The most common reader question I get is this one:

The most common reader question I get is this one:

“How can I pay off my credit card debt as quickly as possible?”

I always pay my credit card balances in full at the end of every month. That being said, I know exactly how I’d handle it if I ever did find myself drowning in an ocean of red ink.

Taking a methodical pragmatic approach is the smartest way to free yourself from a life of indentured financial servitude. If you’re serious about getting out of debt as quickly — and inexpensively — as possible, here’s how:

1. Verify everyone’s committed to paying down the debt. It’s true; the best laid plans of mice and men often go awry. Whether you’re single or married, you’re destined for failure unless everyone is ready to accept the personal responsibility and tough decisions required from those who are committed to spending less than they earn.

2. Take stock of the current situation. It’s tough to develop a plan unless you know where you stand. To do that, you need to run your household like a business. That means getting a handle how much money comes in each month and tracking where every last penny is going.

3. Identify and eliminate all discretionary spending. Once you know where all your money is going, you can identify and do away with the unnecessary expenses. Putting your needs before your wants will allow you to muster the extra funds you’ll need to help pay down that credit card debt.

4. Create a budget. As I have said here many times before, those who fail to plan are essentially planning to fail. A budget is not just a spending plan for your money — it’s a valuable tool that helps you control spending, and set money aside for retirement and rainy days. Most importantly, though, budgets instill financial discipline in those who really need it.

5. Ignore the urge to stop making retirement contributions. When you’re creating your budget, don’t try to boost cash flow by stopping automatic paycheck deductions to your retirement savings plan. Over time, the tax breaks and future investment gains you’ll receive by building your retirement savings should more than make up for the extra credit card interest you’ll be temporarily paying.

6. Consolidate multiple credit balances to a single low-interest card. If you’re carrying balances on multiple credit cards, see if you can transfer them to a single low-interest rate credit card. At the very least, call up your credit card companies and ask them to lower your interest rate; if they strongly suspect you’ll transfer your balance to another card, they just might honor your request.

7. Pay down the highest interest rate credit card first. Although psychologically appealing for some people, it makes little financial sense to pay down credit cards charging 0% interest on, say, a $1000 balance, while simultaneously making minimum payments on others charging as much as 29% interest with even higher balances. Instead, pay the highest-rate card first — regardless of how much you owe on it — before focusing on your remaining cards in descending order. In the mean time, make only the minimum payments on all the other credit cards.

8. Make multiple payments to reduce your interest charges. Just as making biweekly payments can greatly reduce the interest paid on a 15 or 30-year mortgage, dividing your monthly credit card payment in two and then paying that amount every two weeks will reduce your credit card finance charges.

9. Raid your emergency fund. I know. Yes, this advice makes some people extremely uncomfortable. However, if you take emotion out of the equation, using low-interest savings to pay down your high-interest credit card debt makes good financial sense. And keep in mind that you’ll still have access to those funds in an emergency because — as long as you keep faithfully paying down your credit card debt each month — you should always be able to tap your credit card should a crisis arise.

10. Apply all your financial windfalls to your credit card balances. Until you’ve paid off your last credit card, the money you receive from things like overtime, tax refunds, and even garage sales should be used to pay down your highest-interest rate credit card balance. Hey, it all adds up!

11. Find a way to make a few extra bucks. No; I don’t mean trying your luck at online gambling sites. Instead, if you’ve got the time, look into alternative ways to make extra money that can be applied to paying down your credit card debt.

Staying away from credit card debt requires military discipline, but getting out of debt requires discipline too. The good news is, once you commit yourself to getting your financial house back in order, you’ll soon discover that the task at hand is nowhere near as daunting as you might have expected — regardless of how much money you owe.

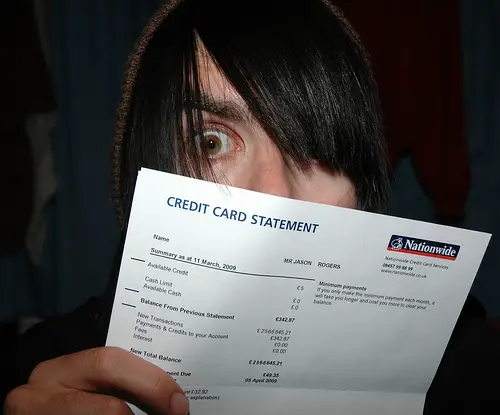

Photo Credit: xJason.Rogersx

I have heard that making frequent small payments on a mortgage during the month (as per point #8) pays it off quicker than only paying once a month. I tried searching your site through Google and could not find an article that explains WHY this is? Do you have one or a link to someone that does?? Thanks.

Greg, by making biweekly payments, you pay off the loan quicker because you end up making one additional payment each year.

In essence, with biweekly payments you are making 26 half-payments each year (which comes out to 13 full monthly payments) — as opposed to only 12 full monthly payments if you paid one payment per month.

You are correct Len, but there is a second way this saves money. Every time you make a half payment 2 weeks early, YOU DON’T OWE THE INTEREST ON THAT AMOUNT OF PRINCIPLE FOR THE NEXT TWO WEEKS. So you are saving that amount of interest in addition to the extra payment each year. this sounds small, but over the life of a load, not paying interest on this money mounts up to a large savings.

I paid off $11,000 in about 2.5 years by extra payments

Congratulations!

Unfortunately, I have a lot more experience paying off credit cards than Len. All of this is great advice but two things are really important:

1. Don’t stop saving to pay off debts. The dumbest thing I have done is to ring up credit card balances. The smartest was to keep saving while I paid them off.

2. Apply all of your windfalls to credit card balances. Nothing feels better than to project a payoff date and beat it because of a windfall. Plus, it balances the emergencies and setbacks that will happen.

Well, I have a lot of experience paying off credit cards, Bret. It’s just that I’ve always paid them off in full at the end of every month. 😜

Bret if you have credit card debt at 10%, 15%, 29% and a savings account giving you less than one percent interest (often way less!) there is no point, once you have an emergency fund, to save more until the credit card debt is gone. The amount of money you save paying off credit cards is so vast compared to the interest that you would earn on extra savings that saving is a bad deal until the credit cards are paid in full. Every dollar of credit card interest you do not pay saves you at least $1.35 because you have to earn money to pay taxes on earned money before you can spend it. If you have a savings account at less than one percent interest the government will charge you income taxes on the interest negating even more of the benefit of saving.

Thank you so much for giving this much needed blueprint on eliminating debt. I didn’t know many of these ideas.

You’re very welcome, Sabz. I’m glad it helped you out.

Len,

might add one more to this list;

12. set a date when you’ll be debt free as an incentive to make those monthly payments and as a time to celebrate with a reward for yourself.

——

as for bi-weekly mortgage payments, a question;

since payment are made up of principle, interest, escrow charges and in some cases mortgage insurance aren’t you also paying in an extra month of charges also, not just additional principle?

wouldn’t you be better off taking your payment and dividing it by 12 and making this additional payment once a month thus making 13 payments on principle and only 12 payments on interest, escrow and insurance?

Agreed. It’s always nice to have something to look forward to, Griper!

As for your mortgage questions:

Yes, if you have an escrow account for taxes and insurance, you can either exclude those charges when figuring out your payment, or include them and receive the benefit of an even faster loan pay-down (because that extra money would be applied to paying down your principle).

The short answer to your second question: for standard mortgages, generally speaking, making a single higher extra payment is going to result in a faster — but almost negligible — payoff, although it ultimately depends on your loan balance and interest rate.

The benefit mainly depends on your mortgage holder’s policy. Many do not credit multiple payments until the end of the month. 2. You still have to send in a payment equal to the required total before a credit is made. 3. With some you need to be a month ahead on your mortgage before an alternative payment plan will work in which case you might as well do larger lump sums. 4. Their software will likely not compute the interest reduction the same as yours because of practice of not crediting payments immediately. 5. Some will only credit 2 or 3 per month, 6. And finally it’s just easier for the bank to not credit you correctly at all. For your own record keeping sanity make absolutely consistent extra payments on quarterly basis or exactly the same amount accompanying your mortgage monthly. No middle of the month extras. Thusly your extra principal will be clearly credited. When you finally go for the payoff it will be dead simple to compute.

12) Find cheap/free sources of entertainment: The best laid plans often fail because a life of complete austerity is crazy boring and most people aren’t willing to live that way.

Good advice. That’s just one of many reasons why digging yourself out of debt requires maturity and a real commitment to fiscal and personal responsibility.

Len, it also makes sense to consolidate all of your credit card debt onto the one lowest interest card or other low interest loan.

Wait a minute … I covered that in number 6, Mindimoo! One point, however: I’m not hip on converting your credit card debt to a low-interest loan if that loan is secured with collateral. That’s because if you default on an unsecured loan, you damage your credit score, but if you default on a secured loan you could lose something much more valuable — like your home!

Oops – how did I miss that!! 🤔

Hey Len, Re: #6. Here are my circumstances: Total credit card debt of $30,000. (Yes, that’s not a misprint.) I have 24 credit cards, have been transferring to 0% to 1.99% offers and currently have balances on 10 credit cards. I lease a house that is too large for me to take care of due to my health. There is approximately $110,000 equity…that’s how most of the credit card debt evolved. Still owe a mortgage on it. Bought a smaller, cheaper 2nd home to live in that needs almost everything but do have approximately $50,000 equity in it as well. I am so sick of juggling the credit cards and having no cash flow. I have been disclipined about not charging for the past couple of years. Can you give me any ideas??!! Been thinking about refinancing the credit cards with the leased house which would be equal to the current monthly payment. My credit score is mid to high 700’s but income is only around $42,000. Any ideas? Pretty tired of debt owning my life and no cash flow.

Hope you have some much needed suggestons.

Thank you.

DT

Speaking only in terms of what I would do…

Although it’s hard to give a pat answer because there are so many things that would come into consideration for me. For example, things like how close I was to retirement, how much did I owe on my home, my living expenses, etc.

One thing is certain, I wouldn’t refinance either home to pay down the credit cards. As I mentioned to Mindimoo, I don’t think it is wise to trade non-secured credit card debt for secured debt like a home.

If the home I was leasing did not provide a significant source of my $42k income — I think I would sell the house and unlock that $110,000 equity, pay off the credit cards and then — depending on my age and how close I was to retirement — invest and/or save the rest of the money. And perhaps spend some of it to upgrade my smaller home to make it more comfortable for me.

But that’s just me. Your mileage may vary, Dianna.

I don’t know if it’s different in the US to the UK, but here there is a mechanism where defaulted credit card debt can be secured against your house by a creditor anyway, so “unsecured” isn’t necessarily the case, and could potentially lead to a forced sale of a property depending on who owns it and whose debt it is.

Another point is that a secured loan would almost certainly be a much cheaper rate than a credit card, so you could pay it off quicker and save a lot on the interest. You’d be debt free earlier.

I think you’re right, KC! 😃

Creating a budget can really help you pay off your loans fast. You have to know where you money is going before you can do anything with debt. I am being successful so far in paying off my debt by managing my budget closely. It really does help speed up your payments.

Len, Len, Len, these things sound good, but dude, they sound like work. What’s up with that?

Oh yeah, your blog is for “Responsible People” bummer man!

If you are committed, you can do it. Great tips!

If you have a bill paying service at your bank then use it to your advantage. If you have a credit card bill that requires that you to pay a minimum payment of $40, then double that amount to $80. Divide the $80 to 4 weekly payments of $20. Set up your bill paying service at your bank to automatically pay $20 every Friday. (or whatever day you choose). I guarantee you’ll never miss the weekly $20. Its automatic. Its all about cash flow.

Great tip, Terry. Thanks!

Great tips, Len. I especially like #5. Raiding the emergency fund is something I’ve considered, but I’m not sure I’d be able to get my wife on board with it.

This is great advice! I have been really trying to dig out of debt and it is HARD – we all know this. This tips are fantastic though. I’m just in a bad habit of seeing “ooh, I have extra money” and spending it on something that is really of no benefit to my bank account or well being.

Running your house like a business is a smart way to go. No business likes to have a deficit every month/year and if they do the business won’t last too long.