It’s a struggle at times, but Tracie and her family are happy and making ends meet on less $40,000 per year in North Carolina.

My name is Tracie and I’m 30-years-old. I’m an associate chemist in coastal North Carolina. I have an eight-year-old son and I’m engaged to his dad.

I wasn’t always financially responsible — I was saddled with $10,000 in consumer debt. Twice.

Then I found Dave Ramsey.

I currently have no consumer debt. I have no student loans and never have; my parents paid for my college.

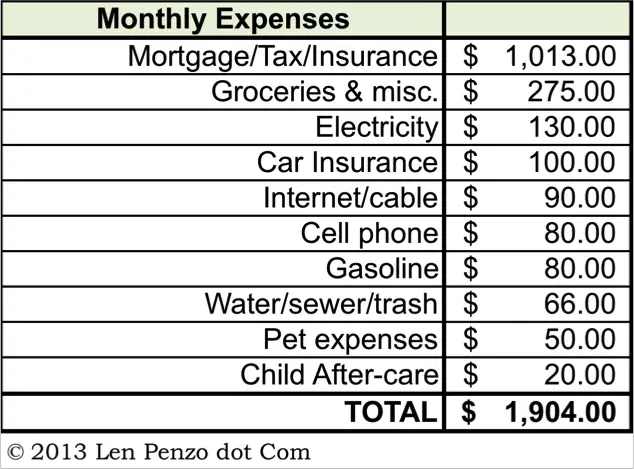

My Household Expenses

I grossed $39,796 last year. After deductions for retirement savings, insurance, and taxes, my take home pay is a little more than $2000 per month.

While my fiance is temporarily unemployed, he’s being a stay-at-home dad and handling the laundry, dishes, yard work and house-cleaning. Right now he’s saving us $120 per week in daycare costs while our son is on summer vacation.

I live in a 1300 square-foot home on acre. Our house payment, including taxes and insurance, is $1013 per month. My water bill, which includes sewer and trash pick-up, is $66 per month. Electricity averages $130 a month. Digital cable and Internet service costs $90 each month. I have two smartphones that only cost us $80 per month through Verizon; the phones are a good deal because I’m grandfathered on an old contract with Alltel.

We spend about $275 per month on food. I realize that doesn’t seem like much, but I get off work at 3:30 p.m. and so I’m able to make the majority of our meals from scratch. We eat a lot of rice and pasta, but we also have meat for every dinner. I’ve made friends with the butcher at the local grocery store, so I always know about the sales in advance.

My fiance and I have two cars that are paid in full. Last year I bought a 2009 Hyundai Santa Fe, which doesn’t get driven very much; in the interest of gas conservation I drive my fiance’s 2001 Ford Focus. Between the two cars, we typically spend only $80 per month on gasoline, as the farthest I drive on average is 10 miles round trip and that is to my parents house. I live three miles from work and pass a grocery store on the way home.

My fiance and I have two cars that are paid in full. Last year I bought a 2009 Hyundai Santa Fe, which doesn’t get driven very much; in the interest of gas conservation I drive my fiance’s 2001 Ford Focus. Between the two cars, we typically spend only $80 per month on gasoline, as the farthest I drive on average is 10 miles round trip and that is to my parents house. I live three miles from work and pass a grocery store on the way home.

For entertainment, we watch television and pay-per-view fights, go out to dinner, play the Xbox, go to the library and drink at home with friends. In the summertime, we often take our son to the beach and go to the aquarium, hike in the national forests, or swim in Grandma’s pool. Once a month we have a family movie night. We also have family game nights, and family dessert nights where we eat cake for dinner and nothing else. (I like to bake.)

I think it helps that we live near the beach. It’s a free source of entertainment and whenever our son gets bored we tell him to “go play outside.”

Savings and Other Automatic Paycheck Deductions

The beauty of automatic deductions is that I don’t actually feel like I’m “paying” for them, seeing as how they are paid for before I even get my paycheck.

I put aside 6% of my income for my 401k and my company contributes an additional 4%. Over the past seven years, I’ve been able to accumulate $33,000.

I also have life insurance on my son and a high-deductible HSA plan for health insurance for my son and I through my employer. The insurance is $40 dollars per pay period and I contribute $50 per pay period to the HSA; my company contributes an additional $1000 a year to it. My fiance is uninsured.

I claim zero deductions for withholding purposes — so I usually get a $4000 rebate at tax time.

We Still Struggle

We aren’t diligent — but we do try to plan our meals. I manage our finances using Mint.com, but I still feel as if I’m flying by the seat of my pants.

There isn’t always a lot of money left over at the end of the month. I don’t feel deprived though because we don’t really do all that much. My son isn’t into sports, but he’s in the Cub Scouts — and I’m the Cubmaster! We could cut a lot of expenses (like cable), but I don’t want to because I like watching the Real Housewives on TV.

I try to maintain an emergency fund. In theory I should be able to save up to $200 every month, but it seems as if something always comes up. I only have $50 in there now because I just spent $700 on new brakes for the car.

Closing Tips and Thoughts

Be happy! I think it’s important to make do with what you have and not feel sorry for yourself.

Sure I could pout that my girls’ nights include cheap wine and free Lifetime movies on demand, but in the end it’s just as fun. As cheesy as it sounds, as long as all my needs are being met there’s a silver lining to every dark cloud. I make a conscious effort to be happy with what I have. In today’s economic climate I’m doing better than a lot of people, so I feel guilty complaining that I have to buy Two Buck Chuck instead of fancy wine.

When I was deep in debt, we were a two income family. I’m thankful that all of the debt was paid off before we became a one-income family two years ago.

Although we’re living paycheck-to-paycheck right now, I know we could cut the fat from our household budget if we had to — but I would definitely miss watching the Real Housewives!!!

***

If you’re a household CEO who is successfully making ends meet on roughly $40,000 per year or less, I’d love to hear from you. Contact me at Len@LenPenzo.com and be sure to put “$40,000” in the subject line. If I publish your story, you’ll get a $25 gift card!

Photo Credit: Tracie

Sounds like you do a good job with what you have. One thing you might want to consider is adjusting your tax withholdings. If you are receiving $4000 back at the end of the year, then you are allowing the government to hold this money and earn interest on it for a significant part of the year. After your adjustment, you should see $300+ (4000/12) more each month.

I agree with the previous comment. I understand the tax rebate is a nice way to force you to save, but if money is tight at the end of every month, I would increase my witholding exemptions to at least 2 or 3. That way you can have a bit more breathing room and still get the benfits of a forced savings acct.

if i ever felt truly pinched or tight or like i was missing out i would go to HR and immediately change my withholding. so far i do better with a big check once a year, i learned during my Dave Ramsey days that the more i have the more things tend to “come up”.

i may go change it to 1 just to have a bit more cash flow and that is something that i talk about with my fiance.

Len! I stumbled on your blog last week and I enjoy it a lot.

Tracie, you’re doing fine and I’m inspired to know that one can live so well near the coast. How far are you from the beach? Are you within walking distance?

Hi Sal!

Thanks, my house is older (built in 1977) so that helps keep things low. I am about a 10-15 minute car ride from the beach. We are withing walking distance to a park with a river and walking distance to a waterway.

Thank you, Sal.

We have family game nights too once or twice a month. They’re one of the best ways I know to have fun on a tight budget. Right now my kids are younger so we play games like Candy Land and Chutes and Ladders. Do you have any favorites?

The cake for dinner idea is cute too! If only I could bake. 🙂

Right now Monopoly is big in our house, and this game called Dinosaurs Extinction for board games, that and Mouse Trap and Connect Four. We also do the Xbox for family game night and play Sonic Racers a lot (it’s a multiple player car driving game) and since we have the kinect the dancing games and Star Wars game is fun too. It is super fun to be able to pretend I’m a Jedi and use the force.

We used to have family game nights too. Not as often now. When our kids were younger we played lots of Candy Land, Chutes/Ladders, and Life. But I’m with you, Tracie — we played even more Connect Four.

I used to play Mouse Trap with the kids, but we eventually lost the guy who dives into the water bucket, so that kind of ended that.

Now that my kids are teenagers, we play Cranium, Apples to Apples — and our new favorite, Things.

(The Honeybee and I got introduced to that game by Joe from Stacking Benjamins when we were at FINCON12 last year.)

Well done, Tracie!!! Errr… Though “Real Housewives” and “Duck Dynasty” were the *very reasons* I cut my own cable.

haha! Real Housewives of Miami starts this week i’m so excited. i’ve heard a lot about Duck Dynasty but haven’t seen it yet, i’m almost afraid, i don’t think i need another show to keep up with 😉

You and the Honeybee would get along famously, Tracie. She faithfully watches all five Housewife series: OC, NY, NJ, Miami, and … I can’t remember the last one.

Atlanta!!! And Beverly Hills!

I’m with you Tracie, I’d never get rid of our satellite! I watch all 6 Housewife series and I’m not ashamed to say, “I’ve never missed an episode!”

Okay, six. 😉

Experiment time for Tracie and the Honeybee:

Would you please rank all six series from your favorite to least favorite? Pretty please.

1. Orange County

2. New Jersey

3. Beverly Hills

4. Miami

5. New York

6. Atlanta

1. Orange County

2. New Jersey

3. Atlanta

4. Beverly Hills

5. Miami

6. New York

Tracie, I’m curious to know when your fiance finds work, how will your spending change? Even though you seem to think you are flying by the seat of your pants it seems to me that you are very disciplined. A second income is quite a windfall for people who have their act together.

I’m sure you’ll pad your emergency fund, but then what? Do you anticipate upping your retirement savings? Will you set aside money for a vacation, or home improvements?

We will work on getting an emergency fund fully funded first. After that I would love to add a deck to the house, but the first thing going up will be the food budget. We love good food so we’ll probably be eating sushi a lot more. I expect we will try and take our son on a family vacation to Disney World.

Other than that I’m not sure what we’ll do. We pretty much do what we want already so it will be nice to have some fun money.

I will up my 401k contribution for sure, and I would really really love to be able to give my son the gift of debt free college education like I was given.

I know you say you don’t feel deprived and well you shouldn’t! It is obvious to me that you have a very **rich** life. Keep fightin the good fight and congratulations! 🙂

Thank you so much!!!

We don’t cut our cable either because we consider it a big part of our entertainment budget while we work our way out of debt. Once your fiance gets a job, hopefully things loosen up a bit and you can save a bit more money!

Thanks! That’s the plan. And I know what you mean about tv and the entertainment….Walking Dead anyone??

Suggest unemployed fiancé get job evenings and weekends, delivering pizza maybe, fast food restaurant, whatever. He could contribute something to the finances that way. Doesn’t take two adults to watch one child evenings and weekends. All the money earned could be put in savings. This would also give Mom some alone time with her child.

you are right and that is something we should absolutely consider. as of right now though i don’t really want him to work nights and weekends, then i would never see him and we wouldn’t get any family time, especially when school starts up again for our son in 3 weeks.

when school starts up again he will start looking for a first shift job, although i’m lobbying hard for him to keep being a stay at home dad. i love coming home to a clean house with the laundry already done 🙂

Sorry, Tracie, forgot to mention what a great job you are doing and how self disciplined you are! Super job!

Thank you so much!

Tracy,

Have you considered getting a Hulu subscription? We currently pay about $13/month for Hulu&Netflix, that’s a $924 yearly savings over your cable bill. Although I’m not a Housewives fan, I *think* it might be carried on Hulu so you might not even miss out.

As for the fiancee, has he considered working from home. I have a full-time job but have side activites I do from time to time that usually pull an extra $1,000 month into our budget. If your husband has nights/weekends free, I’d imagine he could earn substantially more than that.

If nothing else, he oughta hang around Home Depot/Lowes for their free building classes and start designing your deck:)

lol! i love the home depot/lowes suggestion. i’ll be sure to pass that one along!!

i’ll have to look into the hulu thing, i haven’t heard of it but if they carry housewives i’m already a fan.

I LOVE Hulu but I don’t think the subscription version is worth it. The free version along with Netflix are what I have found the most worthy after cutting the cord. Keep up the great work, Tracie!!!!

Kudos to you Tracie. You mention that you have life insurance on your son. Isn’t the life insurance on you? If you die, your son will get a payout to help support him until he reaches 18. That to me would be the smarter choice rather than you getting a life insurance policy on your son.

I probably didn’t get the info to Len correctly. I have life insurance through my employer which costs me 5.16 per pay period in deductions (pre tax i think). For that I am insured for 750,000 and my son is insured for 10,000.

I don’t have a separate private policy or anything. Everything I have is through my work.

Where’s the “Like” button for this? 😀

Your life insurance deduction is almost certainly after-tax.

So any payout would be tax-free.

It’s impressive your employer offers such a generous life insurance plan, and kudos to you for taking advantage of it – often policies through work are limited to 5 times salary.

I’m a little worried about your high housing expense (over 50% of income).

Can you re-fi? (assuming an older mortgage with a higher rate than currently available)

thanks for the info about pre-tax. i always forget what comes out pre and post tax for my benefits. i’m always more interested in what gets direct deposited.

i really like the life insurance too! to break it down its 250,000 no matter what and 500,000 accidental death or dismemberment with payouts for disability if i didn’t actually die.

thanks for the suggestion of a re-fi. i hadn’t even thought of it to be honest, its at 5% now so i could probably call the bank and see if its an option. i did some googling and the closing costs have always been what held me back, but i see you can roll it into the loan in a couple of instances if i read it correctly.

Tracie, you’re doing great.

You are not living “paycheck-to-paycheck” with $33,000 in your 401k. My understanding is that term refers to folks who have nothing other than their monthly paycheck.