Steadfast financial discipline and strategic planning has rewarded Jeff with the financial freedom to enjoy an early retirement.

My name is Jeff and I’ve been reading Len’s blog off and on for a couple of years now. I’m 55 years old.

After getting my high school diploma I spent six years in the military, and then followed up my service with a series of various jobs.

My wife is 57 and has a bachelor’s degree; she worked in the brewing industry for 22 years before becoming a teacher/tutor.

We’ve both been retired since April 2012 and we’re currently living on IRA and 401k (rolled over into the IRA) distributions that total roughly $25,000 a year.

We take advantage of IRS Rule 72(t), which allows us to avoid the 10% penalty for limited early withdrawals. We can stop the 72(t) distributions in four and a half years — then we’ll have greater access to our retirement funds.

Our Household Expenses

We own our house in a small city that’s a ferry ride and an hour’s drive from Seattle. Fifteen years ago we retired the mortgage early by making extra principal payments every month.

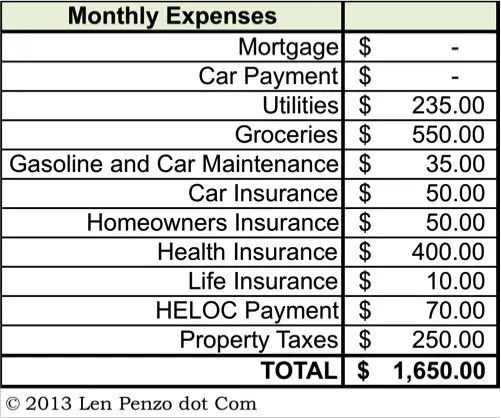

The utilities, including telephone, water, sewer, and garbage payments are $235 per month. Our grocery bill averages about $550 per month.

The utilities, including telephone, water, sewer, and garbage payments are $235 per month. Our grocery bill averages about $550 per month.

Gasoline and maintenance expenses for the 1998 Nissan that we purchased in 2000 are $35 per month. The car is parked in our garage most of the time because we ride our bicycles or walk for errands and other activities around town.

We pay $70 each month on a HELOC loan for a home improvement. Our car and home owner’s insurance are both $600 per year. We also pay $3000 per year in property taxes.

Although we no longer carry life insurance on ourselves, we do carry it on our son who is still in college to pay off his debts. Health insurance for my wife and boys cost $400 per month; I’m covered by VA health insurance.

We also tithe 10% to our church and have tried to be good stewards of the money God has entrusted to us.

The Secret to Building a Proper Nest Egg

We received one inheritance in the early 1980s: a $50 savings bond. Other than that, we built our entire nest egg by ourselves — and we did it while raising our two sons, who are now 20 and 22. To do that, we made sure we lived below our means, and were careful to pay ourselves first, saving 10% or more every year into our retirement funds and regular investments. As a result, today we have a net worth of more than we’ve earned, and live quite comfortably.

We have not changed our investment mix since retirement, except to rollover into IRAs — we plan on being retired for at least 40 years, and would like to have the resources to do some good in the community during our lifetimes.

In addition to volunteering in the community and at our church, we enjoy movies, reading books, riding bicycles, and food.

We don’t feel deprived, as we can tap into an emergency fund in a regular mutual fund without a 10% additional tax.

Closing Tips and Thoughts

- Nobody cares about your family’s future as much as you do.

- Pay yourself first. Do it automatically — believe me, you won’t miss the 10% deduction. Invest in a tax-deferred account to the maximum levels allowed by law, whether it is an IRA, 403b, or 401k.

- Live below your means. Maybe you can afford the payments on a new car, but can you also afford the insurance, upkeep, and depreciation? Know the difference between your wants and needs.

- Work at what you like, and set a good example for your kids. Even if there are parts of your job you do not like, talk about the good things involved with your job, it will boost your and your kids’ self esteem.

- Choose the correct spouse; find someone who is thrifty like you.

- Buy term life insurance, if a loss of income can’t be replaced with your savings. Drop your term insurance, when you’re confident your family will not be left in hock, if you pass away.

- Invest early, let compounding work for you. The best time to buy shares in a mutual fund, if not today, is yesterday.

- Set a goal (like early retirement), plan how to do it, mold it into a doable strategy, and then follow through. If you don’t start, you’ll never finish. You can always rework an investment strategy as the years go on; circumstances change, and nothing is carved in stone.

- View market downturns as a buying opportunity. When the markets turned down in October of 1987, I called in to buy more mutual fund shares and have not regretted it.

- Wait on big decisions for at least a week. If a buying or investment opportunity is “too good to be true” and “needs to be acted on immediately”, it’s not worth the risk.

- Read personal finance information from reputable sources. My favorite books include: Common Sense by Art Williams; The Wealthy Barber by David Chilton; Your Money or Your Life by Joe Dominguez and Vicki Robin; Think and Grow Rich by Napoleon Hill; The Richest Man Who Ever Lived by Steven K. Scott; and The Millionaire Next Door by Thomas Stanley and William Danko. Oh yes … I also read Len Penzo dot Com, with my favorite article being 19 Things Your Suburban Millionaire Neighbor Won’t Tell You.

- Use it up, wear it out, make it do, or do without. This is good advice from my folks.

- You can’t take it with you. Whatever you save, give away an equal amount. Your donations will come back to you in many ways.

- Live simply; don’t sweat the small stuff. And remember, this too shall pass.

***

If you’re a household CEO who is successfully making ends meet on roughly $40,000 per year or less, I’d love to hear from you. Contact me at Len@LenPenzo.com and be sure to put “$40,000” in the subject line. If I publish your story, you’ll get a $25 gift card!

Photo Credit: Chet Rideout

I’m glad you brought up holding life insurance – it’s something which people hate to pay for but is extremely important. If I pass away before reaching financial independence, my partner will receive a lump sum payout that clears all of our debt and buys a conservative portfolio of investments that will replace my entire income. Sure, it costs me a couple hundred dollars per month but it guarantees we’ll reach financial independence one way or another (either I’ll keep working and save the funds needed, or the insurance will cover it). Over time I can reduce the level of cover I hold to reflect the lesser amount needed to reach self sufficiency.

Living below your means and choosing a good spouse are the 2 most important bits of information that I could of used early in life.

I selected a spouse who lived above our means and on credit cards and overdraft every single month. I manage my own single person finances and I am doing much better even though I make a third of what he makes.

You have made life long lifestyle choices and it has really paid off for you.

All incredible advice. These posts always make me a bit sad; I want to do this pretty bad, but here in NJ my property taxes are $15k. That’s a long way toward $40k! With no commute and high taxes throughout the state, the “you should move” comments are worthless to me.

Thank you, Tony. Where there is a will, there is a way. If you decide you want to be economically independent, you can do it, nothing is impossible. Make a plan and stick to it. We started out buying savings bonds, then bought gold coins in the late 70’s, sold them in the early 80’s, then started investing in mutual funds at about the same time in the 80’s. We started saving just $166 every month into an IRA with any extra bonus pay into regular mutual fund accounts and anything left at a payday. We made a game of it, to see how much we could save and it worked. We tried to live on the same amounts we did before raises and/or new jobs. It took years, about 34 to be exact, but we did it. We reached financial independence, you can do it too.

Jeff~ You are exactly the type of person I strive to be! It’s nice to read your story and have the “hope” that living below our means will pay off in the future. I particularly like the statement that you are trying to be good stewards of the money God entrusted you with. Ultimately, that’s what it’s all about for me. I will be printing your story for my 18 year old son to read. Thank you for sharing!

You don’t mention the size of your retirement nest egg, of show much income you were pulling in while you were building it. Judging from what you wrote I assume it’s very healthy. Can you give a little more insight into either of those? I guess I am trying to determine if your retirement savings grew more as a result of the steady 10% contributions you were making, or the investment strategy/returns.

Thank you in advance.

Michael Adams

Great job, Jeff! These stories are so motivating!!

I’m curious to know what kind of jobs you had after you left the service.

Congrats, Jeff! You story is a great example of why proper planning at an early age is so important.

I don’t follow why you carry life insurance on your son. Is it to cover your son’s college debt if he dies? Can I assume you are paying for his education then? Where is that money coming from? I apologize if I misunderstood what you wrote.

Thank you for all of your comments Renee, Michael, Wendy, and Gerry.

We carry life insurance to cover what our son carries in debt from loans which we co-signed, in case of his death while he is young. We also took out loans to help pay for college expenses, which he has promised to repay. We saved funds into UGMA accounts for both boys and made payments into the state college savings plans for both boys, $50 each son every month from their births.

We have always saved 10% or more of our take-home pay, including IRA, 403B and 401K savings.

We have been blessed. Our total net-worth including home value is about what we have earned in our lifetimes. We figured this out after visiting the SSA.gov web-site and adding up all of our earnings. We also tithe to our church monthly and have our pet charities we support.

My wife was a worked up to a senior analytical chemist, gave that job up due to increased pressure and became a teacher/tutor. I worked construction doing flat-work and building foundations, then was a bicycle shop manager, a warehouse manager, Mr. Mom for 10 years, special needs assistant with the school system, and custodial work with the parks and recreation service.

The 72T withdraw system only allows us to withdraw less than 3% of our larger retirement savings. There is a 10% additional tax if we withdraw from these same IRAs, but not if we withdraw from smaller IRAs and regular savings. We kept our accounts separate for this reason, so we have a cushion if we need it. If we have to take more than planned from our initial 72T IRAs we would be penalized with a 10% tax on everything we withdrew in the past and future until we reached our five year limit or 59 1/2 age, which ever is longer. We found this out through a visit to a CPA who specialized in retirement planning.

Great job controlling your expenses. Insurance is a big one. We’ll have to deal with that at some point too. My wife has a good job now and we’re on her plan. When she quits, we’ll have to buy health insurance…

Do you travel? The budget is good for day to day, but if you throw traveling in there, it’ll go up quite a bit right? Just wondering.

Hi Joe, Thanks for your response. We’re not really travelers and live in a vacation area. We have made several trips this year mainly on family visits to the mid-west. We have time to make plans and have no set time schedule when we travel now. We take advantage of staying at friends and family homes, AARP discounts, and booking trips well in advance. We just keep visits short and move around to different homes in each area. We have found this beneficial as we are invited back to visit. We enjoy pitching in and helping around homes and usually have “Honey Do” list waiting for us of small projects, we like to cook, also.

The cost of several trips spread over months is actually very low, maybe $197 a month, but it varies.

Thnaks for sharing your budget. But it looks like you don’t have any stuff except a car, a house, and groceries. Perhaps you do all your shopping at grocery stores? But don’t you have to replace clothes, shoes, electronics sometimes? Are you saving for your next car (or just hoping it lasts through the whole 5-year period before you can withdraw more)?

I’ll try to answer Debbie’s questions. We have never been into fashion. We just try to buy quality items when they are on sale. We do have our savings if we need a big ticket item like a car. We have usually bought used cars, kept the maintenance up to date, and don’t drive hard, just take our time by leaving home early when going anywhere. We both ride our bicycles or walk to most places in town. We always figured if it was within 20 to 30 driving time, it was worth it and more fun to ride our bikes. When our boys were young we encouraged them to walk or ride to events, practices, and “just to hang around with” friends, too. Our car spends more days parked in the garage than out.

We do most of our shopping for everyday items at the grocery store, but we also patronize the local hardware, drug, general merchandise, and electronics stores. We replace clothing and shoes as they wear out with brands we have grown to trust. We live near the beach and mountains, so to get away is a short walk or drive. We enjoy reading books from the library, and watching rental movies and television shows.

Thanks Jeff. I still don’t see the hardware, drug, etc. spending on the budget shown. But the budget shown is under 20K, so there’s plenty of room for that.

I never heard of the 72t rule you mentioned but thanks for the tip! I’m wondering if you plan on increasing your spending once you are no longer tied to the limits imposed by that rule, and what you will spend the extra money on.

Yes, we will be increasing our withdraw amounts in about 4.5 years. We will pay off any loans first, maybe travel more, definitely increase our charitable tithing. We have no great needs and enjoy helping in our community.

Somehow I think there are pensions in this mix (always is when people retire at age 55), which most of us do not have. Even if they are not collecting it yet, that enables them to withdraw some money from their personal retirement accounts. Also- a lot of luck involved in life. That said- commend you and your wife for achieving what you have and the life that you want. Many of us will never have that- even though we have behaved responsibly and been frugal, because we have no pensions or paid health insurance once we retire; have lost jobs or have not gotten raises in years. Many of us live in rural areas with limited job opportunities; or, in our case, have long commutes with big gas bills and wear and tear on our cars- we can’t just garage them! And- on top of that- we have incredibly high taxes here in rural NY- $9000 (school and property!). God help us to even try to even sell our home here!

Hi Mary Ann, Don’t get discouraged. Yes, we have pensions, but they are not accessible until we will be in our mid-sixties. Until then we will live on the money we saved up in our IRAs. They are like collecting social security, they grow larger the longer we don’t use them. Unfortunately, I recently read how social security pays out less if you have a pension. But Congress could change that rule any time, I just won’t hold my breath though waiting for that to happen. Our pensions would only replace about 15% – 20% of our income if we were to withdraw them now. Only you and God can make you lucky. You have to have a road map to arrive at your destination and a Good Guide will help.

Agree, Jeff. I’m a big believer in that we all make our own luck in life.

Are you talking about the windfall provision? I think that only applies if the pension in question was at a job where you were exempt from payroll taxes – and even then in limited circumstances, rather than pensions in general.

Thanks, Sam. You are right. In the article I read, the government pension offset is withheld from the social security payments if the pension was from non-social security taxed earnings to a surviving spouse. We never worked at jobs that were not social security with-holding exempt, so there is not a problem.

I am so glad I came upon this blog. I am a single mom (by choice) to a great 6 yr old who also has Asperger�s and I also foster 2-3 kiddos b/w newborn and 4 years old at any given time. I decided last year that my son needed to be homeschooled for Kindergarten and that the foster kids needed more attention then just throwing them into daycare all day (they have enough going on in their short lives so far) so I rearranged my work schedule and only work evenings now, which really cut back my income. But we are all happier and adjusting well now and I can�t wait to learn some tricks to save money so that I can breathe a little easier!

Weve both been retired since April 2012 and were currently living on IRA and 401k (rolled over into the IRA) distributions that total roughly $25,000 a year.