I’m sorry, folks, but I’m just a little surly right now.

I’m sorry, folks, but I’m just a little surly right now.

I just finished reading an article at Cracked that my son showed me entitled: 5 Things Nobody Tells You About Being Poor.

Apparently, the piece was written by a self-professed member of America’s “working poor.” Unfortunately, it was full of specious assertions, excuses, cop-outs, and lame defenses for why it’s “incredibly difficult” to get away from that situation.

Judging by the numerous comments, most of Cracked’s readership were in complete agreement with the author’s assertion that those struggling to make ends meet have virtually no hope of ever escaping their predicament because, if you read between the lines, their unfortunate condition in life is essentially out of their hands; their fate, hopelessly sealed.

Of course, people who buy that defeatist line of thinking usually end up creating a self-fulfilling prophecy. So I created this quick counterpoint for my son, explaining why the Cracked piece is, well … cracked:

1. There’s an industry that profits by keeping you poor.

The Cracked rationale: People who can’t pay their bills have no choice but to go to a payday loan company that charges a fortune in interest.

Alternative excuse that didn’t make the cut: Congress hasn’t passed a law yet making it illegal for payday loan companies to force people to live beyond their means.

Why Cracked is cracked: I realize this is kind of obvious, but it doesn’t cost “the working poor” anything extra when they spend less than they earn. Not one cent.

2. No credit can be just as damaging as bad credit.

The Cracked rationale: “Having no credit will stop you from getting a loan or an apartment just as fast as having bad credit.”

Alternative excuse that didn’t make the cut: “Everybody checks your credit — if I want cable TV, I have to pay $310 worth of start-up fees.” (Oh, wait … that made the cut too.)

Why Cracked is cracked: There is nothing stopping the working poor from getting a secured credit card, using it responsibly, and building a rock solid credit history.

3. Your next expensive disaster is right around the corner.

The Cracked rationale:“Shit happens, always at the exact worst time.”

Alternative excuse that didn’t make the cut:How can you expect anyone to have money available for a rainy day when they’re paying for satellite television service they can’t afford?

Why Cracked is cracked: Stuff happens to everybody at the worst time — poor and rich. It’s called “life.” And it’s why financially responsible members of the working poor put aside a little money each month into an emergency savings fund.

4. You get charged for using your own money.

The Cracked rationale: “Meticulous, flawless record keeping is the difference between surviving and having the bank seize your next paycheck.”

Alternative excuse that didn’t make the cut: It’s impossible to set aside 30 minutes a week to balance a checkbook when there are so many great shows on satellite television.

Why Cracked is cracked: Folks … if you’re having trouble adding and subtracting, buy a calculator.

5. You’re always in survival mode.

The Cracked rationale: “Down here, at this level, you take what you can get. The journey (out of poverty) is like trying to go from the Earth to the Moon.”

Alternative excuse that didn’t make the cut: Not applicable.

Why Cracked is cracked: Nobody said life is easy. Even so, countless members of the working poor sacrifice and move up the economic ladder everyday. Well … at least the ones who aren’t busy making lame excuses.

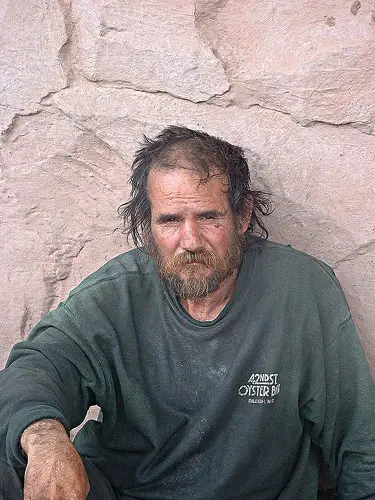

Photo Credit: Arturo Avila

You’re gonna get an ear full from some people on this one Len! I understand where you are coming from but a lot of people insist on equating a call for personal responsibility, hard work and sacrifice as a lack of compassion. Good article and one to be expected on a blog for “responsible people”.

Thank you, Erin.

This comment is probably late. I fully agree with you. John Cheese has been admitted being a selfish irresponsible person that you describe in your article. I’m poor and am among those types of people. I myself am changing careers toward software and work 80 hours a week trying to do that. Trying to change who I am as a person as well. My skill sets have been outdated and my industry is effed like everyone else’s. I’m kinda dumb and easily exhausted. I eat potatoes and lentils everyday. My rent is $350 in Bay Area, CA. I have no family, no parents. They didn’t have a home or inheritance. I don’t believe I’ve ever not been frugal or irresponsible. This “one” might not be worth it to have your reasonable judgments restrained or stop your votes on anything to protect the poor and halt unemployment insurance extensions.(I don’t know politics)but I myself do exist. People look down on the poor for good reason. I’m not that reason. I was a chemist with no grad degree, I think long term, and I can manage money well and I say that I don’t have a bank account because I most definitely will have accidents. I don’t live within my means as in I should be homeless. I’d live in my car if I wouldn’t get fined for it. This is my roommates internet btw. My boss told me he hired the other temp because I’m weird and give him the creeps. I’m working on that,always. I’ve had many girlfriends successful in life so I’m not completely socially broken. But maybe that’s not a good measure. Lessons I’ve learned: Don’t put down you have a college degree when you’re applying for store clerk positions. Must appear familiar to target audience. Breaks over, back to coding exercises.

I’m too busy practicing personal accountability to leave a witty response.

LOL! Get back to me when you finally think of something. I’ll still be here.

Live within your means and if you don’t like your situation work on changing it yourself. Why is this so hard to understand?

Human nature. It’s always easier to sit back and complain than it is do get proactive and actually do something to improve your lot in life. Personal responsibility takes work — and sacrifice.

great great article and i agree with EVERYTHING you said! makes me wish i had facebook so i could link up to this blog so that everyone who whines could get a wake up call!!!

I wish you had Facebook too, tracee!

I don’t know what the deal is – me vs. my older sister, and so far your daughter vs. your son (hoping that will change). Some people seem to almost instinctively “get” fiscal responsibility, and others don’t, even when raised in the same family. Rather like some people seem to be born organized, and others struggle with it their entire lives.

Part of the problem, I think, is a lack of education. “Home Ec” classes are out of fashion now, but I think it needs to be brought back, and teach “common sense” things like how to maintain a check register and reconcile a bank statement. If parents can’t manage their finances, how can they possibly teach their kids?

That said, there are entire industries built around exploiting people who can’t seem to manage: Payday loans, the lottery, bank processes designed to generate more bounced check fees. Whatever happened to usury laws? Seems like consumer protection peaked in the 1970’s, and we’ve been sliding towards a Charlies Dickens world ever since.

When I was in grade school — I can’t remember what grade it was anymore, but I think it was 4th — we were taught how to balance a checkbook. Why don’t they do that anymore?

Still, I’m convinced people who are “good” at personal finance management have brains wired to do so — and therefore, there is still always going to be a segment of the population that really really has to work very hard to keep their finances in good health. I try to teach my son, for example, but even with all my guidance and preaching, it just ain’t sinking in. At least not yet. 😉

My problem with an article like that? It doesn’t make sense at either extreme.

1) If I say, “poor people usually have made poor decisions to be in their situation” – I’m an unfeeling robot. Likewise, if I say “well-off people have generally made good decisions to be in their situation” – a whole barn-full of strawmen will come out to rebut me.

2) To appeal to popular sentiment, I have it down to a science. Tell people life is completely unfair, there is no such thing as luck, and motivation, intelligence, and skill don’t matter at all. Here’s an example: “All poor people are poor due to circumstances beyond their control. All rich people are rich because they stole from the poor, won the lottery, or inherited money”. Simple!

1) Agreed, Paul! It’s a catch-22 that is made even more complicated by those — as Erin alluded to above — who believe asking people who are more than capable of picking themselves up by their bootstraps demonstrates a lack of compassion. Of course, I’ll argue those who continually bail out people like that are the ones who are showing a lack of compassion.

2) The sad thing is, there is a small segment of society that truly believes that too.

I used to be the working poor and I can tell you from my own experience that it sucked. Trying to raise a family of four on one small paycheck is no picnic.

Here is what I did to remedy the situation:

* I put together some goals and worked towards them

* I worked really, really hard and got promoted

* I worked computer shows on weekends for extra money

* I wrote tech manuals at night to make extra money

* I went to night school for years to get a degree

* I saved money for a house and life’s emergencies

None of these things were easy, especially while trying to raise a family. But, they were very effective. I was able to quadruple my income and buy a house for my family.

One thing I didn’t do was to lay around making excuses or blaming others. If someone is poor in America, it’s not the fault of the 1% who got rich. It’s the fault of the person who isn’t making an effort to get ahead.

Great advice, Bret, as usual. I wish the excuse makers would try making their cases to all of the working poor alumni like yourself who prove everyday that nobody needs to stay in that position if they don’t really want to.

And what you did is awesome. I used to be the working poor myself, though I am not now. What offends me about this article is the lack of understanding of how hard it really is. It is REALLY, REALLY hard to get out of. If you have never been there, you wouldn’t know. Spending less than you make is not always possible when all you are spending is for the most basic of needs and you still don’t make enough to cover those. Not everyone has a family member willing to let them live in their basement. I worked two jobs and dug through dumpsters to look for things to sell on ebay to pay bills for me and my kids. Please don’t glamorize it or make it seem like the working poor are complaining for no reason. It completely totally sucks, you are exhausted, overwhelmed, stressed and depressed, ,and while you feel all that you still have to work your butt off to try to improve your situation. How I got out? I kept applying for jobs until I finally got a temp job that hired me permanently. It took 2.5 years. There may be those who complain when they are not really trying, but I can tell you from experience. It is HARD to get out of. I still feel like i got lucky by getting this job, blessed by God is more like it, or I would still be struggling.

Amen!

Besides the fact that the comments above me suggest that everyone in this country operates on the same fair level playing field i agree.

Nobody is allowed to expect equal results. Equal opportunity for everyone is all we can ask for. After that, for most people success depends on hard work, great ideas, and lots of perseverance in the face of adversity.

Amen Brother!! Your life is your responsibility. Take, leave it or change it. It is up to you!

Absolutely!

Len, I have to apologize to you. I am so sorry. When I read this article’s title and the first few paragraphs, I got all bristled up thinking you were going to blame working poor for being working poor — get a job, you bums; you just have to work harder/faster/better and you won’t be working poor anymore. You didn’t do that — thank you — and I’m sorry for thinking you were going to do it.

Then I went to read the article posted on Cracked.com. I am a card-carrying member of the working poor and I have to tell you that I am so offended by that article. I’m having a hard time believing that the person who wrote that didn’t write it as a satire. It is so far off the mark for living as working poor that I can’t believe the author *is* working poor or at least hasn’t come to grips with being working poor. The author sounds more like a spoiled brat who has recently joined the ranks of the working poor. He has no idea how to adjust and wants everyone to boohoo for him as he tries to justify his failure at living as working poor.

#5.You Get Charged for Using Your Own Money

What? Where are these businesses that don’t accept cash? I pay cash for everything. All of my bills are paid within 1/2-mile radius of my house, I pay cash for all of them and get receipts.

While it is true that as working poor, you have to be very meticulous about tracking what you spend so you know what you have left, you shouldn’t have that much to keep track of. As working poor, there are no stops for coffee at Starbucks, no ordering delivery pizza , no lunches out — all those little things that nickel and dime your available funds. If you are working poor, you don’t have the money to spend, period, so if you’re losing track of what you spend, you’re spending too much. If you don’t have enough cash to fill the gas tank, you don’t fill it. You put in only as much as you have cash on hand to spend.

If you do have a checking account and a bank card, turn off the option that allows the bank to “courtesy pay” transactions if you have insufficient funds so you don’t end up turning over your paycheck to cover bank fees.

#4.There is an Industry That Profits by Keeping You Poor

Why on earth is the author going to a payday loan place? If a person is considering a payday loan as a matter of course, he is spending too much money.

What I thought the author was going to talk about here was going to a check-cashing business to have your paycheck cashed because working poor may not have a checking account. Check-cashing businesses charge a fee. As a successful (snicker) working poor person, my advice is to cash the check at the bank on which it was drawn. The bank will cash its own check even if you don’t have an account there. A second alternative would be to open a savings account. Many banks will let you open a savings account with little or no balance restrictions even if they won’t let you open a checking account with them.

I’m not even going to touch the rest of the points in the article. The author is obviously trying to justify why he is a failure and he’s skewing facts and other information to bolster his position. You are correct, and I hope your son listens to you and recognizes that the author of that article is an idiot.

I hope my son does too, Allyn. Thanks for the great comments.

Cashing paychecks is a sore point with me. One former employer (convenience store) released paychecks at or after 5:00 p.m. on Friday.

His bank (on which the paychecks were drawn) was open – you guessed it – 9:00 to 5:00, Monday through Friday. There was no way to get that paycheck there before Monday morning.

More than half the store’s sales volume was generated Friday-through-Sunday, allowing my employer to funnel plenty of cash into the bank in time for Monday morning opening.

Direct deposit was, of course, out of the question – that would have eliminated the weekend float on which my employer depended. And these were minimum wage paychecks; the only one getting rich was our employer.

Have you ever tried paying a landlord with cash?

Yep, my tenants have. I give them a receipt. I deposit the cash – no problem!

In addition to cashing your paycheck at the bank it was drawn on (I seem to remember long ago there was a law that if your employer didn’t pay you in cash, you had to be able to cash your check at their bank, and they had to, in my state at the time, give you time–15 minutes or so–to go to the bank), why can’t working people open a bank account at a local savings bank or credit union? It’s the giant commercial banks that set the bar too high for many people to keep an account.

Savings banks and credit unions usually don’t have minimum balance requirements. I don’t recall any bank where I ever had an account ask me how much I earned or demanding I make an exorbitant deposit to open an account. The credit union requires I keep a balance of $5 in an ordinary savings account–an amount that is quite reasonable.

I once lived in Los Angeles and was self employed. I received a check from a client and went the bank to cash it. Their check, their bank. They wouldn’t cash it unless I opened an account…. I’d only been in LA a few weeks, but I vowed to NEVER bank with [insert well known BIG Bank here] again!!! So far, I’ve kept my word.

1) You have an awesome name. Spelled just like my Dad’s name. 😀 2) My kids are struggling with this whole thing right now, as neither of them have done much with college education, both have worked in a burger shop, and both struggle with no much money. My wife and I taught them about Dave Ramsey, so they at least know not to borrow money and get into worse debt, and one of them is not bad at saving, so I hope they will do better in life moving ahead. Education and planning is the key. I was broke for years, always trying to borrow my way out of being poor. I worked very hard, earning overtime, getting IT certifications, and earned raises and promotions to get ahead, and none of it was easy. We’re not rich, but we aren’t buried in debt any more.

Well said brother!

Thank you, Dr. Dean. (I just knew you’d agree with me!)

Great post – even managed to inject a little humor into it – !

It reminded me of a nice company that I once worked for, where the company provided free coffee, tea, sugar, milk, diet sweetner PLUS having a complete kitchen (fridge, stove, oven, toaster, microwave, dishwasher) for the staff to fix snacks and lunches.

Almost everyone always drank the free coffee and brought food from home to microwave or cook for lunches and snacks, or made their own sandwiches with fixings from ShopRite.

Who didn’t? The assistant bookkeeper whose car was falling apart, who was twice divorced with two little kids and no husband, who could barely make her rent, who was always asking for advances on her salary or hitting others up for “$5 till payday” – She “didn’t like the taste of the office coffee” and bought the Roach Coach catering wagon coffee, plus a $3.00 Roach Coach sandwich for lunch every day ’cause she was “too busy getting her kids ready for school in the morning” to grab something for lunch later on.

It’s pretty obvious that the choices you make determine the life you lead, not vice-versa.

And a lot of times, some of the most critical financial choices are made when we are young and lacking the wisdom that only comes with years of life experience. For example, choosing when to become a parent, deciding if/when to buy a home, deciding to avoid credit card debt, etc.

Nice words, Len. Shame kids will see that Cracked article. Haha, I am struggling, but I switched to satellite TV to SAVE money over cable. Oh boy.

That is some expensive cable.

I don’t have satellite or cable.

Instead, bought a digital converter for $50 or so a few years ago, so my t.v. gets better reception.

One-time low fixed cost, zero monthly costs!

That’s what frugality looks like

Good for you, M!

Wow. I was a member of the working poor; a single mom with a baby at age 20 and no degree. Lived in a room in my father’s apartment with a futon, a playpen as a crib and a couple of cardboard boxes for my worldly possessions while I finished school.

Like Bret @ Hope to prosper, I worked my butt off and clawed my way up the corporate ladder to VP. Went from living in a room with nothing to owning my own lovely 3-bedroom home in one of the most expensive areas of the country. I never complained once nor did I make excuses, I just kept working hard and living within my means. My son and I were always clean and well-dressed with clothes from the second-hand store. We ate all our meals at home and I brought my lunch to work. I wore my hair in a simple hairstyle and kept my nails short so I didn’t need to spend hundreds on beauty services. And so on. I always lived within my means and did not have problems paying my bills, never had a payday loan… people need to stop buying crap they can live without and spending more than they can afford. This Gen X still doesn’t understand the sense of entitlement young people have today…

Great story, Ann! — and good advice too. Having a child so young really makes it tough financially, but as you proved, if you’re determined, it’s still very possible for anyone to climb out of a deep financial hole. You just need to be willing to work hard. 🙂

But you lived in your father’s apartment – so you had family to rely on.

I agree that there seems to be a problem with “personal responsibility” these days – it’s eroding for sure.

But it would be false to pretend that there aren’t some truths to the cracked.com article. I’d venture to say that *most* people could avoid these problems by working and living smartly. But that doesn’t mean that it works for everyone.

I have a cousin who had a baby in HS. Ruined her life, right? Nah, finished HS, married the dad, lived with mom, went to the local college (cheap), majored in Physics. She’s 36, her kid is on full engineering scholarship, and did I mention she has a PhD in astrophysics and has applied to NASA?

But – she’s smart. She was raised in a responsible, hard working, supportive family that did not suffer from substance abuse. She was not homeless, her mother was not on drugs. Compare this to some children in my son’s elementary school who are actually homeless.

There’s equal opportunity vs. equal outcomes – but it’s not a level playing field.

People STILL need to work hard and be responsible, but there is nothing wrong with recognizing the problems that exist (and also recognize that there are entire industries that exist to exploit the poor, and large vasts of poor people who have not been taught – by school or by parents – how to avoid this.)

How do we educate everyone? You are right they don’t teach balancing a checkbook in 4th grade. A fair # of kids in my 4th grader’s class are at a first grade level.

If you couldn’t have lived in a room in your father’s apartment, how would your story have turned out? What kind of transportation did you have? or did you use your father’s too?

I’ll start by saying that I didn’t read the cracked article.

I agree with everything you said except the bit about “shit happens.” Yeah shit happens but when the everyday shit- like needing new breaks and tires and a front axel (true story) all at the same time happens to a well off person, the only hiccup in their day is waiting for a replacement vehicle. When it happens to a working poor person living paycheck to paycheck it’s more like “where in the f*** am I going to get $900 to get my car fixed so I can get myself to and from work and my kids to and from school and daycare?”

I’m not making excuses or looking for pity for the poor people but I’m just saying that there is a big difference between everyday shit happening to a poor person and everyday shit happening to a well off person- I mean, what, your yacht got a scratch on the side right before your big birthday bash you are throwing on board? Man I hate it when that happens!

I completely understand, Laura. It is absolutely tougher for a member of the working poor — and when it comes to building an adequate emergency fund, there is no doubt it’s going to take longer.

However, where there’s a will, there’s always a way. For example, some people might decide to take a temporary side job on the weekend, or hold a yard sale, or whatever to help build that fund a little quicker. 🙂

When there is a will, there is always a way. A guy worked for me for a long time who fell into this working poor category, and he never made excuses – he busted his ass, showed up everyday, and took care of his kids responsibly.

When his car broke down, he took the bus until he could get it fixed. Since he was such a responsible employee, if he needed to take off time to attend his kid’s parent-teacher conference, he had already built up enough ‘credibility’ with management that is was a no brainer to let him go.

And when it came to Christmas, while sad, he wasn’t able to afford anything for his kids because he was so on edge to make ends meet. So you know what, we pitched in at work to support. Why? Because this true working poor guy worked hard, made no excuses, and never asked for special treatment or handouts ever.

Great story, Robert! I firmly believe that the responsible, working poor, are the silent majority. Their very nature just makes it hard for most of us to notice.

I’m going to take a stab here and share what I’m thinking. I would venture that there is a distinct and vital difference between those who can move through these situations and those who cannot. I suspect a large majority of poor people have known nothing but poverty and homelessness their entire lives – likely a generational situation. I also would venture that those people are mentally and emotionally broken at their core.

One the other hand I suspect that there are people who “happen” to currently be poor (may have never earned much but…) and/or homeless due to a particular or cluster of unfortunate events. Again, I suspect that the difference between the two groups is how they perceive their situation. For the “have always been poor/homeless” group they probably can’t see their lives any different that what is has always been and as such probably couldn’t figure their way out of a paper bag….chronic homeless, poverty and hunger increases the risk of mental illnesses, including schizophrenia, depression, anxiety and substance addiction. I imagine that for these folks, the decision making abilities are greatly impaired due to their inability to think rationally about their situation, make a plan and execute.

While yes, where there is a will there is a way… if your poor you don’t have stuff good enough for a yard sale or you have nothing to spare – need all you own to live/function normally. And weekened daycare/sitters aren’t cheap. Especially if they know you are using them for a second job – they think you have more to spare then you do. More often then not a second gig costs more then it brings in and the sitter mistreat the children. What they did in my case permanently screwed up my son.

Not making excuses, coming from the school of life experience.

When you try to aggressivly get ahead the people around you tend to think/act oddly or think your dim for being so poor & it makes it harder to fight up.

One thing you can do is sell unwanted gifts that you don’t need at the flea market. We’ve done that a couple times….

A yard sale? I don’t about you, Laura, but when I’m through with stuff nobody else wants it., because 9 times out of 10, I bought it at a yard sale. What are gifts?

If he’s on the computer blogging about his plight, he doesn’t know what it means to be poor. I grew up poor. Homeless poor. No water or electricity poor. No heat in the winter poor.

Americans has a distinct lack of perspective on what it means to be poor. I wouldn’t call myself poor, but I sure as hell don’t have Direct TV. I have free, over the air TV.

I’m going to have to go read the article, because it sounds to me like the person who wrote the article really doesn’t understand what it means to be poor.

And I just want to point out that I do believe the system is stacked to favor those in power, but that doesn’t mean a person can’t manuever within that system to build themselves a comfortable life. (And I do agree with the Occupy protestors in that we need to get Wall Street, Big Money, and unions OUT of the back pockets of our politicians.)

How’s that for contradictory?

Agreed, Steven. There are very few truly poor people in America. I can’t remember the exact figure, but I read that even the poorest Americans live better than something like 60% of people in the rest of the world. I mean, it’s really hard for anyone to call themselves truly poor when they’ve got an automobile, cell phone, television, running water and an indoor toilet.

People can call themselves poor if their income falls below the threshold of what is considered poor in this country. According to the US Census Bureau, a household of two people under the age of 65 earning $14,676 or less are considered living in poverty. Just because people aren’t homeless and destitute doesn’t mean they can’t be poor. I’m not sure where this notion began that if a person has a cell phone, he can’t be poor. If you have a cell phone in addition to a land-line phone, the cell phone is a luxury; but more and more people are opting not to have land-line service and the cell phone is all they have. My cell phone plan is $23 a month — not extravagant. Likewise with Internet access. Just because a person has Internet access doesn’t mean he is living high on the hog. Basic Internet access can be had for $20 a month. I have running water and an indoor toilet that both come with my apartment for which I pay $454 a month. Yes, people can be poor without being homeless.

Of course. But we’re just arguing semantics, aren’t we? 🙂

There’s poor and then there is *poor* — or as I called it “truly poor” — which I meant to be read as “impoverished” which is the inability to afford any type of material comfort.

I agree that anyone with a cell phone may choose to call themselves “poor,” by American standards. But they aren’t poor by world standards. And they certainly aren’t impoverished.

A cell phone – at least one which is prepaid – is pretty much a necessity for any North American who aspires to get out of poverty.

I have a prepaid cell phone which costs $20 every three months (the cheapest deal I have found) and provides enough minutes to stay in contact with relevant individuals and offices (e.g. family, prospective employers, doctor’s office, credit union). In keeping with my theme that life is regressive and being poor is expensive, the cheapest prepaid cell phone is also the most expensive on a per-minute basis, and thus the worst deal or the worst value. Even so, it’s better than nothing.

Home internet is also something I would not begrudge an aspiring poor person. Government job offices are pretty useless for most people looking for most jobs, and especially for unskilled jobs.

Craigslist is just way way way better for finding jobs and other money-making opportunities (“gigs”). And with Craigslist, opportunities are posted and removed within minutes, which is why I spend too much time trolling Craigslist for the latest money-making opportunities. The way you win on CL is to be in the right place at the right time – something you could never do with one hour a day of free internet access at a public library.

Basic internet can be had for $20 per month IF you have an existing landline. I don’t have a landline and don’t even have wiring for a landline, so I can’t get $20 dialup.

And there is no such thing in my area as an apartment for $454 a month. A quick check on Craigslist suggests that the median rent for a ROOM is $450. (257 rooms under $450, 261 rooms over $450, 61 rooms exactly $450)

Respectfully, Terry, have you considered moving to a location with a lower standard of living?

If not, why not?

A cab driver from a third-world country once said to me that he was thrilled to be here in the USA. His exact words were, “I wanted to live in a country where even the poor people are fat.”

And if you’re poor enough for food stamps, you qualify for a cheap cell phone.

Ahhh.. what a breath of fresh air, Len. I can’t say how much I needed to see this article this morning – not because I’m not always teetering on the edge of “the working poor” but because it has brought a whole bunch of community out to comment and reassure me that the whole world doesn’t believe in the excuses that keep people angry and poor (instead of working and hopeful.)

I admit that we have been that family that has 2-3 vehicles but only one running well enough to take my family anywhere at any one time. We are the family that currently has a 5-gallon bucket under the sink because our plumbing needs completely redone and spending $5K just isn’t in the cards right now. I admit that I went a little long between visits to the dentist because he only takes cash, and I needed the extra time to save up for what I knew would be a couple of fillings. (We are self-employed and our health plan is atrocious.)

However, my kids have new socks, underwear, and some good toys under the tree this year. We eat very well (even though just 2 years ago, we needed food stamps to get by.) We take in the occasional DVD rental from Amazon instant viewing. We help local charities with cash donations and products that I get from sponsors of my blog who want to help out. We see fabulous places during family vacations that I combine with business trips so we can share the experience as a family. (It’s never Disney, but Iowa in spring isn’t bad, either.)

I grew up dirt poor. No winter coat, cabbage soup, being made fun of because my sneakers were held together with tape. There is no way in hell my kids will see that — even though, by most standards, we are the working poor. The first thing we did was move away from the city and into the rural area where the closest Starbucks is 50 miles away and the houses are beautiful and cheap. Utilities are cheap. Taxes are cheap. Keeps us from shopping and our living expenses are super low.

There is a way to make it in this world, but it’s not always pretty or easy, and it may involve (*gasp*) leaving everything that’s comfy to do something bold and scary. I only hope the things I’ve taught my kids through example keeps them from bitching and moaning their way through life. 5-gallon buckets suck, but it’s just a phase. We’ll see it through 😉

Love ya, Len!

Love you too, Linsey. Great tips all. Thanks for sharing them us and showing them that attitude plays a big part in how we handle tight financial situations. 🙂

Did they ACTUALLY make that satellite TV comment?

I’m part of a dual-income, no-kids couple (read: lots of discretionary income) and there’s no way on earth I’d ever spend $310 on startup fees for satellite TV. Are you kidding? I feel guilty enough about spending $17 per month on a Netflix subscription!

I know. I found that one to be a bit strange myself, Paula!

It really all comes down to whether or not you will learn to accept that you create your own circumstances through your thoughts, attitude and of course actions. When you can stop looking at yourself as a victim, you can begin to rise above your trouble – financial or whatever.

One thing middle class and rich bloggers don’t tell you about being poor:

Life is regressive and being poor is expensive.

Being poor means that you can’t buy a home, which means that if you do not already own a home (most “poor” homeowners are retirees who paid off their mortgages years ago when they were working and not poor), you will pay dearly to rent, and will get inferior housing (less space, less or no land, fewer amenities, inferior locations, more noise, crummier neighbors, greater risk of crime and loss, etc) to boot. In my area, renting currently is estimated to cost 18 percent more than owning comparable housing, and renting a room is by far the most expensive way per square foot of space to rent. When living with others I have lost a lot of stuff due to theft by lowlifes who have passed through. (My renters insurance does not cover individual incident losses under $250, and I do not own any one thing worth more than $250.)

I live on a poverty level income and rent a room in a house. I rent only a room and have no control over who else lives or does not live here. The others in the house (currently five) include drunks, druggies, bums on SSI, and one working person. The working person is in the process of buying a home and will move out once the deal closes.

While the monthly house rent is fixed, the rent I pay varies depending on how many rooms are currently rented, which (as noted above) is something over which I have no control. This means my rent is not a fixed amount on which I can reliably depend. Unrented rooms also cost me additional money in the form of split utility bills: the gas bill is the same whether three or six people are contributing, and when only three are contributing, my share is larger and thus my finances are hurting. Money I can save up when there are six people in the house will have to be spent (to cover higher rent and utility payments) when there are only three people in the house. I can pay my bills and keep food on the table but in the long run I can never get ahead, and the reason I haven’t moved out of this place is that I haven’t been able to save up all the money I will need to move into a different place.

Because the single refrigerator/freezer is shared by (currently) six people, the space available to me is extremely limited. This means I cannot take advantage of volume pricing on perishable foods and specifically on frozen foods. For example, I can’t save $1/lb on hamburger by buying the value pack and dividing it into portions to freeze for future use.

Poor people sharing housing also are vulnerable to increased expenses due to problems associated with others living in the home. For example, when I live with others who have bad credit, this can cost me in the form of higher renters or auto insurance premiums. (See CLUE reports, insurance reports.)

When you’re poor, if you’re paying your own way (e.g. not subsidized by parents), you generally can’t afford to live by yourself. Then you very much are at risk for all sorts of problems beyond your control, caused by other people who are beyond your control.

And NO paid media comes into this house, other than the internet for which I alone pay and use. I make enough money online (Craigslist gigs etc) to pay for my internet. There is only free TV and no cable or satellite.

Life can be expensive, but everything is relative. As for it being regressive, I’m still not sure what you’re trying to say, Terry. Are you saying that life in general holds people down?

Life is certainly more expensive in New York City or San Francisco than it is in Huntsville, Alabama. And it’s down right cheap (relatively speaking) in many parts of mid-America.

It sounds like you are living in a very high cost of living area. What do you do for a living? It also sounds like you are your own contractor. Respectfully, Terry, if that is true, then why not move to a place with a lower cost of living? Is something tying you down that keeps you from moving and forcing you to live in such trying conditions?

If I had an extremely limited income, the first thing I would do is find a place with one of the lowest costs of living, pack up, and move there.

That’s one thing I forgot to mention too – if you strive to make your lot in life better people will come after you. I have a little cottage in a nighborhood that used to be OK and is sliding down due to the cheap houses, etc.

Last summer my back porch was ransacked & my deep freeze stolen. Ran into the same thing Terry mentions – insurance said the missing & damaged stuff wasn’t worth enough.

Yes, game plan in place to move up however, this is the seventh game plan! They keep getting torn up by other’s actions that impact me.

Thanks Len, for the great article. Your common sense advice is much better than the crap on the other viewpoint. Of course poor people should stop wasting their money on things that they can’t afford, and continue to contribute to the industry that profits by keeping you poor.

Instead, they should spend their leisure time making money from their hobby. For example, they could set up an online blog-shop to sell things that they made by themselves; or just do some random jobs (e.g. singing a birthday song in a cartoon costume, drawing a logo on their hands, etc.) for $5 per job at fiverr.com. Other than the website mentioned above, there are also many other freelancing sites that one could try out to make a living during their free time, and just stop wasting money on satellite TV.

Len, I discovered your blog today and I love it! Just finished reading the Cracked article, and I can’t believe that guy gets paid to write that kind of crap. The truely sad thing is that all of his commenters are eating up every word he says, all of them wallowing in self-pity. The one rational comment I saw had about a dozen “thumbs down”. Sad.

Thank you, Len, for your straightforward and commen sense advice!

Bingo.

And you know why that is? Because we live in a world that pushes instant gratification and victim hood. So some choose to go the road of “woe is me”…

Sorry, but I am not one of those.

If these people have time to not only read that article on the net, but to also comment on it? They have access to the web and a PC/Smartphone etc…that shouldn’t really fall into the category of “poor”.

Hi. You have totally left out the scenerio where the family has one or more ill family members. Many of the jobs that the working poor have do not allow for illnesses that last more than a week (or two weeks, if they are lucky). I have known young couples who have lost their jobs because they have a chronically ill child who has to be hospitalized or one or the other of the adults becomes ill and exceeds the sick leave allowed. One major illness can easily wipe out any emergency fund they have so carefully saved leaving them with nothing to fall back on when S*** happens in the form of car problems or another illness. Yes, there are lots of people who remain poor because they make poor choices…but there are also plenty of people out there who are hurting despite being fiscally responsible. Second jobs are not always available when needed and sometimes the families have already sold everything that they can to pay the bills.

I actually had read the Cracked article before I read your rebuttal, and I can see a bit of both sides.

The real problem, as I see it, is the feeling of entitlement we all have. I’m a recent college grad, and had a comfortable middle-class childhood where I was my frugal parents meticulously taught me “good financial hygiene”, as it were. But the entitlement feeling must be in the water in America, because, as aware as I am of the nonsense, I still EXPECT to be able to have a huge house and cable tv and awesome internet speeds and the newest smartphone and an upgraded car even though I’m straight out of college and ought to still be paying my dues and building up to an “grown-up” lifestyle. I have relatives who are part of the working poor, and they complain about how tough it is to get out, but they all have iPhones. They whine about how hard it is to get a job (and that’s been my experience too) but they apply to one job per week, if that.

The crazy thing is that the Cracked article matches American’s expectations, and your (should be obvious) arguments are seen as cruel or out-of-touch. There’s no easy fix, but it’s got to start with all of us being a lot more realistic about NEEDS versus WANTS.

I read with interest your comments on the working poor. As much as I like your blog, I must say I have a bit of a problem with your stand.

First I will agree there are people who fit your opinion. But there are many who do not. Some of your comments reveal that you really do not have a handle on what it is like to be poor. Comments like “have a yard sale”, show you have no grip on the reality of being poor.

I was raised very poor because I was born in a rural,poor family. Then my father suffered a stroke. My non-educated (8th grade)mother had to go to work in a textile mill for something like 70¢ an hour in 1955. Another stroke left my father bedfast and she had to leave her job to care for him. We lived on his social security which was something like $200 a month. My mother worked her fingers to the bone taking care of him and my sister and myself. She worked a garden to provide us food. She scrimped to get a cow and milked, and made her own butter. The cow would produce one calf a year to be sold for a few extra dollars. We had chickens for meat and eggs. We had pigs for meat also. Slaughtering one a year. She sewed our clothes. We did not have indoor plumbing until I was 9 years old. Yet I had a very happy childhood because I was loved.

My father died when I was 14 and mother remarried when I was 16, being at a rebellious age I married as well because I did not want to live with my new stepfather. I continued my school and graduated high school. The ill thought out marriage lasted till I was 18 and I divorced. I pretty much ran wild in my twenties, but as I approached thirty, maturity and some of my mother’s influence came out in me and I went to a Junior College nursing program on a Pell Grant to get an LPN licence. I got a job in a hospital and returned to school to get my RN. I worked nights and went to school days. Let me tell you that is hard. But I was motivated. I did not want to be old and in bad health and broke. I was a great nurse and loved my job. I played by the rules. I had the three legged retirement plan in place. My retirement fund, savings, and an IRA. Then the unexpected. At 47 I got cancer. I had to leave work for the duration of my treatments, and just as they were finishing I had a cervical disc herniate. More surgery, then another condition that left me disabled.

Let me tell you, no matter how well you think you have got your bases covered,an experience like that will ruin you financially. Your insurances will fail you, your health insurance will quibble over every charge, disallowing tests and procedures. Your work disability will fail you, repeatedly denying your benefits, and your social security disability will be the worst, denying your claims till you retain a lawyer, who will take the most of your entitlement. I watched my substantial savings dwindle, then I had to start on my IRA fund. All I had worked for up in smoke as doctor bills pile in (at one point I had 7 separate physicians) along with the insurance disallowments, and rejections,and with the bills of everyday life. To this day I cannot pick up the mail without a feeling of panic! All this actually caused the condition that finally rendered me disabled in their eyes. A complete mental breakdown. Had I received help at the outset, I probably would have been able to return to work. As it is I can barely function through a day. It’s very similar to PTSD. I suffer panic attacks, depression, confusion, inability to concentrate and cognitive disfunction, along with severe pain diagnosed as Fibromyalgia, a condition very much related to stress.

I have to exist on $1,100 a month. I still have some of my employee retirement but it has to do me for emergencies however long I shall live. I had to pull some out to replace my worn out car a few years ago. At $1,100 a month there is no room for car payments.I need dental work ($12,000)and a pre-paid burial plan in place ($7,000) and cannot afford either.

So not everyone who is poor is a deadbeat. Now I am old, in bad health and broke. I already pulled myself up by my bootstraps once. Now there are no boots.

I am sorry you are having such a tough time. I just wanted to suggest that, if you live in or near a city with a dental school, you often can get dental work done there cheaply. I learned this when a friend needed extensive dental work. Patients are treated by senior-year dental students under the direction of a professor in a modern, well-equipped facility.

I hope the lawyer took only the amount he was entitled to–the fees are set, I believe, by Social Security.

Thank you for this! It was truly inspiring.

Stories like this one drive me nuts. I read through the Cracked article while shaking my head. And here’s why: my extended family.

They have no money skills, nor do they want to learn. They don’t want to take initiative, they don’t want to “go without”. One of my family member’s made a comment about another family member having food stamps taken from them due to their income being over by a few dollars. Guess what said member has? The latest fancy phones, cable, etc.

I’ve listened to family members complain about being broke and not having money. I’ve listened to the “poor me” stories time and time again. But then I’ve also witnessed what they do with their money. And I’ve also seen what they do to try to prevent being “broke” (hint: not a darn thing).

I realize not everyone is like this. A person can only do so much to handle what life throws at them. And sometimes, no matter how prepared you are, things happen.

I am an orphan (raised by father and his parents). I was poor ( my folks struggled a lot with raising me and giving me the best education possible).

Nothing I have came ‘from the stars’. I worked my butt off to be where I am today and still work to provide for my daughter and our family.

Luck is something you make while working and not finding excuses for your crappy past.

I read your article. I’ve not read the Cracked article. Your article and your attitude epitomizes the divide. Are you an idiot or just talking about something you know nothing about? And you are “teaching” this to your son. Wonderful. Your observations are laughably irrelevant. I understand the Cracked article got you a little miffed. Your rebuttal did the same for me. It seems you both might be hanging around the fringes with at either extreme. Somewhere, in the middle, lies reality. I’m not going to rebut your rebuttal, because idiots like you already know it all anyway and I would be wasting my time and fingers. I followed a link to this article mistakenly thinking I would find some good tips about avoiding being poor. I never once expected such a snarky post.

Should I have dumbed-down the article so even you could understand it, Kathy — or are you still trying to muster up the brain cells required to contribute a cogent rebuttal to my arguments? (see: I can play that game too.)

Of course, you’re not going to rebut my rebuttal, Kathy. Instead of making a cogent counterargument on an intelligent, logical basis, you resorted to a pathetic and childish ad hominem attack. Nice.

I’m not surprised this article miffs you; it clearly opened your eyes, but you don’t like what you’ve been forced to see. For that — and that only — I’m sorry.

Excellent article Len. And excellent responses to it.

Sometimes its so very refreshing to have someone smack you in the face with simple logic and reality. LOL

I was once in that living on the street, no money, no food, poor.

Luckily I had good friends and family who helped me out with a place to stay and I built myself up from there.

I did not buy one single thing I did not absolutely need (IE…food, clothing, essentials) nor did I choose to have children and bring them into the world until I knew I could afford to take care of them.

To me, everything is a choice.

My personal choice is to be financially responsible for myself and my family. Meaning that not once in all my life have I ever taken the govt up on its offer to “help” me out of being poor. To me that’s just another trap in the never ending cycle of “woe is me, victim hood”.

And….Those friends and family that helped me off the streets, were paid back in full with interest too

Hey, Len. Nice job on perpetuating the war on the poor. By that I mean: your lack of understanding worries me.

Oh no, you don’t … you aren’t going to get off that easily.

Please explain. Otherwise, your comment is garbage.

“There’s an industry that profits by keeping you poor.”

That is so profound I can’t even begin with it. This applies to all professions that are defrauding the common people. Take Proactiv, it used to be the first business case at Harvard Business School and it’s nothing more than everything that is available over the counter. The true cure to acne is to eat less processed foods and more vegetables and low glycemic index food. But if your dermatologist told you that, why would you buy Proactiv (or similar kind of product). So so so profound even for the medical profession. Thanks Len for always keeping my brain juices flowing!

And thank you for the comments, Dr. P!

I just finished reading the article and all comments here as well. Life is not fair. I work with several coworkers who continually make poor choices. I keep trying to help them educate themselves to make better future choices. Most repeat. Having a positive attitude, no matter the challenges and persistence is the grail. To those struggling, keep working and try to work smarter. Thanks Len for the reminder to discuss this important topic with my kids.

I wholeheartedly agree — it’s hard to get off on the correct foot without the right attitude.

I’ve been poor and I have not been poor. Both were my fault.

Anyone ever see the movie “The Pursuit of Happiness?” That man NEVER gave up. NEVER NEVER NEVER. I have never had to do anything like that and I have never been that bad off, honestly not b/c I did anything right. I was AWED by this movie. TOTALLY awed. He was/is an incredible person. I dont remember his name and I dont know if he is even still alive. He never cared a fig for the phrase “I cant do it.”

Poverty is not a spending problem. Poverty is an earning problem. If you don’t earn enough, then you don’t any enough to spend even on basic needs. However, the earning problem is caused by not having the mental and physical capability to earn sufficient money to pay basic essential minimal needs. Having more children to support adds to the problem. The problem is also made worse when you work in a high priced area, but cannot make enough money to live in the same area you work. The problem is made worse with high taxes, high rents due to restrictive building regulations and high transportation costs due to high gas taxes, tolls, insurance fees and auto inspection/registration fees.