It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Another glorious week comes to an end. Off we go …

“Chase your passion, not your pension.”

— Denis Waitley

“Always be nice to bankers. Always be nice to pension fund managers. Always be nice to the media. In that order.”

— John Gotti

Credits and Debits

Credit: Evidence of the monetary madness on asset prices is everywhere — including the stock market. In fact, it’s so overheated that the Dow experienced new highs on seven of the first 13 days in June, including another new all-time high on Monday.

Credit: If you ask David Stockman, we’re currently witnessing “the most hideously overvalued stock market in history.” Perhaps people are listening, because the the Dow actually finished Friday on a four-day losing streak.

Debit: Stockman also notes that, during the past 5000 trading days stretching across two decades, the VIX — Wall Street’s so-called “fear gauge” — has closed below 10 on just 11 occasions. However, seven of those times have been within the last month. Yes, any value below 10 means traders are extremely complacent — but the VIX is a contrarian indicator.

Debit: It’s not just stocks that are selling for a pretty penny these days. Last week a Hong Kong parking space sold for $664,300. Hopefully it wasn’t one of those irritating “compact” slots that is incapable of properly accommodating 99.85% of the cars on the market.

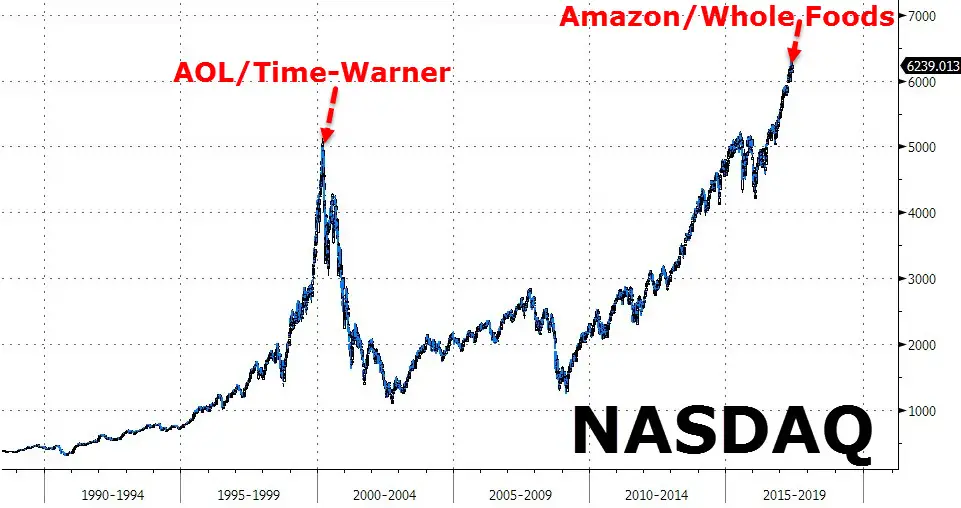

Credit: Meanwhile, the recently-announced Amazon/Whole Foods merger has some analysts wondering if it’s this cycle’s AOL/Time Warner debacle — and a sign that the current stock market party is all but over. Take a look:

Debit: On the bond front, I see that Argentina is now selling 100-year bonds. Yes, the country has defaulted seven times during the past 200 years, but that didn’t stop government officials from offering them to investors suckers anyway.

Debit: You’d think intelligent investors wouldn’t touch an Argentinian 100-year bond with a 10-foot pole, considering the country routinely defaults on its obligations every 28 years or so. Think again — those long bonds disappeared faster than Tums in a Taco Bell.

Debit: In other news, I see that the Illinois state Comptroller is warning that the Land of Lincoln’s fiscal situation is now in a “massive crisis mode.” Hmm. Perhaps they could try issuing 100-year bonds. Or placing antacid vending-machines in their local Taco Bells.

Credit: Then again, if Illinois politicians are really serious, they can start fixing things by eliminating their six-figure government pensions, which are out of control. In the past year alone, the number of government retirees in Illinois drawing gold-plated pensions paying out more than $100,000 annually has ballooned by more than 18%. Of course, this issue isn’t limited to Illinois — it affects almost every state in the union.

Debit: According to the Better Government Association (BGA), Illinois state workers drawing six-figure pensions include “retired cops, lawmakers, judges, teachers — and an oral surgeon from the University of Illinois believed to be the state’s only half-million-dollar-a-year government pensioner. Leslie Heffez, 59, is believed to have the highest public-employee pension in the state: $547,862.” Now I need a Tums.

Debit: By the way, the BGA also notes that, thanks to cost-of-living increases, “If Heffez lives another 22 years — the average life expectancy for a man his age — his pension would top $1 million a year, and he would have collected a total of more than $19 million from the retirement system.” Yes, it’s utterly absurd. It also helps explain why pension costs account for nearly 25% (!) of the entire Illinois budget.

Credit: Unfortunately, math is a bitch — and the accounting tricks can only go on for so long before fiscal reality reasserts itself — which is why Mr. Heffez and many other government workers drawing ridiculous annual six-figure retirement paychecks off the backs of hard-working taxpayers will one day receive a very rude awakening. Not to mention a little heartburn of their own.

The Question of the Week

[poll id="169"]

Last Week’s Poll Results

What is your current net worth (including home equity)?

- $100,000 to $499,999 (34%)

- $1 million or more (24%)

- $500,000 to $999,999 (18%)

- $0 to $99,999 (17%)

- Less than $0 (6%)

More than 1300 people responded to last week’s question and — I have to confess — I was surprised to see that almost one in four Len Penzo dot Com readers have a net worth (including home equity) of $1 million or more. At the same time, 6% said they are underwater, financially-speaking — essentially de facto indentured servants who are beholden to their creditors. That’s not a good place to be, folks. Hopefully, most of them are doing their level best to turn that situation around.

(The Best of) By the Numbers

Is college still a smart financial move? Here are some findings from a recent University of Arizona study on college grads who have been out of school for two years:

49 Percentage of college grads out of college two years who have a full-time job.

$25,000 Lower end of annual salary range for surveyed college grads with a part-time job.

$40,000 Upper end of annual salary range for part-time college grads.

$29,400 Average college debt incurred by students in 2012 after four years of schooling.

63 Percentage increase in average student college debt since 2002.

70 Percentage of surveyed college alumni who claim to be NOT financially self-sufficient two years after graduating.

Sources: CNN; Huffington Post

Other Useless News

Here are the top five articles viewed by my 15,001 RSS feed, weekly email subscribers, and other followers over the past 30 days (excluding Black Coffee posts):

- Lottery Fraud: Don’t Get Caught Paying the Stupid Tax

- The 10 Worst Things I Ever Bought

- A Surefire Way to Beat the Lottery — Guaranteed!

- How I Live on Less Than $40,000 Annually: Nick from Iowa

- The Pros and Cons of Taking Social Security Early

Hey, while you’re here, please don’t forget to:

1. Click on that Like button in the sidebar to your right and become a fan of Len Penzo dot Com on Facebook!

2. Make sure you follow me on Twitter!

3. Subscribe via email too!

And last, but not least …

4. Consider becoming a Len Penzo dot Com Insider! Thank you.

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After reading a guest post that argued why it’s better to be a shareholder than an employee, Conrad said this:

Being a buy-and-hold shareholder in a bull market is easy.

Uh huh. Something tells me most buy-and-hold shareholders will go the way of the dodo during the next major downturn.

I’m Len Penzo and I approved this message.

Photo Credit: brendan-c

Len, The high net worth of your readers and high percentage who have pensions indicates an older than average readership (whatever “older than average” is).

Regarding 100-year bonds: Nobody alive will retrieve the principal – everybody is just speculation on a price increase in the aftermarket.

Offer them tulip bulbs and they’ll buy those, too:

https://en.wikipedia.org/wiki/Tulip_mania

I absolutely agree with your net worth explanation, Dave; it makes sense.

As for those 100-year bonds … they are being gobbled up by people desperate for yield. Unfortunately, like you said, they will never see their principal again — sadly, what they will see is another Argentinian default.

regarding Amazon’s acquisition of Whole Foods: Every human institution is overcome by hubris, eventually. Is this Bezos’ moment?

I’m certainly not predicting it – Bezos has confounded too many naysayers.

But, sooner or later …

Bezos finally has Amazon turning a profit on a non-GAAP basis, but there is also a lot of financial accounting hocus pocus going on behind the scenes that suggests Amazon is hemorrhaging money. Financial analyst Dave Kranzler is one guy who has delved deep into Amazon’s financials and is convinced that Amazon is doing this with smoke and mirrors — and lots of cheap credit.

Thanks for another interesting update Len. I’m perpetually amazed at the resilience and persistence of Stockman’s bearishness. He always has an interesting perspective, even if stock prices haven’t reflected his point of view (yet?).

I completely understand where Stockman is coming from (surprise, surprise). It’s hard to argue that the stock market isn’t over-valued. The trouble is, investors can stay irrational and keep markets elevated longer than they should, despite the evidence.

It’s the same situation for those of us who see a currency crisis coming down the pike. To any one paying attention and willing to do the math, the US dollar has been a dead man walking ever since the Fed expanded its balance sheet with QE1, QE2, Operation Twist, and QE3. But nothing is going to happen to the dollar until the bond market (i.e., the smart money) says it’s time. Maybe QE4 will do the trick … we will see.

If they’re going to go with 100 year bonds why don’t they just go for broke with 500 year bonds?

Have a great weekend Len!

Sara

Yeah … those 100-year bonds ended up paying out a yield of more than 7% — I’ll bet a 500-year bond would pay double digits! The yield-starved pension funds would love that!!

No Tums for me. I’m a Rolaids guy myself.

When I was a kid I remember my dad used Bromo Seltzer. Spooned the stuff out of a cobalt blue glass bottle and added water.

Is there anybody out there besides me and Dave old enough to remember that stuff?

Put a small nail hole in the cap then toss it into a body of water and watch it go!

LOL! That’s the spirit! You and me would have had great fun together as kids, Tom.

Hey Len, I used to walk by the Bromo Seltzer tower everyday when I worked in Baltimore. Two blocks from Camden Yards. https://www.bromoseltzertower.com/

Wow … that’s cool. I’ve been to Camden Yards and the Inner Harbor, but I’m embarrassed to say I don’t remember that tower!

You can work, and then save and invest the fruit of your labor. Or you can trust your future to the government.

That’s an awesome observation, Wide Awake! Sums things up perfectly.

Sadly, most people today want — or should I say “expect”? — the nanny state to take care of them. Especially the younger generation.

I see the pension don’t haves have crept ahead of the pension haves.

Probably because us old-timers were sitting around blogging this morning while the youngsters were out tripping the light fantastic.

Now the youngsters are coming home for lunch …

Probably right … which means most of the later voters have never heard of Bromo Seltzer either.

Bromo Selzer

It’s the Best

Heads and Tails

Above the Rest

Burma Shave

Everybody rants and raves

Use our product Burma Shave

Bromo Seltzer

will ease your fears

and Burma Shave

instead of shears

Len back to your first post….my mouth dropped open when you said that your lunch cost $16.50!!! Time to start brown bagging it my friend😊

If you are referring to the article about what happens when you don’t have the money to pay your restaurant bill, the amount mentioned was $6.15. This must have happened some years ago.

Oops – sorry!!

While I agree some public pensions are out of control, you conveniently left out the last 3 paragraphs of that story that don’t illustrate your point (that high payouts are the problem with public pensions):

The increasing number of lucrative pensions isnt the main reason that pension funds for government employees are facing major shortfalls, though, says Tony Martin, secretary of the Firemens Annuity and Benefit Fund of Chicago Chicago firefighters pension fund.

“Its a multidimensional problem,” says Martin. “You cant just blame the benefits.”

Illinois unfunded pension liability tops $111 billion, Cook Countys is more than $6 billion and Chicagos is nearly $30 billion, records show.

Chronic underfunding by governments, investment losses and generous annual cost-of-living increases are also to blame, pension experts say.

That’s Mr. Martin’s opinion but, for the most part, it is not convincing.

I do agree that those cost of living adjustments are part of the problem — why do retirees earning a six-figure pension need a COLA?

As for the underfunding by the governments, that’s a nice way of saying that the recipients do not contribute anywhere near enough into their pension funds to support what they get in return — I’m sure that is intentional, since their pensions are thought to be “taxpayer guaranteed.”

Finally, I find it hard to believe those pension funds are in dire shape due to investment losses; after all, the stock market is eight years into a bull market and the bond market is 35 years into a bull market. If the pension funds are suffering losses now, what will happen when the market finally goes into an extended downturn?

No matter how one tries to put lipstick on the government pension pig, the bottom line is this: government pensions dole out extremely generous benefits that are impossible to sustain — and after years of abuse, the fiscal chickens are finally coming home to roost.

Len may have taken some literary liberties by highlighting the extravagant pensioners but come on, we are intelligent enough to read through the lines to get at his gist which is indeed true. There is indeed a disconnect between fiscal prudence, rosy assumptions, benefits with no skin in the game (in terms of employee contributions … or … employer profitability versus employer contributions … etc.)

This is also the reason why public sector unions are a bad idea (employees and politicians trading votes and benefits with no regard for fiscal sanity).