Creating a budget isn’t the answer for everyone. After all, there are many people without budgets who have minimal debt. They also pay off their credit cards monthly and save money. Even so, there are just as many who need a budget to track expenses, control spending, set aside cash for retirement, and save for vacations and big-ticket purchases.

Creating a budget isn’t the answer for everyone. After all, there are many people without budgets who have minimal debt. They also pay off their credit cards monthly and save money. Even so, there are just as many who need a budget to track expenses, control spending, set aside cash for retirement, and save for vacations and big-ticket purchases.

The bottom line: Creating budgets isn’t for everybody. But for those who need one, budgets are an important tool for controlling their personal finances and providing the ability to make calculated decisions about how to allocate household income.

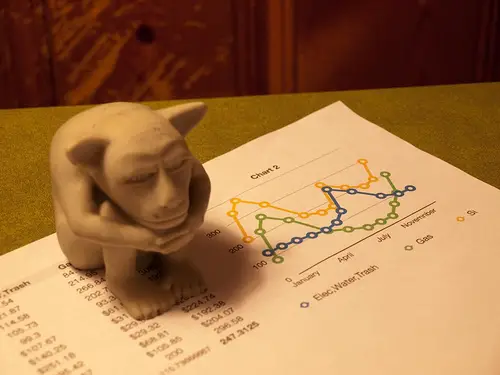

Photo Credit: brad montgomery

I completely agree with you that budgets help you determine a plan for your money and keep you focused to reach your goals. It’s one of the best things I’ve done for my family, and without it I don’t think I would have reached my goal of saving a quarter of my income last year.

Although I don’t budget so much now as simply track expenses, when we were first starting out budgeting helped my family get by too. Couldn’t have done it without it!

Back when money was a lot tighter for us, we faithfully kept a budget. This was before inexpensive/free budgeting software was readily available. What we had was a loose-leaf notebook with tabs for each budget category. It worked well for us – basically an “envelope” system.

For example, if the “eating out” tab showed a zero balance for the month, but “clothing” had plenty of money accumulated, that presented us with a choice: Do we forgo restaurants for the rest of the month, or “eat” the nice sweater we were saving for by transferring funds from one category to the other?

After all, the purpose of a budget isn’t to enslave you, but to make you aware of your choices.

We haven’t kept an official budget for many years now, but the habits and discipline from our budgeting years have stayed with us. Our only debt is the mortgage, and we maintain a spreadsheet amortization schedule which tracks the balance to the penny, so we can play what-if projections if we decide to speed up the rate of payoff. A 2nd spreadsheet tracks major expenses at a high level, not at the detail level of a true budget, but it keeps us mindful of expenses that occur at less than monthly intervals: Property taxes, insurance premiums, etc.

It sounds like you and I followed the same track with respect to budgets; we’re pretty much in the same boat now. We continue to track every penny we spend on the same spread sheet we’ve been using for the past 14 years or so, which we use mainly for future projections and those what-if games you mentioned.

@DC – We are in the same sweet spot that you are, except that we are mortgage free!

We too still use a spreadsheet to track major expenses – ones that come just a few times a year.

I also go back and analyze what our expenses actually were, but only started doing this during the years immediately prior to retiring and will probably continue for a few years into retirement. This was initially just to make sure we could really afford to retire.

@Marie

Wow, that’s where we want to be. Picture Homer Simpson drooling over a doughnut, and that’s us thinking, “Hmmmm. Mortgage freeeeee.”

If feels like jinxing it to put this is writing, but one of our goals is to have our mortgage paid off by May 2012.

I have this theory major ticket items like cars, refrigerators or washing machines choose to break down when when you are working hard to achieve a financial goal that doesn’t include them. 🙂

I love the notion of “allocating income”. That is how I have always looked at it.

I think the biggest thing to note is how you mentioned a budget is not just a plan for money. A carefully organized and recorded budget accurately tells us what we take priority in with our day to day lives when we get a chance to see where our finances are going at a glance. If more folks were to practice establishing a budget, whether for tuition, savings, loans, etc, the small ‘guilty pleasure’ purchases would be made much more apparent in how they affect our true goals for saving over time.

Well said, SMP. Thanks for your comment.

I didn’t start using budgets until a year or so ago. and it totally changed my spending habits! Once I started realizing how much I was spending on coffee and clothes, I drastically cut my spending.

Glad to hear it, Alexis! They’re the perfect tool, for those who have trouble managing their finances. (And they’re usually overkill for those who don’t.)

Thank you Len for this post! I’ve always felt guilty for not being able to use and stick to the arduous tracking and recording of a budget! We don’t have any debt beyond our home and live within our means and have retirement plans and savings going… But every few years I’d try and create a budget and could never make it “work”… Thank you for telling me it’s okay NOT to have a budget! “I’m good enough, I’m smart enough, and doggoneit, people like me!”

lol … My pleasure, Brian!

I prefer the term “spending plan”. Budget sounds like a parent or school teacher telling you that you must obey a rigid set of rules. When you deviate from them, you’ve been bad.

It’s a plan that I can tweak at will. It’s easier for me to maintain, and still feel free.