If you’ve ever gotten a free credit report score, you’ve probably wondered exactly what factors influence your overall credit score. Unfortunately, your credit score is a complex number that’s influenced by a variety of factors.

If you’ve ever gotten a free credit report score, you’ve probably wondered exactly what factors influence your overall credit score. Unfortunately, your credit score is a complex number that’s influenced by a variety of factors.

Major credit reporting companies Equifax, Experian, and TransUnion gather data on your credit behaviors. This data includes your payment history, loans, credit cards, limit on credit cards, length of your credit history. It also includes any outstanding loans and balances.

Of course, every single credit file is unique because everyone uses credit differently. And the factors that influence your individual credit score are totally different than what influences another person’s credit score. As a result, everyone has their own unique accounts and histories. Also, certain characteristics of your credit profile are weighted more heavily than others, and this varies among all consumers with credit histories.

Your Credit Score’s Moving Parts

The latest credit scoring model, known as VantageScore 3.0, looks at at least 900 different characteristics of your credit. There are roughly 140 of these characteristics that play a major role in your final score.

Credit score developers have traditionally included an over-simplified pie chart to explain what impacts a person’s credit score. However, the actual characteristic weightings (such as making payments on time or late, or maintaining a high or low balance) typically vary from one individual to the next.

Here’s an example of how this happens: If you had no recently opened credit accounts, your payment history might be weighted more heavily because of the absence of other information. On the other hand, if you recently opened 10 credit accounts, then your payment history might be weighted to a lesser extent because there is other information to inspect.

What Comprises a Good Free Credit Score?

Just as the information obtained in order to arrive at your final credit score is quite complicated, and varies from person to person, the definition of a good credit score or bad credit score is also a complicated matter with many moving parts.

Credit Score Range

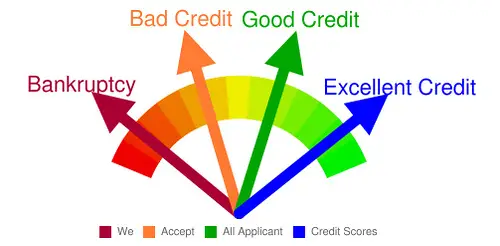

The FICO score, VantageScore 3.0, and most other credit scores have a range of 301 to 850. For example:

- Excellent credit: 740 or higher

- Good credit: 700-739

- Fair credit: 650-699

- Poor credit: 600-649

- Bad credit: 599 or lower

These categories are still not set in stone, however. Lenders have their own categories and definitions of good and bad credit scores. This usually depends on how many borrowers a particular lender is willing to offer credit to. Those looking for a higher number of creditors will accept a lower credit score. At the same time, those lenders wanting to offer money to a smaller number of creditors will have higher standards.

What’s Your Score?

If you’ve always paid your bills on time (or not), don’t assume your free credit report score is good (or bad). You must check your credit score to know for sure. You can actually do this for free. By learning your credit score, you can also see what factors are influencing your score. This will ultimately help you improve it.

The Benefits of an Excellent Credit Score

You can borrow money for a car or house, or open a credit card with a lower interest rate when you have good credit. You’ll save money in the long run by paying less money over time. For example, if you’re buying a house for $300,000 and get a 30 year fixed mortgage, you’ll end up paying $90,000 more for that house over the lifetime of your loan if you have bad credit! Although people with bad credit may be able to find specialist lenders who will give them slightly better rates.

This is why it’s important to establish good credit or improve your credit score. Even if you already have an intuitive feeling about what your credit score is, it’s really important to check it yourself before applying for a loan.

It’s also critical to note that the companies that create the credit score, such as FICO and VantageScore, don’t decide which numbers are good or bad. Lenders and insurance companies are the ones who attach their own meanings to the scores.

When lenders obtain your credit score, they determine what rate they’ll charge you for the loan. Insurance companies use the number to decide whether they want to offer you any kind of discount on your policy. If you have a lower credit score, some lenders may choose not to offer you credit at all.

Final Thoughts

Remember that there’s no such thing as a bad credit score or good credit score, because the number itself doesn’t mean anything until a lender is deciding how to use the number. A bad credit score is only bad if it prevents you from trying to accomplish something (buying a house, car, or opening a credit card) or causes you to pay more money over time in the form of higher interest.

Just like knowing your blood pressure, it’s important to know your numbers when it comes to your credit score. Doing so will prevent you from the potential embarrassment of, say, being turned down for a store credit card while standing at the checkout counter. Then again, it can also save you a bundle because you’ll know if you’re more likely to be charged a higher interest rate.

Photo Credit: Match Financial

This was a really good post. Brief but informative. Appreciate your sharing this one.

Hi it’s me. I really like your website, Len. I can’t stop reading it!

Never knew all this. Thanks for sharing your knowledge.

this is actually helpful. thanks.

Thanks, it was very informative.

This was truly useful to me, thanks.

This is really helpful, Len. Thanks.