Imagine being so rich you never had to borrow money! Sadly, most of aren’t that fortunate, which is why many people endeavor to discover how to get a higher credit score.

Imagine being so rich you never had to borrow money! Sadly, most of aren’t that fortunate, which is why many people endeavor to discover how to get a higher credit score.

If you’re wealthy enough to pay cash for any car or home you like, then you have no need to read about how credit scores are determined — but most of us have to borrow money from time to time. In fact, every time you use a credit card, you’re actually borrowing money.

Credit is important to our economy and necessary in our everyday lives, which is why credit agencies have a score for you — a number that says how credit-worthy they think you are. So, how do they come up with this number? What does it mean?

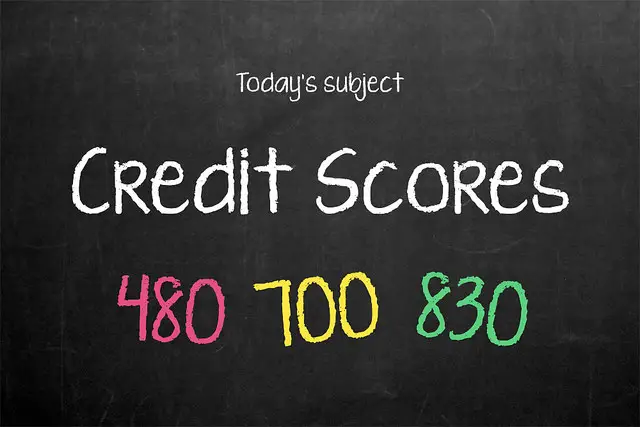

“FICO” is a word you usually hear when discussing credit scores. It’s derived from Fair Isaac Corporation, which developed the method for determining credit scores. They use algorithms and a variety of factors provided by three main credit bureaus: Experian, Equifax and TransUnion. FICO’s algorithm results in a number between 300 and 850; the higher the number, the better.

Here are the five main components that make up your credit score, and some tips on how you can affect the number:

Payment History

Do you pay your bills, and do you pay them on time? If you have demonstrated years of on-time payments, creditors will see you as a safe investment. The opposite is also true. Did you ever lend money to someone who failed to pay you back? Creditors try to avoid people like that.

We all make mistakes. If you’ve been late, but paid and resolved the matter, it will look much better than being delinquent on an account. Another factor is how late you are; longer is obviously not better! In short, being 30 days late is different than being 90 days late. After seven years, resolved late payments disappear from your credit report. Payment history makes up 35% of your credit score.

Amount Owed

This makes up 30% of your score. Creditors want to be sure you’re reliable and not someone who will be delinquent if a financial emergency arises. How much debt do you have? To whom do you owe money? The more you owe others, the riskier it is to lend you additional cash. How deep are you into your credit limit? Owing $1000 on a credit card that has a $10,000 limit is better than having a maxed-out credit card with a $2000 limit.

Credit History

How long have you had credit? Maybe your credit is great, but you’re 22 years-old and have only had one credit card. Fifteen percent of your score is based on how long you’ve been able to prove your creditworthiness. Do you pay your credit card off each month, or do you have a revolving balance? The longer you use — and successfully retire — the credit you are given, the higher this score will be.

New Credit Inquiries

Ten percent of your score is based on how much new credit you have been pursuing and why. If you open too many credit accounts in a short amount of time, that will signal an alarm to potential creditors, and your score will plummet. This is because creditors are unable to see a borrowing history on new credit and may be uncertain of your ability to make payments. For example, inquiries by lenders into your credit history are logged by the credit agencies; frequent credit inquiries signal the potential for more money to be borrowed.

Credit Mix

Finally, 10% of your credit score is based upon your credit mix. How many types of loans have you had? Creditors want to see if you have experience with multiple lines of credit. Do you have major credit cards, and store credit cards? Have you financed a car, and paid utilities on a regular basis?

A mortgage is a much bigger investment than a car, which is bigger investment than a credit card. Creditors try to predict your behavior with different types of credit. Diversity in credit accounts makes your creditworthiness stronger.

Your credit score will fluctuate as you open lines of credit and pay off your bills. Ultimately, it is you who determines your credit score. Your habits, your timeliness in payments, your desire to spend money on credit and the things you want are all factors that end up in a number between 300 and 850.

Of course, the closer you are to 850, the more likely creditors will lend you more money. The good news is, when it comes to raising your credit score, you control your own destiny.

Photo Credit: cafecredit

I find having a high credit limit to be tricky.. Sure, it helps to raise your limit if you owe money and see your credit score improve, but if you’re used to spending money, then ‘yikes!’. Slipping right into debt could be just a matter of time if you’re not careful.

Just don’t charge what you can’t pay off in full each month. Never carry a balance. Make that a rock-solid rule and you will manage credit wisely.

The title of the blog post is horribly misleading, scratching on bait. Might want to be careful with that and not be like BuzzFeed

I don’t see why, Gabriel. If you understand how the number is calculated, then you know how to change your behavior to raise your score.