Today I want to share a primer with you on the gold standard, as well as a fun hypothetical example of how a potential gold revaluation would work.

Today I want to share a primer with you on the gold standard, as well as a fun hypothetical example of how a potential gold revaluation would work.

With nearly $200 trillion in funded and unfunded liabilities on its books, the US government has accrued so much debt that it can no longer be paid back without destroying the US dollar. As such, the only reasonable way out from under the tremendous debt overhang that the US – and the entire world, for that matter – finds itself in today is by reliquifying the system with real money: gold and silver.

And that day is a lot closer than most people realize.

Unlike today’s dollar-based paradigm that gives de facto control of the world monetary system to the United States via the Fed, a monetary system backed by gold ensures a level playing field by removing the ability of any one nation to affect monetary policy. This is because when there isn’t a single, verifiable standard by which a country’s wealth – and subsequently its money supply – can be measured (i.e., gold and/or silver), then everyone is at the mercy of the nation or central bank that controls the commodity and currency markets.

And, unfortunately, politics only serves to raise the ruthlessness of those manipulations to an even higher level, as recent events have made crystal clear to all of the world’s nations.

Measuring Gold’s True Value

The claim that there is not enough gold in the world to support a gold standard or gold-exchange standard is specious, to say the least. In fact, there will always be enough circulating gold to support a gold standard at the right price. The easiest way to ensure this is by allowing the gold price to float freely in the free market.

And in a more rigid system where gold is artificially pegged to a static price, any liquidity shortages can be alleviated by simply revaluing the yellow metal to a higher price. After all, that’s exactly what Franklin Roosevelt did when he revalued gold back in 1933 from $20.67 to $35 per troy ounce (actually, Roosevelt devalued the dollar by 70%, but why quibble?). No matter which way you choose to look at it, FDR instantly expanded the money supply by 70% in order to put more dollars into people’s pockets.

So when an economy runs too hot, a nation can reduce the amount of paper currency in circulation, and the gold price drops in turn.

On the other hand, when an economy is in the doldrums and expansionary credit is required, a nation can increase the price of gold which increases the paper currency supply.

Regardless, gold’s relative purchasing power remains virtually unchanged in both cases.

An Gold Revaluation Example

Here is an overly-simplified example:

Let’s assume I am the emperor of my own tiny island and I want to have a gold-backed currency. Let’s assume I have a modest stash of 100 troy ounces of the yellow metal in my Treasury. Let’s also assume the gold price for one troy ounce is fixed at $1.

So … how much fiat can I create?

Well, for a fully-backed 100% reserve requirement, the answer is $100. For a 20% gold reserve ratio, five times more currency can be created: $500. See how that works?

Now … How do I expand my currency supply if my island economy starts to lag? Of course, I can reduce the reserve ratio, but that may cause some people to lose confidence in my currency. The wiser solution would be to increase the dollar-price of gold.

Now … How do I expand my currency supply if my island economy starts to lag? Of course, I can reduce the reserve ratio, but that may cause some people to lose confidence in my currency. The wiser solution would be to increase the dollar-price of gold.

So, with a 20% gold reserve ratio, and 100 troy ounces of gold in my Treasury priced at $10 per ounce, I can now expand my currency supply to $5000 (i.e., $1000 worth of gold in the Treasury times 5 equals $5000).

Stay with me now — we’re almost finished!

If you held $5 in cash on a Friday when a single troy ounce of gold was selling for $1, but on Saturday morning you wake up to discover that I revalued the price to $10 per troy ounce, then your claim on the gold in my Treasury would have fallen from five troy ounces to 0.5 troy ounces.

As emperor of the island, I know that whenever there happens to be a rush to redeem my currency for gold because the people are losing faith in my funny money, then I can always increase the price of gold to essentially deflate the value of their cash.

By the way, back here in the real world, even though today’s US dollar is an unbacked fiat currency, the Fed will eventually be forced to do the exact same thing when confidence in their debt-based monetary system finally collapses; they really have no other choice. The only way out of our current fiscal mess is to devalue the fiat US dollar by revaluing gold to a much higher price than it is selling for today.

In fact, I think it’s safe to say that, 50 years and $30 trillion of debt after Richard Nixon officially broke the US dollar’s anchor to gold, we’re almost there.

And that, my friends, is why gold (and silver) are the premier holdings for both an overheating economy (i.e., inflationary times) and economic depressions (i.e., deflationary periods). Make sure you have some before the revaluation comes.

If you don’t, you’ll be wishing you did.

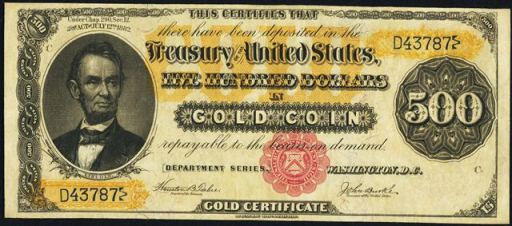

Photo Credit: US Treasury

If your island currency is backed by gold, why would the islanders lose faith in the currency?

Because there is a difference between a gold “backed” currency and a gold “convertible” currency. The latter is accompanied by specie (gold coins that circulate as legal tender); this is how the US operated until 1933 when FDR put a stop to it. Up until then, you could freely exchange $20 bills for $20 gold coins at any bank. This tends to be – if you’ll pardon the pun – a rock-solid means of holding public confidence in the circulating paper medium.

On the other hand, a gold “backed” currency does not include specie; it essentially forces the public to trust that the government will only print enough currency so as not to exceed its stated gold reserve requirement. Basically, in this system, the government says “trust us” and offers no such confidence check to the citizens. This is how the US operated from 1933 until Nixon closed the gold window in 1971. During that period, only sovereign nations could exchange their dollars for gold. By the late 1960s, the US was over-printing so much currency that France and a few other nations began losing faith in the US’s fiscal position and responded by draining the US Treasury’s gold reserves until they got so low that Nixon completely decoupled the dollar from gold, making it a pure fiat currency.

And that was the beginning of the end for America’s unparalleled economic strength, its strong and deep middle class, its manufacturing dominance, the one-income family, and independent “Mom & Pop” businesses.

Hi Len, long time follower, first time responder. I hope you or someone can clarify something for me please. It has been mentioned before that you should view precious metals as a store of wealth. When the currency collapses and the value of gold and silver significantly increases, then what? If one is to hold onto their precious metals until values rise, what are we to do with it? Is it a benefit during and/or after currency collapse or wait until a new system is in place? If its to trade, and lets say a silver coin is worth hundreds, who are you trading with? Who can afford to trade with you with values are so high? If we wait until a new currency comes around, then wouldnt they also keep gold/silver down like they are now? I hope I am making sense, you can probably tell why this is my first time commenting hahaha. Thanks in advance!

Hi Margarita! I’m glad you took the time to write your question because it is a good one. Believe me, this is probably the most common question I get asked!

Simply put, physical gold and silver is primarily for wealth insurance in case of a currency collapses. What that means is the currency hyper-inflates to the point where it is no longer useful as medium of exchange. Look at this way: When it takes $1 quadrillion to buy a dozen eggs, it’s safe to say the currency is for all intents and purposes, dead.

When that occurs, the government will be forced to issue a brand new currency. If our US dollar implodes such that it takes $1 quadrillion to buy a dozen eggs, they will issue a new currency – let’s call it the “amero.” As part of that change, a market price for gold will be established in the new “amero” currency.

People who hold gold (and silver) can then exchange their gold and silver for the new ameros and they will still have, at a minimum, the exact same purchasing power they had before the dollar collapsed – regardless of whether the price of gold ends up being 1 amero per ounce of gold, or 10,000 ameros per ounce of gold. (Athough in reality they will probably end up with even more purchasing power; but that is a topic for another day).

Now … what if the US dollar does not collapse? What if the Fed saves the dollar by devaluing it before it collapses (by boosting the dollar price of gold as described above)? Well … in that case, people without any physical gold in their possession, will see their purchasing power decline by the amount of the gold revaluation. In 1933, people who didn’t hold any gold saw ALL of their purchasing power decline by 70%. However, those who held gold, saw no decline in their overall purchasing power, because their purchasing power in gold remain essentially constant. (Edit: In reality, it is a bit more complicated than that. I wrote about the dirty details here.)

As for trading with silver coins, the “price” of the coin is irrelevant. It is its silver content in troy ounces that matters. This is why I recommend everybody own at least a little bit of so-called “junk” silver (US silver dimes, quarters, half-dollars and dollars) minted in 1964 or earlier. We know that a silver dime will always buy a loaf of bread or a pound of chicken. And we also know that a silver quarter will always buy a gallon of gas – regardless of how many dollars it take to buy an ounce of silver.

Does that help?

If you have follow-up questions, let me know.

Thank you for this, Len; it’s clear enough that I think husband will finally fully understand the concept!

I also think Margarita’s question is pondered by many, and would love to hear your guidance on it.

Glad it helped, Lauren!

Older people may be wise to hold more “junk” silver than gold, because the populace with whom they will have to deal in of a time of extreme fiat money crisis will be familiar with the devalued form of that money in circulation and will implicitly trust it more than unfamiliar specie gold.

Folks will rapidly apply the real world value of a silver dime and a silver quarter, etc, and they will quickly find acceptance everywhere – it will almost be like bartering, for awhile – two individuals making a transaction will, in effect, set their own “value” on the coins. As you point out, inevitably this will be constant per unit of goods or services, over time.

But there are problems in life for which there are no solutions – holding a store of physical precious metal subjects on to the risk of violent seizure. Holding anything of value in one’s possession involves that risk. Think of the poor kid in one of our contemporary cities who is wearing Nike shoes and gets violently dispossessed of them.

Great comments, as always, Dave.

Dave, that’s exactly why I buy ‘junk silver instead of other items. Everyone knows d U.S. several coins, as opposed to something from Tuvalu, etc.

This is an unfortunate thought experiment of mine every Saturday morning with my black coffee.

Particularly in a country where the populace enjoys the hobby of buying ammunitions over the hobby of saving money/buying wealth insurance.