If you ask me there are few things in life better than a warm chocolate chip cookie, fresh from the oven and accompanied with a little cold milk for dunking purposes.

If you ask me there are few things in life better than a warm chocolate chip cookie, fresh from the oven and accompanied with a little cold milk for dunking purposes.

As far as I’m concerned, the bar-none gold standard of chocolate chip cookies is the Nestle Toll House cookie.

In fact, a few weeks ago my daughter, Nina, and I whipped up a batch, as we like to occasionally do.

Normally, I faithfully follow the Toll House cookie recipe to the letter, which calls for doing things in a very specific order:

- Combine the flour, baking soda and salt in small bowl.

- Beat the butter, granulated sugar, brown sugar and vanilla extract in large mixer bowl until creamy.

- Add the eggs, one at a time, beating well after each addition.

- Gradually beat in the flour mixture.

- Add the chocolate chips.

This particular time, however, I was in a bit of a hurry, so I just threw everything in the bowl at one time and had Nina beat the heck out of it with the kitchen mixer. (Or should I say mixed the heck out of it with the kitchen beater?)

Anyway, as I pulled those cookies out of the oven, it was obvious by looking at them that something wasn’t quite right. Sure enough, as soon as I tasted one, the truth was evident. The cookies were edible, but they tasted, well, a bit off.

The flavor was nothing you’d expect from a properly made Toll House chocolate chip cookie; they tasted more like cake, and they had a very spongy consistency.

I learned a valuable lesson that day that I’m sure any good pastry chef could have told me, if I had only bothered to ask: When baking, the order of the ingredients is just as important as the quantities.

The Connection Between Baking and Financial Freedom

That little episode got me thinking; believe it or not, doing things in the proper order is also extremely important when it comes to maintaining healthy personal finances.

Just as the most delicious chocolate chip cookies in the world can be baked by anyone, financial freedom can be achieved by anyone too — regardless of their annual income — as long as they take life in a proper and orderly fashion. You can bet the savviest pastry chefs know that little financial croissant too.

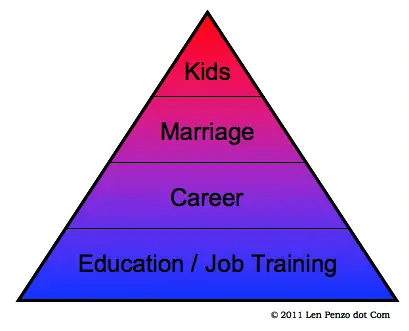

In fact, I firmly believe that there are four key milestones in life that, when followed in order, greatly increase the odds of achieving financial freedom regardless of one’s income. Those milestones are, in order:

In fact, I firmly believe that there are four key milestones in life that, when followed in order, greatly increase the odds of achieving financial freedom regardless of one’s income. Those milestones are, in order:

- Getting a good education, either through college or via on the job training.

- Establishing a career.

- Marriage.

- Kids.

Now, before you send me a nasty-gram, I understand these four milestones aren’t all givens — many people never get married or have kids.

And, yes; I also realize you can be financially successful by doing these tasks out of order, so if you want to be an undisciplined cream puff and ignore my advice, by all means, go right ahead.

However, as my nifty pyramid diagram tries to illustrate, you certainly increase your odds of success when you do the tasks in the proper order because each milestone provides a foundation for those that follow.

Don’t believe me?

I’ll guarantee you that people who have trouble making ends meet on $50,000 per year have, in most cases, done at least one critical thing out of order in their recipe of life that caused them to be in that situation.

For example, perhaps they decided to have kids before they were married or completed their education, or maybe they got married before really getting their career underway which ended up in a costly divorce due to unforeseen commitment issues. You get the idea.

Sometimes, as in the case of kids, these tasks are done out of order unintentionally. Other times, they are simply due to a lack of patience.

Whatever the reason, the end result is often a heavy financial burden that is extremely tough to recover from.

Our Lot In Life Is Influenced By the Choices We Make

A big part of our financial success is based upon the decisions we make in life. Even if you understand that the biggest secret to achieving financial freedom is spending less than you earn, that may end up being completely impossible if you chose to stray from the natural order of life.

With that in mind, why would anybody ever consciously jeopardize their financial futures by “messing with the recipe” and doing things out of order?

Screwing up a bunch of cookies is one thing; you can easily toss them in the trash and make up another batch. The same thing can’t always be said regarding your finances.

Photo Credit: Rachel from Cupcakes Take the Cake

As someone who did these four things out of order, I can confirm that it made my life very difficult financially.

We can’t control everything in our lives and I certainly wouldn’t change mine. But, I strongly recommend being prepared financially before getting married or having children.

It’s hard to crawl out of poverty with this much finacial responsibility. I was able to do it, but many people can’t.

Wow. What an unexpected fact! This made my day entirely)

I strongly agree with you.

And I will add anecdodally that this progression worked very well for us (although I will admit that my husband and I did steps 2 & 3 at the same time as we got married right out of college, but my husband did have a job in his career all lined up).

Scope and sequence. A good recipe for success.

Aww, thanks, Christine, but I’ve been having WordPress issues; I’m trying to figure out which plugins are causing a recent rash of instability here, so I’m experimenting by removing certain ones for awhile to see if the prob goes away. Hopefully, the tweet button will be up again soon!

When I read your title, I thought you would talk about saving up money before buying stuff.

I did things mostly in this order, but I also bought a house before I had kids. That made things infinitely easier not having to try to save for a house downpayment while also paying for children’s expenses.

Plus it’s a good rule of thumb to figure out how to take care of yourself first before taking on the responsibility to take care of spouses and kids to the mix.

The out of order problem you describe is endemic in our area, and the cause for such poverty and unnecessary heartache.

Until that changes I don’t see a fix. Trillions in government aid hasn’t worked so far.

Hi Len, my husband and I followed this order although we skipped the kids part. My parents, on the other hand, got married while my dad was still in college. They started having kids and bought a house very early in my dad’s career (mom stayed home for several years). I can tell you that money was very tight until I was a teenager, but at least my parents knew how to save. They are retired now and doing well.

Did you just refer to some of your readers as “an undisciplined cream puff”?

LEN!

I just saw this article on Yahoo! Keep up the great work, and have an awesome 2021.

Hi Len,

I also came across your quotation from reading an article on Yahoo. I agree with you 100%. Although I haven’t done it in the order as noted, it was always my view that if life is challenging, it cannot get better by irresponsibly throwing something else in the mix. He who makes us Man and Woman,along with our Vaginas and Penises, gave us a brain….that we sometimes seem to send on vacation (without a return fare).

I have grown up on very tough times, education was delayed but I got married (12 years and counting), my hubby financed my education where it was on pause, I have been working (though needing a change) and we don’t have kids (though we assist our nephews, nieces and other young ones) and certainly will not feel less than a man/woman, if we don’t have any.

Good points….keep it up.

That’s great, but if the economy changes such that your job is no longer viable or wipes out your savings, and you already have the marriage and kids, what are you supposed to do then?

You can’t bake cookies by playing numbers, but you’re suggesting that we all play numbers with everything else. It would be nice if the people with all the advice but none of the responsibility for the lives of the people they’re advising, would come out with some actually useful tips for dealing with problems as they arise, rather than giving people a false sense of security that the problems can be avoided. Because they can’t. There’s always that one thing that can happen to you that knocks you sideways. If you manage to get through life without getting tripped up in that way, it is entirely down to luck.

You seem to be suggesting that because we can’t completely control our fate, there is nothing we can do, Dana. That kind of fatalistic thinking usually results in a self-fulfilling prophecy.

Of course, there is no foolproof protection from bad luck. All we can do is prepare ourselves as best we can. To do that requires forethought and a plan, don’t you agree?

One of the best protections from the economic calamity you describe is taking life steps in a natural order. Those who follow that plan will naturally have the means to build their emergency and rainy day savings funds over time to help partially mitigate the loss of a job. Obviously, there are limits to how much money you can save, but those who start soon enough can build a tremendously large cushion.

Yes, there are always things that, as you say, can knock you sideways. That doesn’t mean there aren’t tasks we can undertake in the meantime — like taking things in the natural order of life — to try and at least partially protect ourselves. There are many many people out there who have been knocked sideways and came away relatively unscathed simply because they had a plan to deal with such an eventuality.

Thanks for your comment.

Great advice, Len!

Occasionally, unexpected things happen to throw us off track, whether it’s the economy, a health problem, or a divorce, but we’re always going to be better off with a good foundation.

I’m passing this link along to my teenage grandkids!

Wow, nice analogy Len! I have 2 friends who are pastry chefs, so I was interested in reading this..then you went off in a different direction. Well done! That said, the “recipe” seems to be changing a bit. Plans need to be amended all the time, and the ability to improvise will serve us (and especially our kids!) very well in the future. The way I look at it, my kids will have to reinvent their careers numerous times simply due to the advent of new technologies….

I agree, my life took those steps and it has worked out great. Beautiful frugal wife (teacher) and a fine young man. One more point. I was blessed as being ugly. It took 30 years to find someone to take me – plenty of time to get education and career started. Then found out I was shooting blanks….That fine young man came a little later than planned. Blessed indeed.

Well, Eric … I see we have more than a few things in common. 😉

Hi Len

Good solid advice. The education bit early on in your life I think is very important. It is much better to get this aspect sorted early on rather than wait until you are older. If you can build a reasonable education foundation it is easier to add a bit here and there when required as you get older. Try doing an assignment as a post graduate, requiring being locked away for the whole weekend whilst your wife must totally look after the kids. Man can that create issues on the home front!! The pyramid is pretty close to the mark. (and so are the cookies)

Regards, Adrian

These steps have been around for possibly thousands of years.

It’s why some younger women married older men. The men were financially established. It provided for the woman and her future children.

My grandparents were all out of school, and established when they married. My dad’s parents were born in 1888, and 1891. They didn’t marry until 1913.

My mother worked 3 part-time jobs to put herself through college, and graduated with no debt. She taught school for 5 years before she married.

My dad had worked at a refinery for over a decade before he married.

It enabled them to put a lot down when they built their house, and only have a 15 year mortgage. He already owned the land free and clear. Mother started substitute teaching when her youngest was 5, and paid off the mortgage 3 years early.

Mother’s education/experience allowed her to substitute when times got hard, and she kept the bills paid.

I worked part-time, and put myself through college. It took 6 years but I graduated with no debt, and $20k in the bank. It was 1978-1984.

The plan works.

It really does, Bill! Thanks for sharing some real-life examples.