It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I hope everybody had a wonderful week. And with that, let’s get right to this week’s commentary, shall we?

Hitting rock bottom is an opportunity to rebuild.

— Anonymous

We’ve come to the edge of the abyss. Now it’s time to take a bold step forward.

— Ed Balls

Credits and Debits

Credit: Did you see this? A new Harvard poll has found that, for the first time in four years, a slight majority of Americans perceive the economy as “strong” – this despite constant fear peddling from mainstream media that trade tariffs will harm the economy. Huh. We’re not sure if this is more evidence that the mainstream media has truly lost any semblance of credibility, or that its ability to influence a significant portion of the public is finally dead.

Credit: On a related note, the CFO for Home Depot said this week that the home improvement retailer has diversified where it sources its merchandise and doesn’t plan to raise prices because of higher tariffs. In fact, more than half of all its inventory is American made – and no foreign nation supplies more than 10% of its inventory. This is in direct opposition to WalMart, which warned that it would most likely have to raise prices by the end of this month because the majority its inventory is currently sourced from China. See how that works? Oh, and speaking of sources …

Debit: Meanwhile, over on Wall Street, the Big 3 stock market indices all finished in the red on Friday. The Dow Jones Industrial Average sank 0.6%, the S&P 500 fell 0.7% and the tech-heavy Nasdaq Composite backed off 1%. That only served to make the major averages’ weekly performance figures worse than they already were. In fact, for the week, all three major averages fell more than 2%. Needless to say, the bear market continues. Then again, for some people, it’s always a bear market …

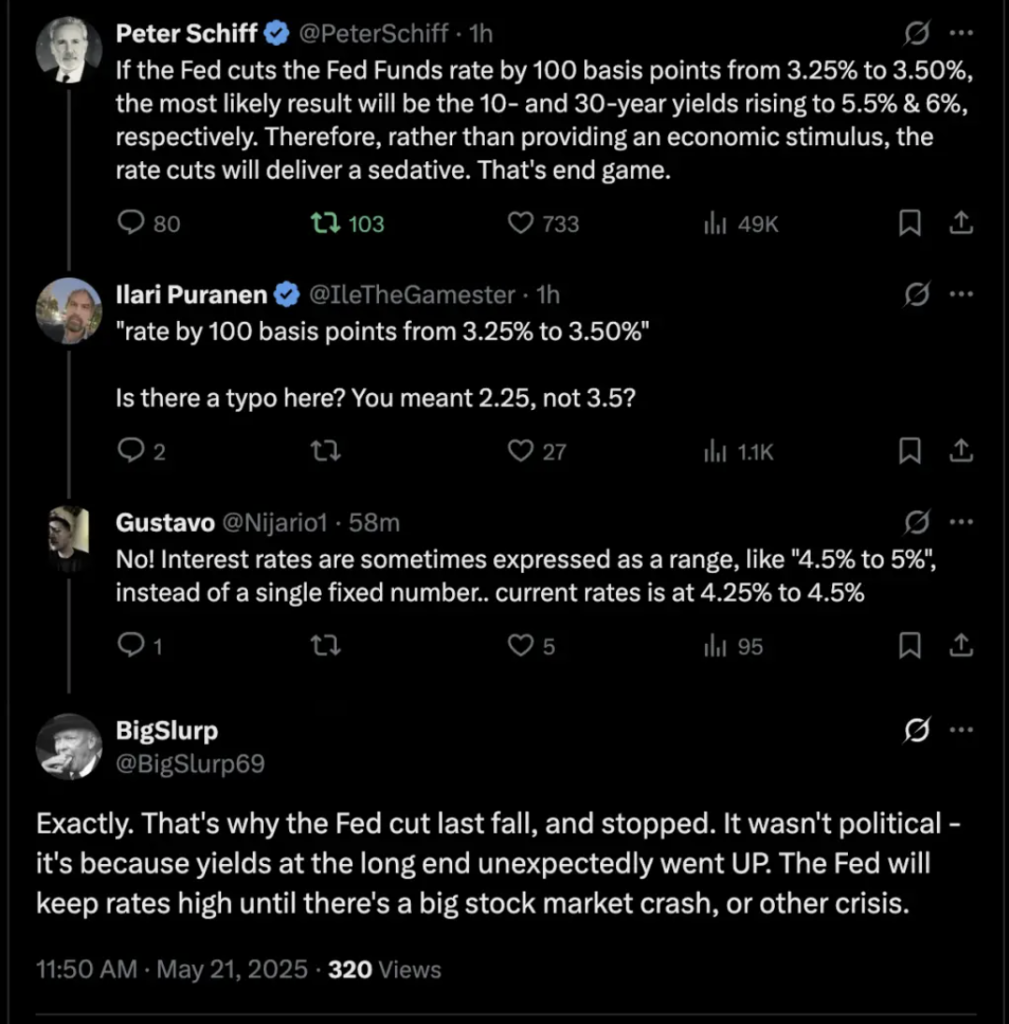

Debit: Last week, the Moody’s rating agency downgraded the US credit rating by a notch to “Aa1” from “Aaa”, citing rising debt and interest “that are significantly higher than similarly rated sovereigns.” For those not counting at home, that was the last top credit rating the US had among the major credit rating agencies. Yes; that means higher interest rates to borrow in the future. Oh … and we know what you’re thinking. So here’s a refresher for those who forgot what each of the credit rating scores actually mean …

h/t: @GoldSilverHQ via @TFMetals

h/t: @Foundation_Bots

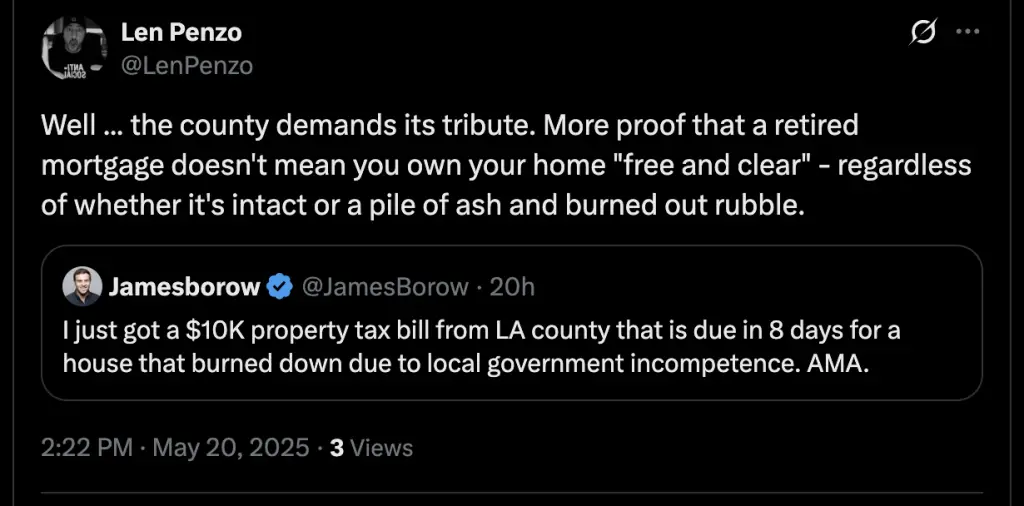

Debit: The lower credit rating is not surprising when considering that the federal budget deficit is running near $2 trillion a year – that’s more than 6% of gross domestic product (GDP). At least the US government can print its own currency to “pay” the bills – unlike the many state and local governments who currently find themselves in deep fiscal holes. On the bright side, at least all of that local spending – and the taxes that partially support it – is being put to good use by highly-pragmatic leaders. Oh, wait …

Debit: Meanwhile, America’s nearly $37 trillion National Debt has already surpassed the size of its economy – especially since the pandemic borrowing. Making matters worse, higher interest rates have also pushed up the cost to service the debt. As sagacious macro analyst Franklin Sanders points out, “This year $9.2 trillion of that debt matures and must be rolled over at much higher rates. The snowball is rolling downhill. When does it become uncontrollable?” It’s a good question. Eventually the debt will lead to destruction of the US dollar (USD). If only that was as fun as destroying this stuff:

Credit: Macro analyst David Jansen pointed out this week that, “for decades … central banks have executed – and denied – inflationary monetary policies that inflated global debt and asset bubbles that are now collapsing. After their 2008 global bubble collapse, central banks purchased more than $21 trillion of assets to fake their value as a ‘solution.’” Oh … and speaking of fake news …

Editor’s Note: This applies to central bankers too.

Credit: With all that in mind, it shouldn’t be surprising that macro analyst John Rubino is reporting that a growing number of experts are concluding that a new Bretton Woods monetary agreement is imminent, which is why central banks around the world are “stocking up on gold” and, as a result, driving up its price. Hmmm. “Stocking up“? Or furiously replenishing their vaults before the monetary system SHTF with all of the yellow metal they leased into the market over the past several decades to keep the price suppressed?

Credit: Indeed, this week none other than the European Central Bank (ECB) warned that investors are now showing “high demand for gold as a safe haven and, a notable preference for gold futures contracts to be settled physically. So any disruption in the physical gold market could increase the risk of a squeeze, leaving (short sellers) exposed to potentially large losses.” Uh huh. Translation: Central banks expect a very sharp and sudden gold price increase to occur when the market finally calls speculators selling gold contracts who don’t actually own the yellow metal onto the carpet. Scoff if you wish. But as hot tips go, we bet it’s more credible than this:

Credit: Upon reading the ECB’s warning, precious metals analyst Chris Powell wryly noted: “Better late than never, one may suppose. Has the ECB now earned its own tin-foil hat?” The truth is, although they sometimes act like it, central bankers aren’t stupid.

Debit: You can be sure of this: It’s definitely not a coincidence that the seeds of the current monetary mayhem were planted in 1971, when the USD was decoupled from gold. Unfortunately, the current corrupt international monetary system – which is still stubbornly anchored to the fiat USD – continues to determine the totality of life on this planet. At least for a little while longer.

Credit: So here’s the bottom line: Central banks hold gold because they know it’s wealth insurance, par excellence, against a failure of their fraudulent debt-based monetary system and the fiat currency that backs it. So shouldn’t you own a little bit of the yellow metal too? You know … just in case.

The Question of the Week

Last Week’s Poll Results

Which of these bodies of water have you dipped your toes in?

- Atlantic Ocean 23%

- Pacific Ocean 22%

- Gulf of Mexico (America) 18%

- Any of the Great Lakes 15%

- Caribbean Sea 13%

- Mediterranean Sea 7%

- Indian Ocean 2%

More than 1800 Len Penzo dot Com readers responded to last week’s question and it turns out that slightly more of you have set foot in the Atlantic than the Pacific Ocean.

Last week’s question was submitted by reader Frank. If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

By the Numbers

An accounting firm analyzed income and expenditure data from the Bureau of Economic Analysis (BEA) to determine the states with the fastest rising affordability over the past decade, based upon the percentage rise in per capita disposable personal income (income after income taxes) and per capita personal consumption expenditure over the period. Here are the ten most affordable:

10 Arkansas

9 Nebraska

8 Massachusetts

7 Idaho

6 Arizona

5 Minnesota

4 Oregon

3 Nevada

2 Washington

1 South Dakota

Source: Avenues Accounting

Useless News: The Birds and the Bees

A young boy asked his father, “Dad, how were people born?”

His father said, “Adam and Eve made babies, then their babies became adults and made babies, and so on.”

The child then went to his mother, and asked her the same question. She told him, “Well, Honey … We were monkeys; then we evolved to become like we are now.”

The boy, who was now completely confused, quickly ran back to his father and said, “Dad! You lied to me! Mom said we started out as monkeys.”

The father smiled, and then replied, “I didn’t lie to you, son. Your mom was talking about her side of the family.”

(h/t: Sam I Am)

Squirrel Cam

This young California ground squirrel – cheeks packed with extra nuts – was ready for its close-up …

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Here are the top five articles viewed by my 51,223 RSS feed, weekly email subscribers, and other followers over the past 30 days (excluding Black Coffee posts):

- Saving Made Easy: How I Saved $36,000 in 12 Years With This Simple Trick

- How to Retire On Time: 10 Things You Should Be Doing Now

- Why I Prefer a Spreadsheet to Track Expenses and Manage My Finances

- 3 Things That People Overpay For

- 6 Simple Travel Tips That Save Time & Money

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X (Twitter).

3. Become a fan of Len Penzo dot Com on Facebook too!

And last, but not least …

4. Please support this website by patronizing my sponsors!

Thank you!!!! 😊

(The Best of) Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading my article on Why You Should (and Shouldn’t) Use a Credit Card, Laddester L. Conyers shared this observation:

The credit card industry calls people like us who never carry a balance, ‘dead beats.’

Uh huh. But that’s mild compared to what most people call the credit card industry.

If you enjoyed this, please forward it to your friends and family. 😊

I’m Len Penzo and I approved this message.

Photo Credit: public domain

Hi Len, thanks for another good cuppa Joe. So much going on in the world, and depending on which ‘news’ one reads, the USA is once again doing GREAT or everything this administration does is causing the end of civilization. I suspect some folks are rooting for The End so they can blame the other guy!

I worry that many people are just, plain TIRED of all the drama and are tuning it out at this point.

But beautiful South Dakota is going strong, you’ve reminded me to watch “Network” again soon and this Memorial Day weekend we’ll honor those who gave their lives in service to America. Take care everyone! 🙂

Hi Lauren! I was at an expensive high-end steak house (you could easily spend $100+ per person just for the entree) to celebrate my 29th wedding anniversary last week. It was a Tuesday. The place was completely packed with about two dozen people waiting for a table outside the doors. It boggles the mind.

I’m pretty sure we won’t see a visible drop in the economy – and the next (final?) crisis – until the banks panic and the credit stops flowing.

Enjoy your long weekend in beautiful South Dakota. I’d love to be at Custer State Park right about now, kicking back at Sylvan Lake!

Hi Len,

Thanks for the cuppa and greetings from Indiana! I’m here this weekend with some friends to see the Indy 500!

I don’t know much about car racing but I’m excited to see the race tomorrow and I’m enjoying the pre-race festivities.

Have a great Memorial Day weekend everybody! And be sure to say a prayer for those gave their lives for our country.

Sara

Hi Sara! I hope you have a great time! To be honest though, I never got into racing. There’s only so many times I can watch a car go around a big oval before I get bored. ha ha ha

One of the photos from Home Depot reminded me, we need to not only have some hard assets on hand, we need to stock up on lube.

Noted. 🤣