It’s time to sit back, relax and enjoy a little joe …

It’s time to sit back, relax and enjoy a little joe …

Welcome to another rousing edition of Black Coffee, your off-beat weekly round-up of what’s been going on in the world of money and personal finance.

I hope everybody had a wonderful week. And with that, let’s get right to this week’s commentary, shall we?

Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him.

– Dwight D. Eisenhower

Credits and Debits

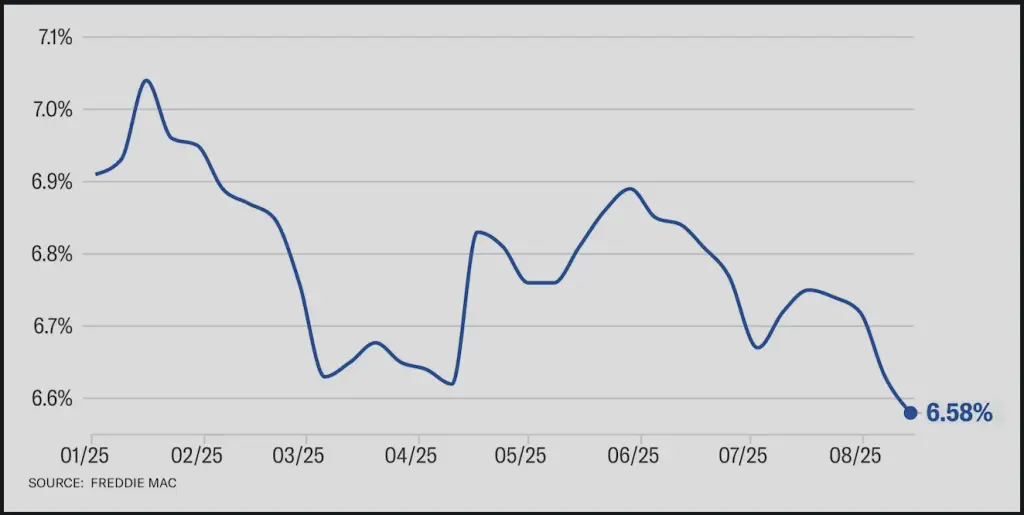

Credit: Did you see this? There was good news and bad news for first-time homebuyers. The good news is that mortgage rates drifted lower last week to their lowest level since October 2024, with the average 30-year fixed mortgage rate settling at 6.58%. The bad news is that in most cases, lower mortgage interest rates typically do very little to make homes more affordable as sellers have typically been raising their asking price to keep the potential monthly payments from falling. The real solution is higher interest rates – they offer the best chance of breaking the housing market, which will lead to more affordable prices.

Credit: On Wall Street, market analysts are pointing out that last week the S&P 500 closed above its 20-day moving average for 68 straight days. Stock market bulls point out that when that milestone is reached, the S&P 500 is almost always higher in the following year. That’s a great news for stock investors because history suggests that the S&P can now expect an average annual return of 11% in 2026. Then again, rules are made to be broken. Take decorum, for instance …

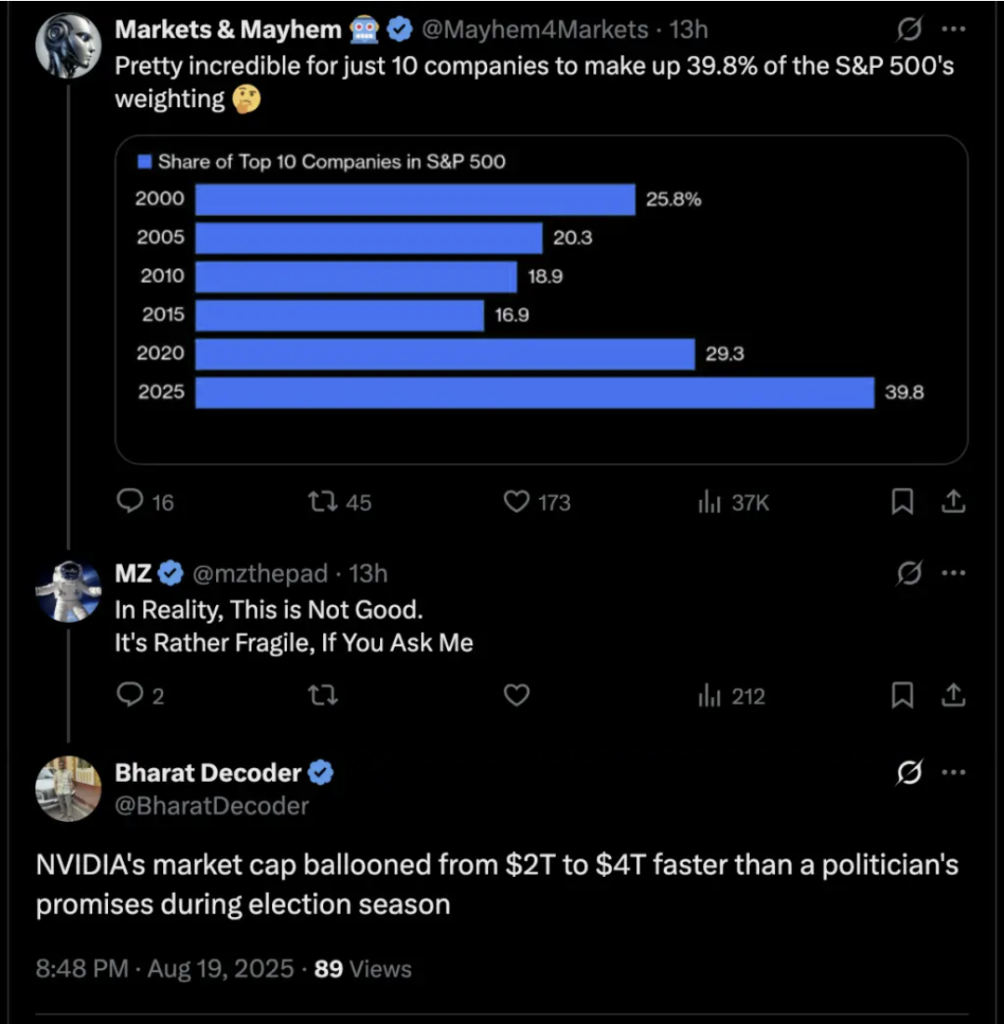

Debit: On the other hand, a new study by Bank of America found that the largest 50 stocks in the S&P 500 have outperformed the benchmark index by 73 percentage points since 2015. BofA notes the last notable run of similar outperformance for the 50 largest stocks in the index came in the late 1990s, leading into the bursting of the Dot Com bubble. Imagine that.

Credit: Meanwhile, economic analysis estimates taxpayers will see an average $3752 tax cut in 2026, due to provisions in the One Big Beautiful Bill Act (OBBBA). The OBBBA also implemented a host of temporary tax provisions set to expire in 2030, including a quadrupling of the $10,000 state and local tax (a.k.a. SALT) deduction cap; a $6000 deduction for seniors; and temporary tax deductions for tips and overtime pay, capped for single filers at $25,000 and $12,500, respectively. Oh, and speaking of cuts …

Credit: In case you’re wondering, individuals in Wyoming, Washington, and Massachusetts will see the largest average tax cuts in 2026 – hovering around $5100 – while residents of West Virginia and Mississippi will see the smallest average tax cuts that year, around $2400. Well, at least the honest ones …

Debit: Unfortunately, while individual households will benefit from the tax cuts, the country’s fiscal health likely won’t. In fact, the Congressional Budget Office. CBO estimates that the trillions in lost federal revenue will add more than $4.1 trillion to the National Debt over the next decade. Ouch. That being said, no matter how bleak the situation seems, there are always optimists out there …

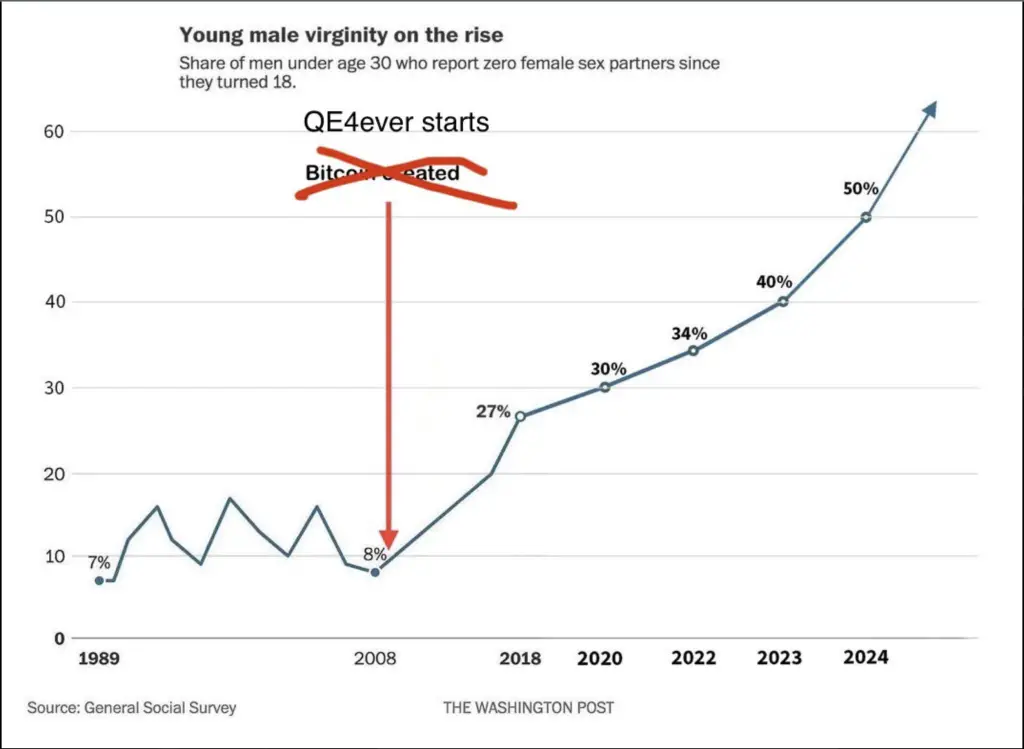

Debit: On a somewhat related note, there is a growing chorus of voices suggesting that the increasing age of male virgins in the US is a direct result of the Fed’s monetary policy; specifically, quantitative easing (QE).

Debit: Needless to say, most people tend to scoff at the suggestion that QE leads to a society of older male virgins – but a similar pattern emerged in Japan during their Lost Decade of the 1990s. The question is: Does correlation equal causation in this case? Or is there something else at work? What’s that? You never heard of Japan’s Lost Decade. Well… that’s not the only thing from the 1990s that – once upon a time – was completely unfamiliar to the public…

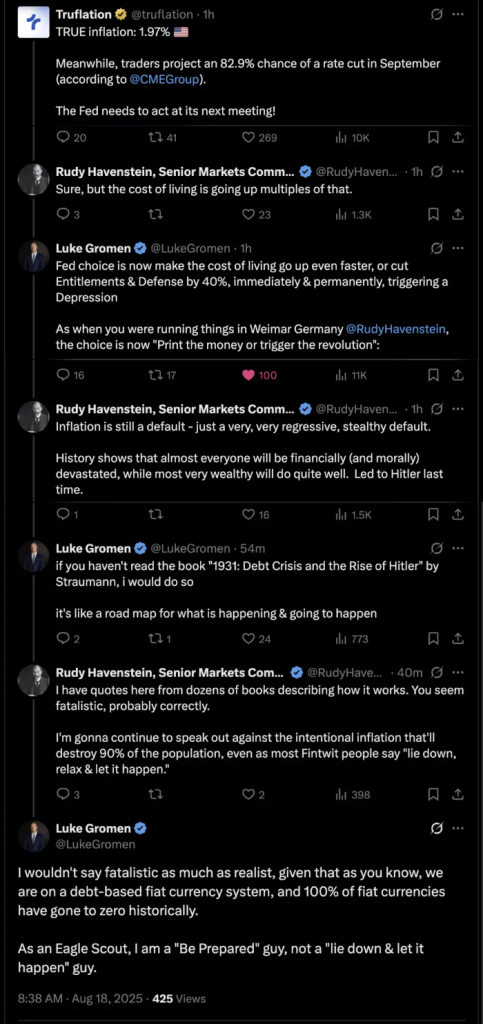

Debit: Of course, it’s not as important as whether or not you believe that there is a causal relationship between the Fed’s long-running and reckless monetary policy and male virginity. What is important is that you recognize that the current debt-based fiat monetary system is now in its death throes – and what’s coming won’t be pretty. (GET LINK)

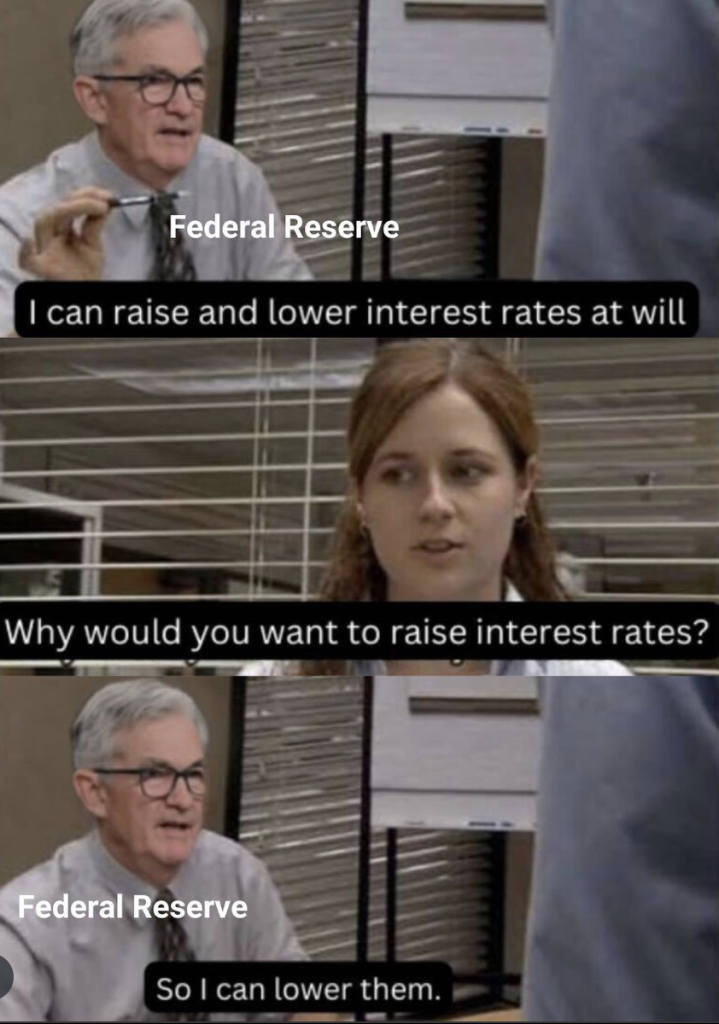

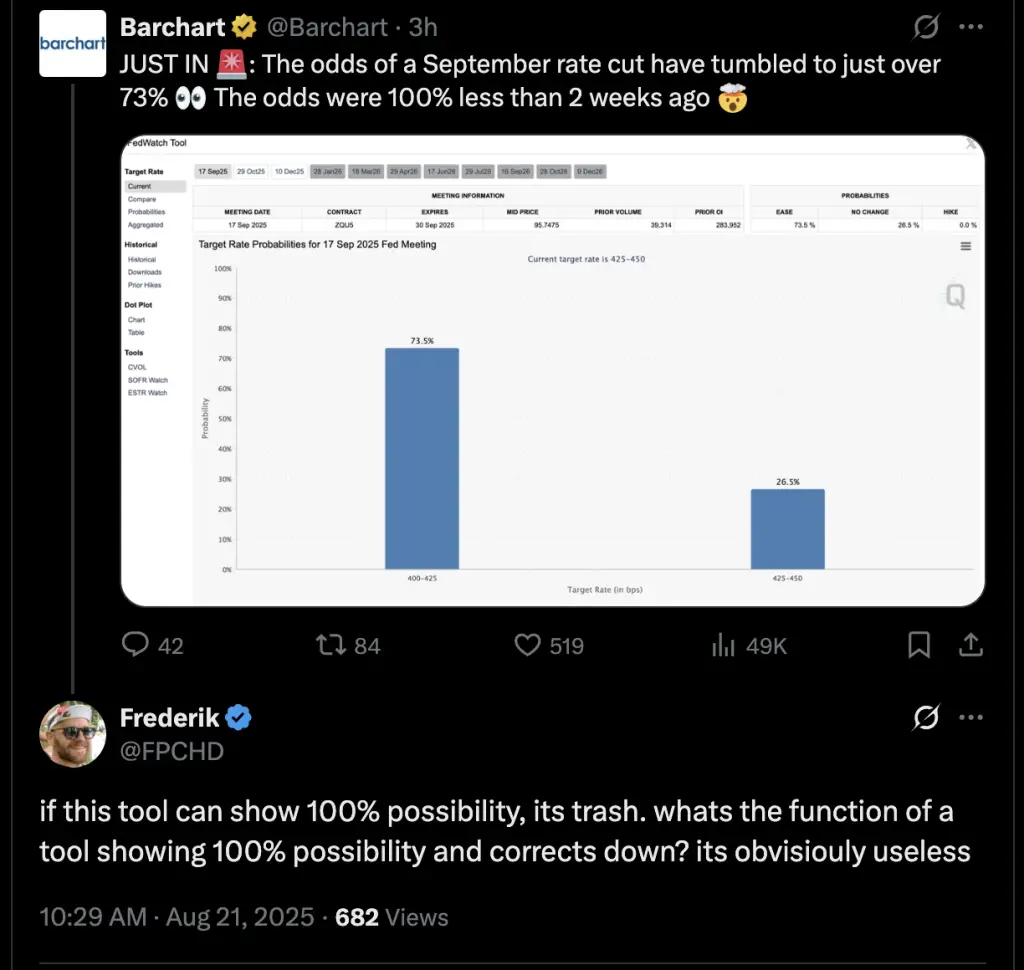

Debit: Among the growing body of indisputable evidence that reveals that the current monetary system is no longer fixable is global central banks’ inability to control interest rates. Consider Exhibit A where, despite the European Central Bank (ECB) cutting its deposit rate by 200 bps over the past year, German and French 30-year yields have moved in the opposite direction and are now at 14 year highs. We strongly suspect that the Fed will see the same results after it begins lowering its Fed Funds Rate later this year.

h/t: @MemetiqCream

Credit: The good news is although there will be a reckoning, it’s still possible to purchase the wealth insurance everyone needs to minimize – if not profit – from the eventual end game that we now find ourselves in. However, checkmate is on the horizon. Once the game is over, that insurance will be cashed out, leaving everyone in the middle class who failed to buy it, financially devastated. Got gold?

By the Numbers

Since 2022, the average apartment vacancy rate in America has been on an upward climb since; it’s now 7.8% in major US metropolitan markets. As of April 2025, here were the US cities with the lowest – and highest – apartment vacancy rates in America:

1.2% Grants Pass, OR

1.5% Jefferson City, MO

1.6% Glens Falls, NY

1.7% Ocean City, NJ

1.8% Stanton, VA

21.2% Fort Walton Beach, FL

22.7% Wenatchee, WA

27.1% Sherman, TX

27.2% Myrtle Beach, SC

34.8% The Villages, FL

Source: Apartments.com

The Question of the Week

Last Week’s Poll Results

- $1000 to $1499 44%

-

$500 to $999 39%

-

$0 to $499 12%

-

$1500 or higher 5%

More than 1800 Len Penzo dot Com readers responded to last week’s question and it turns out that just over half of you carry auto insurance with a deductible of $500 or less. Of course, one of the best way to save money on your premiums is to raise your deductible as high as you can afford. Remember, insurance is intended to cover incurred expenses you can’t afford to pay. Most drivers – especially the good ones – will end up saving money by paying lower premiums on the front end in exchange for paying the higher deductible on the back end.

If you have a question you’d like to see featured here, please send it to me at Len@LenPenzo.com and be sure to put “Question of the Week” in the subject line.

Useless News: Camping Trip

One day Sherlock Holmes and Dr. Watson decided to go on a camping trip. After a long first day of enjoying the great outdoors, they set up their tent, and fell asleep.

Some hours later, Holmes woke his faithful friend. “My dear Watson! Look up at the sky and tell me what you see.”

“I see millions of stars.” Watson replied.

“And what does that tell you?” asked Holmes.

Watson pondered the question for a long minute. Finally, the good doctor turned to his friend and said, “Astronomically speaking, it tells me that there are millions of galaxies and potentially billions of planets. Astrologically, it tells me that Saturn is in Leo. Time wise, it appears to be approximately a quarter past three. Theologically, it’s evident the Lord is all-powerful and we are small and insignificant. Meteorologically, it seems we will have a beautiful day tomorrow. What does it tell you, Sherlock?”

And with that, Holmes looked at his partner and said: “Watson, you idiot! Someone stole our tent!”

(h/t: Susan)

Squirrel Cam

Provided this week without comment …

.

Buy Me a Coffee? Thank You So Much!

For the best reading experience, I present all of my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a coffee! (Dunkin’ Donuts; not Starbucks.) Thank you so much!

.

More Useless News

Here are the top five articles viewed by my 51,777 weekly email subscribers and other followers over the past 30 days (excluding Black Coffee posts):

- My 17th Annual Cost Survey of 10 Popular Brown Bag Sandwiches

- 18 Amazing Credit Card Facts You Probably Didn’t Know

- Good Personal Finance Habits Everyone Should Follow

- 14 Things You Shouldn’t Buy When Traveling

- Breaking Down the Cost of Saying Goodbye: My Journey with Funeral Planning

Hey, while you’re here, please don’t forget to:

1. Subscribe to my weekly Len Penzo dot Com Newsletter!

2. Make sure you follow me on follow me on X (Twitter).

3. Become a fan of Len Penzo dot Com on Facebook too!

And last, but not least …

4. Please support this website by patronizing my sponsors!

Thank you!!!! 😊

Letters, I Get Letters

Every week I feature the most interesting question or comment assuming I get one, that is. And folks who are lucky enough to have the only question in the mailbag get their letter highlighted here whether it’s interesting or not! You can reach out to me at: Len@LenPenzo.com

Superman has Lex Luthor and I have Oscar — who asked the following question:

If you had the cash on hand and your two options for buying a $300,000 house were for $400,000 or $600,000, which would you choose?

Um… is that a trick question?

If you enjoyed this, please forward it to your friends and family. 😊

I’m Len Penzo and I approved this message.

Photo Credit: public domain

Happy Saturday, Len! I feel kind of bad for young adults these days, as so many of the things that held true for their parents (graduate, work hard, buy a home, get married, move up the corp. ladder, etc.) simply don’t apply anymore. But everything changed in my grandparents’ time via the Great Depression, and THEY all managed to get through it and learn from some hard lessons.

Of course, there wasn’t so much government largesse (welfare, food stamps, WIC, TANF, medicaid, etc.) in my grandparents’ day. I guess time will tell…

Anyway, I hope everyone has a great weekend! 😉

Hi Lauren!

I feel bad for Gen Z especially. My kids have good paying jobs and unless the housing market crashes (fingers crossed) neither of them have a prayer of owning a home here in Southern California. It’s all because we have been using corrupt money since 1971.

Hopefully, circumstances are going to force us to return to an honest monetary system in the near future.