stopping lawn watering, and being more conscious of how we use our water in other ways I think I can reduce usage by 25%.

Our satellite plan includes several premium options that we can cut out, including the $40 or so we spend each month for on-demand satellite movies; the most basic bare-bones plan is less than $25 per month.

As for the utilities, we already eat in six days a week, so that ain’t going to be a big deal. But more importantly, we waste a lot of energy in my home — I’m constantly on the kids to turn off lights and the television, computer, etc. I am absolutely positive if I got draconian, we could cut our electricity bill by 25%.

You make an interesting point about potentially looking in to slashing spending 20% in some areas. Some places that may work, other places, not so much.

If the kids leave lights on, get LED bulbs for everything. I did, and cut our electricity bill considerably (we have very high rates, too).

One thing I find to be a real budget buster is insurance and ever increasing co-pays. Our employer-provided insurance is still reimbursing at 1983 scheduled costs. Cobra coverage for a dependent who aged out of coverage is $700/month, but can’t be avoided until they find a job that provides health insurance, and that’s proving very difficult.

How does the Honeybee taste?

As far as I can tell, she tastes fine. (At least, I’ve never heard her complain about her taste buds.)

We are going through my husband’s unemployment period, and even with savings it is scary. Here, max unemployment is $1100 a month before taxes — our COBRA for his insurance would have cost $1378 a month. We switched to my company insurance, at about $400 a month, but it has an individual deductible of $1500 each person, $3000 per family, which is rough to pay on unemployment. I work, but only bring home $1700 a month for full-time work. I can’t get overtime. We both have chronic health conditions that are quite treatable, but expensive to treat. We fortunately have no car loans or consumer debt, but we have a mortgage.

When you factor in what you need during unemployment time, let me warn you to factor in “Oh No’s”. In the first 30 days after my husband’s paychecks ended, the water heater went out, my car developed a problem, a beloved pet required emergency surgery, my husband had a never-happened-before health crisis requiring diagnosis and treatment, and a family member’s very serious illness required much travel, eating out, etc., for two weeks. You may think you have enough saved, and find out that you don’t! I’ve sure watched our melt away.

You know, you make a great point about the “oh nos!” It’s funny how those always seem to pop up at the most inopportune times, isn’t it?

4.5x more on manicures and pedicures than on their dog’s vet bill? Shameful.

I guess I don’t understand your logic, Val. Are you saying that if I had subjected my dog to a couple of unnecessary surgeries to bring the vet bill up to par with the sum total of my wife’s biweekly manicures, that would be okay? Really? This is a budget and most of that money is related to grooming costs anyway; we can bathe and pretty up the dog ourselves in a money crisis. There’s $200 budgeted for the vet. Odds are that would be sufficient.

Didn’t realize it was mostly for grooming expenses in which case I agree. No reason for that in a financial crisis. Also didn’t see the separate $200 category for the vet as it seemed that the $16.74 was for both the vet and the groomer. Apologies to you and your wife for my harsh response to your post. Sadly, I have seen too many cats and dogs returned to shelters in the past few years and euthanized because their owners did not make them a financial priority. Makes me sad beyond words – thus my knee jerk reaction to your post. I now realize that this doesn’t refer to you and your family. Think your post was great otherwise and hopefully you will never have to use your layoff budget.

No worries or apologies needed, Val.

I am a big animal lover too. Like I said, it’s a budget, but budgets can be broken or reconfigured to meet emergency needs.

Just curious about what state pays $2000/mo. unemployment? Over the past 20 yrs., my husband has been unemployed in 5 states (for several times in 2 of those)and he’s recieved (max benefit) between $750 and $1800. We’re ants — unemployment (for as much as 10 mos.) is a way of life. And we’re about to do it again (employer heading toward bankruptcy and job search not yielding anything yet.)

California pays almost $2k per month (i.e., $24,000 annually) — and that doesn’t even put that state in the Top 5, which are:

1. Massachusetts pays up to $48,984 per year.

2. Rhode Island (up to $34,320 annually)

3. Connecticut (up to $30,888 annually)

4. New Jersey (up to $30,368 annually)

5. Pennsylvania (up to $29,432 annually)

Hang in there. I wish you nothing but the best of luck in your job search.

Source: http://fileunemployment.org/unemployment-benefits-comparison-by-state

We never really made this exercise, but I think it is a very good one. We both contribute to the household revenue, but one has a higher income. Without that income, we would be in trouble. We do have some emergency money, but not as much as we would like to, mainly because we are still quite young. Did you accumulate this money each month, each year, each pay check?

At least the Jack is not on that list.

Seriously though…Great article and very important for everyone.

Ha ha! Never happen, Ant.

For those who don’t know, Anthony is a friend of ours and he knows the Honeybee loves Jack Daniels.

We did this a little less than a year ago (I posted it as What Would We Do If We Lose a Job?) and we got our expenses down from $3600-$4000 a month to less than $2600 a month without being in too much pain or $2000 a month but missing a bunch. We are both employed, so we live off of my husband’s salary and save my own…we are ants.

Great exercise Len. It tells you a lot about your marriage when your cuts were so similar.

Sure she wanted to keep a manicure occasionally, or was she wanting you to keep yours…

But for the most part you attacked the same things, you, as most of us men are, were just more violent!

This is sorta like on of our drills in medicine. If you have practiced it, you won’t panic when it happens for real!

Preparation is key!

Oddly, I always thought that the very end of that story is that the grasshopper eats the ants. I’ll need to reread the fables.

Impossible; grasshoppers are vegetarians, Silly.

Thank you for the information. I am curious about your ‘eating out’ expenses because I did not see it in your spreadsheet. Our family eat out a lot so I wanted to see how much is a ‘normal’ budget for eating out.

Grace, our restaurant expenses are buried in the entertainment and ATM expenses. For a long time, we simply budgeted $100 per month for eating out. As my income has now become larger with time, We no longer have a set budget, but we tend to eat out once a week now and I suspect we’re spending $300 per month doing it.

Hi just found this blog and really love the budget honestly and advice you’re sharing. My budget suggestion is to try out for a couple of months the pared down budget and see if it’s really feasible. Don’t wait until you’re laid off to see if it’ll work. Plus I’d get rid of the cell phone and the satellite tv. Can you use the bus or carpool? That would really cut down your transportation costs. If your cars are paid for can you drop your car insurance to liability only? That saves 50% or more. At my household we really attack expenses and take advantage of all the free stuff on the internet (Hulu, Skype, etc). I also do weddings and other photography work on weekends so have a side business in case I’m laid off. It’s good money and I just save it up for a rainy day. Anyway multiple streams of income and low expenses is what I think everyone should shoot for.

I love the idea of a trial run budget. I may actually try that idea out in a couple months just to see the impacts on us. I suspect some things will have to be “simulated” though — for example, I am not in a position to cancel our cell phone contract, nor am I willing to eat the penalties, just to run a fire drill. But I can take away everyone’s phones. I need to talk this over with the Honeybee, but I really like the idea.

In our house, it’s cats that could break the budget (but not the bank).

We have long been practitioners of Len’s sound advice in this article, although with a much smaller budget due to our ages and where we live.

There are also insurance products for unemployment. I own both and budget them into my costs. Combined they would nearly replace my household expenses and I would only only have to to cut back on automatic investments for the first 6 months before going into cash.

IncomeAssure will fill in the gap between what unemployment pays and your previous salary to get you back to 50% of your salary. Pricing depends on State and Industry but you can self quote with no calls and no personal information from their website. There is a six month exclusion before it covers you though.

Also First Protector supplemental homeowners insurance from Assurant has an option to cover your mortgage in the event of unemployment, price depends on location and mortgage but for the 90001 zip code (LA county in CA) and your mortgage from the spreadsheet the 6 month option carries a yearly price of 614.00. 30 day exclusion before it covers you on involuntary unemployment.

Have not seen many touch on these options though; but they exist.

Will, thanks for the tips. These are great ideas that I am going to look into!

I did not check really closely, but I don’t see any conversation on charitable giving. Do you or any of your followers consider themselves part of a faith community?

I am always in awe of your mortgage payment Len. We have a 50% savings rate and are doing ok because we are in healthcare and managment but still practice too and have always been big savers. But we have always had multiple backup plans in case things go south fast. I think we live a frugal life compared to those in our income tax bracket, and have never been wedded to this lifestyle at all. Plan Z, would be to sell our current home which we have a lot of equity. Pull the kids out of private school (I know its a crazy stupid expense but we do it because we can afford it and we are dual income couple), and move into one of our rentals in Carlsbad which is a nice 3 bedroom townhouse which is paid off. It’s also in a good school district. Between the equity in the house (even if we sold at a few hundred thousands loss) and savings that are in taxable accounts, we could survivie for 10 years without touching any of our retirement and other investments. That would be plan Z.

Sounds like you’ve got it all mapped out. Good for you!

My original mortgage payment started at a tad over $1400 (not including insurance or taxes) — we were able to lower it substantially over the years via a combination of multiple refinancings (only to lower the interest rate; NOT cash out) and making a couple of extra principal payments per year during the first ten years.

This is a timely and wise post. This plan is not only true of when someone is laid off but also true of retirement for many of us Baby Boomers. I have been retired for four years and my wife is going to retire in a year. We have a plan similar to this worked out to live as much as possible on our pensions and Roth IRA and leave the equity in our house to our kids.

What a wonderful blog! I’ve only today discovered it, and reading from ‘down under’ in Australia. Regarding preparing for layoff’s, which is a fact of life in my hubby’s industry, mining, we are always prepared with an emergency budget, cost cutting as you have shown. A couple of further steps we take, as my husband is the sole bread winner, especially during the economic downturn at present, is accumulate his annual leave (he has 10 weeks paid leave up his sleeve) and 3 months paid long service leave. (In Australia, once 10 years service is completed the employer pays 3 months long service leave which some people keep till retirement etc or also take 6 months off at half pay). Another step which has saved his bacon a few times is jumping at any company paid further training opportunities, which has put him in a great position, having qualifications that the mine requires by law, and he is the only employee with them. Has paid off big time! Also going ‘above and beyond’ as an employee and establishing good relationships with the company bosses. We also keep 3 months emergency money to cover expenses. I’m ‘touching wood’ here as I write as the mines are again struggling and looking at further layoff’s. Also being a long time employee he would receive a hefty redundancy package, which is 1 months pay for every year you have worked for the company. So really for us its keeping holidays and any other leave accumulated at the moment just in case!

Thank you, Elizabeth. I appreciate you taking the time to comment and I hope you’ll become a regular here!

good stuff

thanks

You’re welcome.