It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I hope everybody had an enjoyable week. Without further ado, let’s get right to this week’s commentary …

The opposite of courage is not cowardice; it’s conformity. Even a dead fish can go with the flow.

— Jim Hightower

Credits and Debits

Debit: Did you see this? Last month, Jack in the Box divested Del Taco for $115 million, well short of the $575 million it paid for the chain less than four years ago. Now there’s this: Yum Brands is considering the divesture the struggling Pizza Hut chain – one-third of its fast-food triumvirate that also includes Taco Bell and KFC. The chain’s share of the pizza market has shrunk from almost 23% in 2019 to 18.7% last year, and sales are still declining in 2025. Meanwhile, there’s breaking news at the Golden Arches…

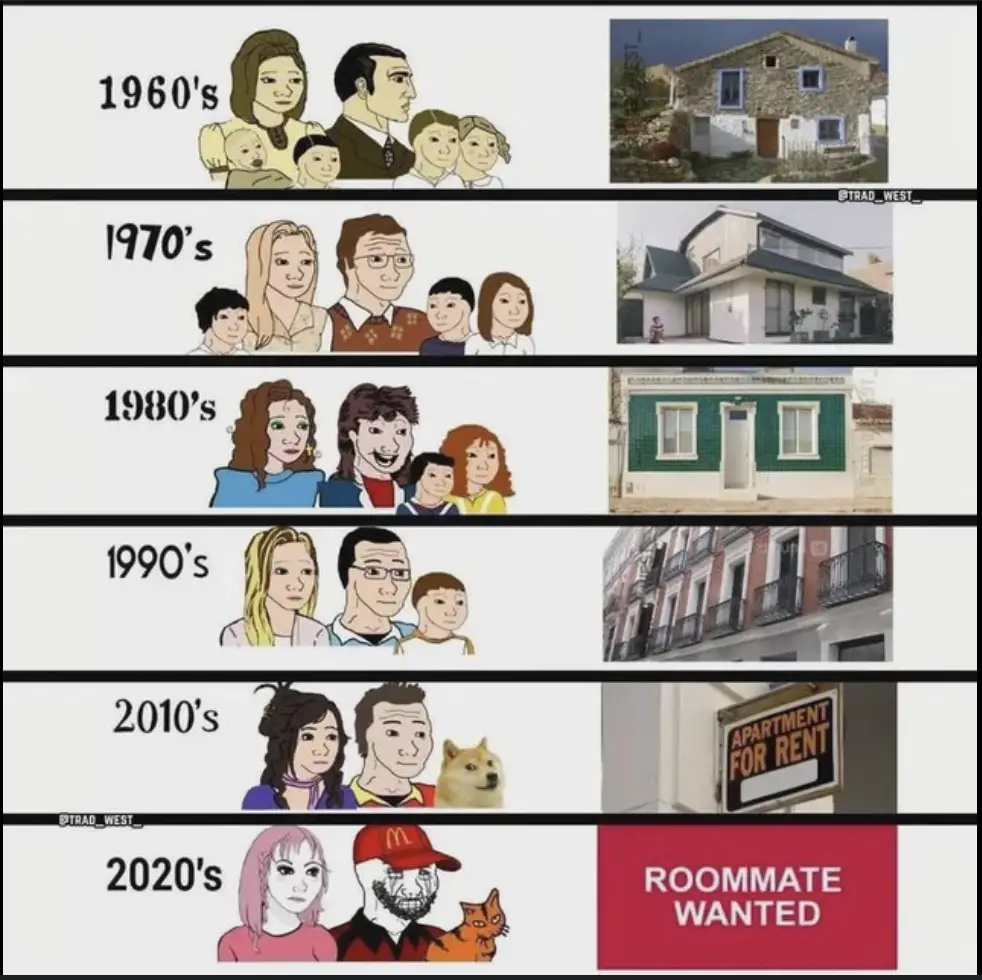

Debit: In other news, a recent study has determined that in order to return housing affordability to 2019 levels, one of three things has to happen: 1) home prices fall 38%; 2) household incomes rise 60%; or mortgage rates drop to 2.35%. Amazingly, the study’s authors failed to identify the two most realistic solutions to the housing affordability problem: 1) sharply-higher mortgage rates that result in a housing market crash; and/or 2) the long-overdue death of our fraudulent debt-based fiat monetary system. Until then, expect to keep seeing headlines like this:

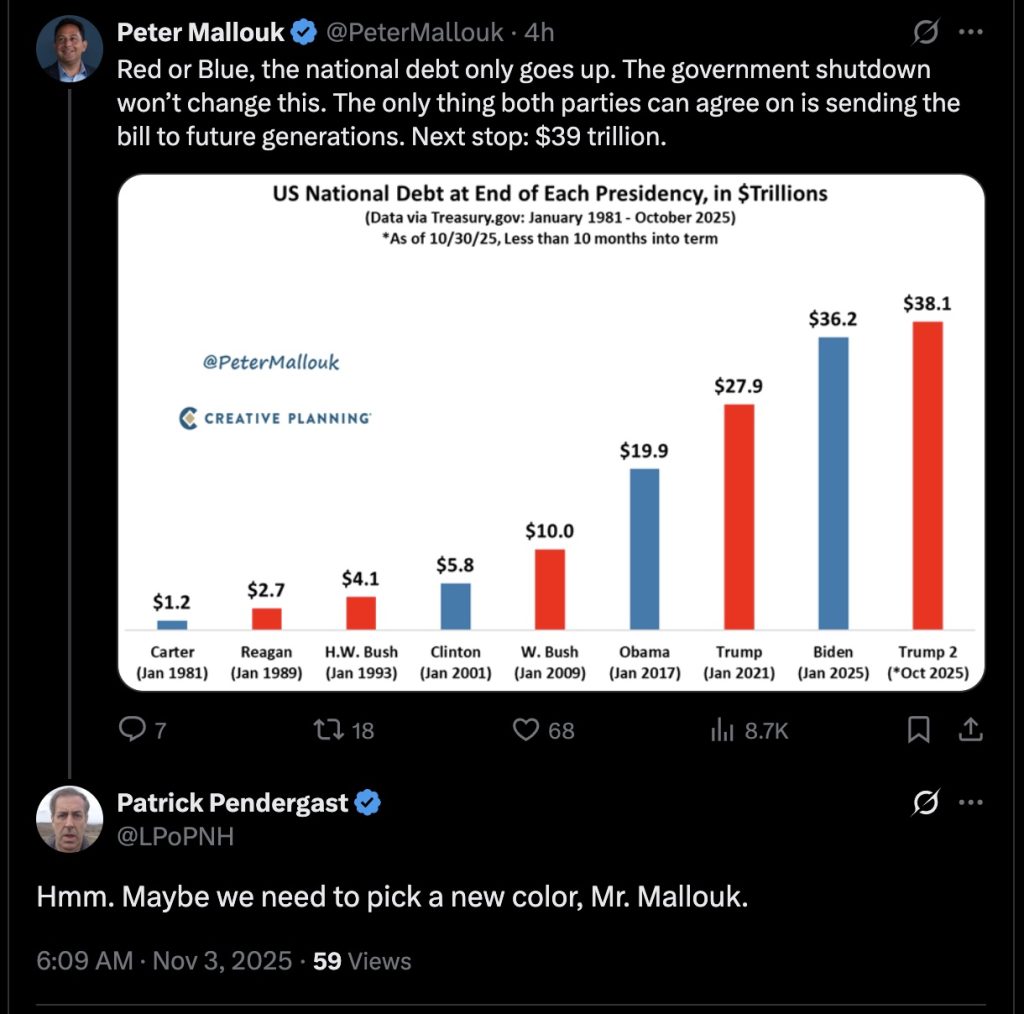

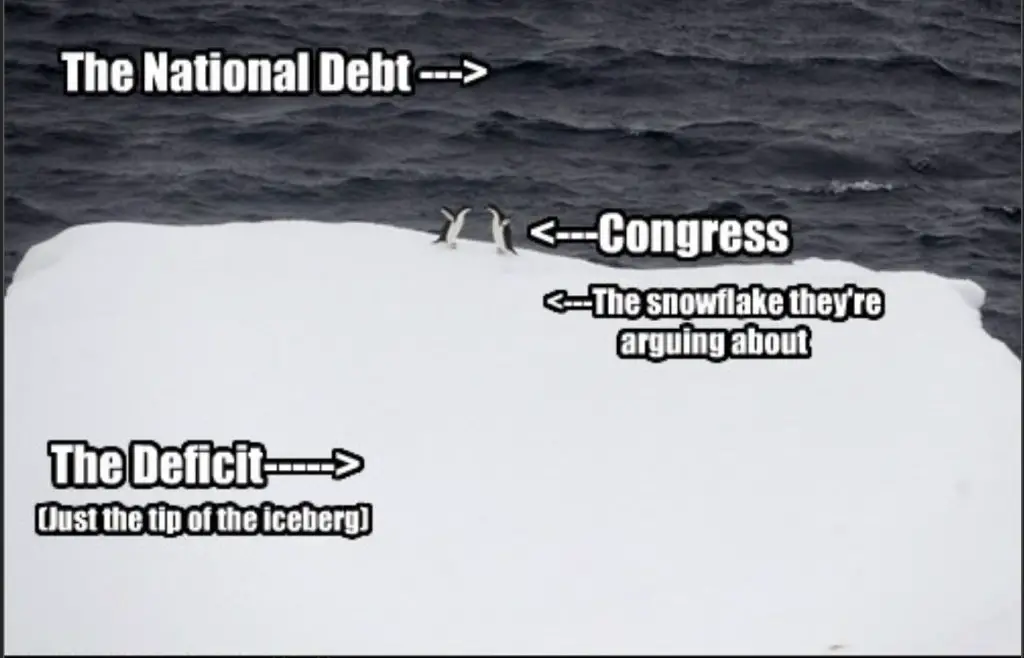

Debit: Of course, when the government decides to live beyond its means and pay for its excessive expenditures via the printing press, rather than by increasing economic output, massively-higher bills for everything should be expected. Thus, here we are. In the meantime, we can only hope that the misguided monetary system “experts” who keep telling us that long-running large deficits are perfectly fine because “we owe it to ourselves” will finally figure out that there really isn’t any such thing as a free lunch. Oh, and speaking of “experts” …

Debit: Not coincidentally, the US National Debt quietly surpassed $38 trillion last week. That’s $330,000 for every American taxpayer. It took the US 205 years to amass its first trillion of debt. And we can expect another trillion US dollars (USD) to be added to the balance sheet before 2026 is a few weeks old. The good news is the Magic Money Tree crowd insists the debt isn’t a problem because “we owe it to ourselves.” Never mind that foreign debt holders aren’t “ourselves” – or that the people incurring and benefitting from the debt are entirely different from the individuals who will ultimately bear the burden of actually repaying that debt.

Credit: Needless to say, the exploding US debt situation is why, as macro analyst Jesse Columbo points out: “the USD has lost over 20% of its purchasing power. This means that $100 in 2020 now buys only $79.89 worth of goods and services. A $100,000 salary back then now has the equivalent purchasing power of just $79,890. To maintain the same standard of living, a person would now need to earn $125,905.” This, folks, is what happens after kicking the proverbial debt-can down the road for decade after decade. And we thought this was a bad idea …

Debit: Of course, Americans’ rapidly-declining living standard since the Great Financial Crisis is even easier to see when comparing the ratio of USDs to official US gold holdings over time. In 1913, that ratio was roughly $26 for every ounce of gold held by the US Treasury. Today, that figure is nearly $10,000. Then again, when it comes to declining living standards, everything is relative. The good news is that our debt-based fiat monetary system is being managed by thousands of ivory-tower academics – like Fed Governor John C. Williams – who are paid big bucks for their deep financial insights and wisdom …

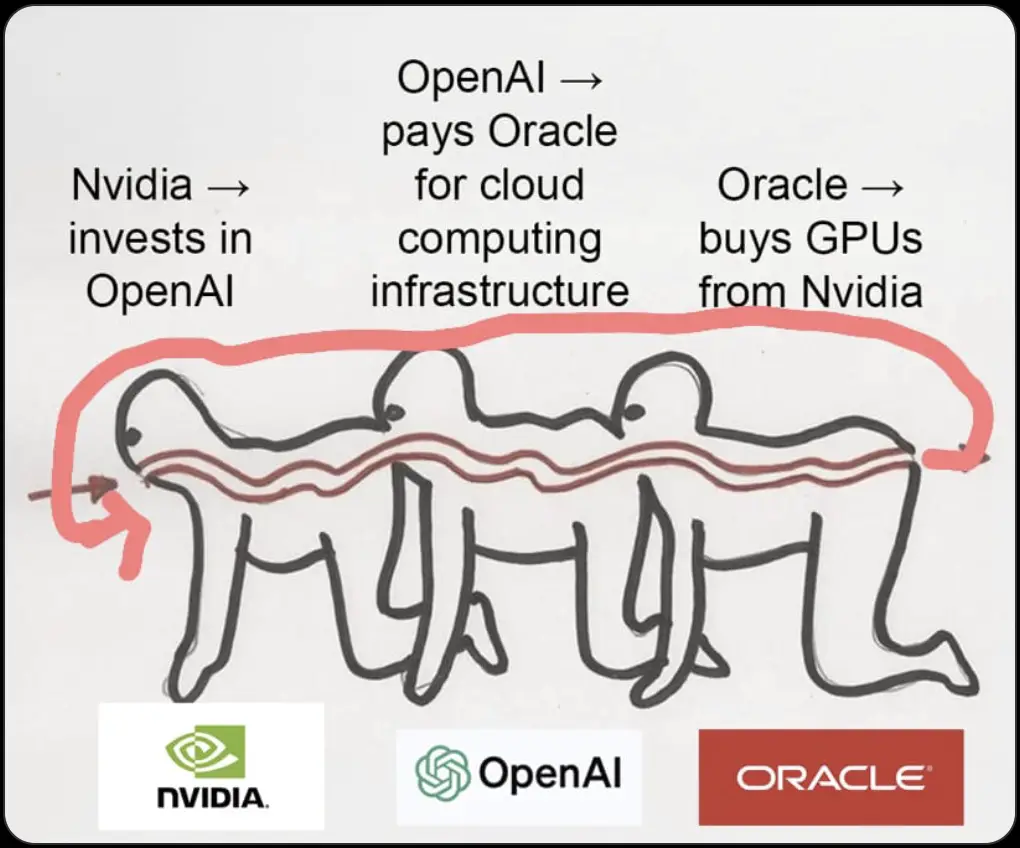

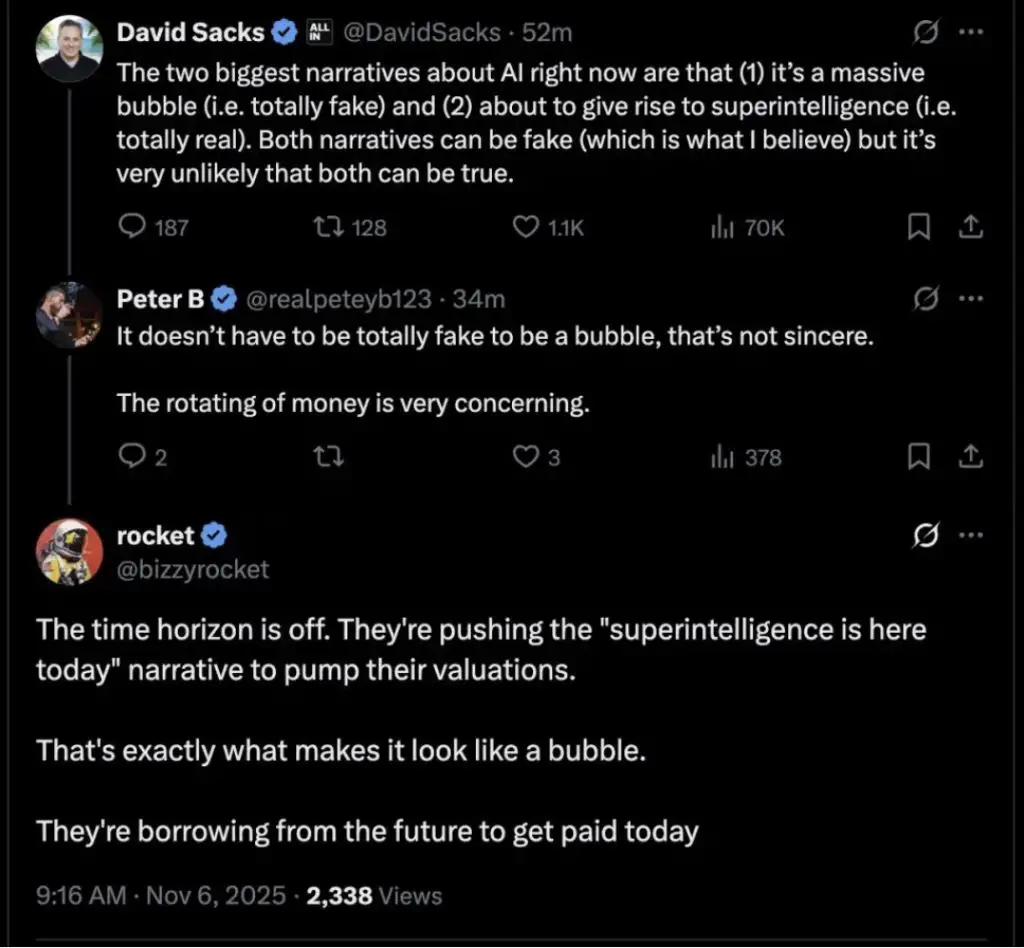

Credit: Then again, not everyone is suffering. The giant AI chipmaker known as Nvidia became the first company ever to have a market value of $5 trillion. The company is now larger than six of the 11 sectors in the S&P 500 Index and the entire equity markets of most countries. Sure it is. That seems like the sign of a perfectly healthy and robust stock market to us – not to mention the artificial intelligence (AI) market that has been backstopping it for the past several years…

h/t: @singh88835

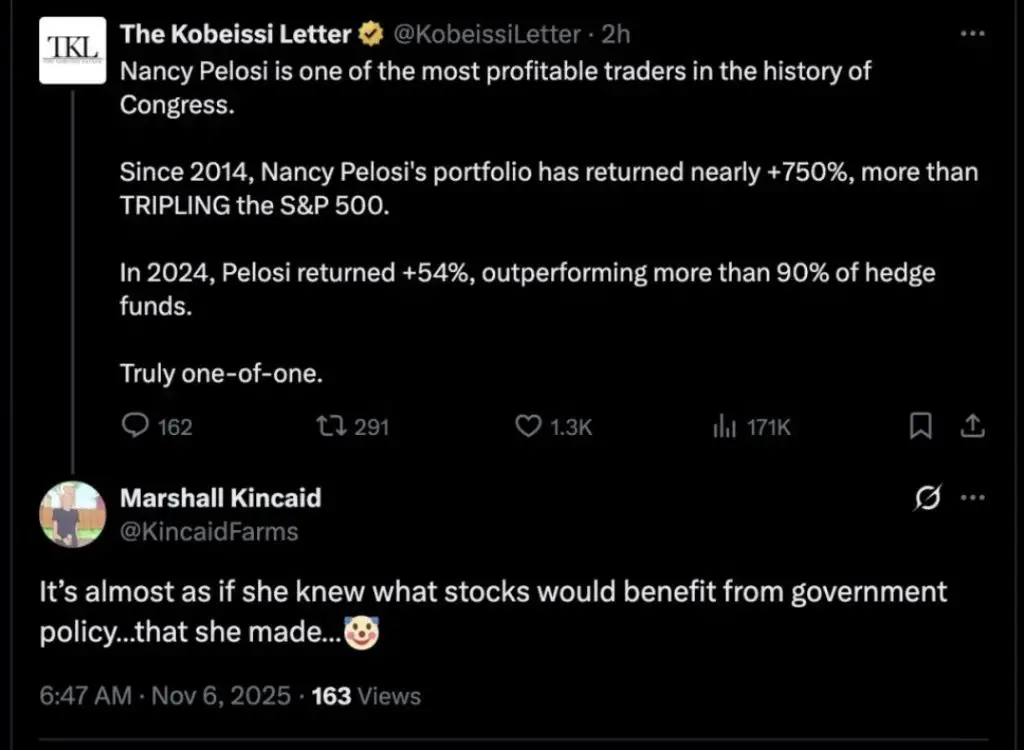

Credit: For their part, American households are now holding 80% of their entire wealth in equities – that’s an all-time record that’s even higher than during the infamous Dot-com Bubble peak. Most of those households are left to manage their stock portfolios on their own, so they stick to broad-based stock market index funds and preset retirement target-date funds (TDFs) offered by their 401(k) plans which inherently limit investors’ gains (and losses). After all, in reality 99.9% of American investors will never become wildly-successful day traders – unlike the bulk of Congressional representatives who supposedly serve them. Behold, Exhibit A…

Credit: Speaking of the stock market, equities ended the week lower than they started on Monday. The Nasdaq finished the week down 3.1% – that was the index’s deepest weekly loss since April, while the S&P 500 (-1.6%) and the Dow (-1.2%) also finished the week in the red. Here’s another interesting financial tidbit to consider: Since 2020, gold has quietly outperformed the Nasdaq. (Don’t tell that to CNBC.) As for silver? Well… it’s up 177% over the same period. No, really.

Debit: Here’s the bottom line: The Fed has been backed into a corner. In fact, unrestrained currency printing and the persistent inflation that comes with it is now a matter of national security. As for the rest of us – the citizenry on Main Street – the only way out of this financially-repressive predicament is a new monetary system based upon sound, debt-free money. Short of that, they can buy a little time by massively devaluing the USD against gold. Just remember, as history will attest, those without wealth insurance will be left footing the bill for the Fed’s monetary ineptitude.

By the Numbers

The credit card delinquency rate has been increasing across all 50 states over the first two quarters of 2025. With that in mind, here are the ten states where the number of credit card delinquencies increased the most during the first six months of 2025:

10 Michigan

9 Arkansas

8 New Hampshire

7 Mississippi

6 Colorado

5 Ohio

4 South Dakota

3 Kansas

2 Iowa

1 Minnesota

Source: WalletHub

The Question of the Week

Last Week’s Poll Result

-

One 27%

-

Two 22%

-

Three 20%

-

More than four 15%

-

Four 13%

-

Zero 3%

More than 1700 Len Penzo dot Com readers answered last week’s question and it turns out that 2 in 7 of you have owned four or more homes during your lifetime. As for yours truly, I’ve owned two homes in my lifetime, including the current one which I have been in for almost 30 years. When we bought it, our current abode was just an empty lot and we were able to watch it being built from the ground up, which we documented with photos and video over the entire five-month construction process. Great memories! (And as an added bomus we have a visual record of the precise locations for all the wires and pipes inside the walls – which has been very handy at times in the past.)

If you have a question you’d like to ask the readers here, send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Success Story

Every morning, the CEO of a large bank in Manhattan walked to the corner for a shoeshine. He would sit in an armchair, and examine the Wall Street Journal while the shoe shiner buffed his shoes until it had a beautiful mirror sheen.

One morning the shoe shiner asked the CEO: “What do you think about the situation in the stock market?”

The businessman answered arrogantly, “Why are you so interested in that topic?”

The shoe guy replied, “Well … I have millions in your bank and I’m considering investing some of the money in the capital market.”

“Is that so?” the executive asked with a sheepish eye. “What’s your name?”

“John H. Smith,” said the shoe shiner.

After getting his shoes shined, the CEO made his usual short walk to the bank and then took the elevator to the top floor, where he asked his chief accounts manager, “Say, Harry … Do we have a client named John H. Smith?”

“We most certainly do!” answered the manager. “In fact, he’s a high-net-worth customer with $16.7 million in his account.”

So the executive immediately got back into the elevator and, upon reaching the ground floor, he made a beeline back to the street corner. He approached the shoe shine guy and said, “Mr. Smith, I’d like to invite you to be the guest of honor at our monthly board meeting next Monday so you could tell us the story of your remarkable life. I’m quite sure we could all learn something from you.”

The shoe shiner told the CEO it would be an honor to do so, and promised he would be there.

At the board meeting, the chairman introduced the shoe shiner to the members sitting around the ornate table. “Gentlemen,” the CEO said, “I think we all know Mr. Smith from the corner shoeshine stand — but many of you probably aren’t aware that Mr. Smith is also an esteemed customer here at the bank. In fact, some of you may be surprised to learn that he is one of our biggest clients. So I invited him here to tell us his remarkable life story, as I’m sure there’s something we can all learn from him.”

And with that, Mr. Smith walked to the front of the board room and began his story…

“Thank you all for having me here today. I came to this country 50 years ago as a young immigrant from Europe with an unpronounceable name; I got off the ship without a penny. The first thing I did was change my name to Smith. I was hungry and exhausted. I started wandering around looking for a job but to no avail. Fortunately, I found a dime on the sidewalk and I bought an apple with it. I then had two options: eat the apple and satisfy my hunger, or start a business. So I sold the apple for 25 cents and bought two apples with the money — then I decided to sell them too.

“Before I knew it, I had myself a thriving business selling apples. After I started accumulating a few dollars in profit, I was able to buy a set of used brushes and shoe polish and started polishing shoes. I didn’t spend a penny on entertainment or clothing; I just bought bread and some cheese to survive. I saved penny by penny and, after a while, I bought a new set of shoe brushes and polishes in different shades and expanded my clientele.

“The whole time I continued to live like a monk, saving every penny I could. After a while, I was able to buy an armchair so my clients could sit comfortably while I shined their shoes — and that brought me more clients.

“Through it all, I didn’t spend a single penny on the joys of life; I kept saving every cent. A few years ago, when the previous shoe shiner on the corner decided to retire, I was blessed to have saved enough money to buy his stand at this great location!

“Then, six months ago, my sister – who lived her entire adult life as a hooker in downtown Chicago – passed away and left me $16.7 million.”

(h/t: Phillip)

Squirrel Cam

Is it a bird? Is it a plane? No… it’s Super Squirrel! (Don’t blink… he’s faster than a speeding bullet.)

.

Buy me a coffee? Thank you so much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Whether you enjoy what you’re reading here – or not – please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X. And last, but not least…

3. Please support this website by purchasing my book! Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment — assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

After somehow finding a very old article of mine explaining why private schools are a financial rip-off, Jack left these words of encouragement in the comments section:

Good job kicking that hornet nest, Len!

Thank you, Jack; the article definitely created quite a buzz.

If you enjoyed this edition of Black Coffee and found it to be informative, please forward it to your friends and family. Thank you! 😀

I’m Len Penzo and I approved this message.

Photo Credit: stock photo

Hi Len,

I missed my Black Coffee the last two weeks! Glad your back!

I’m still not sold on the AI revolution. So far it seems to be great at repeating what others have written, but it hasn’t shown me any signs of actual thinking or reasoning yet. I guess we’ll all find out some day if it is the real deal or not. For now, I don’t see it.

Have a great weekend everybody!

Sara

The shoeshine story was funny and right on. A happy medium seems the best to shoot for, but I always return to debt….if you have no debt or at least control it, the crazy news is just a sideshow and cautionary tale. If you have no debt, you also have a chance to control your life. If you owe others you are on a treadmill of satisfying obligations. Life is everyday (my folks used to say), but I am horrified at the current news and the overt decline of civility and cooperation. I don’t see how this ends well? If all levels in society cannot at least compromise and quit pointing fingers solutions are impossible. “I win you lose” doesn’t work….in a family, financial situation, relationship, governance, whatever. A long term trading relationship? Alliances? I have read just this week AI will eventually cause between 30 and 99% unemployment in modern society in the next 5 years!!!

May the rebuild and renovation work better, because right now the house looks pretty crappy. Might be a very good time to get to know your neighbours, just sayin’.