With millions upon millions of users, consumers regularly flock to see their free credit score on Credit Karma. And why shouldn’t they? On the surface, the Credit Karma free credit score offer seems like a good thing, and it is – but only for the credit bureaus!

With millions upon millions of users, consumers regularly flock to see their free credit score on Credit Karma. And why shouldn’t they? On the surface, the Credit Karma free credit score offer seems like a good thing, and it is – but only for the credit bureaus!

Although no money changes hands for using Credit Karma, it is far from free. Once you understand the downside of using their app or even signing up, you’ll realize it’s quite fitting that “karma” is in their name.

Why Credit Karma’s Credit Score Offer Isn’t Really Free

A quick Google search reveals that Credit Karma is partnered with TransUnion and Equifax. These two companies rake in tons of money by gathering information about you, and then selling it to banks, lenders, employers and others.

The best thing about you choosing to use Credit Karma is this: TransUnion and Equifax don’t have to seek out information about your personal credit situation because you download their shiny little app and then proceed to volunteer answers to all kinds of detailed financial questions about yourself. To put this another way: You willingly put your personal finance info into their grubby little hands, which can then be used against you later. What a great deal, right?

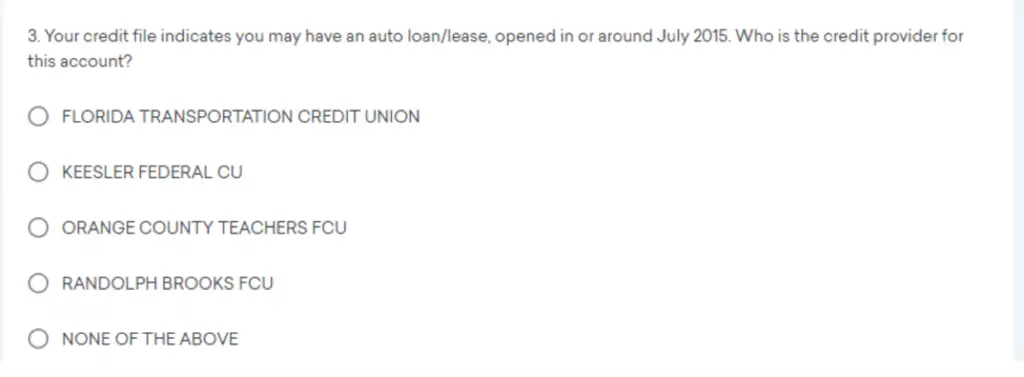

The trojan horse, so to speak, is that many people don’t realize that the credit bureaus have little tricks to get you to validate your own debt! Here is one example of the validation process they use (click to enlarge):

You must answer this question correctly to even get a Credit Karma account; it’s basically asking you to admit to a debt. Good luck disputing it after you answer the question.

So remember, when you see the words “free credit report,” it really means “free information for the credit bureaus.”

FICO vs. VantageScore: Only One Actually Counts

Now, here’s the final kick in the teeth if you use Credit Karma: the product you receive is basically worthless! They’ll send you this really cool number and call it your credit score. However, the score means nothing and here’s why: every bank and lender uses the FICO Scoring System. When it comes to credit scores, FICO is the industry standard. But Credit Karma, and other free credit scoring companies, use what is called VantageScore. It’s a scoring system designed by the credit bureaus to provide a quick ballpark-estimate — but it is not accurate.

In the credit scoring industry, VantageScore is known as a “FAKO” score.

Unfortunately, the FICO Scoring System was set up to service the banks — not consumers. FICO is not a credit bureau, but a standalone company that sells credit scoring software to a wide range of creditors and bureaus. Today over 90% of all lenders use the FICO scoring system to determine your ability to pay back a debt. Quite frankly, your FICO score is the only credit score that matters.

Let me repeat that: Your FICO score is the only score that matters.

The following complaint to ConsumerAffairs from “Leah of Memphis, TN” offers one example of the issues you can run into by relying on Credit Karma’s credit scores:

I have been using Credit Karma diligently for two years now, working so hard to rebuild my credit to accomplish my goals. Finally, I made it to excellent status of 753 and 751. So when we decided to move forward on an adoption and went to get a HELOC loan, the credit report the bank pulled was … get this: 666! Why on earth should I use a service that gives me THIS VASTLY INACCURATE information??? The bank representative said that the service was OK to peek at every now and then, but to definitely not rely on it. Use your annual free report instead. Wow. I’m out!

As for Credit Karma’s Better Business Bureau grade, it’s currently a D — so it doesn’t look like many people are having a good experience with the Credit Karma app, or any free credit scoring company.

Don’t waste your time!

***

About the Author: Sean Strauss is the creator and lead writer for Fico Wars.

Photo Credit: ispot.tv

Many “freebies” on the internet use their “gift” to you for information gathering, which they then use to benefit themselves.

Google, for example, tracks your searches and uses the information to target you for advertisements.

Want to avoid search tracking? Use DuckDuckGo https://duckduckgo.com/ , which I find to give better search results than Google as well because, unlike Google, it does not set its search priorities to favor its client’s listings (Google is facing anti-trust charges in Europe because of that).

RD,

This is true. However; if you answer the questions Credit Karma poses during sign up about whether you are responsible for a car loan or previously lived at an address they can use this answer to validate a debt. You are basically incriminating yourself. Thanks for the feedback!

Not quite understanding how this is incriminating. It’s almost like you are looking for a reason to get out of a debt and you’re mad that the question validates your obligation. If it is your debt, then it’s only incriminating if you plan on purposefully defaulting on it.

In a sense you are correct. My tips aren’t necessarily for the person who wants to claim and pay their debt because in reality there is no advantage to that as far as your credit goes. You may feel like a better person at the end of the day but that is it.

Here’s why: The company that you originally owed the money to has basically considered your debt as a sunk cost. They have sold your debt to collectors for pennies on the dollar. So if you decide to do the “stand up” thing and pay your debt you are simply contributing to the profit of a collection agency or credit bureau.

According to the Fair Credit Reporting Act, it is up to the credit bureau to prove without a doubt (which they never can) that a given debt belongs to you. Why volunteer information that isn’t required. They are not here to help you! They are here to collect!

This was really good info. I had no idea there were two different types of credit scores so I can see how people can get upset when they apply for a loan thinking their credit score is higher than it really is, but I think the bigger surprise was Kredit Karma’s BBB rating.

Paul,

I was surprised myself when I learned this. It is rather misleading. In reality, what is the point of using this score if it is inaccurate?

I assume the same situation applies with Credit Sesame’s free credit score offer? FAKO, not FICO?

You got it!

I’ve been waiting for my score to rise so I could get a better deal on a new car. My latest Credit Karma score said it was 706 but now I’m not so sure.

Does anybody out there offer the ‘good’ credit score for free?

Sherri,

Yes. You can go to Freecreditscore.com and get your FICO credit score from Experian. This is the best free credit score offer.

My freecreditscore report says 670. Grrrrrrrrrrr!!!!

WOW…just checking the freecreditscore.com and since credit Karma says its 584 and this give me 626( not where I want to be yet!), but it still asks questions where you have to answer…

so ok?

Great article. My credit score over (FICO 8) is always over 700. But the credit karma FAKO score is never above 630. Totally useless and like the guy says: there is no such thing as a free lunch. Just remember that.

Sean, you don’t know anything about credit. Vantage scores are for reference only. Fico scores are reference scores too. Plain and simple there are hundreds of scoring models.

It is important that the average person understand that

Each Lender uses their own scoring model as part of risk assessment when considering a loan/credit application. THE MOST IMPORTANT THING TO UNDERSTAND is what an individual can do to improve their score components.

Payment history, Utilization, Negatives(collections/public records), Age, Diversity, Inquiries and Debt Load.

There are 3 major Credit Reporting Bureas:

Transunion (TU), Equifax (EQ), and Experian (EX).

Each bureau has countless scoring models, as do a multitude of other risk assessment organizations such as, FICO, DUNNS&BRAD, SBSS, PAYDEX to name a few.

They say negatives will stay on your credit report for 7 years.. That is false. It affects your score up to seven years, but negative reports remain and can still affect risk assessment decisions made by lenders you do not have a lending history with.

Point here is practicing proactive financial responsibility determines bottom line measurements about an individuals habits and abilities.

That is what risk assessment is all about. And that determines approval.

John, your comment is hyperbolic and pedantic. (Although I did change the editing error you pointed out that inadvertently had ‘Experian’ in place of ‘Equifax.’ Thank you for that.)

First off, Sean used to work for Equifax, so he understands how the system works.

Second, it’s obvious that you missed the entire point of the article: Despite your assertion, the Vantage score is NOT on par with the FICO score — and there are numerous consumers who relied on the CK-provided Vantage score who found this out the hard way. One only has to look at Credit Karma’s BBB grade (F), and/or the negative comments about CK-provided credit scores at both the BBB and ConsumerAffairs websites to verify this. If you did, you would see it is absolutely clear that the Vantage score provided by Credit Karma can be extremely misleading when it comes to predicting how a lender views a consumer’s ultimate credit rating.

When requesting the free annual credit report, I am asked to confirm loan/debt information to confirm my identity. Is this a potential problem?

Ellen, according to the author, the biggest drawback to this is that you officially admit to owing money to a lender, which may make it more difficult to disavow in the future. The ramifications of that is for you to decide.

Ellen,

The best way to obtain your credit report is to hand write a letter to each bureau and include a copy of your ID and SS. Keep it short and sweet.

Hello,

Please send me a copy of my free credit report.

Thank you,

This way you are volunteering zero information. It may take a little longer but is much safer than filling out any forms!

I’ve been working hard on improving my credit score, and I was going to download a credit score app, but thankfully I found your article first. It’s a wonderful post with great information. I’ve been relying on the free credit scores to assess my financial health, and I didn’t realize that it would be so very different depending on where I got it from. I assumed that they would use very similar criteria! The fact that they get such differing credit scores is a little confusing so from now on I’ll order my free annual credit report and use it instead.

Hello Eric,

Thanks for the comment! If you want an accurate FREE FICO credit score go to https://www.freecreditscore.com/. However; there are two issues with this. They may ask questions regarding your debt and it is only based on your Experian credit report.

The safest and most accurate way to obtain your full credit report will cost $60 at https://www1.myfico.com/home?mboxSession=ae74d6c66fda45849509e91f1af3f6b6&adobe_mc_ref=. This will cover all three credit bureaus.

Thanks

Very interesting. I always had my doubts regarding Credit Karma and this proves it .