It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Another glorious week comes to an end. Off we go …

“I can calculate the movement of stars, but not the madness of men.”

— Isaac Newton

Credits and Debits

Credit: I see that the de-dollarization of the world continues to pick up speed. This week, Russian President Vladimir Putin directed his government to approve legislation making the ruble the main currency of exchange at all Russian seaports by next year. And so the expiration date on the dollar’s role as the world reserve currency draws nearer — as does most Americans’ very comfortable standard of living. Tick tock.

Credit: In other news, all three key indices — Dow, S&P 500, and Nasdaq — closed at record highs on Tuesday. Then the Dow did it again on Wednesday. In fact, the Dow has been climbing for so long that it’s up approximately 22% and 4000 points since the election. Is this a great country, or what?

Credit: Things are going so well that a record 65% of respondents in the latest University of Michigan Consumer Survey expect that stocks will rise during the next 12 months. That has Mish Shedlock wondering if all of that optimism is a signal that the eight-year bull market is finally nearing its end. I agree. Now you know why guys like Mish and I don’t get invited to a lot of parties.

Credit: And Simon Black points out that it’s not just stocks: “Stocks are at all-time highs. Bonds are at all-time highs. Property prices are at all-time highs. Many alternative assets like private equity and collectibles are at all-time highs. Yet asset prices keep climbing.” Uh huh. Simon usually has nowhere to go on the weekends either.

Credit: By the way, the Dow isn’t the only stock index that’s en fuego: The S&P 500 hasn’t had a 3% decline in ten months. That’s the second longest streak since 1928; beaten only by an 11-month streak that started in 1994. It’s also the fourth longest period without the S&P experiencing a 5% decline. Thanks, Fed. (And the ECB, BoJ, and BoE).

Credit: In fact, according to the National Bureau of Economic Research, American stocks have risen more during the past eight years than in almost any other post-World War II period of economic growth. And in case you’re wondering, if you invested $100 in the S&P 500 at the start of this bull market on July 1, 2009, you’d now have $272. Nice.

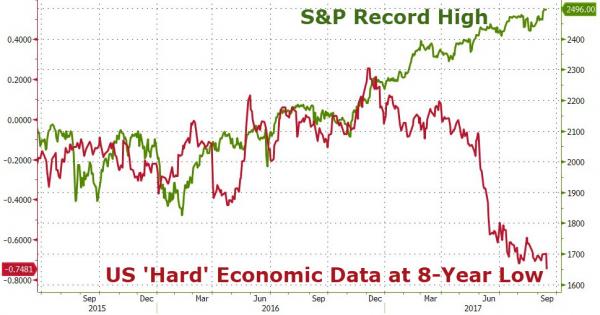

Debit: The stock market has delivered terrific returns for investors since the end of the last recession. But, as Zero Hedge points out, there’s a problem with the current market euphoria: when measured against hard economic data, today’s stock valuations simply don’t align with reality. Take a look:

Debit: Speaking of not aligning with reality … Since 2006, corporate giants such as Exxon, IBM, Johnson & Johnson and McDonald’s have shown little to no improvement in performance — or, in some cases, worse performance — despite the addition of significant debt. Yet, thanks to the Fed’s relentless multi-trillion dollar printing campaign, their stock prices are much higher. Something will have to give. Eventually.

Credit: Meanwhile, investment advisor John Mauldin is warning that a pension storm is coming that, he says, will become “one of the most heated battles of my lifetime.” That wouldn’t be so alarming if John was only 18 years old — but he’s actually closer to 81.

Debit: To prove John’s point, this week, financial stresses forced CalPERS to slash its pension payments to retirees in the towns of Redding and Niland, California, by up to 90%. They join Golden State pension funds from Loyalton and the East San Gabriel Valley whose benefits were similarly reduced last year. If you’re wondering how that’s possible, with equities eight years into a bull market, you’re not alone.

Credit: Then again, it’s really no mystery at all. As Zero Hedge correctly observes, an ever-increasing number of municipalities are finally beginning to admit what most astute observers have known for years: “Namely, that they’re running Ponzi schemes which simply don’t have the funding required to pay the benefits they’ve promised.” In other words: What cannot be sustained, won’t be sustained.

Credit: Finally … Did you see this? Swiss prosecutors are trying to figure out why someone dumped upwards of a hundred-thousand euros into a Geneva bank crapper. No, really. As crazy as it sounds, perhaps they were trying to make a statement about the future of fiat currency. Okay … maybe not. Regardless, it definitely gives new meaning to the term “flushing money down the toilet.”

By the Numbers

This week, retail giant Toys R Us filed for bankruptcy protection, echoing a larger trend for struggling brick-and-mortar retailers in 2017:

1000 Number of Toys R Us stores in the US.

1600 The number of Toys R Us stores worldwide.

1948 The year that Toys R Us was founded.

1957 The year that Toys R Us’ mascot, Geoffrey the Giraffe, made his print-advertisement debut.

1984 The year that Toys R Us opened its first international store. (Canada)

$5,000,000,000 Total debt that the toy store currently owes its creditors.

$6,000,000,000 Price that the private equity firms of Kohlberg Kravis Roberts and Bain Capital paid for Toys R Us in 2005.

Source: Heavy

The Question of the Week

[poll id="182"]

Last Week’s Poll Results

Should the US repeal its debt ceiling law?

- No (60%)

- I’m not sure. (33%)

- Yes (7%)

More than 1200 people responded to last week’s question and one thing is clear: a lot of people are torn on whether or not the debt ceiling should be repealed. In fact, one in three aren’t sure. That being said, a strong majority of folks are still in favor of holding Congress’s feet to the fire when it comes to fiscal responsibility — even if, ultimately, they’re only pretending.

Other Useless News

Here are the top five articles viewed by my 16,041 RSS feed, weekly email subscribers, and other followers over the past 30 days (excluding Black Coffee posts):

- Money Mirages: 6 “Money-Saving” Ideas That Are Anything But

- 5 Proven Ways to Crush Credit Card Debt

- The 4 Biggest Ways to Stretch Your Income

- How Your Employer Is Stealing from You

- A Child’s Wise Advice to Adults on How to Earn and Save Money

Hey, while you’re here, please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading my article on why a college degree isn’t necessary to succeed, Jimmy Ekwere left a comment that explains why he only partially agrees with me:

“Your [sic] 65% right. For me i [sic] believe that if one is able to read and write than [sic] your [sic] good to go. Hence if we could teach our children how to communicate and enroll than on an handwork [sic] it could help reduce unmployment [sic].”

You definitely made your point, Jimmy!

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Len,

Does it make sense to trade 1 oz gold bullion coins for common date pre 1933 gold coins due to the fact that premiums are very low right now?

You’re right, Jack. Premiums on pre-1933 US gold coins are at all-time lows. Whether you choose to trade some of your American Gold Eagles (or other bullion) for them is a personal choice. Keep in mind that, in addition to the transaction costs for trading, you are probably losing a little gold in the process (e.g., those pre-1933 double eagles contain 0.9675 troy ounces of Au).

I believe in holding a diversified portfolio of precious metals: modern gold and silver bullion (coins and bars) from multiple countries, “junk” silver (i.e., pre-1965 US dimes, quarters and half-dollars), and pre-1933 US gold coins.

Some people prefer the pre-1933 coins as a hedge against confiscation based on the assumption that the last confiscation exempted collectable numismatic coins (the pre-1933 gold coins would fit that description today, although there is no guarantees the exemption would be repeated — assuming there even is another confiscation attempt in the cards). Of course, silver is also a hedge against confiscation, since the US doesn’t consider silver as a monetary metal anymore.

For what it’s worth, two-thirds of Americans never turned in their gold after the last confiscation order in the 1930s.

Always enjoy these articles Len. And hey, at least the Fed is starting to normalize their balance sheet. Have a great weekend!

The Fed says they are going to start normalizing their balance sheet. We’ll see how long that lasts — assuming they do it at all. You can’t taper a Ponzi scheme without causing it to eventually implode!

It’s obvious we can’t rely on any pensions or even social security to fund our retirement anymore, so I started setting aside my own long term savings by buying a little physical silver every month.

Enjoy the weekend Len!

Smart move, Sara! You too.

When will you loony gold bugs realize there isn’t enough gold in the world to support gold backed currencies? And there never will be.

When will you fiat currency worshipers understand that there is always enough gold available to sustain a formal gold standard, or a gold-exchange standard as long as the gold is priced properly?

In case you’re interested, that little fact is Economics 101.

I’m not a fiat currency worshiper. I’m a realist.

We’ll see. Good luck to you in the future.

John Mauldin writes in his article which Len cites, above:

“As Ive said, this (underfunded pension) crisis we cant muddle through. While the federal government (and I realize this is economic heresy) can print money if it has to, state and local governments cant print.”

Since Social Security is Federal, it may be that S.S. payments are somewhat more assured than state and local pensions are.

Cynically but quite in line with my experience for three quarters of a century or so, I believe Federal pensions are the most secure available because they are enjoyed by Congress, which ALWAYS looks after its own care and feeding.

“The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.” — Alan Greenspan

Dave: I agree with you to a point. The fine print in Mr. Greenspan’s statement above is that the faster the US prints money out of thin air (i.e., without generating a corresponding output of equivalent wealth in the form of real goods), the faster it reduces the dollar’s purchasing power.

The SS checks will always be delivered in the promised amount, but they won’t go far if a loaf of bread is $100 and a gallon of gas is $250!

Inflation expectations are one reason to convert as much pension income as reasonable (life should be more than subsistence while hoarding) into assets that survive fiat currency failure, such as precious metals for bartering and land that will be enjoyed for its own sake ad as a source of food and fuel.

BTW, Referring to the 2/3 of gold coinage that was supposed to be turned in to Uncle Sam but wasn’t: I think very little bartering today is reported for taxation and it would approach zero if the citizenry were in economic distress.

The US fell into the same trap that Great Britain did at the turn of the previous century which led to its downfall. It allowed financialization to dominate its economy and act as parasite on the producing class. The US is now in the same boat. It’s a trip that started in the late 70s. The USD will fall as the world reserve currency just as the British pound did.

I agree, SM. America has lost its way. When the dollar tanks, the over-sized stranglehold that Wall St. currently has over the US economy should disappear.

I have a question. What is “hard” economic data that the graph refers to? Is there “soft” economic data too?

Kim, “hard data” is based on activity that measures actual economic output like durable goods orders and retail sales. “Soft data” is based on consumer confidence surveys and business reports.

As always, thanks for this column, Len; it’s a great reminder and incentive to get our own financial house in order. Meanwhile it’s time to brush up on your “Economic Collapse 101” article again…

Thanks, Lauren!

For those who haven’t seen them, I probably should gradually repost those Economic Collapse articles over the next few months.

Excellent idea, Len!

Far more credits than debits this week. That’s a rarity!

It sure is, Sandy!

Hmm, so 2015 – 2016 Dec, stocks correlated with hard data reasonably. That is interesting to note …. despite all furore over QEing and overregulation and …., there is some hard data support., eh?

Since 2016 Dec, stocks have diverged completely from hard economic data …. Hard economic data actually took a nose dive (forget about it being even flat) and stocks took a frothy upswing ….

I wonder what happened at the end of 2016 ….

LOL!!!

Thanks for such interesting insights. I’m honestly in shock of the large amount of debt Toys R Us needs to pay.