Welcome to Part 3 of my State of the Household financial report for 2008. I’ve been very serious about running my household like a business for close to 20 years now. As a result, I have managed to compile detailed data across a long time period. Today I will be showing you my detailed household expenditures over the past ten years. Before going any further though I’d like to encourage those of you that missed them, to check out Part 1 and Part 2 as they describe each of the categories in detail.

This long-term data reveals trends applicable to typical households with a genuine commitment to living within their means. These long-term data allow us to glean additional insights regarding the advantages and benefits of sticking to a disciplined budget that just can’t be seen over shorter periods of time. In addition, for those of you in your twenties and thirties, not to mention those who may be questioning whether early scrimping and saving is really worth all the hassle, this data will hopefully supply you with the incentive and encouragement to keep plugging on!

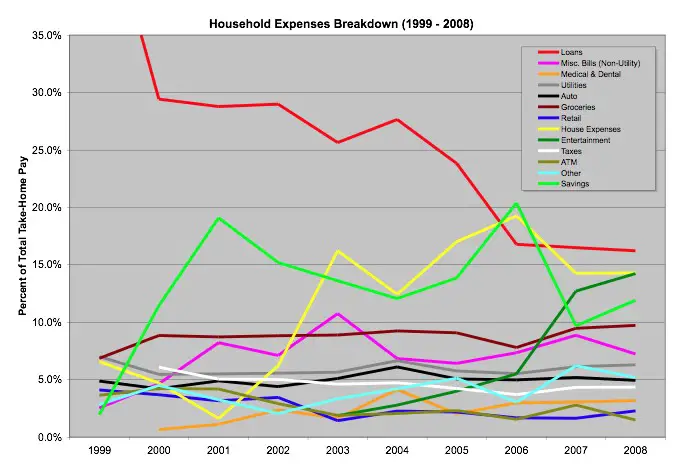

The figure below is a graphical representation of the Penzo family household expenditures between 1999 and 2008 as a percentage of my total take-home income, which excludes withheld taxes, paycheck deductions for health and other benefits, and contributions to my 401(k) plan. As I previously mentioned, the Honeybee is a hard-working but unpaid stay-at-home mom, so our household relies on only one income.

Let’s analyze some key areas of this graph.

Loans

Personal Target Number: 38% (28% mortgage; 10% auto)

Worst Performance: 48.2% (1999)

Best Performance: 16.5% (2008)

Current Impact: 16.5% (2008)

Now, when looking at this summary chart of my household expenses over the past 10 years, the most glaring item is the red line on the chart. This is the percentage of my take-home income dedicated to loans and, as you can see, in 1999 it was literally off the chart! For the record, in 1999 exactly 48.2% of my take-home pay went to cover a car loan and the mortgage on my house.

My original goal was to get this number down to 38%. My assumption for this was the generally accepted 28% maximum for the home loan and an additional 10% for auto loans. I realize conventional wisdom says the percentage of take home pay devoted to the car loan be as much as 20%, but I prefer not to devote that much money to an auto. Of course, your mileage may vary. Well, at least on this subject.

Generally, high debt-to-income ratios are usually the biggest hardship for those who are just starting out. The good news, however, is that over time those who hate to pay interest and choose to live within their means should expect to see less of their take-home income consumed by loans. As the graph shows, this is clearly illustrated in my particular case.

For me, the first significant drop in loan expenses occurred in 2000 when we paid off our first car loan. We bought another car in 2002 but the loan on that car was retired in 2005, resulting in the second significant drop in loan expenses.

Key Takeaway: When you no longer are committed to servicing loan debt you suddenly find yourself with more money available to put towards…

Savings

Personal Target Number: 10%

Worst Performance: 1.9% (1999)

Best Performance: 20.4% (2006)

Current Impact: 11.2% (2008)

Next, we’ll focus on the lime green line that represents my contributions to savings. Notice the impact that the loans had on my savings (not to mention all of my other expenses) in 1999. That year I was only able to sock away a pitiful 1.9% into my emergency fund. The irony, of course, is this is the very time when I was most vulnerable to defaulting on those pesky high loans that were eating up most of my take-home pay!

As time passed, however, I was able to begin building a significant savings cushion.

Key Takeaway: For those who can minimize their debt load, the ability to save increases over time.

Utilities

Personal Target Number: 6%

Worst Performance: 7.0% (1999)

Best Performance: 5.5% (2000, 2001, 2006)

Current Impact: 6.3% (2008)

Over time, my utility bills have thankfully managed to keep pace with my increasing take-home pay. Unfortunately, for those who have not averaged annual pay increases approaching five or six percent over the last decade, the hit on take home pay would not be as flat as shown on my chart. In real dollar terms, my utility bills have increased 52% over the period from 1999-2008! That outpaced inflation by 15% or so over the same period.

Earlier I asked if you had any guesses as to how each of my utility bills fared in real dollar terms over the past decade. For my household, here are the numbers:

Electricity: 69% increase

Natural Gas: 7% decrease

Telephone/Cellular: 50% increase

Sewer/Water/Trash: 4.8% decrease

Cable/Satellite: 220% increase

Remember, these numbers are as they relate to real dollars. I was shocked to see the decreases in both the natural gas and sewer/water/trash bills. But I was completely taken aback by how much more money my household devotes to television now than in 1999. Some of it can be partially explained by our conversion from cable to satellite in 2004. But still… 220%?

Key Takeaway: Utility bills are very capable of outpacing the rate of inflation. Oh, and I may need to reconsider my commitment to the joys of TIVo and satellite television.

Property Taxes

Biggest Impact: 6.7% (1999)

Current Impact: 4.3% (2008)

I am extremely fortunate that my property taxes, represented by the white line on the graph, continue to drop as a percentage of take home pay thanks to California’s Proposition 13. I expect this number to continue to drop over the long run. Before Proposition 13, property taxes were capable of doubling every couple of years, and putting significant numbers of people at risk of losing their homes to their inability to pay the outrageous taxes. Hopefully, you live somewhere that has similar restrictions on property tax increases.

Key Takeaway: Count your lucky stars if you live in a place with property tax restrictions. Otherwise your property taxes could eventually outpace your ability to pay them.

Groceries

Personal Target Number: 10%

Worst Performance: 9.7% (2008)

Best Performance: 6.9% (1999)

Current Impact: 9.7% (2008)

The trend is gradual but unmistakable. The brown line that represents my household grocery bill is slowly increasing. Since 1999 it has more than doubled in real dollars and I expect it will probably nearly double again over the next 10 years as my 11 year-old son begins to enter his teen years. Luckily my income has managed to keep up with the increase in the grocery bill over the last ten years, but I expect the slope depicted on the graph will begin to steepen just a bit over the next ten years or so.

Key Takeaway: Yes my grocery bill is large, but did you know my food bill would be as much as twenty times higher if my family of four ate most every meal at a restaurant? You can see the complete analysis here.

Summary

The ten-year graph of my household expenses clearly shows that for younger households that are just starting out, say with a new house and car, by the time the everyday expenses are taken care of, there is very little left to devote to discretionary income. Therefore, serious household CEOs have to be extremely vigilant in ensuring that budgets are adhered to because the money here can be so tight that the temptation to pull out that credit card and run up a few charges that you can’t cover at the end of the month will be great.

Needless to say, the Honeybee and I really sacrificed in the first couple of years. In fact, for the first couple of years, as you can see from the graph we did not even track entertainment as a separate expense because we spent so little on it. At that time, our entertainment was basically tracked by our ATM withdrawals.

But the same graph should inspire you, for it clearly proves that disciplined households that are committed to achieving financial freedom will begin to reap the fruits of their hard work in a relatively short amount of time.

The final part of my State of the Household financial report will cover my net worth figures as of the end of 2008.

I agree that when starting out there is very little money. However, I’ve found that starting out my DH and I prioritized savings ahead of even our mortgage.

That put us in a position where we based our lifestyle on what it could be after we had saved. It is a good lifestyle? Yes.

But compared to most people in our income bracket? They would say that we are living wayyy to frugally. Maybe so. But we’re living a reasonable lifestyle according to our expectations.