Do you find yourself running into financial problems and falling into debt? Do you wish you could save more money but find that you have nothing left of your paycheck to save? Overspending can cause a lot of financial problems including consumer debt and a lack of retirement funds. So what’s the secret for how to save money? Well … if you can learn how to change your mindset from spending to savoring what you have, you can improve your finances as a result.

Do you find yourself running into financial problems and falling into debt? Do you wish you could save more money but find that you have nothing left of your paycheck to save? Overspending can cause a lot of financial problems including consumer debt and a lack of retirement funds. So what’s the secret for how to save money? Well … if you can learn how to change your mindset from spending to savoring what you have, you can improve your finances as a result.

How Overspending Leads to Debt

When you spend more money than you take in, you go into debt. The most common form of debt is credit card debt. It’s easy to apply and qualify for a credit card. It’s even easier to charge everything to your card, even things you really can’t afford. Top it off with a high interest rate, and the debt will grow exponentially over time until it becomes too overwhelming.

You must get your spending under control if you want to stay out of debt. Following a budget that forces you to save each month is necessary to get enough cash to pay off the existing debt you have. Controlling your spending will keep you from accumulating more debt in the future.

Enjoy What You Have and Break the Need to Spend

Many individuals who overspend do so because they have a need to spend. They think that spending will make them happy, and they believe the things they buy are necessary. In actuality, most of what you really need is fairly inexpensive, and a lot of things you think you need are just extras. You don’t need new clothes if the ones you have are appropriate and in good shape. You don’t need a new computer just because the one you have is a couple years old.

Enjoying what you have and understanding the value in your belongings will help you appreciate what you have and break the habit of needing more.

You Don’t Need the Biggest and the Best

Just because a brand new cell phone comes out every month doesn’t mean you need to buy it. If impressing other people is so important that you need to throw thousands of dollars away every month to get the latest and greatest, then you need to take serious inventory of what you value from relationships with other people. Learn to love what you have and not what you don’t have.

Staying Out of Debt is Good, Saving for Your Future is Better

When you change how you think from constant shopping to enjoying what you do have, both physical objects and relationships with other people, you will start to reap the benefits.

Getting control of your spending will help you pay off your debt. But, even better, you’ll also be able to save money for retirement and other more important things in life.

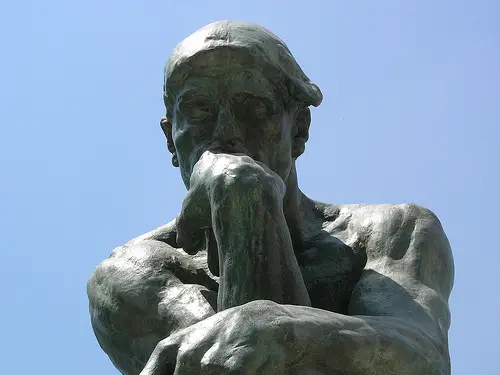

Photo Credit: Dano

Basically,

You always save when you save before you spend.

You seldom save when you spend before you save.

You are so true!!!

Completely agree that it is all mindset.

You should also always take time to think about everything you just “need” to have. If you sit on the item for a few days and really think about it, you will probably see that it isn’t a need but actually a want and it won’t make you any happier overall.

We don’t need to spend money on our “Wants”. If we spend money only our “Needs” then we would save much more on a daily basis. Therefore I prefer to go shopping with a list in my hand to avoid buying according to my “wants”. Because later when I really need to pay my monthly hosting, expired Godaddy domains, etc … I regret why I didn’t save some sum in my credit card or paypal 🙂

Totally get it! This article rocks! Stop spending all your cash, start liking what you got. Spending too much makes you broke. Enjoying what you have is cheap and cool. No need for fancy stuff. Saving is awesome. Change your money game!

Yes Hannah i totally agree with you i always look for discount codes on coupon sites so i can save money on each of my purchase.