It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

Well… another busy week is behind us. So with that in mind, let’s get this party started!

The real problem is not whether machines think, but whether men do.

– BF Skinner

Credits and Debits

Credit: Did you see this? After the $7500 electric vehicle (EV) tax credit ended in September 2025, the trajectory of EV sales in the US went into reverse, falling to just 234,000 units last quarter – that’s a 46% decrease compared to the prior quarter. As we strongly suspected, the only thing sustaining the mass appeal of EVs was the tax incentive. Then again, it doesn’t help that people are also struggling just to make ends meet – unlike back in the good ol’ days…

Debit: Hey… if you think working in a quarry is tough work, consider this: It’s no secret that the tech sector suffers from high turnover rates due to high-stress environments that often involve complex tasks, unrealistic timelines, and job instability. In fact, the average rate of talent churn in the tech sector approximately 16%. For the tech industry, this is a serious concern if only because replacing tech talent can cost as much as 150% of a worker’s salary. Meanwhile, in the cosmetology industry…

h/t: @Spillthememes

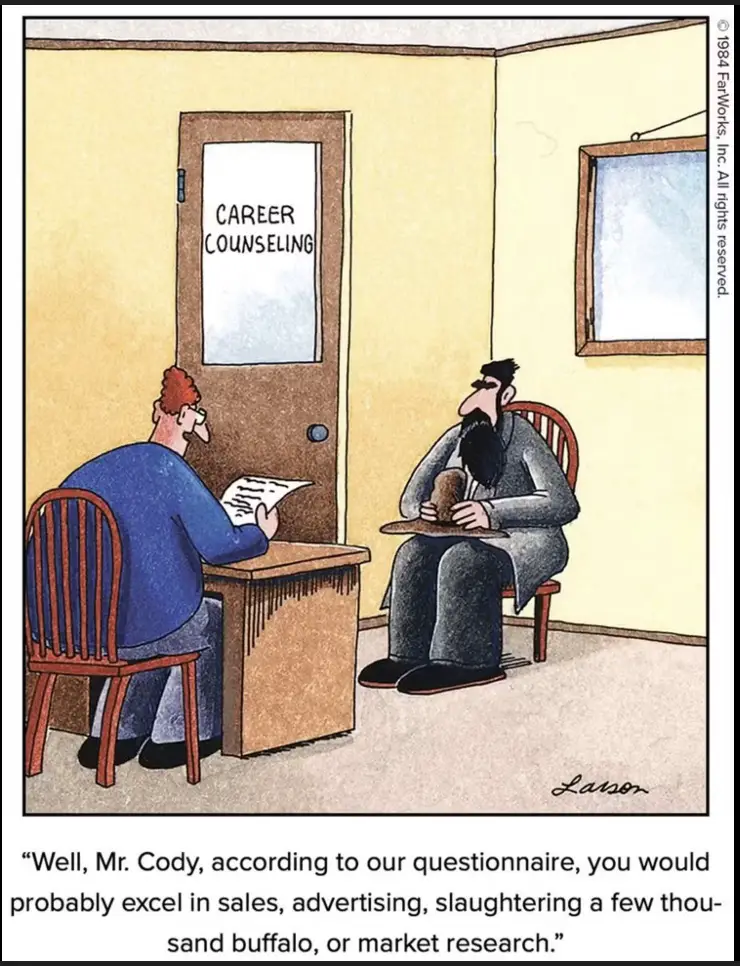

Debit: Of course, one of biggest tech industry focus points is artificial intelligence (AI). With that in mind, Dario Amodei – who leads AI developer Anthropic – is now predicting that AI will eliminate 50% of entry-level white-collar jobs within one to five years. Now for the punchline: Many people in the AI industry believe he’s being conservative. Uh oh.

Gary Larson – The Far Side

Debit: On the bright side, while the capability for massive employment disruption could indeed be here by the end of this year, it’ll take some time to ripple through the economy. That being said, the underlying ability of AI to displace an enormous number of human jobs is arriving now. The good news is, life will carry on. If you don’t believe us, just ask the people who used to depend on this: (er, if there are any still alive)…

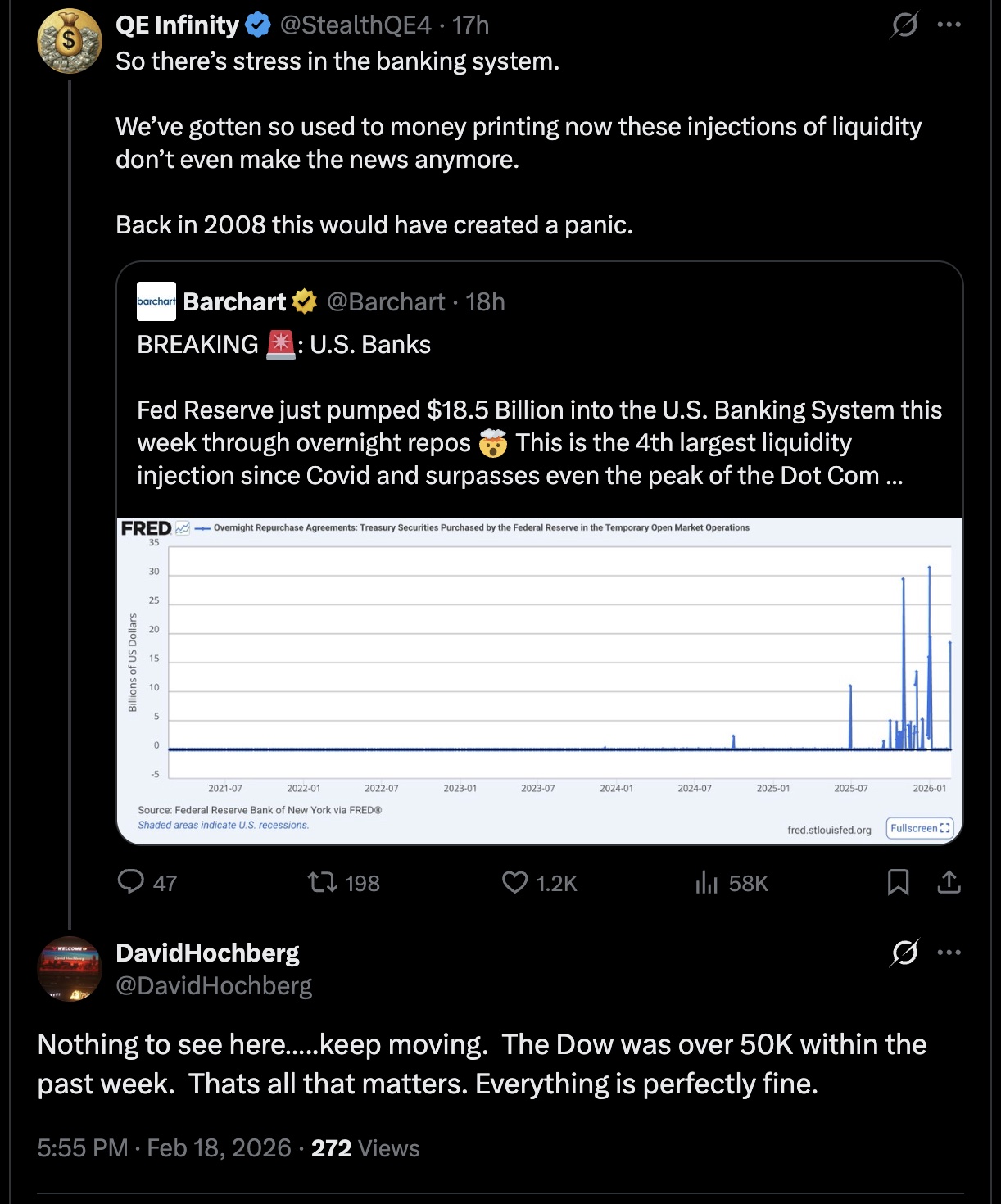

Debit: Meanwhile, the latest CBO report predicts that the US National Debt will rise from $39 trillion today to $64 trillion in 2036. Translation: The US National Debt will be $100 trillion by 2036. Oh… and if you’re wondering why every dollar of new debt only generates about 10 cents of GDP growth these days, well… there’s your answer. If only there were financial historians out there to help the spendthrift politicians who are responsible for all this debt learn from the past. Oh, wait…

Debit: Back in 2023, the current US Secretary of State (SoS) Mario Rubio, warned that the world was aggressively working to end-run the US dollar (USD). “They’re creating an economy secondary to the US economy totally independent of the US. In five years, we won’t be talking about sanctions because there will be so many countries transacting in other currencies that we won’t have the ability to sanction them.” Uh huh. Perhaps more importantly, it also means that America’s open credit limit with our lenders around the world will soon be a thing of the past. Of course, the damage is entirely self-inflicted…

h/t: @kyotrixitaly

Credit: For those who are struggling to find the significance of the SoS’s shocking admission, sagacious macro analyst Franklin Sanders summed it up thusly: “There you have it from the horse’s mouth: The world is repudiating the USD as the world’s reserve asset.” Indeed it is. And if Mr. Rubio’s prediction remains on track, the world will be effectively free from USD hegemony by 2028 – if not sooner. Although it looks like Grandma has yet to receive the memo…

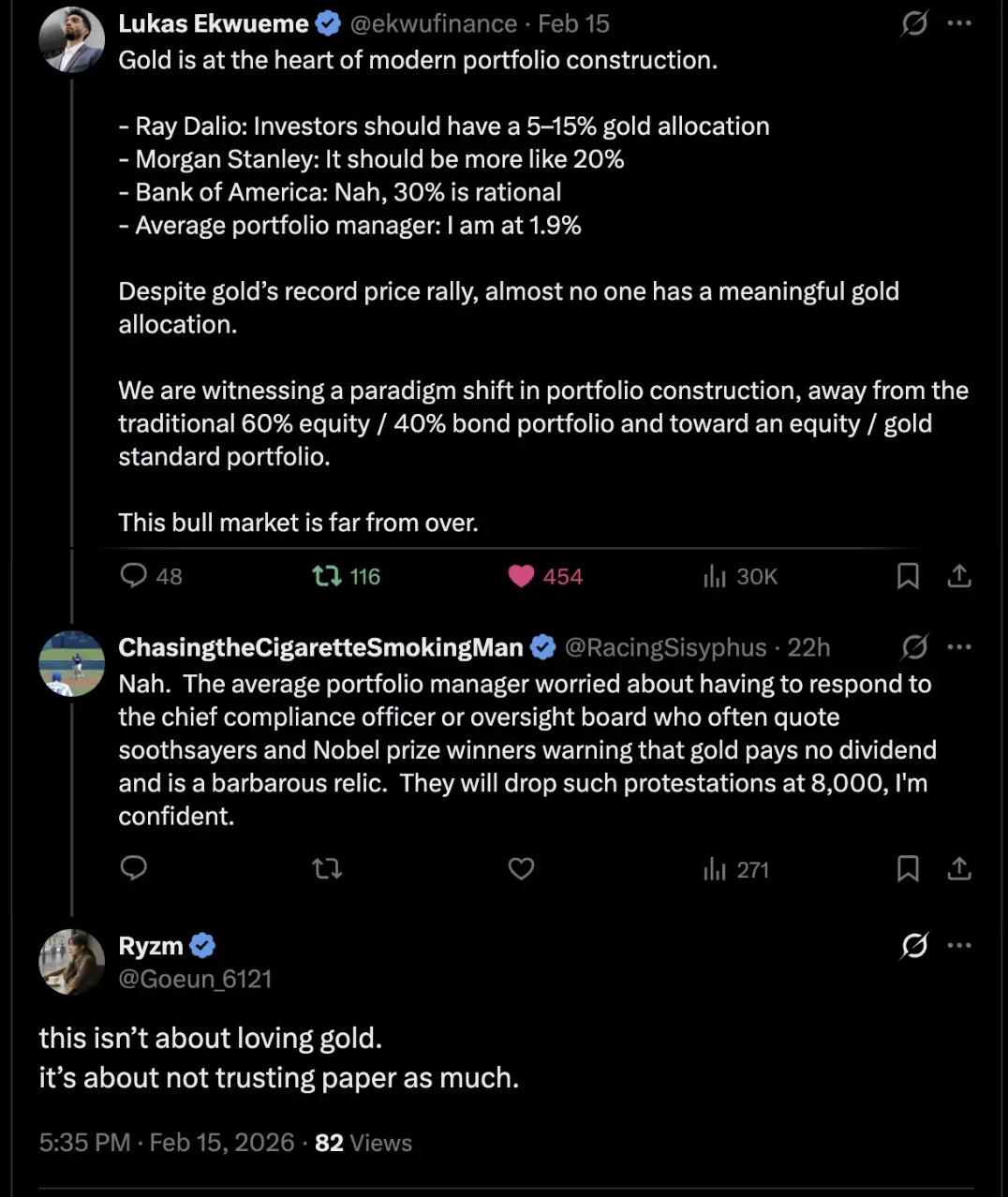

Credit: Needless to say, Mr. Sanders isn’t alone in his observation. Last week, an analysis by Sprott concluded that, “Markets appear to be entering a new monetary regime shaped by rising geopolitical fragmentation, declining institutional trust and the increasing use of financial systems as policy tools.” As for that “new monetary regime” that is displacing the fiat USD? Well… it’s real money that never loses value, in the form of physical gold. Why? Because in 2022, the world rediscovered that, unlike debt-based fiat currencies, physical gold held in their possession carries no counterparty risk. Zero. Zip. Nada.

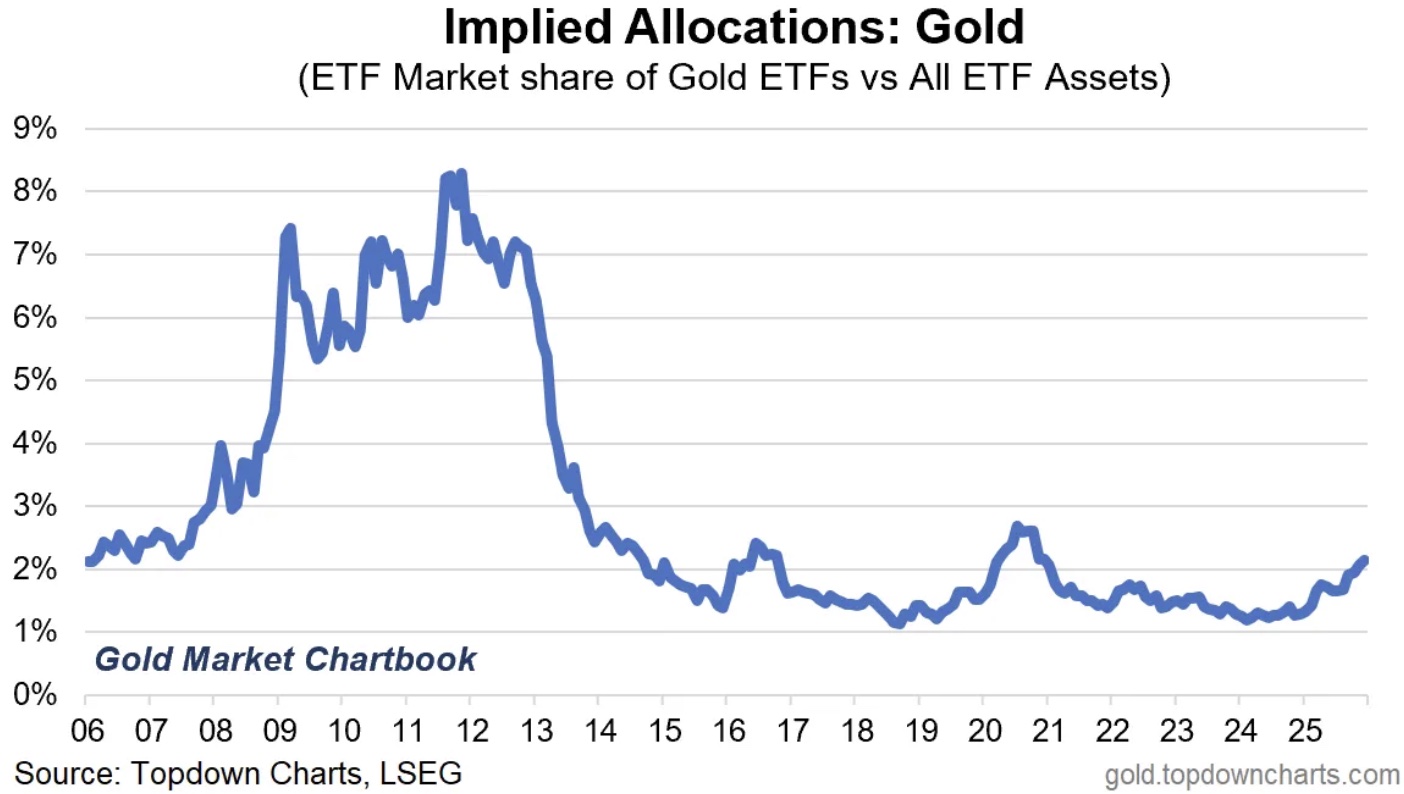

Debit: Unfortunately, very few Americans seem to be noticing that this monetary regime change – one that could impact the purchasing power of their long-term savings – is currently underway. In fact, the latest data shows that American investors’ gold portfolio allocations have only started rising slightly over the past year. As a result, those gold allocations still remain far below the previous highs seen from 2009 to 2012. Imagine that.

h/t: @duediligenceguy

Credit: We’ll end this week’s wrap-up with a few more recent words of financial and macro-economic wisdom from Sprott, where they observe that, “In a system in which financial assets can be frozen, politicized or devalued, gold stands out as neutral, unencumbered outside money. As fragmentation deepens, geopolitical risks rise, and confidence and trust in fiat architecture become more conditional, gold’s long-term appeal is shifting from a hedge to a neutral reserve asset in a new monetary regime that is still taking shape.” It doesn’t get any clearer than that. Got gold?

By the Numbers

A new homeowner survey has found that 50% of them say there are necessary home repairs or renovations they need right now that they can’t afford. Here are several other findings from that survey:

64% The share of homeowners who would rather renovate their home than move to one that’s already been remodeled.

70% Percentage of homeowners who have completed a renovation in the past five years that went over budget.

22% Percentage of homeowners who say their completed renovation wasn’t worth the cost.

16% The share of homeowners who say their renovation took too long.

19% Homeowners who say they had to stop a renovation project before it could be completed because of unexpected costs.

85% Homeowners who say they spent money on an unplanned repair in 2025.

26% The share of homeowners who spent more than $5000 on those unplanned repairs in 2025.

58% Homeowners who say they currently have nothing saved for emergency repairs.

Source: Clever

The Question of the Week

Last Week’s Poll Result

- One 27%

- Two 24%

- Four or more 19%

- Three 16%

- None! 14%

More than 1900 Len Penzo dot Com readers answered last week’s poll question and it turns out that more than 1 in 3 of you have been involved in at least three car accidents. As for yours truly, I have been in only one accident while I was the driver – and, yes, it was my fault. (Story here.)

This question was submitted by reader Frank. If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Good Question

(h/t: Susan )

Squirrel Cam

The squirrels are holding their own Olympics this week. (Unfortunately, the French judge only gave this squirrel a 9.1 for its effort.)

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Whether you happen to enjoy what you’re reading — or not — please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach me at: Len@LenPenzo.com

Here’s another gripe sent to the Len Penzo dot Com Complaint Department from Jayson:

Your weekly poll questions aren’t scientific, so they can’t be trusted.

Oh, yeah? That’s not what the Department of Homeland Security told me.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Question of the Week