Not every merchant goes by the mantra, “The customer is always right.” Therefore, even if you’ve received a fraudulent charge or want to return a piece of merchandise, they may not let you — and you may not get your money back. Fortunately, credit card chargebacks act as a built-in protection for situations like these. In fact, as long as you know how to use them, you can get your refund.

Not every merchant goes by the mantra, “The customer is always right.” Therefore, even if you’ve received a fraudulent charge or want to return a piece of merchandise, they may not let you — and you may not get your money back. Fortunately, credit card chargebacks act as a built-in protection for situations like these. In fact, as long as you know how to use them, you can get your refund.

What is a chargeback?

A chargeback takes place when you, the cardholder, get in touch with your credit card company or bank to dispute a charge on your account. They then reverse the transaction, effectively issuing you a refund for a purchase made.

Chargebacks offer protection from fraudulent purchases or when there’s a billing error on an account. Make sure you’re organizing your bill monthly to pinpoint any extra or unfamiliar charges. You can also request a chargeback if you’re unhappy with product quality, poor service, or delivery issues and the merchant refuses to provide a refund.

What’s the benefit?

You might have already picked up on the benefit of using your chargeback power — you get your money back for a purchase that should be refunded. You can even go back through previous billing cycles and ask for refunds of purchases after they’ve been finalized if they fall into the categories described above.

Another benefit of the chargeback is the fact that your credit rating won’t suffer if you’re disputing a charge. You won’t have to pay the amount in question right away, nor will it go against your credit score and hurt you financially. You might even receive a provisional refund as you wait for the final result of your claim, although a full refund can take a bit longer to receive.

How can I do it?

If you’re making a claim on your credit card account, you’ll find that most providers make the process as painless as possible. This is especially true if you have an app on your phone. There, you can tap the purchase you wish to dispute and make a claim without much effort.

Some companies may require you to go online and fill out a claim form. They may also require you to call in to negate the charge in question. In rare instances, you may have to write out your dispute and physically send it to your bank or card provider.

Just make sure you don’t waste time in filing your claim. According to the Fair Credit Billing Act, which provides many of these protections, you should ensure your dispute reaches the creditor within 60 days of receiving the bill where you found the error.

Is there anything I should do before asking for a chargeback?

A chargeback shouldn’t be your initial course of action. Instead, you should first approach the merchant and attempt to resolve the problem on your own.

Merchants are always charged a monetary penalty for a chargeback. some credit card companies charge up to $100. So, to be fair, you should give the merchant a chance to offer a refund before using the chargeback tool.

Remember that excessive use of chargebacks could eventually hurt consumers. Think about it: If businesses constantly have to pay fees for these transactions, then they’ll have to raise the prices of their products or services to continue turning a profit.

Thankfully, most merchants are willing to work with you to avoid the extra charges and maintain their good reputation. Figure out a way to solve the problem in person, online, via social media or over the phone. If you can reach an agreement that way, both of you will be better off.

Of course, chargebacks must only be used for legitimate reasons. If your credit card company finds you’re abusing this protection you’ll likely lose your account. A good example: using chargebacks to get refunds on purchases that didn’t actually require a claim.

The Final Verdict

The chargeback is an empowering tool for customers who encounter uncooperative merchants. But remember: Only use this resource when absolutely necessary! Otherwise it could hurt both businesses and the buyer. So only proceed if you’ve exhausted all other options.

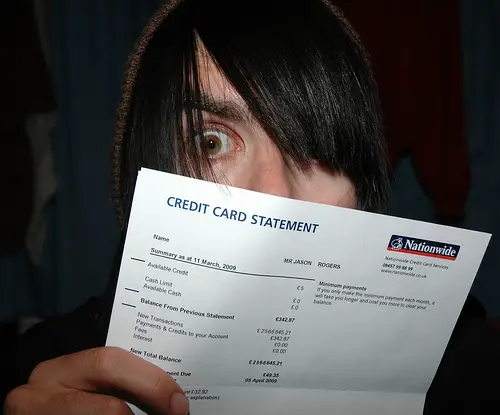

Photo Credit: xJason.Rogersx

A few months ago, I ordered a skylight for our house from an online source and was told 4-6 weeks shipping time. OK.

6 weeks goes by, nothing…I email, was told ‘on back order’ still waiting for manufacturer to ship.

8wks, I call (on hold 20 min), was told it ‘might’ ship in another 3 weeks. I said “unacceptable”…..cancel the order. Followed up immediately with email, to which they replied my card would be credited in 4-7 business days. Amazing how they can charge it immediately, but returning it takes a week.

Of course, they didn’t…..so after 10 business days, I got the CC company involved, and got my credit that day.

One thing I learned I SHOULD have done is check online reviews….Google the company name, and I would have found this was their SOP….charge your card and delay shipping for months. Next time I order something and get a long lead time, I’ll keep shopping to see if that is the truth or not.

The skylight ? Yeah, ordered from another place, and had it in 3 days…..was told manufacturer (Velux) had dozens of them in stock.

I’m one of those folks who relies heavily on online reviews myself, Andy. Nothing beats personal recommendations.

I ate at a restaurant and they accidentally double charged me. Not a big deal, it happens, so we tried to get it reversed…and the restaurant refused!

First time and only time in my life I had to call the credit card company and request a chargeback.

I think I noticed it on my credit report though?

Len,

This is an excellent article discussing a way around stubborn vendors.

From my experience with credit card companies so far, I’ve only had excellent customer service. It would not surprise me if I called them up and gave them the situation details, that they would help me receive a refund on an item that did not satisfy me.

I completely agree that the chargeback is a tool that should only be used sparingly.

Thank you so much for sharing and keep these great tips coming!

Cheers,

Fiona

Thanks, Fiona. I’m glad you found it helpful.

My experience with credit card companies has been been very good too. I can’t remember the last time they didn’t bend over backward to make me happy on a dispute.

I rented a car from Sixt at LEJ Airport (Germany.) Returned clean car and topped off the gas tank at the station 2 miles from the Airport. Luckily paid by credit card. Returned car to attendant who noted on rental form “no damage”. Next credit card statement there was a charge from Sixt for $40. for filling gas tank. I emailed them polite note with picture of the receipt from the gas station. No luck, they still claimed I left tank empty. They ignored receipt time stamped a few minutes before car was turned in to their worker who signed off on the car. Contacted Chase / United Airlines card and explained situation. The nice lady asked me to email copy of receipt to her. Charge removed from statement with apology. I told her she didn’t need to apologize, but Sixt ought to have offered apology for trying to cheat me! Keep those gas receipts and charge the gas to your card!

Amen, Karen!