It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Merry Christmas, everyone! Grab yourself a cup of hot cocoa or some delicious egg nog, put a log on the fire, and let’s get started …

“Socialism is a philosophy of failure, the creed of ignorance, and the gospel of envy; its inherent virtue is the equal sharing of misery.”

— Winston Churchill

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.

— Charles Mackay

Credits and Debits

Debit: Despite having the largest proven oil reserves in the world and an abundance of other natural resources, Venezuela’s economy is three years into an economic collapse. Starvation is rampant and the poorest people there are now paying for the fiscal calamity with their lives. How can that be, you ask? One word: socialism. And yet, the statist tyrants in power there refuse to change course. Imagine that.

Debit: On the other hand, a booming economy is making life difficult for many people in the San Francisco Bay Area, where RVs have become the only affordable housing option; the median cost of a two-bedroom apartment is approximately $2500 in San Jose and $2200 in Oakland. This is what happens when central banks flood the world with liquidity and misprice the cost of money via low interest rates.

Debit: Speaking of central bank meddling, this week the Fed released a tweet that shows they’re serious about imposing negative rates as a “policy tool” during the next recession — or financial crisis: “Negative interest rates may seem ludicrous, but not if they succeed in pushing people to invest in something more stimulating to the economy than government bonds.” Financial alchemists. All of them. (h/t: Craig Hemke)

Credit: Frankly, it’s hard to see how rates can remain negative when you realize that the Fed will sell as many bonds during the next three or four years than the total number of bonds that had been accumulated by all of the world’s central banks in recorded history up to 1995. At least that’s what they say they’re going to do — just not in those words.

Debit: Then again, way back in 1988 the Economist boldly predicted that a single world currency would appear in 2018. Yes, this coming year. If the central banks’ iron-fisted grip on the bond markets slip and they lose control of interest rates, the Economist’s prediction may actually come true.

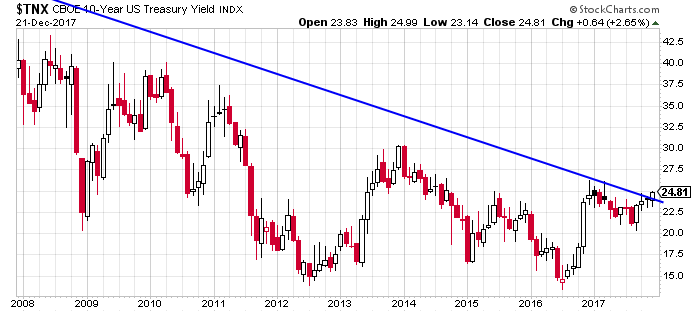

Credit: For what it’s worth, this month the 10-year Treasury bond poked its head above a three decade old downtrend line. The only other time that trend line was broken was during a couple of months in 2007 — and that corresponded to the stock market top before its last major crash. (h/t: Matt_ at TFMR) See for yourself:

Credit: Did you see this? Last Monday the Dow did something it had never done previously during its entire 121-year history: it closed the day on its 70th all-time high for the year. Hooray!

Credit: By any measure, the latest stock market run is almost unparalleled. For example, since 1928, stock market declines of 5% or greater have occurred, on average, three times per year — however, the market has now gone 375 consecutive trading days without a 5% decline. The last time that happened was 1959, which was on the tail end of a streak that lasted 405 trading days.

Credit: Meanwhile, the largest financial bubble in the history of mankind — ahem, better known as “bitcoin” — continues sucking in fresh capital from around the world. In fact, the top 20 cryptocurrencies all hit record highs this week. No, really. This is getting serious, folks; if the financial pull of these cryptos continue getting stronger, they could actually merge into a black hole that swallows planet Earth.

Debit: Of course, financial analyst Dave Kranzler notes that,”The crypto/blockchain delusion has exceeded the absurdity of the Dot-Com and housing bubble eras.” Has it ever. As an example, Kranzler cites an animal medical tech development company called Bioptix — its stock price rapidly climbed from $4 to $40 after the firm renamed itself “Riot Blockchain.” Heh. You can’t make this stuff up, folks.

Debit: Oh … And just in case you think the Bioptix rebranding strategy was a one-off anomaly, you better think again. Shares of lemonade company Long Island Iced Tea soared 500% this week after it changed its name to the “Long Blockchain Corporation.” I know. And yet, those of us who are screaming from the rooftops that the financial world has gone totally insane are the ones accused of wearing the tin foil hats.

Credit: With the cryptocurrency craze obviously in full swing, retired market trader, Kevin Muir from the MacroTourist blog, had a very simple request for his readers: “Stop asking me what it was like to trade in the Dot-Com bubble, because you already know — it was just like today.”

By the Numbers

Christmas is the most widely observed cultural holiday in the world. Here’s how Americans observe it:

95 Percentage who say they celebrate the holiday.

93 Percentage who exchange gifts.

88 Percentage who put up a tree.

74 Percentage who attend parties.

65 Percentage who attend religious services.

Source: History Channel

Last Week’s Poll Results

Are you shipping any Christmas packages by mail this year?

- No (64%)

- Yes (33%)

- I haven’t decided yet. (2%)

More than 1500 Len Penzo dot Com readers answered last week’s question and it turns out that 1 in 3 shipped at least one Christmas gift by mail this year. I expected that number to be higher — especially since most online retailers make it so easy.

The Question of the Week

[poll id="194"]

Other Useless News

Here are the top 5 articles viewed by my 17,777 RSS feed, weekly email subscribers and followers over the past 30 days (excluding Black Coffee posts):

- 10 More Old Wives’ Tales Masquerading as Financial Rules of Thumb

- How Canadian Families Save Money on Groceries

- Grandfather Says: Thanksgiving Greetings from West Virginia

- How to Know If It’s Better to Renovate Your Current Home or Move

- 6 Things That Are Better to Buy Than Rent

Hey, while you’re here, please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading my article on the most common birthdates, Gina shared this:

“I have family members born on September 14th, 16th, 19th, 20th, 21st, 25th, 26th and 30th. I guess you know what my relatives are doing between Christmas and New Years! ha ha”

Well, Gina … at least no one can say you’re family doesn’t know how to ring in the New Year!

I’m Len Penzo and I approved this message.

Photo Credit: breweddaily.com

“… the top 20 cryptocurrencies all hit record highs this week.”

Woops!

https://wolfstreet.com/2017/12/22/cryptocurrencies-crash-25-to-50-across-the-board/

Yes, Dave. Five steps forward and two steps back. The volatility is incredible. Cryptos have since stabilized and are slowly recovery some of those losses.

One hallmark of a legitimate currency is its stability. The tremendous volatility of bitcoin (and other cryptos) suggests its use as a currency is badly misplaced. At least for now.

Len,

I sometimes see things differently than you do, but I can’t agree with you more on this particular topic. Something with built in volatility and deflation is completely broken as a currency.

Yep … a business would be crazy to accept any currency that is highly volatile.

I wonder what percentage of people who put up a Christmas tree have real trees?

Merry Christmas to you Len and to all your readers!

Sara

Hi Sara,

Us old folks don’t put up a tree anymore, but when the kids were here we cut down an Eastern red cedar for our Christmas tree. They volunteer in abundance here.

They’re not as bright green as other confers, but they are wonderfully aromatic.

Grandpa, Congrats on making Len’s top 5 articles. Merry Christmas everyone!

Thank you, Sandy.

Happy Christmas and merry new year!

I’ve always had real trees. I prefer Douglas firs, but the Honeybee like Noble firs — so that’s what we always get.

“Top 20 cryptocurrencies?”

I had no idea there were so many. How many are there?

I know this may be hard to believe, Bill, but Wikipedia claims there are currently more than 1300 of them.

With a potential for an unlimited number.

Makes one wonder why Bitcoin over Andycoin or Billcoin, huh ? ….I mean as long as they are simply making it up.

As the country song says: “God is great, beer is good, and people are crazy”

Andycoin … I like it.

When is the ICO?

A cashless society is what bankers want because it gives them more control, and a one world currency is what the globalists want because it means more control for them. Combine the two (cashless worldwide currency) and you have everything in place for the Mark of the Beast.

Anyone who believes that a one world currency would work also must believe that the Euro is working beautifully for everyone in Europe. I assure you that the Greeks and Cypriots disagree.

A global currency that enslaves the world is how the world’s central bankers are trying to grow their way out of their currency problems.

The problem with a global currency is it is impossible to have a common currency across borders with differing political aims. Okay … it’s not impossible, but it’s implementation and control will be in opposition to the desires of many nations. As you mentioned, just ask the people in Greece and Cyprus how the euro is working out for them. That so many people fail to understand this is scary … and why the eventual implementation of a global currency is not out of the question.

Biggest problem I see is how they would deal with the underground economy if there is no privacy in transactions. A large percentage of the above ground economy depends on money earned below ground.

The illegal drug market, for example, or the guy that mows lawns on the side, or any one of a thousand other deals. While that initial exchange is ‘underground’, that is, not taxed…it doesn’t stay underground.

At some point, that money is spent above ground….the drug dealer buys an Escalade, the yard sale gal buys groceries….then that money becomes part of the GDP….and LOTS of taxes get paid as it ripples out thru the economy.

SO, if they take away privacy and tax evasion, they also take way the incentive, and many of those transactions simple won’t happen…damaging a fragile GDP.

Unless they solve that problem, we ain’t going total cashless in my opinion.

I hope you’re right, Andy.

People are living in RV’s because housing prices are out of control because of Fed money printing. But in Silicon Valley, too many H-1B visas are largely to blame.

I don’t follow your H-1B logic, Ben. As an engineer, I obviously despise H-1B visas … their only purpose is to lower wages of American engineers by bringing in engineers (many of questionable pedigree, I might add) from third-world nations who are more than happy to accept lower pay for their services. That being said, whether those jobs in Silicon Valley are filled by H-1B visa holders or American workers, the high price of housing wouldn’t change.

When Trump was a candidate he criticized the Fed and called it “a big fat ugly bubble.” Now he takes credit for it almost every day. That’s a mistake. He owns it now. It’s very disappointing and hypocritical that he has nominated “Mr. Goodfriend” to the Fed. “Goodfriend” is not your friend. He is an advocate of negative interest rates and cashless. Financial repression is the new norm. The sad thing is that the average person on the street has no idea who the Fed is or what’s coming down the pike.

Spot on analysis, Jack.

If Trump were smart, he should have continued pointing out that the stock market was in a bubble – which it is. At the very least, he should have simply stayed quiet. I can’t begin to tell you how disappointed I am that he decided to take credit for the rising stock market. I still wince every time he ties himself to the market.

This is why I am certain he will not be reelected. When the bubble pops, he will now get the blame. If the bubble pops prior to the midterms, the Republicans in Congress will almost certainly be swept from power too.

Regarding negative interest rates. What the central banks want and what they get are 2 different things. If there is a crisis and the public begins selling bonds, there is no way the banksters will be able to maintain negative rates.

Correct. The bond market dwarfs the stock market. If there is a panic out of bonds there is no way the Fed can stop it (and watch yields skyrocket) without destroying the dollar. Then again, skyrocketing yields will bankrupt the US Treasury — so there is no way out this time. The can has been kicked about as far as it can go. A reckoning is coming.

Merry Christmas, Len.

It looks like 2018 will be an intereting year.

It sure does, Cole. Fasten your seatbelt!

Len, I don’t have to force myself to do what I do, so I answered your poll question “saver by nature”, even though I have not put any fiat currency into a bank account intending to keep it there, for as long as I can remember.

My saving is by creating non-monetary wealth, using it and passing the long-lived stuff on to the next generation. Some might call that “investing”, but thats a problem because “investing” is commonly understood to be putting money into an enterprise.

I dont use credit much anymore, so Im not a debtor, either

So, if Im not really a save, a debtor or an investor, what am I? Something of a misfit, to be sure, but what else would our gentle readers call me (be nice!)?

I would call you “a very wise man,” Dave.

Companies increasing their stock prices by 10x just by adding “Blockchain” to their name. It is complete insanity.

“Insanity” is certainly one word for it, Frankie. I can think of a few others …

RD Blakeslee

Dec 28, 2017 at 9:43 am

leverage the word blockchain to create hype and extract billions from gullible speculators.

These folks arent gullible so much as plain, old greedy.

Greed comes at a price not all monetary, either.

https://wolfstreet.com/2017/12/28/im-in-awe-of-how-far-the-scams-stupidity-around-blockchain-stocks-are-going/#comment-117561

My brother told me to check out your Black Coffee’s a about six weeks ago. Just want to say I’m hooked. I really enjoy your weekly take on things.

Thank you, Mr. Smith! Welcome aboard! We’ve got a nice little community here and I’m happy to say it is steadily growing!

So mike maloney has new secrets of money out about cryptocurrencies… (haven’t watched it all)

My questions:

Does a company “own” bitcoin? Or any other cryptocurrency? Can that be manipulated/used to extort the common man?

Because of all the purported benefits Mike seems to think that things will move towards cryptos for general money use, so does it make sense to get in now, ie early, or wait until it’s normalized?

Thoughts?

Love the dialogue here everyone! Good people!

Merry Christmas! Happy Hanukkah! Kiss my ass! Kiss Len’s ass! Lol

Hi Brian, I’m a fan of cryptocurrencies myself. To answer your question, no company owns Bitcoin. That is part of its beauty — it’s decentralized and doesn’t require a trusted third party like a govt, central bank, or clearing house. Instead, it relies on a worldwide network of independent nodes (bitcoin miners). In fact, it was apparently created for the expressed purpose of escaping central bank manipulation.

That being said, the price can be indirectly manipulated by people who own a lot of bitcoin, simply by flooding the market and then buying back at a low price — but that’s just free market forces on a larger scale. They do NOT have the ability to “print” more bitcoin or to confiscate it from anyone. The price fluctuation comes from free market forces among miners, buyers, and sellers (with a heavy dose of hype from the media).

I can’t speak for other cryptos in general. Some have a lot of potential, others are just money-grabbing scams. Personally, I just invest in a select few that fit with my libertarian principles and that I believe have high potential. I try to buy right after price corrections (like the recent one). I recommend doing your research before buying in, and remember this is a high risk venture.

Here are a couple of links you might enjoy:

https://fee.org/articles/bitcoin-is-deflationary-transparent-and-antifragile/

https://coinmarketcap.com/

Good luck!

Brian, the only time I would even consider getting involved in any cryptocurrency is if/when they have been widely adopted by the general population for use as a legitimate currency. None of them are even close to that; for now, they are in my opinion merely speculative plays — and dangerous ones at that.

Hi Len, I understand why you say cryptocurrencies are speculative, but why “dangerous”? Do you mean in the sense of potentially losing any money you’ve put in, in the same way that individual stocks are “dangerous”?

Yes, Carrie. Although in my opinion comparing bitcoin to, say, shares of General Electric or Coca-Cola is not a good yardstick. Instead, if one is going to compare bitcoin to stocks, then I think it is more accurate to say that buying a bitcoin is (ironically, given its current price) equivalent to taking a flyer on a “penny stock.”

In that respect, compared to listed companies, I consider penny stocks to be dangerous (extremely high risk) speculative plays.

Merry Christmas Len! Hope 2018 is a happy and healthy year for you and the family. Your old pal. Doug

Merry Christmas you too, Doug! Let’s hit the links soon.