Barb proves that it’s just as easy to make ends meet on $40,000 north of the 49th parallel as it is south.

My name is Barb and I live in Alberta, Canada. I’ve been working in retail sales management for ten years. My income is just over $40,000 per year, although the climb to get there was very gradual.

I have a teenage daughter who lives with me. She’s a full time university student, currently in her first year. I also have two cats.

The Quest for Maximum Value

I grew up in a culture of fiscal penny-pinching, although not in a stressful way. It was more as a puzzle or challenge to see that full value was received for our spending.

I cut the grass. I shovel the sidewalk clear. I cook. I clean. I trim my bangs and color my hair. The choice is always there, of course, to have someone else do those things, but I would rather save the money.

My family has lived without a car for five years now. Transit works very well for us. I rent a vehicle twice a year to do any chores and purchases that need a vehicle. For instance, I’ll use it to stock up on six months worth of kitty litter and things like canned milk that are handy to have but quite heavy.

How I Manage My Spending

I manage my spending more than I manage the tracking and charting of my household expenses. For instance, my food purchases are limited by how much I can carry home in a day after work because I have to walk up a hill.

Any pre-made packaged item, like crackers, or frozen meals, or bread has to pass the test of being less than its gram weight. For example, crackers weighing 225 grams (a half-pound) have to cost less than $2.25 and these days, that usually means it is on sale. Toilet paper has to be 30 cents per roll. Bar soap a dollar a bar.

I check the flyers and make a grocery list every week, which I always carry with me, and we post a list of the main items in the freezer over the stove.

We also spend time looking for good values for shoes, socks, underwear, purses, and earrings; these are too personal to purchase second hand.

We actually enjoy “the hunt” in thrift shops such as Value Village, as all levels of quality are there. All of my purchases for work clothes are made there too, even though there’s a dress code. Overall, there is a theme to our spending: taking the time to look for a good deal. Sometimes, it requires patience and reminding ourselves that, well, we just need to keep looking.

Our household utilities spending is carefully considered. We only purchased a new fridge after reading that our older model — which we bought way back in 1981 — was actually costing us a small fortune in electricity because the newer models are much more efficient. The best improvement we made for lowering our winter heating bill was to have the attic insulation brought up to the current standard. Our stove, washer and dryer were also purchased in 1981 and are still working very well. I’ve got to give a shout out to Maytag for my washer and dryer!

I have term life insurance. My entire government “family allowance” check went into an education savings vehicle, tax-free, that covers my daughter’s education expenses.

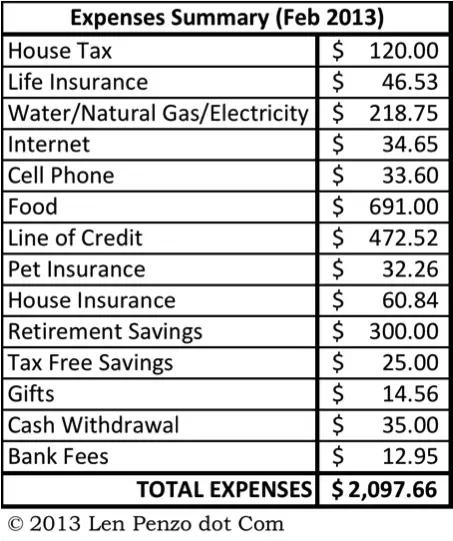

Health insurance is a benefit that’s deducted from my paycheck. I also have pet insurance that covers my cats, but I will never buy it again. I now think it’s better to set up your own dedicated fund to cover their ill health. However, being this far in, and because I have an older pet, I’ve decided I’m going to stay with it. Here is a typical summary of my monthly expenses:

For entertainment, we make visits to the library at least once a week. We can reserve books, videos, on the library website. We also go to the movie theater courtesy of family who send gift cards at Christmas. The discount movie theater is a great buy at $5 per person.

We have no cable television; when we want to watch a program, we use our laptop computers instead.

We do make the effort to set aside a vacation fund; I have the money automatically deducted from my paycheck every two weeks. We take a vacation every other year; it used to be annually but costs have escalated. I usually book a bed & breakfast very early in the year, but this year I chose a mid-price hotel near a large park and the sea instead. We like to purchase Christmas gifts on the vacation as it is a time of low stress.

My emergency fund is healthy at the moment. I currently have $5,000 saved up.

I save for retirement through a matching program at work; I contribute the maximum allowed. I recently increased my retirement savings to $300 per month. At the same time, however, I decreased my savings for vacations.

I also put any income tax refunds, work bonuses, or any other unexpected monies I get into retirement savings too.

***

If you’re a household CEO who is successfully making ends meet on roughly $40,000 per year or less, I’d love to hear from you. Contact me at Len@LenPenzo.com and be sure to put “$40,000” in the subject line. If I publish your story, you’ll get a $25 gift card!

Photo Credit: dhererra_96

Nice job managing your funds. Sounds like you do well currently and set yourself up for the future. At the same time, you are planning for catastrophes with your insurance policies. A model we should all live by.

It’s a balancing act, isn’t it? You have to choose where the money goes, keeping in mind you can only spend it once.

We need to start going to the library. I haven’t been in YEARS!

Libraries have morphed into multi-media centres of late, so there is lots to choose from: DVDs, Blu-ray, etc.

Does your washer and dryer run on electricity or gas? They’re 33 years old. Very impressive. How many times have you had to have them repaired and how much did it cost to do so? I’m wondering if it still might be cheaper to buy newer more efficient ones.

The washer and dryer run on electricity. They have each been repaired once. All I can remember is the repair cost seemed reasonable. Certainly the newer models are extra efficient, especially in water use. It is a bit like seeing just how long an older car will hang in there!

Older washers can be efficient, if you wash in cool or cold water, only run full loads, and/or adjust the water level to suit the size of the load. Older dryers can be efficient if you keep the vent pipe clean (also a fire-safety measure) and hang-dry when you can. My old apartment in Virginia was so dry in the winter that I could hang up a load of laundry all over the place and everything except things like the waistbands of my jeans would be dry in about 2 hours.

Great job, Barb!

Does your pet insurance have a deductible? The monthly premium seems really expensive.

Yes, the deductible just rose to $400 now that our cat is over ten years old. Medical procedures can cost an astounding amount; a cardiac ultrasound was nearly $1,000. The other cat is not insured, however.

Congratulations on maintaining a frugal lifestyle. It just goes to show that the people who say there is no way they can live on $30k or $40k per year aren’t trying very hard.

It is amazing on how little we can live on if we put our mind to it, and that doesn’t mean having to dumpster dive for dinner.

It’s all about our priorities and the ability to spend less than we earn.

Thank you for sharing this with us Barb.

Thank you for your encouragement! No, I have never (yet) dined a la dumpster. Some of the real pros at frugality are in the generation previous to mine, I think. Thank goodness for the internet and the ability to compare brands, prices and quality before you spend those precious dollars. Money has so much potential, until it is spent.

Whoo-hoo! Awesome, Barbara! Another rockstar at Len Penzo. …And all these people out there complaining about how expensive it is to live in Alberta. (Mostly ’cause they’re wearing cowboy hats driving big SUVs around everywhere.) I walk home with my groceries too–talk about a back breaking experience if I end up buying too much. But meanwhile I see all these suckers driving by me to get to the gym. Hey, my intense workout is free.

What’s the $472 line of credit line? I hope you don’t have to pay that much every month?

Not only is the workout free, but you can feast as soon as you get the food home. Bonus.

Ah, yes, the line of credit was the payout amount in the divorce settlement, so I could keep the house. And, ouch, it is every month, but at least I am paying it down. And I locked in the interest rate, in case rates start to creep upward.

Thank you for your kind words!

Your 40k club has a few things in common: they think about what they do, they plan, they budget, they do not let spending determine their self esteem and they even manage to save for retirement…all American traits of the past

Well said, Kev!

I do a lot of things like prepping and still get by with around 40,000 a year.

Good luck to you.

Have you looked at having a free bank account?