I know. A lot of you wish you could retire now, looking for reasons to retire early.

However, before that can become reality, it’s important to understand our magic number; that magic number, of course, is the amount of money we’ll need to have accumulated by a certain age in order to not outlive our savings.

Now I am of the opinion that one can most certainly save too much for retirement.

After all, I’m not working my butt off and diligently sacrificing and saving money so my relatives can receive a big inheritance after I pass away. Sorry.

To me, I’ve planned my retirement perfectly if I pass away with enough money and assets left over to cover my funeral and provide for the Honeybee until her time comes.

But, Len, what about your kids? Yeah, yeah, what about them?

Even though they are still pre-teens, I’m already teaching the little buggers that they need to be personally responsible for their own financial well-being. Rest assured after they leave the nest I’ll continue to provide for them and my grandchildren – but it will be on my terms while I am alive and can savor the joys of helping them out. That’s not to say they won’t receive something when the Honeybee and I are finally gone, but they shouldn’t expect anything because I’m not planning for it.

When saving for retirement, it is important to occasionally take a step back and reassess why you’re doing what you’re doing.

So just what is the right magic number for retirement?

That depends on the individual, of course.

For me, it is important to ensure that I don’t over-save for retirement at the expense of other important financial goals. To do so can be detrimental to other goals, like building a future-home down-payment, an emergency saving account, or simply having a little extra each year to enjoy a nice vacation.

To guard against this, I feel it is important that we all consider whether or not established rules-of-thumb actually apply to us when we’re working on our retirement planning.

For example, a classic area where many people get too conservative is their estimate regarding the amount of money they’ll spend in retirement. Most people figure that they will spend more money in retirement than they do now, continually traveling abroad, splurging on fine dining, and fulfilling other expensive desires until the day they die.

Yet, a study published in the Journal of Financial Planning found that seniors actually go through less money as they get older – not more – and as a result it suggests that retirement savings may last longer than many people think. According to the study’s author, financial planner Ty Bernicke, a typical household whose residents are over 75 only spent $25,763 in 2004, or approximately $29,000 in today’s inflation-adjusted dollars.

Am I Saving Too Much?

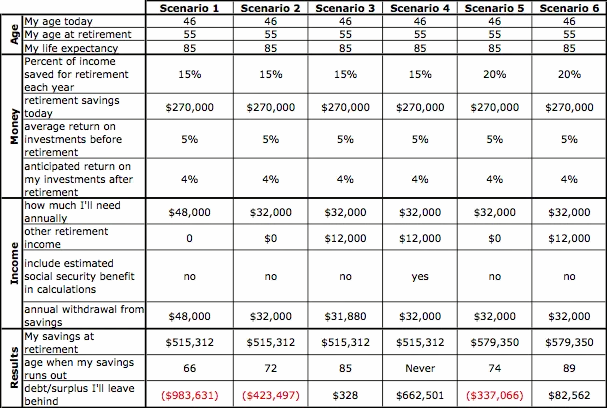

With that study in mind, I wanted to know whether I have been saving too much. So I ran some rough numbers using MSN’s Retirement Planner Calculator. The MSN calculator uses current dollar values and the rate of return on investments is adjusted for a three percent inflation rate.

I understand that uncertainties such as future tax laws, future health care costs, and the availability of social security mean that no calculator in the world can accurately tell us how much we’ll really need in retirement. But I had to start somewhere to at least get a gross ballpark figure.

I made some fairly conservative estimates:

1. My expected pre-retirement investment returns are only five percent, and four percent post-retirement.

2. Except for Scenario 4, I assumed I would receive no social security benefits.

3. I assumed no additional retirement income of any kind in half of the scenarios. The other half assumes an extremely conservative figure that represents only a portion of my actual company pension. In reality, I suspect that figure would be significantly higher; even if my company went belly-up (highly unlikely) and my pension was completely obliterated, I expect to be earning some sort of income from ages 55 to 70 either through consulting or other endeavors and projects.

Furthermore, although I can’t be 100% sure, it appears as if the calculator does not account for increases in my salary due to annual raises.

In all scenarios except for Scenario 1, I assumed I would withdraw approximately two-thirds of what I currently spend right now to run the household. For example, by the time I retire I expect our home will be paid off, so there will be no mortgage payment to deal with. The kids should also be out of the house by then too, further reducing expenses – with the elimination of the lights and TV always being left on, that should save me enough money to cover my property taxes every year.

As you can see from the figures above, based upon those assumptions, my money runs out in Scenarios 1, 2 and 5.

However, in the other three scenarios I don’t outlive my money – despite the extremely conservative numbers. In fact, in the Goldilocks Scenario (#4) where I naively assume I’ll get to draw on Social Security, I would actually leave my heirs a sizable surplus.

Of course, the MSN calculator figures I’ll spend the same amount every year throughout retirement, which flies in the face of Bernicke’s study; but perhaps that is offset a bit by my lower estimate for how much I plan on spending in the early years of my retirement — that $32,000 figure could be a bit too low early on.

Some Personal Observations

So, based solely on these “back of the envelope” numbers it appears that I’m in great shape for making my goal of retiring at age 55. The bottom line is I am now in a position where I no longer have to devote my future salary increases to my retirement accounts.

Despite the tenor of this post, I firmly believe that it is still a smart move for young people to research various investment brokers and contribute early and often to their retirement accounts.

I started seriously saving for my retirement in my mid-twenties and I have no regrets. Not only is it far better to contribute more early in life and let the compounding returns increase the value of those savings over time, but it also takes advantage of striking before other expenses arise — like weddings, kids, home ownership, and/or unforeseen hardships.

To me, the goal should be to get a head start and reach that magic number earlier than your expected retirement age. Yes, there is significant opportunity cost for each additional fraction of your income that is committed to your retirement savings – but for those who are committed, the long-term payoff is enormous.

That is the place I currently find myself at, and as a result, I have additional options available to me now that I wouldn’t normally have had assuming I had waited to start building my nest egg until I was in my thirties. For example, if need be, I can now reallocate money currently being devoted to my retirement savings and use it to help offset large emergency expenses that may temporarily arise knowing that it will have only a minimal impact on my nest egg.

Can We Really Save Too Much for Retirement?

I think it is safe to say that nobody should save so much of their income for retirement that they end up sacrificing their quality of life — but it is just as important to not let living in the moment jeopardize those so-called golden years.

Maximizing your retirement savings early gives you flexibility.

The trick is to decide what mix of saving for tomorrow and spending for today we are comfortable with – understanding that if we neglect to properly take care of the future, we’re still going to end up paying for that decision down the road in the guise of reduced financial freedom, and the lack of flexibility to do what we want to do in our later years.

Great post and great strategy. I do think that you can save too much but it is better to save too much than too little unless you may enjoy bagging groceries at 80. My kids don’t expect any inheritance from me, either, but I got the funny feeling that something will be left over when I will die. (I’ll outlive the misses since I got some serious longevity genes!) Again, I am not too worried about that since it is better to have something left over than to be short of money at the end of your life. If there is some money left over my kids may get a windfall inheritance; and that is all it should be: a windfall to my kids.

Len

congratulations on your very savvy financial moves since you were young. You have been prudent and never got caught up in the whole real estate leverage game like these folks here:

http://www.fiscalgeek.com/2010/01/retired-early-in-debt/

You did it the old fashion way. I have nothing to really add to the post. Whether you save enough or not really is irrelevant when you have saved quite a bit and you still plan to be doing consultancy jobs to keep your grey cells working.

I think this is simply an excellent example of prudent personal finance…work hard, save, instill good values in your kids (or try to anyway)..and not simply dream for the passive income retire at 35 pie in the sky nonsense that seems to float around.

I guess the only thing you really have to watch out for is the value of the dollar! A lifetime of savings can go poof overnight if our currency becomes a banana republic money!

A little while ago I went through a ton of different options as to what it would take to retire early based on past history. I used firecalc.com and it’s really cool to see what has happened in history and your odds of making it with a given amount of money. Kind of crazy, actually. At what point do you have enough? 70% 80%? 90%?

@Ctreit: Well said. I’m with you, kids should look at any inheritance they might receive as a windfall.

@Mr. CC: I saw that article at Paul’s site. You are so right about inflation robbing retirees. As the great Ronald Reagan said, it comes like a thief in the night to steal from all of us. That’s why I am so irate when I see our government continue to grow bigger and bigger everyday while running unsustainable deficits and dooming our kids to a declining standard of living. As a regular reader here, you know I believe high inflation is inevitable. If things get too bad, I will have to stay employed longer than I expected.

@Daniel: Thanks for the tip! I just went over to Firecalc. They use a Monte Carlo analysis which is, in my opinion, a much better way of predicting future outcomes when model inputs can vary. I run Monte Carlo analyses all the time in my engineering job. For those of you who aren’t familiar with them, Monte Carlo analyses make hundreds to millions of runs using pseudo-random inputs to simulate variations in outcomes. As for the point where you have enough – that comes down to how much risk you are willing to accept. That is the beauty of a Monte Carlo analysis – it allows us to make trade-offs. Are you willing to live with the risk that you have a 70% chance of not outliving your money, or would you only be happy with 100%? To me, I think I would accept 90% and feel fairly confident that I won’t have to be bagging groceries at 80. I may also choose to accept 70%, but I would do so with the understanding that I may have to pick up a bit of extra income somewhere along the way to ensure I don’t run out of cash. Then again, my numbers are quite conservative, so maybe if I think about it a bit longer, I may be willing to accept 70% – and not lose a bit of sleep at night – precisely because my numbers had a lot of pad in them to begin with.

You smart dude – monte carlo…beware the fat tail!

I’m well beyond that nest egg, and I’ll be 55 this year. So, why don’t I feel comfortable retiring right now?

@John: Well, I know some people who are NEVER comfortable retiring. I work with guys who have been at my company 50 and 60 years and they are still going strong. Not sure if they are afraid of running out of money, or the (unfounded) fear of wasting away because they will not having anything productive to do with the rest of their lives. That being said, maybe it is too simplistic to assume that retirement is for everybody.

I agree with your thoughts about inheritance, but it’s dicey to plan such that you spend your last penny on the last day of your life. You write “however, in the other three scenarios I don�t outlive my money” but in those two you put your age at death at 85 and 89 respectively. How do you know you won’t live well into your 90s?

@LittleHouse: Good idea. I’ll work on that!

@Susan: You’re absolutely right! I If I did know when I was going to die that would make retirement planning an easy exercise for sure. 😉 All I can do is make some educated guesses as best I can. As I told Daniel, I can hedge my risk of outliving my retirement by being conservative with my numbers (which I think have done). As I get closer to retirement, the crystal ball will get a bit clearer and I will be adjusting my numbers and plans accordingly. My biggest fear is not outliving my retirement – instead it is the risk of prolonged high- or hyper-inflation destroying the nest egg I have carefully nurtured, as Mr. Credit Card alluded to. That is why I am so adamant that our government get its fiscal house in order ASAP – otherwise, all of my sacrificing and saving that I did in my 20s,30s and half of my 40s will have been all for naught. The MSN calculator assumes an average inflation rate of 3% – that will be a very poor assumption that could ultimately undermine my projections if we don’t quickly find a way to turn off the government printing presses that are running on overdrive at the Treasury.

I urged my parents to spend any money they could, but they only got a little way into it before illness struck my father. I think that’s a hidden sadness in the disparity between what people think they’ll need in retirement, and what they actually get to spend. A lot of those over 75+s are probably pretty immobile or out of it, to be honest. (Not all by any means, but enough to pull the numbers down).

On the other hand, if you’re 70, fit and optimistic, life has more possibilities than ever before.

I agree with Susan. And it’s not just that you might outlive your money – it’s that you don’t want to be fretting about running out of money in those final years.

Oversave my friend. You know it makes sense!

Perhaps put an extra $200 a month into something high/risk return, like small cap value stocks, with the assumption that you’ll keep that money invested until you’re 65 or so. Could be an extra fillip to your retirement pot.

Of course, LenPenzo.com may be bringing in the big bananas by 2018! 🙂

@Monevator: More sage words, Investor, to be sure. However, I’m still struggling though with balancing the living with today and saving for tomorrow dilemma. I have been saving diligently for a long time and I am really ready to start spending a little more on me and the family now. Just a bit. The kitchen and bathroom needs a remodel! Of course, that doesn’t mean I am stopping my retirement saving, just that I am slowing down the rate of increases for a bit.

I’ve really appreciated the thoughts shared here–would like to add another to think about….my husband and I were diligent savers–probably to the excess. He was killed in an accident a few years ago, and I can tell you that there are unseen benefits of saving regularly….because we were accustomed to living on much less than his salary, it was much less of a “shock to the system” (for me and for my 7 children)to make the adjustment to living on much less, ie social security, until I remarried. However, I will also say, on the other side, I wish that he had taken more vacation days (he was an extremely dedicated employee and seldom missed work) and we had spent more time making memories with our family…those memories are priceless! Just something to evaluate in the “can you save too much?” question.

I am very sorry to hear about your loss, Marie. But thank you for sharing your story and pointing out another intangible benefit to living below your means: It is a lot easier to recover from financial catastrophes when you are accustomed to living on much less than the household earns.

Yeah, to die with too much money will really spoil your kids.

I just hope my parents spend to their heart’s content and never worry about me b/c that wouldn’t be right.

Cool spreadsheet! $32k/yr is frugal!

Hats off to you for investing early. If we get it right, our kids will see what we leave them as ‘bonus’ money, not money they need to get by on.

@Sam: Yep. I suspect the $32,000 will be roughly equivalent to what I spend now minus the expenses attributed to the kids and mortgage though. It may be a bit too aggressive of an estimate – but, if I am wrong, I am comfortable that I was even more conservative in other areas like investment returns and annual income after retirement.

@Mr. CC: Better beware the “long tail” too. 😉

@Ken: That is what I am hoping for too.

Very cool graphic above showing the diff scenarios. Thanks for the insight into your plans.

I agree with the fact that you shouldn’t worry about leaving lots of money to your kids. However, I do think that saving plenty for retirement is fine. One thing you didn’t mention is illness.

My husband’s grandparents had thought they had saved enough to even leave some for their kids. However, they lived much longer than they thought they would and had a lot of medical problems that included assisted living facilities. My husband’s grandfather is still alive, but has Alzheimer’s disease. He has no clue who anyone is, but is still ticking. His room and board is close to $5,000 a month and his retirement savings has pretty much run out, leaving the kids to fund his medical expenses. So, I’m not so sure there’s such a thing as saving too much. Just something to think about!

Little House: You’re right. One of my safety “backstops” for a lingering illness is going to be my home. If everything goes according to plan (which, I understand, could be derailed by other life events) It will be paid off before I retire – tapping that equity should provide years of additional cushion in such an unfortunate scenario. That ‘s my plan anyway.

All you need is $900,000 cash at a 4% interest rate and you’re there! Sounds good to me!

I just noticed that you are living off less than $50,000 a year. How do you live so inexpensively with kids? Just asking because I don’t even have kids yet (I’m a real late starter!) and think I still don’t make enough to comfortably support a couple of them. Do you have a frugal living list? Maybe that could be your follow up post, how to live on under X amount a year.

Also, it’s great to hear that you only have 9 years left before retirement. Any plans for that portion of your life?

My kids are going to learn how to save for themselves too

That’s the rule: I save for my own retirement so you don’t have to take care of me, and you don’t ask me for money when you’re a working adult

Your points are well taken. My children also have been taught the importance of having their own. Although the inheritance may not be extravagant, I do plan to leave something behind.

There’s been some great comments here but I’ve particularly thought the ones about the possibility of illnesses derailing retirement plans have been the most powerful.

I’ve been saving for retirement since I was 22 (I’m 2 months shy of 24 now) but it’s better to start saving now rather than later as I’ll be old soon enough.

I quite like the idea of leaving a financial legacy though, if not to my children but to a charity or organisation.