By carefully managing his budget and cutting unnecessary expenses, Nick lives very comfortably on less than $40,000 while still saving $8500 annually for retirement.

My name is Nick. I’m 25 years old and single with no kids. I work in radio, with a salary of $40,000. I also have side gigs that add an additional $5000 of income per year.

In 2014 I received my bachelor’s degree in mass communication. After I graduated, I was left with about $23,000 in student loans and a $7500 auto loan — but I’m happy to say that I paid off the last of my student loans in March and now I’m debt free!

I’ve always been financially responsible; I grew up that way.

I hate wasting money too! I’ve always liked finding ways to save. It helps that I’ve never been a materialistic person.

Since my first job at 14, I’ve always kept track of my paychecks and made sure that I never spend more than I can afford. I tracked my account balances during college, and then began budgeting religiously after graduating. Since then, I’ve tracked every penny I’ve spent or earned.

Expenses

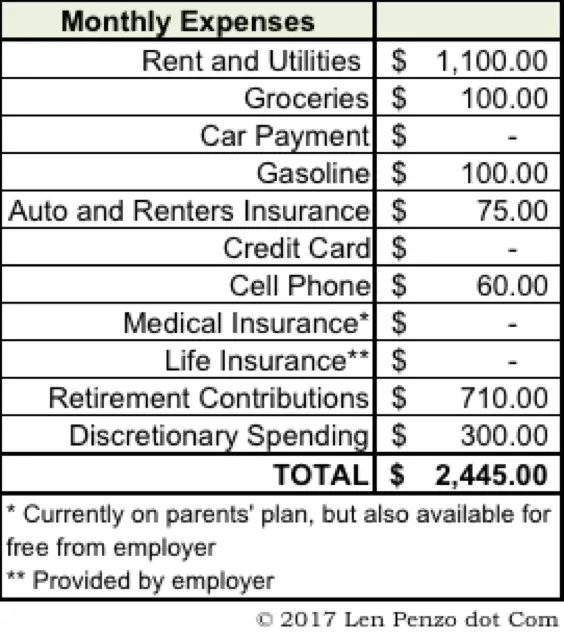

I currently rent an apartment, so I don’t have any property taxes; my monthly rent and utilities come to $1100.

In 2014 I bought a used car; it’s a 2010 Ford Focus that I paid off last year.

I’m still on my parents’ health insurance plan. When I turn 26 next year, I’ll get insurance from my employer; depending on the plan I choose, it will cost between $0 and $50 per month. I also have a life insurance policy through work; it’s a free benefit that’s good for twice my salary.

I typically spend $300 per month on dining and other entertainment. I enjoy NASCAR and I’m also an NFL fan, so I watch them on television — but I attend a few events per year too.

I typically spend $300 per month on dining and other entertainment. I enjoy NASCAR and I’m also an NFL fan, so I watch them on television — but I attend a few events per year too.

I enjoy board games, but my guilty pleasure is going to the casino with my friends! I’ll usually bring a bankroll between $40 and $100. When my bankroll is gone, I’m done for the night. I track all my winnings and losses to ensure I don’t exceed my entertainment budget.

Savings

To handle unexpected financial emergencies I have ten months of expenses currently saved up. I’ve been saving for retirement too. I contribute the maximum $5500 per year into a Roth IRA; I also contribute $3000 annually to a 401(k), which my employer matches.

Closing Thoughts and Tips

I use a spreadsheet to manage my finances. I track everything including: savings and checking account balances, income, budget, net worth, loans (when I had them), retirement accounts, and more. By doing so, I can easily verify that the income from my full-time job covers all of my expenses and savings.

I took advantage of side gigs to help pay down loans quicker — and now that those loans are retired, the extra income boosts my savings.

If you find yourself struggling to make ends meet on a tight income, I recommend focusing on these three areas:

- budgeting

- cutting unnecessary expenses

- getting a side gig, if possible

I’ve cut most of the fat from my budget. I try not to dine out too much. I don’t buy pop or alcohol at the store and only drink occasionally — that helps the budget immensely. I buy generic grocery brands and I’ve started shopping at Aldi’s more lately. I recently saved $25 on my auto insurance premium by dropping collision and switching to semi-annual billing; the car lost enough value that I can now afford what the insurance would pay. And I was able to trim my cell phone bill by $15 after I told my carrier that I was going to leave them for a lower-cost competitor.

I’ve also churned credit cards by taking advantage of sign-up bonuses. Each card I’ve signed up for has different categories for higher rewards. For example, I’ll use one card for gas and groceries, another for my cell phone bill and dining out, and a couple cards with rotating categories.

All of my credit cards are set up for automatic monthly bill payments, in full. Since signing up for my first card seven years ago, I’ve never paid a penny in credit card interest — best of all, I’ve earned hundreds of dollars in sign-up bonuses and cash rebates from my everyday spending.

***

If you’re a household CEO who is successfully making ends meet on roughly $40,000 per year or less, I’d love to hear from you. Contact me at Len@LenPenzo.com and be sure to put “$40,000” in the subject line. If I publish your story, you’ll get a $25 gift card or 1 troy-ounce of pure silver!

Photo Credit: Nick

While I’m very fortunate to have great benefits through work, I make sure that I’m not wasting that advantage. I made sure to pay down debt quickly and contribute as much as I can to retirement accounts. If I happen to incur a rainy day, I’m prepared. It’s led to great peace of mind.

Congrats on paying off your student debt! Looks like you’ve got a good handle on your finances. Thanks for sharing your story and keep up the great work.

Good job Nick. I’m curious what your healthcare deductibles are? Are they so high they could wipe out your savings if something serious happened?

Since I’m on my parents’ plan still, I don’t know exactly all the details of the plan (I probably should look at that a little closer, thanks for reminding me to look into that). I believe it’s $750 though? I do know the new plan I’ll be getting on next year through work will have a $750 deductible.

Congratulation, Nick! You are indeed thrifty and financially responsible and the world can be “your oyster”!

Since you are a young man (I am old) where will your ultimate home be?

Think about it, plan and arrange your life for it (as I did 60 years ago) and you will have your own private fiefdom.

“Ralph from West Virginia”

P.S. My wife likes your cat. She has three of the damned things – nothing but expensive little food gobblers …

KIDDING ! HIDDING!

Haha! That’s Peaches, my girlfriend’s cat. But we’re moving in together next month so Peaches will be “adopting” me! Might have some pet expenses then but my rent will go down. Trade-offs!

All the best to you both, Nick!

I was married 53 years to my late wife. She died in the living room of our little fiefdom 10 years ago and I have since remarried.

My personal experience has been that the teamwork of two mutually responsible people in marriage has been essential to a good, shared life . The dividends are more than twice what each could accomplish alone – its some multiple of mutual benefit, growing as time goes on.

Sort of reminds me how Albert Einstein characterized compound interest: “A miracle”.

The bankroll is a good idea. When you go to the casino what do you usually play? I could go through $40 in about 5 minutes if I hit a bad streak in blackjack.

Usually blackjack and roulette, sometimes with some craps mixed in. Not a big slot guy. If it’s a night where I brought only $40 or so, I’ll do more of the cheap roulette to make it last longer. Some nights are just quick nights!

Well done, Nick! I wish I was as financially disciplined as you when I was your age.

Great job. You are doing awsome for your age. You are well on your way to reaching FI. Be carful with hanging out at the casino.

I’m definitely aware of the dangers of gambling, but a reminder is always good!