Taking on excessive debt — and continuously spending more than you earn — greatly reduces the wealth you can accumulate down the road. As a result, your options in the future become greatly diminished because you are essentially spending tomorrow’s wages today. In short, accruing excessive debt can severely limit your choices in life as you get older, thereby making you an indentured servant to your lenders.

Taking on excessive debt — and continuously spending more than you earn — greatly reduces the wealth you can accumulate down the road. As a result, your options in the future become greatly diminished because you are essentially spending tomorrow’s wages today. In short, accruing excessive debt can severely limit your choices in life as you get older, thereby making you an indentured servant to your lenders.

The bottom line: By staying away from excessive debt you’ll not only maintain more control over your life as you get older, you’ll also avoid the chains that prevent you from ever attaining financial freedom.

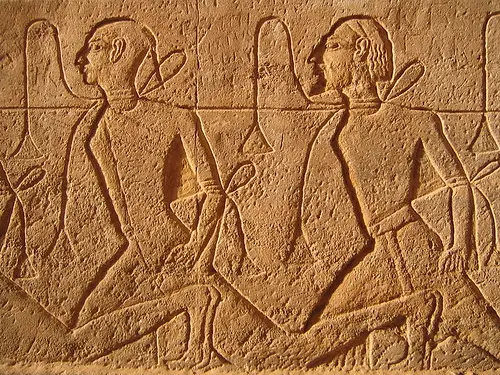

Photo Credit: kudumomo

I take the position that ANY DEBT (as opposed to excessive debt) makes a person a slave.

There are two types of people: Those who understand the difference between principle and interest, and those that do not.

Principle is the basis for the amount of interest you PAY. INTEREST is what you get from the PRINCIPLE of others, who have debt.

I prefer to live in the second batch of folks!

Fair enough. 🙂 My position, Spedie, is that not all debt is bad debt (a home mortgage assuming you don’t buy more house than you can afford, business loans, higher education loans for worthy degrees). These are loans that permit folks to acquire things they would never be able to save for — or at least require them to save an excessively long time. To me, if the loan payment(s) for good debt are reasonable and do not pinch your lifestyle, then I personally would not consider that servitude. But that’s me.

Taking on any debt is bad IMO. But society is ingrained to think taking on a mortgage is OK.

Agreed. It’s so difficult to get get out of the pattern, but so easy to get into. Many also dont realize when they are doing it, and dont think they can turn around at all, so they use that as justification to continue down the same path.

If you can’t put away 20% of what you earn for retirement then you are an indentured servant, because you will have to toil in your twilight years, just to survive.

By the way – I love the term indentured servant being associated with debt!

Thanks!

That’s 101 words you liar! You’re the worst Len! Oh, sorry, you’re right, 100. just kidding; I do love these posts.

I’m curious if this was a narrative on the US deficit spending spree or Americans in general.

Your sentiments are true to both, but what is even more egregious is when the government overspends since it punishes responsible individuals with higher taxes regardless of their contribution to the societal debt.

And you will also be able to hopefully handle any health (or other) expenses that come along without stressing out.

Freedom to make choices instead of having choices made for you is a great thing.

I like these 100 word posts. You’re right on.

@Squirrelers: This little factoid was pointed out to me by my cousin Kevin when I was still in college, and it is what solidified my determination to always be in control of my finances. To be in control of your personal finances is control your life.

@Darwin: Is it? I may have erred, although, just for the record, my goal is to try to hit 100 words exactly on all of these posts. 🙂 The government’s overspending also punishes us responsible folks because it can eventually lead to inflation, which hurts us net savers.

@Everyday: That it is, Kris!

@FirstGen: I’m glad you enjoy them. Thank you. 🙂

You got to the point very efficently here, and I totally agree. When in debt, you work for others. You aren’t in control of your time and energy – someone else is. That’s lousy. Is a material “want” worth becoming an indentured servant? No. Do what you can to avoid having your financial life structured that way!

I agree completely – most debt is bad news!!!

I have a question for you/your followers: my wife and I have been averse to debt for most of our adult lives (in our 40’s). We are routinely amazed at the financial mistakes our younger neighbors make (early 30’s); expensive new cars every couple of years, not saving for retirement, foregoing health insurance as its “too expensive”, etc. We can see the road they are on and the cycle they will never break away from without some enlightenment.

Since we all know people like this, I am curious what others do to “help”? Anything? Sit back and watch them continue? A touchy subject to be sure, just curious the thoughts of others…

Thanks!

I have a dear friend who is deeply in debt, having repeatedly re-mortgaged their home to pay off credit card and other debts. They always asked my advice, and I repeatedly warned that they were putting the roof over their head up for collateral. The answer has always been that It would just be this time, and then they would change their ways.

It is now years later, their home is mortgaged for more than three times its original price (and much more than it is worth now), and the credit cards are all maxed out again. Retirement is only a few years off, and their options are few.

People like this will never learn.

I, PERSONALY, liked your old stance on paying off the mortgage. I understand your flip-flop. Why not, with the crash and current FED policy allowing interest rates that no one could have foretold? I get that. BUT, purchase a home within your realistic budget get the upfront out of the way and then pay it off. Don’t suckle at the teat. Leverage is leverage no matter how you look at it. I’m not referencing some objective on peace of mind—I’m referencing money and security “wellness”� that happens to support moral peace of mind. The latest thing that I can tie this to is how some think it’s okay to lock into Obamacare since they have all the tax implications and benefits in finding a way to get free health insurance when they technically make over the limit — but, after deductions, can blurt out medicaid! You spent it, you owe it, there’s no moral reason (FED policy/ low interest rates or not) to hide it. I have such great disdain for what is happening all around us (banks getting the goodies while the rest of us …) that I don’t want the banks (central bank to!) to even earn 4% off of me for what they got for less than 1% from. Perhaps I digress. Mine is mine– and it still isn’t mine unless I pay my property taxes — it can still vanish. So, paying off my mortgage was the best thing I have ever done. It’s kind of like pulling up the middle finger on everything that I can’t believe is happening around me. Hey, HAPPY HALLOWEEN LEN! Sorry to rant. Not a trick, I promise. Just a libertarian, saying “What?”

No worries. I think you make some great points. After all, I’m a libertarian too — so there’s no surprise there.

The mortgage thing is deeply personal; I am convinced there is no right answer — at least as long as our government, aided and abetted by the clueless Fed, continues to pursue their reckless monetary policies, which only serve to hasten the demise of our current monetary system.

And don’t get me started on the evils of Obamacare …

@Chris – I have found that mostly people do not want your help. Offer it once, then let them come to you. For example, when your neighbor complains about the payments on something, comment that you’ve had good success with Ramsey’s program (or whatever). Then wait for the add-on questions – or not.

I find the only debt worth taking on are mortgages for cash flowing rental properties.

Spending tomorrow’s money is easy. Finding more tomorrows to repay the debt is far more difficult.

I won’t defend taking on debt generally, just because I know it’s the wrong answer for most people.

But I’m almost certain it was the right answer for me as the schooling (that gave me all this debt) more than doubled my income. I’ll hit the break-even point in about three years, so assuming I live that long, taking on debt will have been correct.

Amen, brother!

Short, sweet and REALLY POWERFUL!

I prefer to have my dollars be enslaved to me, earning me a living…not the other way around.

@Chris, I am a person who was helped by a friend. She knew that my husband and I were in financial stress, and she knew that her occasional offers of wisdom were not going anywhere fast with us. She then asked if we’d be interested in listening to Dave Ramsey’s CD Book The Total Money Makeover. I accepted in a “whatever” kind of way. The CD gave me a vision that my husband likewise adopted upon hearing it – and there’s been no turning back. We’re almost a year and a half into our journey out of debt. If your own words don’t have any impact on your neighbors (who really do sound like they could use some good advice)perhaps you could try lending a book/audio book/DVD that you have found effective. Your intentions are good. Your neighbors might some day consider themselves lucky to know you.

Get into massive debt, that’s the American way. Just look at our local, state and federal governments. The American population no longer save, they spend, they no longer produce they consume. We are truly a debtor nation!

I grew up reading the Bible in Proverbs, where it said in many different ways that ‘the borrower is slave to the lender’.

Proverbs goes to great lengths to tell us how much of a bad idea debt truly is.

Now the way our society is set up, it is pretty difficult not to get debt somewhere – at least student loans and a mortgage.

However I think we’d all agree that a lot of our debts are for things we could have done differently. A much cheaper, used car saved up for, furnishings and home decor not put on a credit card – you name it.

Now that I’m an adult and am dealing with debts, both ‘good’ and ‘bad’, I really understand why Proverbs was so opposed to debt. I hate it.

I hate being a slave to it. And when you get down to it, we are. We’re slaves to the lender. Until it is paid off we are not truly free. When in debt you can’t just up and move across the country, or hitchhike the Alps, because you have monthly payments to make.

It is enslaving and I can’t wait to be free of it!